EXECUTIVE PERSPECTIVE

The State of

Stable Value

In a recent interview, Pete Chappelear, managing director,

Fixed Income, at J.P. Morgan Asset Management, shared his

views on the evolution of stable value funds. These strategies—

which seek to maintain, but do not explicitly guarantee,

daily price stability—generally consist of a diversified

bond portfolio combined with bank or insurance-company

“wrap” contracts, which enable the funds to be maintained

at a dollar per share, much like money market funds.

How did stable value funds perform during the financial crisis? Through the

crisis, stable value funds were probably the only investments to achieve

their objectives—offering participants

principal preservation while still earning a substantially higher yield than

most money market funds. From participants’ perspectives, these funds did

exactly what they wanted and proved

to be a safe place to wait out the crisis.

How have market changes affected the

wrap market? Wrap supply and de-

mand remain out of balance. Many

wrap issuers have left the market since

2008. New issuers have entered, but at

higher prices and in limited scale. Discomfort with contract protections, as

well as market uncertainty and overall

de-risking at financial institutions, has

caused many issuers to cease accepting

JOU RN EY Spring 2012

new deposits. Most wrap issuers that

remain committed to the business are

requiring tighter investment parameters and contract terms and higher fees.

How have those changes affected plan

sponsors? Plan sponsors seem to have

developed a love/hate relationship

with their stable value funds. While

the funds are well liked by safetyseeking participants, they sure have

created frustrations for plan sponsors recently. Protective covenants in

wrap contracts effectively handcuffed

sponsors from making changes to

their plans, especially during the crisis. Imagine if you are a plan sponsor

and wanted to do something quickly,

like add a government bond fund to

your line-up, but were unable to do so

because of your stable value fund; or

maybe you experienced extensive lay-

offs, which you found out might lead

to adjustments to the wrap contracts

or a “break-the-buck” situation. Many

plan sponsors faced these types of

situations. In addition, wrap providers are constraining the investments

backing such funds, which ultimately will lower the expected returns,

though healthy outperformance versus money markets should remain.

The combination of these things has

driven sponsors to a general feeling of

frustration or fatigue with the product.

Are there any alternatives to stable value?

While we expect that

over time a more normal equilibrium and

increased flexibility

will return to the stable

value market, we don’t

know how long that

might take and there is

no guarantee that the

long-term solution will

be reasonably flexible.

Collective or pooled stable value funds

offer partial relief from some of the

pressures being faced today by clearly

defining the rules of the road with regard to things like plan changes. With

pooled funds, plan sponsors have

more flexibility to make changes, as

long as they adhere to the prescribed

rules. While this certainty may help in

some situations, it falls short of providing meaningful relief for many plans.

Another alternative for plan sponsors

seeking more flexibility today is what

we call a stable income fund. These are

similar in nature to stable value funds

in that the primary objective is principal preservation, but they don’t cling

to the strict dollar-per-share concept.

Essentially, a stable income fund is a

conservative bond fund paired with

stable value technology, which dampens the price volatility. By wrapping or

stabilizing a meaningful portion of the

fund, say 50% to 70%, the daily price

fluctuations of the fund become quite

muted and, over a relatively short

timeframe like one month or quarter,

the price remains stable. Historical

data shows that a fund structure

with 70% of the assets wrapped

should produce positive returns

on a monthly, quarterly and annual basis, but with daily and

short-term price fluctuations in

the range of three to five basis

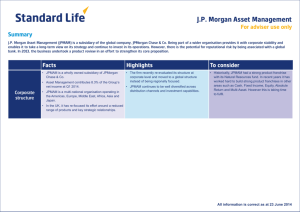

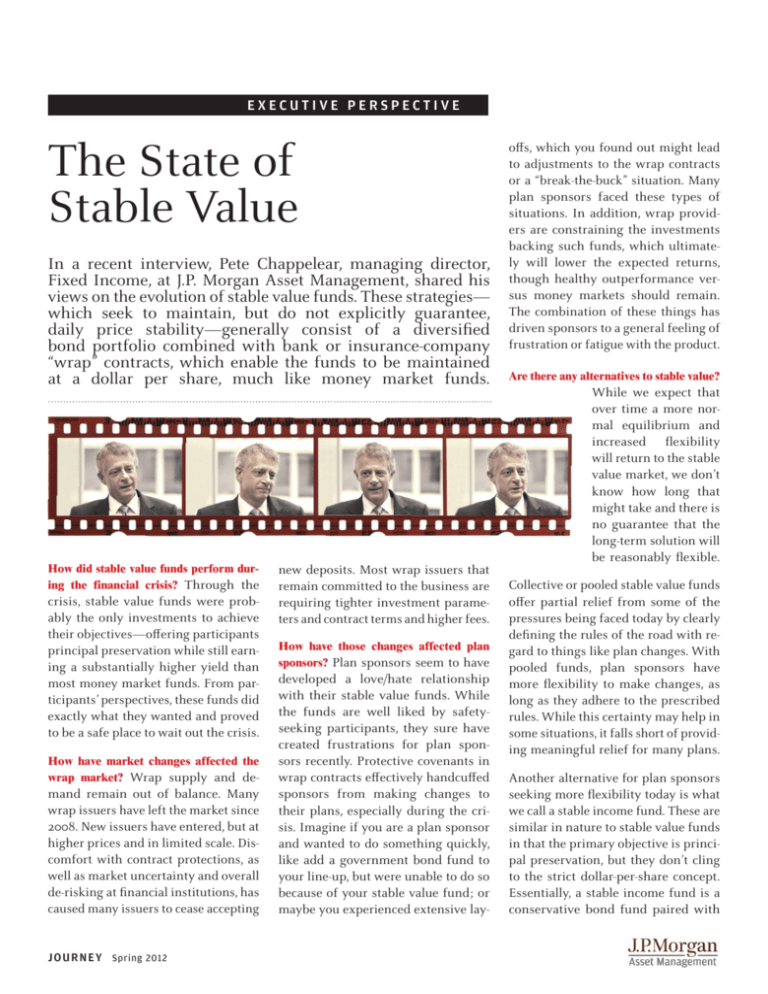

points. As Exhibit 1 illustrates,

a stable income strategy would

have roughly the same low volatility as money market and stable

value funds, but with the potential for higher expected returns.

How significant are these changes? From

my perspective, I see product changes

like stable income as game changing.

Stepping away from the confines of a

strict dollar per share product could

be hugely liberating for plan sponsors, and may not be that big a deal

for participants. For plan sponsors,

the structure would give them the

freedom to pursue actions—such as

revamping their DC line-ups or adding target date funds—that would normally be constrained by the traditional

stable value fund. In addition, the fear

of breaking the buck would obviously

“

The combination of

market conditions and

product frustrations

appears to be creating

a favorable climate

for change.

”

go away because participants would

become accustomed to modest daily

price movements. Participants, on the

other hand, would likely view this type

of fund as a safe haven where their

balances would generally remain

protected, much the way they view

stable value or money market funds.

E X H I B I T 1 : C O N S E R VAT I V E A LT E R N AT I V E S W I T H I N A D C P L A N

How committed is J.P. Morgan to

the stable value industry? While

many traditional wrap providers are exiting the business, J.P.

Morgan Asset Management remains firmly committed and is

working to enhance the business for plan sponsors and participants. J.P. Morgan has created

partnerships with leading insurance companies that are bringing

new wrap capacity to market, and

we are making structural changes to

our existing products to ensure continued growth and viability. We expect these efforts, and new product

offerings like stable income, to build

on our position as a market leader.

Pete Chappelear,

managing director

Stable

Value

Return Potential

Despite the many benefits of this type

of fund, we realize it is not for everyone, and that it often takes time for

sponsors that are accustomed to the

dollar-per-share feel of stable value

to consider something somewhat different. That said, the combination of

market conditions and product frustrations appears to be creating

a favorable climate for change.

Bonds

Stable

Income

Money

Market

Volatility

Source: J.P. Morgan Asset Management; diagram for illustrative purposes only.

is a client portfolio manager in

the U.S. Fixed Income Group. An

employee since 1997, Pete is the

head of the firm’s Stable Value

Group, with overall business and

client responsibilities. He currently serves on the Stable Value

Investment Association (SVIA)

Board of Directors. Pete received

his B.A. in economics and

business from Lafayette College.

Stable Value funds are not federally guaranteed and may lose value. Stable Value funds have interest rate, inflation and credit risks that are associated with the underlying assets

owned by the fund. The strength of the “wrap contract” is dependent on the financial strength of the financial institutions issuing the contracts.

Publications referenced in this material are presented for general educational purposes only. JPMorgan and its affiliates did not receive any compensation or consideration for referencing these titles. The opinions and information presented in these titles do not necessarily reflect the opinions of JPMorgan Chase & Co. and its affiliates.

This document is intended solely to report on various investment views held by J.P. Morgan Asset Management. Opinions, estimates, forecasts and statements of financial market

trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should

not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors. References to asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. Indices do not include fees or operating expenses and are not available for actual

investment. The information contained herein may employ proprietary projections of expected returns as well as estimates of their future volatility. Any forecasts contained herein are

for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. Discussions presented should not be construed as legal opinions or advice.

You should consult your own attorney, accountant, financial or tax advisor or other planner or consultant with regard to your own situation or that of any entity that you represent or

advise. Past performance is no guarantee of future results.

J.P. Morgan Asset Management is the marketing name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. IRS Circular 230 Disclosure: JPMorgan

Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be

used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with JPMorgan Chase & Co. of any of the matters addressed herein

or for the purpose of avoiding U.S. tax-related penalties.

© 2012 JPMorgan Chase & Co. All rights reserved.