6 Strategic Prospecting Tips

advertisement

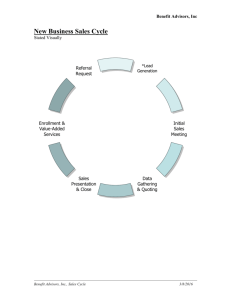

6 Strategic Prospecting Tips By Bruce W. Fraser November 10, 2015 An advisor's first priority should always be helping existing clients. But drumming up new business is an essential part of running a successful, sustainable practice, financial planners and other experts say. Having a prospecting strategy in place will take the guesswork out of growing your business. Follow these tips for finding new clients and retaining those you already serve: 1. Have a system in place. For example, keep track of the number of new appointments you have had over the past 30 days, advises Nate Lucius, managing director at Gradient Investments, based in Arden Hills, Minn. “Having a system in place holds advisors accountable for making time in their busy schedules to dedicate to building prospective client relationships and growing their business,” says Lucius. 2. Prospect purposefully. Generalists today are vulnerable to increased competition and fee compression, according to David R. Lee, director of practice intelligence at Raymond James Financial. Advisors should therefore identify the types of cases or groups they love and narrow their focus to deliver specialized services or serve that specific market, he says. This will increase attractiveness to the target group and center-of-influence referrers. 3. Develop a one-year marketing calendar. Break it down into monthly prospecting strategies, suggests Willie Schuette, a financial coach with the JL Smith Group in Avon, Ohio. Track the results and measure against established industry benchmarks. Marketing examples could include educational workshops for the community and for clients and their guests on subject matters that are current, such as Social Security, market volatility, Medicare and IRA planning. 4. Let people know what you do. "People know what brokers do--buy and sell stocks and bonds and mutual funds for clients," says Larry Luxenberg, managing partner and chief investment officer of Lexington Avenue Capital City in New City, N.Y. "Most people do not have a grasp of what financial advisors do, which is more involved. Besides making investments, they give advice on taxes, estate planning, retirement plans, insurance, and other things that impact their wealth. Giving friends and acquaintances a succinct description of this is important and helpful and should lead to more clients." 5. Be curious. Ask the right questions. Remember, it’s about them, not you. “It’s important to be genuinely interested in a prospect or client,” says Raymond James’ Lee. “It can make all the difference. Are you looking to close a sale – or are you looking to uncover gaps in their thinking process that you can assist with?” 6. Develop a set time to communicate with clients. It should be on a regular basis, according to Schuette. “This allows the opportunity to share with them the successes you had as their advisor and to ask for introductions or referrals to your upcoming marketing calendar,” he says. “Personal phone calls work best.” Bruce W. Fraser is a New York financial writer and contributor to Financial Advisor and On Wall Street magazines.