1 FIN 3115 INTERNATIONAL FINANCIAL MANAGEMENT Instructor

advertisement

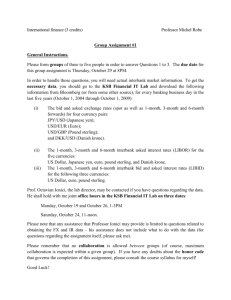

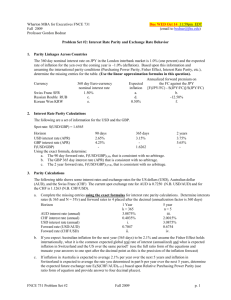

FIN 3115 INTERNATIONAL FINANCIAL MANAGEMENT Instructor: Asst. Professor Zhang Weina MRB, 07-47 Tel: 65168120 Email: bizzwn@nus.edu.sg Session: Semester 1, 2010/2011 Course objectives This course is an elective course for BBA students majoring in Finance. This course is designed to provide you an understanding of international financial instruments, markets, and institutions necessary to be effective financial managers nowadays. In particular, we focus on how to deal with exchange risk and market imperfections, using various financial instruments and tools that are available, while taking advantage of globalization trend. The topics we cover include: the basic macroeconomics concepts, the nature of foreign exchange risk, the determination of exchange rates, the management of foreign exchange risk with forwards, futures, options and swaps, exchange rate forecasting, the evaluation of international investments, the causes and consequences of currency crises, international cash management, multinational company management, international tax environment. Students will also learn how to access useful and updated financial information in today’s business environment and how to critically interpret those information. Information source providers include Bloomberg, Datastream, Reuters, FACTIVA, OSARIS, ORBIS, WRDS and various online resources. Prerequisites FIN3102 Investment Analysis Course Resources and Requirements The references noted below have been placed in the RBR section in HSSML: Course textbook Eun Cheol S., Bruce G. Resnick, International Financial Management, 5th edition, McGraw Hill, 2009 (ISBN: 978-007-127619-1) Supplementary materials are handed out in class. I encourage you to bring news articles from publications such as the Wall Street Journal, the Financial Times, The Economist and Business Week for discussions in class. All other course materials, journal articles, data files, and information pertaining to FIN3115 will be posted on the IVLE. You are expected to check any updates and files on the IVLE system on 1 the regular basis. You are encouraged to use IVLE discussion forum for your questions and comments. Consultation Hours To be decided Assessment Methods (i) Class participation (10%) Credits will be given for active participation in class. (Warning: Zero mark will be given for non-participation throughout the course.) Students will also be prompted with questions on the additional assigned readings from the financial times, the economists, and the Bloomberg. (ii) Weekly Group Presentations (20%) Students are required to form groups not exceeding 5 students. Each group will pick a currency pair (such as EUR/USD, USD/JPY, EUR/JPY, USD/CAD, EUR/GBP, GBP/USD, USD/CHF, AUD/USD, SGD/USD, AUD/JPY, Gold/$ etc.). Each group has 20-25 minutes to present the time trend of the currency pair, the determinants of its dynamics and future outlook of the trend (both in the short-run (1 week), the medium-term (1 month) and the long term (1-year)). You should utilize various research databases available. The group should submit the presentation slides (PowerPoint) before the previous Friday midnight. The total number of slides can not exceed 40. (iii) Test (50%) 2-hour test will be held in week 11 on 30 October 2010. (v) Final Group Project and Presentation (20%) Each group will be given a research project to complete. Non-presenting students gain credit for active participation in discussion during each presentation (see class participation above). Each group must submit soft copies of PowerPoint presentations and final report by 29 October 2010 Midnight (Friday). The final report should be single-spaced and not exceed 10 pages (including appendices). The font size should not be less than 10. The group writes a report on an Asian multinational corporation. The content of the report should include but not limited to the following items: 1) the main business and different methods of international business used by the company 2) the history of its development and management changes 3) possible reasons for their globalization (such as significant historical events) 4) good (or bad) examples or illustrations of management of foreign exchange risks 5) effective international management strategy of the firm can be highlighted 6) recommendations (or strategies) for the company to improve its performance You can collect the information about the company from news articles, company annual reports, financial databases and reports, or interviews with the managers in the company. You are highly encouraged to apply the knowledge learnt in the course in your analysis. Critical 2 and creative discussions are highly evaluated. The final presentation should last 20-25 minutes. The total number of slides can not exceed 40. I expect you to bring your name plate to class. The use of computers during class is not permitted. Tentative Course Plan (subject to changes): Week 1 1. Brief Introduction (Chapter 1) 2. National Accounts 3. Balance of Payments (Chapter 3) Week 2 4. The Evolution of the IMS (Chapter 2: pp. 25-35) 5. Introduction to the Foreign Exchange Markets (Chapter 5: pp. 108-124) Week 3 6. Exchange Rate volatility 7. Hedging Exchange Rate risk (Chapter 8: pp 192-193, 205-209) 8. Forward Contracts and Futures Markets (Chapter 5: pp. 125-129; Chapter 7: pp.165174; Chapter 8: 194-197) Week 4 9. Covered Interest Rate Parity and Synthetic Forward Rates (Chapter 6: pp. 134-142) Week 5 10. Foreign Currency Options (Chapter 7: pp. 174-179, Chapter 8: pp. 197-201) Week 6 11. Currency Swaps (Chapter 14: pp. 336-343) 12. Case Study (Chapter 9: pp. 236-238) Week 7 13. International Parity Conditions (Chapter 6: pp.142-151) a. The Forward as a Predictor of the Future Spot b. Uncovered Interest Parity c. Purchasing Power Parity and the Real Exchange Rate d. The Fisher Equation Week 8 14. Forecasting Exchange Rates (Chapter 6: pp.151-157) 15. Case Study (IVEY case study “Lufthansa” Case Number 9B00N022) 16. Fixed versus Floating Exchange Rates (Chapter 2: pp. 54-55) 17. Europe and the Euro (Chapter 2: pp.35-45) Week 9 18. Currency Crises (Chapter 2: pp. 45-54) 19. Harvard Case study “Currency Crisis” (Case No. 9799088) Week 10 20. International Portfolio Investment (Chapter 15) 21. Foreign Direct Investment and Cross-border Acquisitions (Chapter 16) 3 22. International Cost of Capital (Chapter 17) 23. Harvard Teaching Notes “Cross-Border Valuation” (Case Number 9-295-100) Week 11 24. Cash Flow Management (Chapter 19) 25. International Trade Finance (Chapter 20) 26. International Tax Environment (Chapter 21) Week 12 27. Final Presentations Week 13 28. Final Presentations 4