Intermediate Microeconomics: Final Exam

advertisement

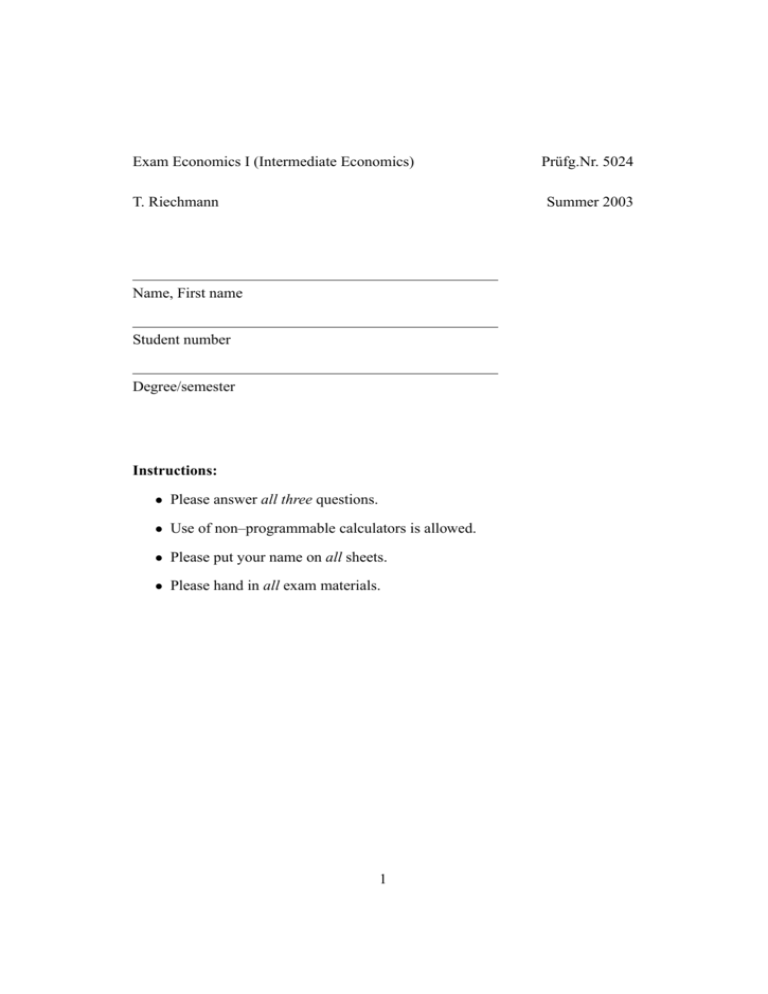

Exam Economics I (Intermediate Economics) T. Riechmann Prüfg.Nr. 5024 Summer 2003 Name, First name Student number Degree/semester Instructions: • Please answer all three questions. • Use of non–programmable calculators is allowed. • Please put your name on all sheets. • Please hand in all exam materials. 1 Question 1 The demand function is given by x = A p−γ with x giving the demand, p the price and A and γ as positive parameters. a) Derive the price elasticity of demand, ε. What is the economic meaning of the price elasticity of demand? What is elastic, what is inelastic demand? b) Denote revenues as a function of demand x and price p. How do revenues change as a reaction to an increase of the price, if demand is inelastic? c) Is the good in focus a Giffen good? Explain your answer both verbally and analytically. Answer 1 a) ε = dx p dp x: ε = −γ A p−γ−1 γ = − A p−γ x γ = − x x = −γ p x first important step Price elasticity of demand gives the reaction of demand to a change in price in relative terms. Elastic demand means, in relative terms, the reaction of demand is stronger than the initiating price change. Inelastic demand means, in relative terms, the reaction of demand is weaker than the initiating price change. b) R(x, p) = x(p) · p. If demand is inelastic, an increase of the price will increase revenues. c) No, it is not. For a Giffen good, the demand should increase with an increasing price, i.e. dd xp > 0. This is not the case, as the first derivative shows: dx = −γ A p−γ−1 < 0 . dp Question 2 A consumer has the utility function u(x1 , x2 ) = √ x1 x2 . a) Find the demand functions for x1 and x2 . b) Let the budget be m = 100. Prices are (p1 , p2 ) = (1, 1). What are the demanded quantities? What is the utility level? c) Let the price for the second good rise to p02 = 2. What are the demanded quantities? What is the utility level? 2 d) What is the income compensation necessary to put the consumer back to his original utility level after the price change? (What is the compensating variation?) e) Assume, the utility function is u(x1 , x2 ) = ln x1 + ln x2 . How does this new utility function change your results from parts a) to d) of this question? Answer 2 Remark: This question is identical to parts of Problems 2 and 3 of Problem Set ‘Consumer Surplus’. a) x1 = m 2 p1 , x2 = m 2 p2 b) x1 (p1 , p2 , m) = 50, x2 (p1 , p2 , m) √ = 50, u [x1 (p1 , p2 , m), x2 (p1 , p2 , m)] = 2 500 = 50 c) x1 (p1 , p02 , m) = 50, x2 (p1 , p02 , m) √ = 25, 0 0 u [x1 (p1 , p2 , m), x2 (p1 , p2 , m)] = 1 250 = 35.3553 d) needed: m0 , such that u [x1 (p1 , p02 , m0 ), x2 (p1 , p02 , m0 )] = u [x1 (p1 , p2 , m), x2 (p1 , p2 , m)]: q √ x1 (p1 , m0 ) x2 (p02 , m0 ) = 2 500 ⇔ x1 (p1 , m0 ) x2 (p02 , m0 ) = 2 500 m0 m0 ⇔ = 2 500 2 p1 2 p02 2 ⇔ m0 = 2 500 · 4 p1 p02 √ ⇔ m0 = + 20 000 = 141.421 compensating variation: ∆m = m0 − m = 41.421 e) Nothing changes. Question 3 A firm has the cost function c(y) = y2 + 1 and can sell its output at a price of p. a) Derive the firm’s inverse supply curve and the supply curve. b) What ouput level minimizes average costs? c) Compute the maximum profit as a function of p. d) Compute the producer’s surplus for p = 100 and p = 120 Answer 3 Remark: This question is identical to parts of Problem 1 of Problem Set ‘Individual Supply’. 3 a) inverse supply: p = 2 y, supply: y = p 2 b) two possible ways to solution: • minimize average costs AC: AC = y2 + 1 y d AC 1 ! = 1− 2 = 0 dy y ⇔ y = 1 • remember that ACmin is where the MC–curve crosses the AC–curve: ⇔ AC(y) = MC(y) y2 + 1 = 2y y ⇔ y = 1 c) We know that maximum profit is achieved by following the supply function: y = y? = 2p . Profit is given as π = p y − c(y). Consequently, maximum profit is π = p y? − c(y? ) p p = p · − c( ) 2 2 2 2 p p = − −1 2 4 1 2 = p −1 4 d) PS = p y − cv (y): p = 100 ⇒ y = 50 P = 120 ⇒ y = 60 ⇒ ⇒ cv = y2 = 2 500 cv = 3 600 4 ⇒ ⇒ PS = 5 000−2 500 = 2 500 PS = 7 200 − 3 600 = 3 600