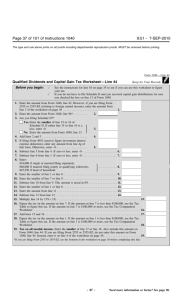

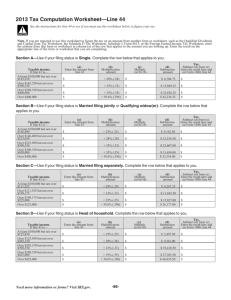

2011 Instruction 1040

advertisement