Syllabus Insurance Law 2014

advertisement

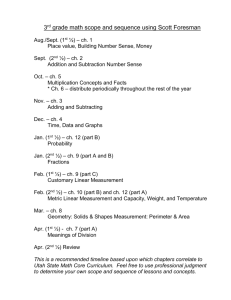

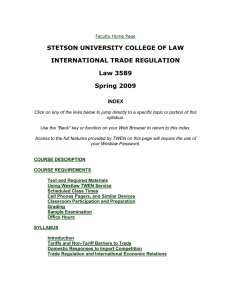

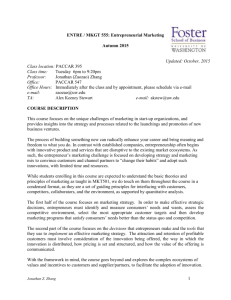

Creighton University School of Law Insurance Law Syllabus Spring 2014 2 Credits Instructor: Sherman P. Willis, J.D. State Farm Insurance Omaha, NE sherman.willis.kl9n@statefarm.com or sherman@shermanpwillis.com Texts: Required: Kenneth S. Abraham, Insurance Law and Regulation (5th ed. 2010)— Thomson Reuters (West); Healthcare Supplement to Abraham’s Insurance Law & Regulation (July 2012); supplemental materials to be handed out in class Recommended: Robert H. Jerry II et al., Understanding Insurance Law (5th ed. 2012)—Lexis Additional Resources: John F. Dobbyn, Insurance Law in a Nutshell (4th ed. 2003)—West; Steven Goldberg & Tracy McCormack, The First Trial (Where Do I Sit? What Do I Say?) in a Nutshell (2d ed. 2008)—West Class Times: Tuesdays and Thursdays, 8:00-9:00 a.m. Overview: Insurance is more than just a creature of contract law. Whether or not we recognize it, insurance touches virtually every aspect of our lives. The Supreme Court recognized this fact 70 years ago: Perhaps no modern commercial enterprise directly affects so many persons in all walks of life as does the insurance business. Insurance touches the home, the family, and the occupation or business of almost every person in the United States. United States v. South-Eastern Underwriters Assoc., 322 U.S. 533, 540 (1943). I am teaching this course to provide you with insight on insurance fundamentals so you can be better trial attorney (personal injury or defense), transactional attorney, or insurance professional. In a 2-credit course, we can only cover so much. So, topics like unemployment insurance and workers’ compensation will be omitted (which is a shame, since I practiced in the latter area for a number of years, and would love to cover it if we had time). These topics have been covered in the Social Legislation course in the past. More nuanced aspects of insurance law, such as no-fault insurance and secondary-market insurance (e.g., residual-market insurance, surplus/excess lines, and reinsurance), will not be covered in this course. Page 1 of 3 During our class sessions, I will make every effort to present the material in a practical way and provide examples to help humanize what we read. Attendance: The law school requires students to attend at least 80% of a course’s classes, and I will take attendance as required by the law school. I will treat you as the adults you are and not impose additional requirements. However, I expect that you will be punctual and participatory in class. Judges, opposing counsel, employers, and clients expect nothing less. Participation: I will assume that when you come to class, you have read the material and are ready to discuss it. I randomly call on pairs of students to participate. There might be an assignment or two that requires you to work with at least one other classmate and make a presentation to the rest of the class. Grade: There will be one final exam at the end of the course that accounts for the entire grade for the class. Page 2 of 3 Assignments: Page references are to the Abraham case book unless otherwise specified. Week 1 (Jan. 21, 23) Week 7 (Mar. 4, 6) INTRODUCTION Catch Up Trial Anatomy (handouts) Insurance History and Function, 1-5 Imperfect Information, 5-20 Week 8 (Mar. 18, 20*) Week 2 (Jan. 28, 30) LIFE, HEALTH, AND DISABILITY (con’t) INSURANCE CONTRACT FORMATION Disability Insurance, 429-37 (skim) Bad Faith, 442-62 Standardized Forms, 31-42 Public Policy Restrictions, 78-93 Week 9 (Mar. 25, 27) Week 3 (Feb. 4, 6) LIABILITY INSURANCE INSURANCE REGULATION Commercial Insurance, 463-94, 502-32 Regulatory Power Allocation, 114-18 State Regulation, 118-33 (skim) Federal Regulation, 158-70 Week 10 (Apr. 1, 3) Week 4 (Feb. 11, 13) Commercial Insurance, 532-40, 552-81 Directors & Officers/Professional Liability, 588-623 (skim) LIABILITY INSURANCE (con’t) FIRE AND PROPERTY INSURANCE Sample Homeowners Policy, 192-219 Trigger and Occurrence Issues, 219-26 Exclusions, 232-46 Measure of Recovery, 266-73 (skim) Subrogation, 274-81 (skim) Limited Interests/Mortgages, 282-85 (skim) Week 11 (Apr. 8, 10) Week 5 (Feb. 18, 20*) Week 12 (Apr. 15, 17*) LIFE, HEALTH, AND DISABILITY AUTOMOBILE INSURANCE Life Insurance, 327-45, 355-61 Week 6 (Feb. 25, 27) Sample Personal Automobile Insurance Policy, 683-96 Liability Insurance, 697-712 LIFE, HEALTH, AND DISABILITY (con’t) Week 13 (Apr. 22, 24) Healthcare Supplement, 4-31 (replaces case book materials on Health Insurance) AUTOMOBILE INSURANCE (con’t) INSURANCE DEFENSE/SETTLEMENT Insurance Defense, 624-50 Settlement, 659-68 Liability Insurance, 723-37 Uninsured/Underinsured Motorist Coverage, 74755 * Assigned date and/or time of class will need to be moved due to instructor conflict. Page 3 of 3