as two large economies. Export biased growth in country H will

advertisement

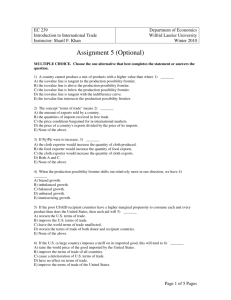

+consider H(home country) and F(the trade partner) as two large +what would be the effects of an export subsidy on natural gas economies. Export biased growth in country H will imposed by Russia? improve terms of trade of country F Relative world supply of gas rises and relative world demand falls +a country cannot produce a mix of products with a higher value than +what would be the effects of an import tariff on steel imposed by the where US? the isovalue line is tangent to the prod. poss. fronties Relative world supply of steel falls and real world demand rises +a country will be able to consume a bundle which is not attainable ~japan primarily exports manufactured goods (M) while importing raw solely from domestic production only if materials such as food and oil (R) Supposing that relative prices are expressed as PmPs and relative quantity as QM/QR, consider the the world terms of trade differ from domestic relative costs following hypothetical situations (i) a war in middle east disrupts oil supply +the offer curve of Nation shows the nations demand for imports and supply of exports (ii) korea develops the ability to produce automobiles that can sell in Canada and the US (iii) US engineers develop a fusion reactor that replace fossil fuel electricity plants and decreases the demand for raw material +exports prices must rise for a nation to increase in exports because (iv) a harvest failure in Russia the nation all of the above +which of the above shifts the RS curve to the right? (i), (ii) & (iv) +if two countries with diminishing returns and different marginal rates of substitution between two products were to engage in trade, then +which of the above shifts the RD curve to the right? the marginal rates of substitution of both would become equal (ii) & (iii) +in which of the above causes does japans term of trade deteriorate +during the 19th century, economic growth of the major trading (i), (ii) & (iv) countries was biased toward manufacturers and away from food. The less developed countries of that time were not exporters of food. From this information, we would expect to observed +intra-industry trade will tend to dominate trade flows when which of falling terms of trade for the less developed countries the following exists? small differences between relative country factor availabilities +production possibility frontiers shifts out….? biased growth +intra-industry trade is most common in the trade patterns of industria countries of western europe +a large country experiencing import biased growth will tend to experience improving terms of trade +if a nation exports twice as much of a differentiated product than it imports, its intra-industry index (Grubel-…) is equal to 0,67 +internal economies of scale arise when the cost per unit +what is “immiserizing growth” ? falls as the average firm grows larger export-biased growth that worsens term of trade so that a country is worse off +international trade based on external scale economies in both countries is likely to be carried out by A relatively large number of price competing firms +which of the following is not the reason for external economies of scale? large fixed costs +if Slovenia were a large country in world trade, then if instituted large set of subsidies for its exports, this, deteriorate its terms of trade +import tariff of TL 10 per unit imported good imposed by a large country: increase the price of this goods in the importing country by less than +A product is produced in a monopolistically competitive industry with TL10 and lowers export prices scale economies. If this Industry exists in two countries with similar endowments, and these two countries engage in trade one with the other, then we would expect +which of the cases below is a example of internal economies of scale the country with a relative abundance of the factor of a production in rather than external economies of scale~? which production of the product is intensive will export this product (i) most musical instruments in the US are produced by dozens of factories in Ellehart, India +two countries engaged in trade in products with no scale economies, (ii) All Hondas sold in the US are either imported or produced in produced under conditions of perfect competition, are likely to be Marywille, Ohio engaged in inter-industry trade (iii) All airframes for Airbus, Europe is only produce of large aircraft are assembled in Toulose, France (iv) Hartford, commecticed is the insurance capital of the northeast US +the larger the number firms in a monopolistic competition situation (ii) & (iii) the higher is the price charge +a monopoly firm engaged in international trade will +in industries in which there are scale economies, the variety of goods equate marginal costs with marginal revenues in both domestic and that a country can produce is constrained by foreign market the size of the market ~simit ayran tablo +it was found that when the united states imposed steel quotas, this +based on the above table in autarky caused harm not only to steel consumers, but also to many producers for whom steel is an important input. This insight Bulgaria produces 2 simits and 2 Ayrans suggest that steel production is an infant industry in the US +based on the above table, judging from autarky conditions, which country has comparative advantage in which goods +if a small country were to levy a tariff on its imports, then this would decrease the country’s economic welfare neither country has comparative advantage in any good +based on the above table, if Bulgaria completely specialized in simits, Romania produces no simits and 7 Ayrans +an important difference between tariffs and quotas is that tariffs generate the tax revenue for the government +based on the above table, if Bulgaria completely specialized in simits and if the world terms of trade were established at 3,5 simits=3,5 ayrans, which country would enjoy agains from trade as compared to +if Slovenia were a small country in world trader then if it imposes a autarky situation? large series of tariffs on many of its imports, this would have no effect on its terms of trade both countries gain equally ~(tablo) small nation produce at Q1 and consumers at D1 under free +if relative to its trade partners Gambinia has m…workers but little trade conditions. The nation imporses a tariff on its import commodity land and even less produce capital, then following the specific factor (good x) and ends up production at Q2 and consuming at D2 model in order to help the countries economic welfare Gambinion gov. should +GDP evaluated at international prices after the tariff represented by protect the manufacturing sector V1 +international trade has strange effects on income distribution +the consumption distortion loss created by the tariff is represented by Therefore international trade the movements from D1 to D2 will tend to hurt some groups in each trading country +the production distortion loss created by the tariff is represented by +tastes of individuals are represented by the shifts of the budget constraint from U2 to U1 the indifference curve ~above figure shows the partial effects in a small country of a %100 +when the production possibility frontier shifts out relatively more in tariff on imports which have a world supply shown by Sworld. one direction we have Calculate the welfare effects and answer the below questions on the answer sheet. biased growth +what is the TL value of the change in producer surplus? Is it an increase or decrease? 15 increase +if two countries were very different in their relationship factor availabilities, then we would not expect which of the following to be empirically supported? the Tecksher-Ohlin theorem +what is the TL value of the production distortion loss? 5 decrease +export prices must rise for a nation to increase in exports because the ration ~large offers subsidy on exports where by world price falls from Pw to faces increasing opportunity cost in production Ps* and domestic price increases letters designating the related areas answer the following questions on the answer sheets +calculate the welfare loss associated with the government subsidy on +external economies of scale arise when the cost per unit exports falls as the industry grows larger rises as the average firm grows -d-e-f larger +which of the following is not source of welfare loss consequent to the imposition of tariff? tax revenue from tariffs, redistributed government expenditures +in the 2 factor, 2 goods Heckscher-Ohlin Model, a change from autarky (no trade) to tarde will tend to make the wages in both countries more similar +factors tend to be specific to certain uses and products in the short run +suppose that there are two factors, capital and land asn that the Canada is relatively land and owned while European Union is relatively capital endowed according to the Heckscher-Ohlin +empirical observations on actual North-South trade patterns tend to European capitalist should support a Canadian European free trade agreement support the validity of the Heckscher-Ohlin Model