Maternity Benefit MB 10

advertisement

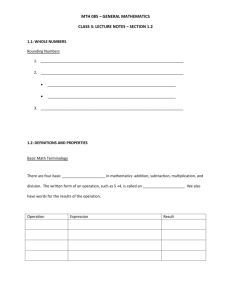

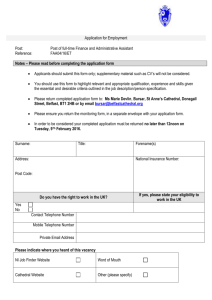

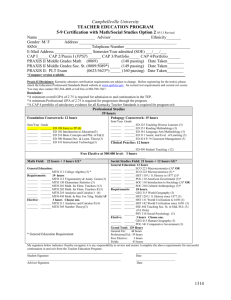

Social Welfare Services Office Claim form for Maternity Benefit Complete this claim form as follows: — if you are in Employment - Complete PARTS 1, 2 and 5 to 10 — your Employer must complete and stamp PART 3 — if you are Self-Employed - Complete PART 1 and PARTS 4 to 10 REMEMBER: Your Doctor MUST complete and stamp PART 11. • Please use BLOCK LETTERS and place a tick ( ! ) in the boxes provided. • Please answer ALL questions, if some questions do not apply to you draw a line through the answer box. • Failure to answer questions could cause a delay in processing your claim. PART 1 Please state: 1. Your Full Name ‘Maiden Name’ is your name before you married. 2. Where do you live? 3. Telephone Number if any Your Own Details Mrs. Miss Last Name First Name(s) Maiden Name (if any) Address Code 4. Your Date of Birth 5. Your RSI Number (same as tax number) 6. Your Old Social Insurance Number if you have one Ms. Local Number DAY MTH YR LETTER(S) FIGURES This number was used prior to 1979 - if no number write ‘none’. 7. Are you? ‘Cohabiting’ means you live with a man as his wife and you are not married to him. 8. If you are Married when did you get Married? Married Single Separated Cohabiting Widowed Divorced DAY MTH YR MB 10 e PART 2 Your Employment Details ‘Employed’ is where you work for another person or company and you get paid for this work. 9. Are you employed at present? YES y r NO If YES please state: a u r b e Employer’s Name Who do you work for? Address What is your job? Occupation Is your employment full-time or part-time? FULL-TIME F : PART-TIME If PART-TIME state how much you get paid Gross Pay £ n o i s r e ‘Gross pay’ is your pay BEFORE any deductions are made e.g tax, PRSI, union dues etc.. 10. When do you intend to start Maternity Leave? 11. If you are not in employment when did you last work? V t Who did you work for? e n r What was your job? If YES please state how you are related to him/her: DAY MTH YR DAY MTH YR MTH YR Employer’s Name Address Occupation 12. When did you originally start working? 13. Are you related to your employer? a week DAY YES NO Relationship: If you are in Employment your EMPLOYER must complete PART 3 across e To be completed by your EMPLOYER PART 3 REMEMBER: An employee MUST give at least 4 weeks notice of her intention to take Maternity Leave. 14. Please state your Employee’s Name Her Full Name 16. Please give details of Employee’s PRSI record for the 12 month period immediately before her Maternity Leave starts: a u r b e Number Period of Employment FROM DAY TO MTH y r LETTER(S) FIGURES 15. Her RSI Number (same as tax number) YEAR DAY PRSI of Weeks Class MTH YEAR Class If more than ONE Class of PRSI has been paid, please give details. Period of Employment F : FROM DAY TO MTH YEAR n o i s r e 17. Has Employee given notice of her intention to take Maternity Leave? V t Number PRSI of Weeks Class YES DAY MTH YEAR Class Class Class Class NO I/We certify that the above-named employee has given notice of her intention to take Maternity Leave as follows: If YES please complete across: e n r FROM TO DAY MTH YR DAY MTH YR Signed by or on behalf of EMPLOYER: NAME: Employer’s Official Stamp (NOT block letters) POSITION IN COMPANY/ ORGANISATION: EMPLOYER’S REGISTERED NUMBER: TELEPHONE NUMBER: Code Local Number DATE: WARNING - EMPLOYERS PLEASE NOTE: False or misleading statement made in order to obtain Maternity Benefit for another person can result in a fine of up to £10,000 or Imprisonment for up to 3 years, or both. e PART 4 Details of Self-Employment - complete here if you are or were self-employed ‘Self-employed’ is where you work for yourself. 18. Are you or have you ever been self-employed? YES a u r b e If YES please state: What is/Was your profession? Occupation When did you start self-employment? DAY MTH If you are no longer self-employed when were you last self-employed? DAY MTH 19. When do you intend to start Maternity Leave? F : DAY MTH n o i s r e 20. What date do you intend to return to self-employment after your Maternity Leave? 21. Please give details of your self-employment business as follows: y r NO DAY MTH YR YR YR YR Business Name Address of Business V t e n r 22. Is your business a Limited Company? 23. Are you a Sole Trader? Business Registration Number Business Telephone Number Code YES Local Number NO • IF YES ATTACH A COPY OF YOUR P35 FOR THE RELEVANT TAX YEAR(S). YES NO • IF YES ATTACH A NOTICE OF ASSESSMENT OF TAX FOR THE RELEVANT TAX YEAR(S) AND A COPY OF A RECEIPT OF PAYMENT FROM THE REVENUE COMMISSIONERS. Remember to send in ALL the Certificates/Documents with this claim. Work Details in Another EU Country PART 5 24. Have you ever been employed in an EU country other than Ireland? YES NO y r If YES complete the following: Country where you worked EMPLOYER’S Name and Address 25. Have you been employed in Ireland since you returned? PART 6 Your Social Security Number there Dates you worked there? FROM: TO: YES NO F : a u r b e FÁS Courses/Other Claims Details If you have claimed or you have been paid any social welfare payments, or if you have participated in a FÁS course in the last 2 years, you may be entitled to credited contributions (credits) to help you qualify for Maternity Benefit. e n o i s r e 26. Give details of FÁS courses you have attended (if any): 27. Have you during the last 2 years ‘signed’ for Unemployment Benefit/Assistance or for ‘credits’? If YES please state: Type of FÁS course YES Date you last signed/attended V t Name of local Social Welfare Office you attended 28. Are you being paid any pension, benefit or assistance from the Department of Social, Community and Family Affairs (formerly the Department of Social Welfare)? e n r If YES please state: 29. Are you getting any payment(s) from a Health Board? If YES please state: FROM: DAY TO: NO MTH YR Local Social Welfare Office Address YES NO Type of Payment Claim/Reference Number Amount you get £ YES Type of Payment Name of Health Centre that pays you a week NO e Your Husband/Partner’s Details PART 7 Your ‘partner’ is a man who is not married to you but lives with you as your husband. Please state: y r Mr. 30. Your Husband/Partner’s Full Name Last Name a u r b e First Name(s) 31. His RSI Number (same as tax number) 32. Is your husband/partner in employment? YES If YES please state your husband/partner’s gross weekly income: F : V t — from the Department of Social, Community and Family Affairs (formerly the Department of Social Welfare)? per week If his Gross Weekly Income is under £105 per week please send in his last 6 payslips as a higher rate of Maternity Benefit may be payable. n o i s r e 33. Is your husband/partner getting a weekly payment: e n r NO His Gross weekly income £ ‘Gross Income’ is his pay BEFORE any deductions are made e.g tax, PRSI, union dues etc.. or LETTER(S) FIGURES YES NO YES NO Type of Payment — from a Health Board? Amount he gets £ If YES please state: Claim/Reference Number Name of Office that pays him a week e Child Dependant Details PART 8 If you qualify for Maternity Benefit you will be entitled to a rate of payment not less than the rate of Disability Benefit which would be paid to you if you were absent from work through illness. To enable us to calculate the correct rate of benefit, you must give details of your child dependants (that is, your children under age 18). 34. Do you have a child or children under age 18? If YES please give details here: YES NO Date of Birth Child’s Full Name PART 9 Your Maternity Benefit can be made: *Type of Account: The account used must be a Current or Deposit Savings Account (NOT a mortgage account). YEAR Payment Details — — V t MTH How is s/he Is this child related living to you? with you? F : n o i s r e 35. If you are getting Child Benefit, what is your Child Benefit Number? e n r DAY y r a u r b e Start with your eldest child by Direct Payment to a Bank or Building Society Account* or by cheque direct to you at home. Give details here if you want your payment made by Direct Payment: into a Bank Account into a Building Society Account. Bank/Building Society Name Bank/Building Society Address Whose name is the Account in? Type of Account Account Number Sort Code Payment by Cheque direct to me at home. PART 10 Declaration to be completed by YOU I wish to claim Maternity Benefit. I declare that the information I have given is true and complete to the best of my knowledge. I will tell the Department of Social, Community and Family Affairs if there is any change in the details given. y r YOUR Signature or Mark DATE (NOT block letters) a u r b e If the claimant is unable to sign, her mark should be made and witnessed. The witness should sign below: SIGNATURE OF WITNESS DATE (NOT block letters) ADDRESS OF WITNESS IMPORTANT: You should claim at least 6 weeks BEFORE you intend to start Maternity Leave. WARNING: Penalty for false statement or withholding information: Fine or Imprisonment or both. F : To be completed by your DOCTOR PART 11 This section should be completed NOT earlier than 16 weeks before your baby is due. n o i s r e To (Name of Claimant) my opinion you may expect to be confined on Date of Examination DAY DOCTOR’S SIGNATURE: (NOT block letters) ADDRESS V t DAY I certify that I have examined you and that in MTH (that is, expected date of delivery) MTH . YR YR Doctor’s Official Stamp This completed Claim Form should be sent to: e e n r Maternity Benefit Section Social Welfare Services Office Government Buildings Ballinalee Road Longford. If you have any problem filling in this form, please phone us at the following telephone numbers or call to your local Social Welfare Office: Telephone: Longford Dublin (043) 45211 (01) 8748444 The Department of Social, Community and Family Affairs will treat all information and personal data which you give as confidential. It will only be disclosed to other bodies in accordance with Social Welfare law and it will be the Department’s responsibilities under the Data Protection Act and Freedom of Information Act. 40K10-99 Data Protection and Freedom of Information Edition: Oct., 1999 INT: Mar 2000 If you are Self-Employed remember to send in ALL the Certificates/Documents with this claim.