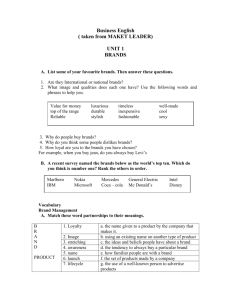

Burberry 2014/15 Strategic Report

advertisement