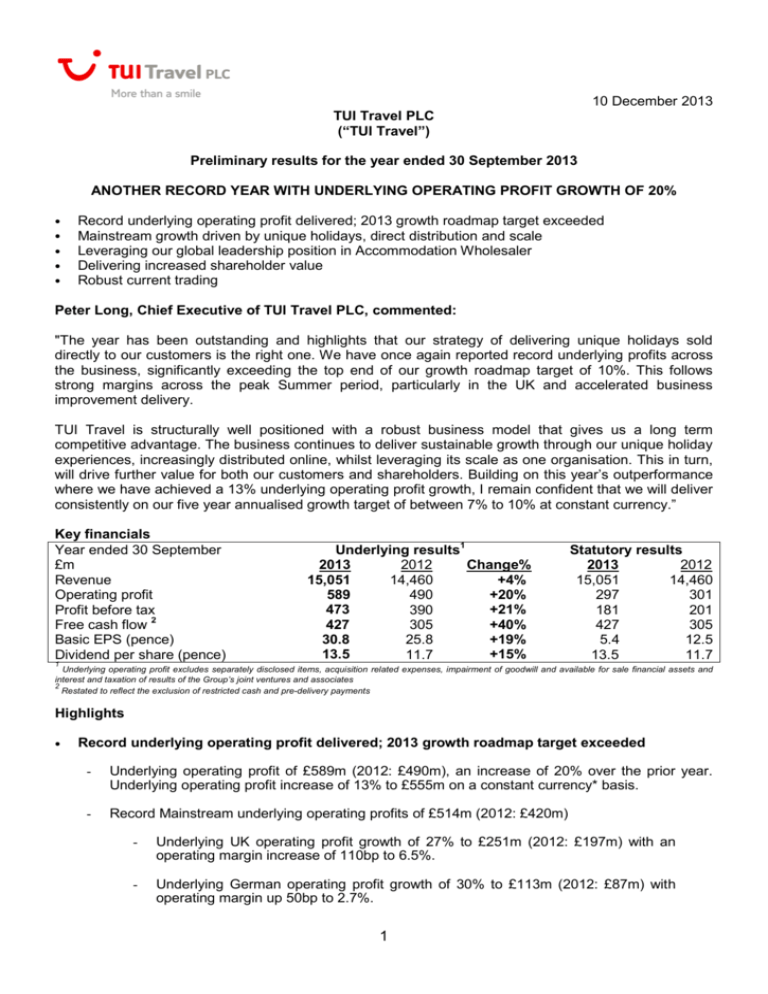

10 December 2013 TUI Travel PLC (“TUI Travel”) Preliminary results

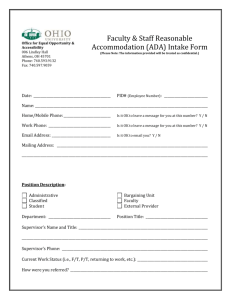

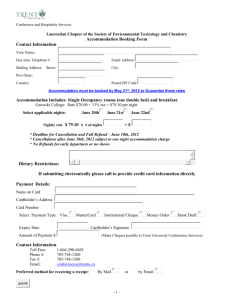

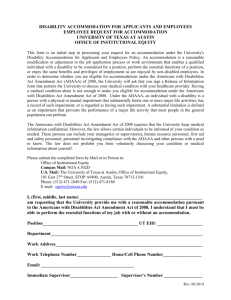

advertisement