Beauty Salons

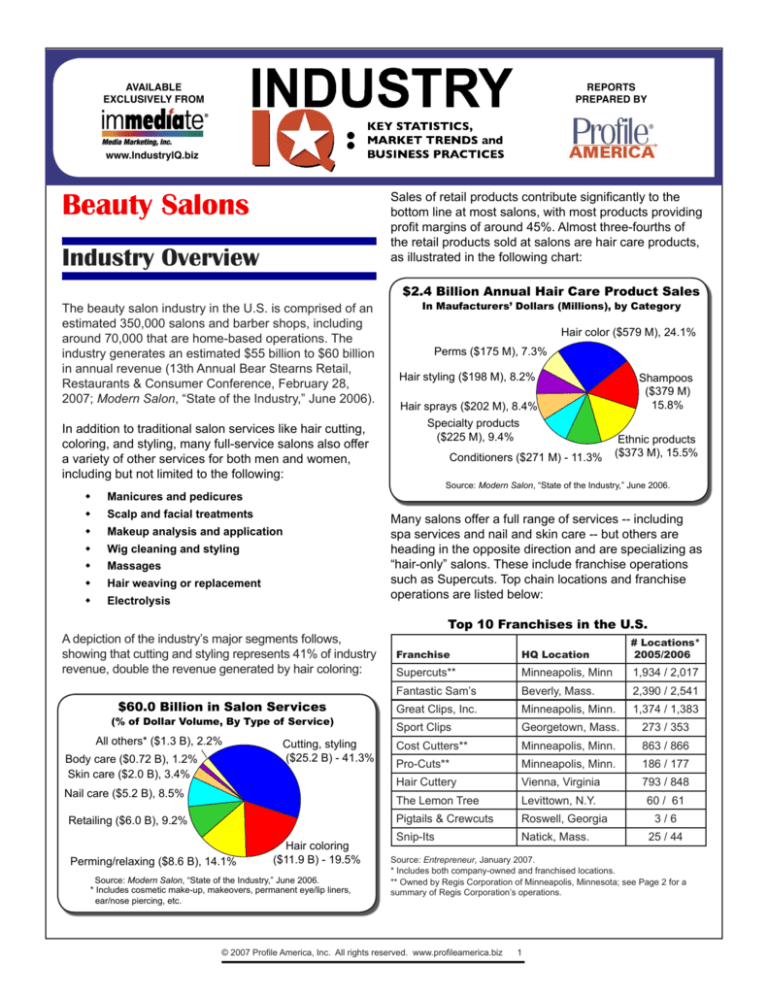

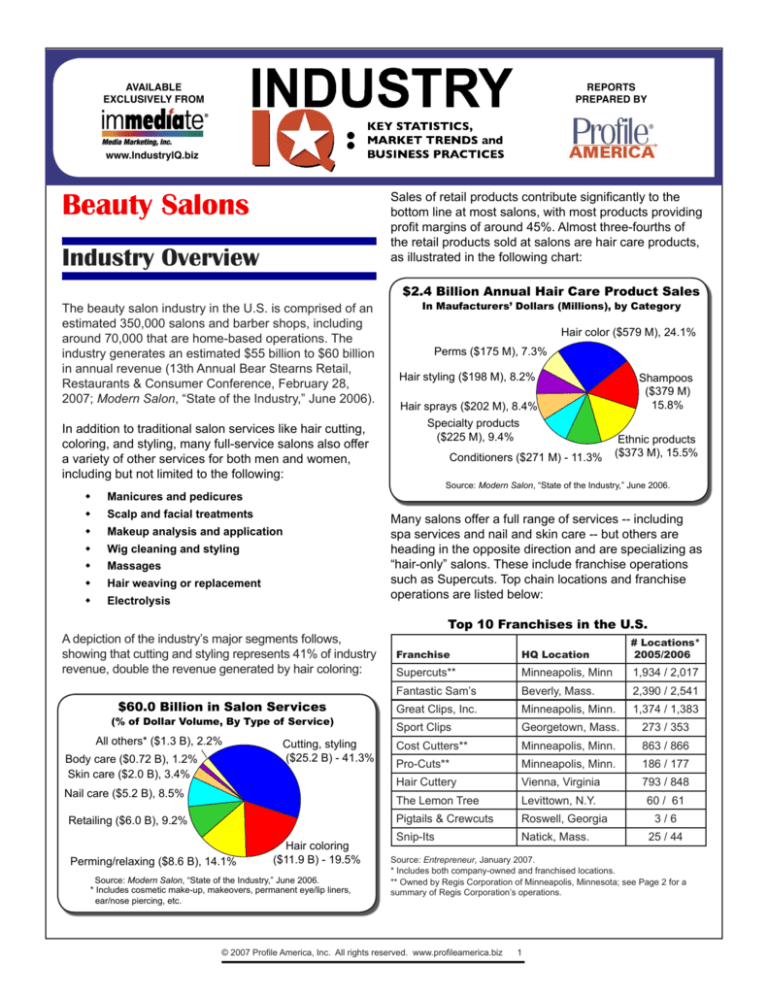

Sales of retail products contribute significantly to the

bottom line at most salons, with most products providing

profit margins of around 45%. Almost three-fourths of

the retail products sold at salons are hair care products,

as illustrated in the following chart:

Industry Overview

$2.4 Billion Annual Hair Care Product Sales

The beauty salon industry in the U.S. is comprised of an

estimated 350,000 salons and barber shops, including

around 70,000 that are home-based operations. The

industry generates an estimated $55 billion to $60 billion

in annual revenue (13th Annual Bear Stearns Retail,

Restaurants & Consumer Conference, February 28,

2007; Modern Salon, “State of the Industry,” June 2006).

In addition to traditional salon services like hair cutting,

coloring, and styling, many full-service salons also offer

a variety of other services for both men and women,

including but not limited to the following:

Manicures and pedicures

Scalp and facial treatments

Makeup analysis and application

Wig cleaning and styling

Massages

Hair weaving or replacement

Electrolysis

A depiction of the industry’s major segments follows,

showing that cutting and styling represents 41% of industry

revenue, double the revenue generated by hair coloring:

$60.0 Billion in Salon Services

(% of Dollar Volume, By Type of Service)

All others* ($1.3 B), 2.2%

Body care ($0.72 B), 1.2%

Skin care ($2.0 B), 3.4%

Cutting, styling

($25.2 B) - 41.3%

Nail care ($5.2 B), 8.5%

Retailing ($6.0 B), 9.2%

Perming/relaxing ($8.6 B), 14.1%

Hair coloring

($11.9 B) - 19.5%

Source: Modern Salon, “State of the Industry,” June 2006.

* Includes cosmetic make-up, makeovers, permanent eye/lip liners,

ear/nose piercing, etc.

In Maufacturers’ Dollars (Millions), by Category

Hair color ($579 M), 24.1%

Perms ($175 M), 7.3%

Hair styling ($198 M), 8.2%

Shampoos

($379 M)

15.8%

Hair sprays ($202 M), 8.4%

Specialty products

($225 M), 9.4%

Conditioners ($271 M) - 11.3%

Ethnic products

($373 M), 15.5%

Source: Modern Salon, “State of the Industry,” June 2006.

Many salons offer a full range of services -- including

spa services and nail and skin care -- but others are

heading in the opposite direction and are specializing as

“hair-only” salons. These include franchise operations

such as Supercuts. Top chain locations and franchise

operations are listed below:

Top 10 Franchises in the U.S.

Franchise

HQ Location

# Locations*

2005/2006

Supercuts**

Minneapolis, Minn

1,934 / 2,017

Fantastic Sam’s

Beverly, Mass.

2,390 / 2,541

Great Clips, Inc.

Minneapolis, Minn.

1,374 / 1,383

Sport Clips

Georgetown, Mass.

273 / 353

Cost Cutters**

Minneapolis, Minn.

863 / 866

Pro-Cuts**

Minneapolis, Minn.

186 / 177

Hair Cuttery

Vienna, Virginia

793 / 848

60 / 61

The Lemon Tree

Levittown, N.Y.

Pigtails & Crewcuts

Roswell, Georgia

Snip-Its

Natick, Mass.

3/6

25 / 44

Source: Entrepreneur, January 2007.

* Includes both company-owned and franchised locations.

** Owned by Regis Corporation of Minneapolis, Minnesota; see Page 2 for a

summary of Regis Corporation’s operations.

© 2007 Profile America, Inc. All rights reserved. www.profileamerica.biz

Industry giant Regis Corporation (which owns Supercuts

and Cost Cutters, among others) has experienced

explosive growth over the past decade:

Industry Leader Regis Corporation

•

Headquartered in Minneapolis, Minnesota, Regis is

the world’s largest owner, operator and franchisor

of salons in the industry -- with approximately

11,500 salons around the world (including 9,500 in

North America).

•

In 2006, Regis reported over $2.4 billion in

revenue, up 11% from $2.2 billion in 2005.

•

Regis operates 1,700 SmartStyle salons in WalMart stores and is the largest Wal-Mart tenant

(followed by McDonald’s). It has been adding 230

SmartStyle salons annually.

•

It entered the beauty school business through its

acquisition of Blaine Beauty Careers in June 2004.

•

With the purchase of Hair Club for Men and

Women (90 locations) in 2005, it entered the hair

restoration business.

•

In addition to Supercuts, Cost-Cutters and Pro

Cuts, Regis Corporation’s other brands include

Best Cuts, City Looks, Coiff & Co., First Choice,

Hair Express, Hairmasters, Holiday Hair, Magicuts,

Mia & Maxx, Mastercuts, Style America, TGF,

Trade Secret and Vidal Sassoon.

•

Regis holds an estimated 4% of total industry

revenue and contends that its nearest competitor

is one-tenth its size. It states that 50,000 salon

operations are attractive acquisition targets, and it

acquires just one out of thirty salons or chains that

are presented to it for consideration.

Source: 13th Annual Bear Stearns Retail, Restaurant and Consumer Conference, February 28, 2007.

Despite the presence of large national players like Regis

Corporation and other franchise operations, the industry

is comprised primarily of small salons. An estimated

80% have four or fewer employees, according to

zapdata.com, a unit of D & B Sales and Marketing, Inc.*

Issues and Trends

Most salon owners experience small to moderate

year-to-year increases in revenue, with 3% to 4% the

norm (Modern Salon, June 2006). While most industry

participants do not see double-digit gains in revenue

from one year to the next, they enjoy stability and

modest growth if they give clients what they want, for a

fair price, in an appealing setting.

Salons are in the “replenishment business” -- offering

clients a regular lift, makeover or transformation in their

* It may appear that more people are employed by salons than is the case. It is

customary in the industry to see a salon with 10 stylists at work, but many (or

sometimes all) of them are independent contractors who rent “stations” at salons

and are not actual employees.

look and their attitude, generally for a fair price. There

is no technological obsolescence to worry about, and

competition from China or other offshore providers is not

an issue, so volatility is rarely a problem for salons.

The challenges include growing competition from niche

players; a shrinking middle class; increased costs of

doing business; and clients’ tendency to stretch out visits

to save money. According to one industry distributor

of salon products, salons that find a high-quality niche

and concentrate on marketing directly to their target

market can expect to see higher-than-average revenue

increases (Modern Salon, June 2006; Salon Today,

February 2007). Among the niches mentioned as

showing high growth potential are the following:

•

Products and services for thinning hair

•

Hair-color only salons

•

Sophisticated men’s salons (or specialized men’s

departments within full-service salons)**

•

Hair extensions (and/or wigs for people who’ve

undergone chemotherapy or extreme hair loss)

Once considered a “niche” but now mainstream, spa

services are offered at 14,000 beauty salon-day spa

combination shops. According to the International

Spa Association press release (February 5, 2007), an

estimated $9.7 billion is spent at spas annually, up from

$5.4 billion in 2003. The ISA press release also notes

that almost one-third of all men have visited a spa, and

two of the fastest growing spa services are “traveling

spas” (for in-home wedding parties and the like), and

”medical spas,” offering facial peels, microdermabrasion,

and other dermatological procedures.

Many salons continue to struggle and are being forced

to cut expenses to maintain profitability, but others have

enjoyed impressive growth. Profiled in the 2007 “SALON

TODAY 200” issue (January 2007), the fastest-growing

salons in the U.S. averaged 29% revenue growth in

2006. Average revenue at these 200 fast-growing salons

is around $1.6 million; average operating costs follow:

Salon Today 200 - Average Salon Expenditures

Other - 4%

Telecom/utilities/insurance - 5%

Professional services - 2%

Education/training - 2%

Employee benefits - 2%

Marketing/advertising - 3%

Owner compensation - 5%

Rent/mortgage - 6%

Taxes - 6%

Labor costs

48%

Profit - 7%

Supply costs - 12%

Source: Salon Today, January 2007.

Totals more than 100% due to rounding.

** Barbershops are coming back into focus in some markets, since bottoming out

in the 1980s. There are an estimated 220,000 licensed barbers in the U.S., up

from 185,000 in 1989, according to the National Association of Barber Boards in

America. A trend that may gain momentum is franchise operations like Roosters,

which has around 20 locations in operation and 20 planned. Based on the

concept of men-only camaraderie and atmosphere, the chain also hopes to bring

© 2007 Profile America, Inc. All rights reserved. www.profileamerica.biz

back the art of the facial shave (Wall Street Journal, May 2, 2006).

Salons featured in the “Salon Today 200” report

share many of the same characteristics, including an

emphasis on customer-retention programs, moneyback guarantees, in-house employee training programs,

fully-stocked retail departments (rather than just a few

shelves of items), community outreach programs, and

clean, comfortable surroundings.

Another characteristic shared by most of the 200

high-growth salons is that almost all have websites to

showcase their stylists and services. Some are even

able to let clients book appointments, and employees

are often given password-protected access to areas

of the site for education and training, to view their

schedules, and to make notes and leave feedback for

salon managers (Salon Today, January 2007).

Factors mentioned in the advertising placed by the

owners or managers of beauty salons are intended

to encourage consumers to call or visit the salon.

“Confidence factors” and “convenience factors” are

designed to appeal to consumers’ desire for reliable

products and services. Examples of each follow:

Conference (February 28, 2007). Among the “Salon

Today 200,” average spending jumps to $47 (including

shampoo, cut, and style). Upscale salons typically

do more than shampoo, cut and style hair; in many

cases, additional services are performed (all-over color,

highlights, extensions, flat-iron process, or chemical

treatments to straighten hair or give it more body).

Multiple services and treatments can easily push

average per-visit salon spending to $300 or more.

Average household spending can be calculated

to determine market size and share of the market.

Spending on salon services for men and women in the

U.S. reached around $60 billion in 2006, or $535 per

household. In an area of 45,000 households, it is fair

to assume that around $24 million is spent on salon

products and services. If a salon generates $750,000

annually, its market share would be around 3.1%, a

baseline for comparison with future results.

Critical Success Factors

•

Listen to what clients want -- especially first-timers.

Set aside 10 minutes on the first visit to ask about

their prior salon experiences and what they expect

out of their experiences with a new salon. And

never assume clients will be happy with someone

else’s recommendation of what should be done

with their hair; it’s up to the client to decide.

•

Start and finish with client on time. This requires

that front-desk staff be efficient and that if a stylist

is running late or cannot start on time, a complimentary mini-service (nail polish change or deep

conditioning treatment) be offered.

•

Answer every technical question that clients may

have. Educational programs are offered at most

successful salons, which stylists are often required

to attend. This helps build trust and confidence in

all stylists at a salon, so if one stylist is out for an

extended period, clients can be referred to another

stylist.

•

Guarantee the work done by stylists. If clients are

not 100% satisfied, agree to remedy the problem

fully and immediately.

Confidence Factors Mentioned in Ads

Photos / Illustrations

Before and After Photos

Training -- Sassoon, etc.

Years in Business

Specialty - Fine Hair, Curly, etc.

“Problem Hair Experts”

Advanced Cutting Techniques

Satisfaction Guaranteed

European Skin Care / Full-Day

Pampering

Awards Won /

Professional Staff

Owner’s Name(s)

Smoke-Free Environment

Source: 2006 Comparative Ad Analysis Survey, Norbert J. Kuk & Associates

Convenience Factors Mentioned in Ads

Location Data / Maps

Multiple Locations

Walk-Ins Welcome

Invitation to Visit Website

One-Stop / Full-Service Salon

Private Booths

In-Home Service - Weddings

Gift Certificates

Virtual Tour of Day Spa

Phone Consultation

Current Specials on Website

Same-Day Appointments

Source: 2006 Comparative Ad Analysis Survey, Norbert J. Kuk & Associates

Value of Products and

Services in the Industry

Average per-client spending for a haircut in hair-only

salons owned and operated by the Top 10 players (like

Supercuts or Cost Cutters) is around $16, according

to Regis Corporation’s CEO, in a presentation made

at the Bear Stearns Retail, Restaurant and Consumer

Source: Modern Salon, December 2006.

Industry Resources

Salon Today, www.salontoday.com

Modern Salon, www.modernsalon.com

American Salon, www.americansalonmag.com

American Spa, www.americanspamag.com

International Spa Association, www.experienceispa.com

National Cosmetology Association, www.ncacares.org

Professional Beauty Association / The Salon Association,

www.probeauty.org

© 2007 Profile America, Inc. All rights reserved. www.profileamerica.biz

Background

Values and Benefits

Media Marketing, Inc., creators of imMEDIAte®

software, has been in the forefront of sales

presentation systems since 1987. The imMEDIAte suite, a state-of-the-art consultative

system, is used by hundreds of media reps every day to create compelling presentations

and expert media proposals. Built on Microsoft

Office® technology, the imMEDIAte system

provides a complete solution to your media

sales needs.

Media Marketing is an authorized distributor

of Profile America’s IndustryIQ reports. Sales

and marketing teams embrace these industryknowledge reports because of their concise,

easy-to-read style and rich store of information.

Regular use of IndustryIQ reports creates a

relationship-building, consultative environment. Since 1986, Profile America has provided

profiles of industries, markets and trends to

business-to-business marketers, facilitating

an understanding of the industries into which

they sell their products and services.

Program Objectives

IndustryIQ reports are used by managers

as sales training, planning and business

development tools. Sales reps use IndustryIQ

reports to prepare for sales calls and as a

valuable leave-behind.

Armed with independent, third-party

assessment of industry dynamics, media reps

can “walk the walk and talk the talk” of their

advertisers’ industries, allowing reps to better

assist advertisers in creating compelling,

effective messages for their target audiences.

Sales reps want to be smart about advertisers’

industries, but face the realities of limited time

and resources. They need to track dozens of

different industries, and value these concise,

easy-to-use sales tools that they can leave

behind with their advertisers.

Likewise, managers want reps to be confident,

professional and informed. They want their

reps viewed as partners, not vendors -- and

they appreciate the IndustryIQ method

of collecting, analyzing and presenting

information.

Independent, third-party IndustryIQ reports

leave marketing and sales professionals

free to practice their core competencies:

developing successful advertising strategies

for their clients.

Delivery

IndustryIQ reports incorporate a customer-

guided approach to gathering information

and creating industry-knowledge products.

We value your content recommendations as

we strive to create the most useful, fact-filled

industry reports available.

IndustryIQ reports are available in PDF

format from Media Marketing’s web site, www.industryIQ.biz.

IndustryIQ is distributed by Media Marketing, Inc., in association with Profile America, Inc., for use by advertising sales representatives.

Although the information in this report has been obtained from sources that Profile America, Inc. believes to be reliable,

no guarantees are made as to the accuracy of the information presented, and any information presented may be incomplete or condensed.

© 2007 Profile America, Inc. All rights reserved. www.profileamerica.biz