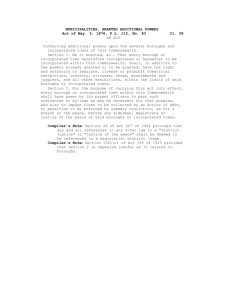

Partnership Act 1891 - South Australian Legislation

advertisement