Disclaimer - Royal Nickel Corporation

advertisement

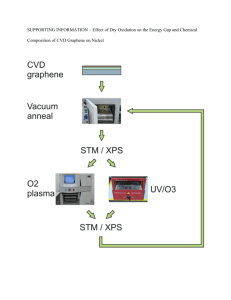

Nickel Outlook The Most Exciting Nickel Cycle Yet to Come ? Metal Bulletin 2013 International Nickel Conference Mark Selby, SVP Business Development Royal Nickel Corporation April 29, 2013 Disclaimer Cautionary Statements Concerning Forward‐Looking Statements This presentation contains "forward‐looking information" including without limitation statements relating to mineral reserve estimates, mineral resource estimates, realization of mineral reserve and resource estimates, capital and operating cost estimates, the timing and amount of future production, costs of production, success of mining operations, the ranking of the project in terms of cash cost and production, permitting, economic return estimates, potential upsides, and the future price and supply and demand for nickel. Readers should not place undue reliance on forward‐looking statements. Forward‐looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward‐looking statements. The pre‐feasibility study results are estimates only, are preliminary in nature and are based on a number of assumptions, any of which, if incorrect, could materially change the projected outcome. Until a positive feasibility study has been completed, and even with the completion of a positive feasibility study, there are no assurances that Dumont will be placed into production. Factors that could affect the outcome include, among others: the actual results of development activities; project delays; inability to raise the funds necessary to complete development; general business, economic, competitive, political and social uncertainties; future prices of metals; availability of alternative nickel sources or substitutes; actual nickel recovery; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; delays in obtaining governmental approvals, necessary permitting or in the completion of development or construction activities. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward‐looking statements, refer to RNC's filings with Canadian securities regulators available on SEDAR at www.sedar.com. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward‐looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward‐looking statements contained herein are made as of the date of this presentation and the Corporation disclaims any obligation to update any forward‐looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws NI 43‐101 Compliance Unless otherwise indicated, the Corporation has prepared the technical information in this presentation ("Technical Information") based on information contained in the revised pre-feasibility study dated June 22, 2012 relating to the Corporation's Dumont Nickel Project and news releases (collectively the "Disclosure Documents") available under Royal Nickel Corporation’s company profile on SEDAR at www.sedar.com. Each Disclosure Document was prepared by or under the supervision of a qualified person (a "Qualified Person") as defined in NI 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. Readers are encouraged to review the full text of the Disclosure Documents which qualifies the Technical Information. Readers are advised that mineral resources that are not mineral reserves do not have demonstrated economic viability. The Disclosure Documents are each intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Information is subject to the assumptions and qualifications contained in the Disclosure Documents. The Mineral Resource for the Dumont Deposit was classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (December 2005) by Sébastien Bernier, P. Geo (OGQ#1034, APGO#1847), an appropriate independent person for the purpose of NI 43‐101. The Mineral Reserve for the Dumont Deposit was classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (December 2005) by David Penswick, P. Eng. (PEO#100111644), an appropriate independent person for the purpose of NI 43‐101. Preparation of this presentation has been supervised by Alger St‐Jean, P. Geo., Vice President, Exploration of RNC and Qualified Person and Johnna Muinonen P. Eng., Vice President, Operations, of RNC and Qualified Person as defined in NI 43‐101. All currency references in U.S. dollars, unless otherwise stated. TSX: RNX www.royalnickel.com 1 1 Introduction Most Exciting Nickel Market Cycle to Come? Don’t be too bearish for 2013 ‐ many forecasts for large surpluses (80‐100kt) in the past in nickel market have failed to materialize. Why ? Continued failures of many new nickel projects to ramp up effectively New production does NOT equal new supply – don’t forget about inventories Market mechanisms in China and globally provide REAL supply response Past turns in the market indicate that turns in nickel cycles are ALWAYS explosive, NEVER slow (This was true even before China came along …) By mid‐decade, nickel market may face supply shortfalls even greater than 2005–2007 China (and ROW) is going to need 1+ MILLION tonnes more nickel annually Current projects under construction, at best, provide ½ the requirement NPI unable to provide the supply answer this time “Project cupboard” is largely empty ‐ sulphides to play a larger role going forward, including in NPI production www.royalnickel.com 2 Nickel – Don’t be Too Bearish for 2013 ! Despite much “noise” about large oversupply for the last 2 years, nickel (after falling sharply in 2011, and rebounding in 2012) has performed well overall — better than all other LME base metals % Change in Total Exchange Inventory Levels Dec. 31, 2010 – Dec. 31, 2012 100% 80% 60% 90% 40% 51% 20% 3% 4% 20% Ni Cu Al 0% Zn Pb Source: MetalPrices.com, RNC Analysis www.royalnickel.com 3 2 Nickel – Don’t be Too Bearish for 2013 ! A “Tidal Wave” that was more like a “Little Ripple” 2013 marks a milestone as Koniambo and Taganito, the last large projects of the “tidal wave” of more than 500kt of new supply that began at the end of last nickel boom, enter production Despite almost 400kt of capacity already built, production rates in Q4‐2012 were only a fraction of name plate capacity www.royalnickel.com 4 Nickel – Don’t be Too Bearish for 2013 ! A “Tidal Wave” that was more like a “Little Ripple” Many projects have yet to achieve commercial production and, in some cases, have been trying to reach capacity for many years Achieved Commercial Production N Voisey’s Bay Mirabela Kevitsa Ravensthorpe Commissioning Under Construction Talvivaara* Ambatovy Goro Ramu Eagle Taganito Many laterite / leach projects have struggled Barro Alto Koniambo Onca Puma Tagaung Taung Sulphide Laterite (HPAL) All sulphide open pit mine/mill projects have fully ramped up Laterite (ferronickel) * Bioheapleaching process www.royalnickel.com Are you really still nervous about a tidal wave of supply hitting the market? 5 3 Nickel – Don’t be Too Bearish for 2013 ~$7/lb ($15,000/t) Providing Good Floor 2012 showed again that $7/lb nickel still a good floor for nickel prices as NPI production slowed at these levels … LME Cash Nickel Price 25 LME Nickel Price $/ lb 20 15 10 NPI supply response and cost curve providing floor to nickel price at ~$7/lb 5 0 Source: MetalPrices.com, RNC Analysis www.royalnickel.com 6 Nickel – Don’t be Too Bearish for 2013 Cost Curve @ $7/lb ‐ $15,000/t Providing Good Floor … And the nickel cost curve is providing excellent support as ~33% of cost curve is losing money on a C1 cash cost basis at current price levels. At $6/lb, more than 50% is losing money on a C1 cash cost basis At ~$7/lb Current Price Levels At $6/lb www.royalnickel.com Supply Response • A number of higher cost FeNi producers have closed • Sustained prices at current levels will result in additional production cutbacks • Also don’t forget that scrap supply is also very price sensitive, particularly with discounts at 70‐75% 7 4 Nickel Price Cycle Analysis — Consistent Rebounds Time from trough to peak is relatively consistent; either 16–19 months or 26–29 months (with 1 exception) Nickel Market Price Cycle Trough‐> Peak (months) Nov 1982 to April 1985 29 Jan 1987 to Mar 1988 14 Sep 1993 to Jan 1995 16 Oct 1998 to Mar 2000 17 Oct 2001 to Jan 2004 26 Nov 2005 to May 2007 19 Dec 2008 to Feb 2011 Source: MetalPrices.com, RNC analysis 27 0 5 10 15 20 25 30 www.royalnickel.com 8 Nickel Price Cycle Analysis — Explosive Price Moves Nickel price moves have always been explosive …. Nickel Price Increase (Trough to Peak) 700% 600% 500% 400% 300% 200% 100% 0% Trough Peak 301% Q4 2001 Q1 2004 371% 221% Q4 2005 Q2 2007 Q4 2008 Q1 2011 Source: MetalPrices.com, RNC analysis www.royalnickel.com 9 5 Nickel Price Cycle Analysis — Explosive Price Moves … even without China. Again, why do we think it will be different this time? Nickel Price Increase (Trough to Peak) 700% 600% 500% 400% 300% 595% 200% 301% 100% 84% 0% Trough Q4 1982 Peak Q2 1985 Q1 1987 Q1 1988 157% 184% Q3 1993 Q1 1995 Q4 1998 Q1 2000 Q4 2001 Q1 2004 371% 221% Q4 2005 Q2 2007 Q4 2008 Q1 2011 Source: MetalPrices.com, RNC analysis www.royalnickel.com 10 Nickel Price Cycle Analysis — Rapid Demand Growth China has also had no discernible difference on the rapid growth in nickel demand after a price trough 35% 30% 25% 20% 15% 10% 5% 0% World Nickel Consumption Growth (2 years after price trough) 31% 26% 13%* 1982 to 1984 1986 to 1988 1993 to 1995 10% 11% 1%* 1998 to 2000 2001 to 2003 2005 to 2007 16% 2008 to 2011 * Denotes those time periods where demand growth limited by supply shortages Note: 1982-84, 1986-88 are Western World only Source: CRU, Inco Limited December 2002 Quarterly Presentation www.royalnickel.com 11 6 Nickel Market NOT Ready for the Next Turn By mid‐decade, the nickel market has the potential to once again face supply shortfalls even greater than 2005–2007 China is going to need 1+ MILLION tonnes more nickel annually during this decade (Rest of world will also need more) Current projects under construction only provide ½ the requirement (at best) A largely empty “project cupboard” underpinned by 35+ years of underdevelopment has resulted in the current set of projects under construction cleaning out the project “cupboard” NPI has supplied more than 2/3 of nickel growth since 2005 and will likely struggle to provide more nickel during next cycle as Indonesia (the “Saudi Arabia” of the nickel market) has restricted ore exports and Chinese cost pressures increase By 2015–2016, only a few new large scale projects, such as RNC’s Dumont and First Quantum’s Enterprise sulphide nickel projects, will be ready to meet the world’s growing demand for nickel www.royalnickel.com 12 Beyond 2015 ‐ Evolution of Nickel Demand As an economy industrializes, demand moves from more basic materials like carbon steel into stainless steels and ultimately into specialty alloys that require a lot of nickel and will drive non‐stainless nickel consumption in China Carbon Steel Stainless Steel 2010 Kg/capita consumption 2010 Kg/capita consumption 1.5 20 500 503 400 441 300 200 Nickel 2010 Kg/capita consumption China 18.4 15 1.3 1.3 1 13.5 10 China 203 100 5 0 0 0.5 China 0.3 3.8 0 Source: World Steel Association, ICSG, World Stainless Steel Statistics, Brook Hunt – A Wood Mackenzie Company, RNC Analysis www.royalnickel.com 13 7 China – 1+ Million Tonnes More Demand Despite huge growth in demand, Chinese per capita consumption is still less than half of that of industrial economies such as Western Europe and Japan Nickel Consumption per Capita 2010 (kg/capita) 1.4 1.3 1.3 1.2 At Japanese and German per capita consumption levels, Chinese nickel demand would increase by over 1 million tonnes annually 1.0 0.8 0.6 0.4 0.4 0.2 0.0 Germany Japan China Source: CRU, RNC Analysis 14 www.royalnickel.com Nickel Supply — “Project Cupboard” Empty Beyond 2015, over 500+ kt of new supply is required, but “project cupboard” is empty — few projects in pipeline and 35+ years of inertia to overcome Global Nickel Demand Growth Vs. Potential Supply 2010‐2020 1,000+ Laterites – HPAL? 500+ kt New Supply Required 490 Where is new project supply going to come from? Laterites – FeNi? NPI? 242 Higher Risk – PAL, Leach 248 Lower Risk ‐ FeNi, Sulphide Sulphides? Projected Nickel Supply Nickel Demand In Construction Growth 2011‐15 Source: Brook Hunt – A Wood Mackenzie Company, RNC Analysis TSX: RNX www.royalnickel.com 15 8 Nickel Supply — Little Project Development for 35+ Years Today’s weak project pipeline is a result of the inertia from 35 years of relatively little project development after “nickel boom” in late 1960s Global Nickel Supply Growth “Traditional” vs. Alternative 1965–2010 (% CAGR) 7.0% 6.0% < 2% growth for 35 years! 1.3% 5.0% Stainless Demand Destruction Japan FeNi 4.0% FSU Collapse 3.0% 5.2% 1.7% 2.0% 1.0% NPI 2.8% 1.2% 1.4% 1.6% 1.4% 1975-90 1990-00 2000-10 0.0% 1965-75 1965–75 saw a burst of new projects driven by inability of existing operations to meet global demand 1975–90 saw significant project rationalization Collapse of former Soviet Union demand (20% of world total) provided supply during 1990s Ni pig iron and demand destruction in 2000–10 closed gap caused by lack of new supply from weak project pipeline development Source: Brook Hunt – A Wood Mackenzie Company, Macquarie, RNC Analysis www.royalnickel.com 16 New Nickel Supply: Laterites – HPAL? Too High Cost, Too Much Risk? HPAL projects not expected to play a major role in nickel supply going forward HPAL projects have faced large capital overruns (2 projects now +$6 billion), delays, and commissioning issues. Industry will have little appetite for new projects until one or more ramp‐up successfully which won’t occur until 2014 at the earliest Few companies can afford to finance $5–6 billion projects Little visibility over operating costs for HPAL — only recent project to date to ramp up to full capacity is First Quantum’s Ravensthorpe project which has reported 2012 C1 cash costs of $5.97 per pound of nickel ($13,200 per tonne) and C3 cash costs of $7.25 per pound ($16,000 per tonne) 1 These operating costs are much higher than many other companies are indicating for their projects Many jurisdictions with the most attractive resources for HPAL continue to be among the more difficult jurisdictions globally e.g. Indonesian requirement for 51% domestic ownership in project once certain milestones are achieved 1. Source: First Quantum Q4 2012 Financial Report, Company reports www.royalnickel.com 17 9 New Nickel Supply: Laterites – FeNi? Little High Grade Left to Be Developed? FeNi also not expected to play a major role in nickel supply going forward as the highest grade resources are already being developed and no new high grade discoveries have been made The current set of projects have now developed ALL known saprolite deposits with large resource of 2%+ average grade or higher (Koniambo, Onca Puma, Barro Alto, Tagaung Taung) NO NEW HIGH GRADE LATERITE DISCOVERIES HAVE BEEN MADE IN MORE THAN 30 YEARS TO REPLACE THESE PROJECTS IN THE PROJECT PIPELINE Tagaung Taung was discovered in early 1980s, Onca Puma in the 1970s, Barro Alto in the 1960s and Koniambo in the 1900s If Koniambo with an average grade of 2.6% required $5+ billion to develop, how much would similar output from a 1.8% saprolite (typical grade of the highest grade resources now available) greenfield project in a similar jurisdiction cost? www.royalnickel.com 18 NPI – Rapid Growth in Overall Mine Production Ore imports for nickel production have quickly become a large share of overall global mine production Nickel Ore Imports—% Share of World Mine Production 14% 12.4% 12.2% 12% 10.2% 10% 8% 5.9% 6% 4% 6.6% 3.9% 2% 0% Source: USGS, Brook Hunt – A Wood Mackenzie Company www.royalnickel.com 19 10 New Nickel Supply — NPI? Significant Challenges to Provide More Nickel at Similar Prices Like Japan in the 1960s, Chinese NPI output will ultimately be limited due to lower ore grades, stronger currency, and higher energy and input costs — even before taking into account the impact of Indonesian announcements NPI is not new, it is effectively the same process used in Japan in the 1960s. 1st time was France in 1880s–1920s Even by 1960s, ore grades in New Caledonia were falling. Minimum ore grade imported into Japan in 1963 was 3%. By 1970, it was down to 2.5% and is trending to 2% today By 1970, ore imports into Japan had leveled off as lower ore grades, higher energy costs, and rising input costs reduced its competitiveness. By 2010, ore imports were still at 1970 levels of approximately 4.5 Mt Source: USGS, Brook Hunt – A Wood Mackenzie Company, RNC Analysis 20 www.royalnickel.com New Nickel Supply — NPI? Significant Challenges to Provide More Nickel at Similar Prices Indonesia, the “Saudi Arabia” of the nickel market supplying 15% of world nickel supply, has provided more than 2/3 of nickel supply growth since 2005. Its ability to further increase nickel output will face a number of significant challenges. Export restrictions, ore export ban in 2014, and 51% investment requirements will impact amount of foreign investment Despite some analyst assertions, can’t simply pick up and move NPI plant from China to Indonesia Most nickel ore is found in regions of the country with little infrastructure and no power = higher capex NPI plant at mine site saves transportation costs, but labour, power, and other costs are higher than China = higher (not lower) opex As an example, PT Antam, the state‐owned nickel company, produced FeNi in 2011 at cash cost of $US 6.39/lb — similar to lower cost NPI producers in China World Nickel Supply Growth Refined (Kt) 2011 vs 2005 Rest of World (29%) NPI (71%) Source: GTIS, Brook Hunt – A Wood Mackenzie Company, www.royalnickel.com 21 11 New Nickel Supply — NPI? The Next Wave – RNC Signs Strategic Alliance with Tsingshan RNC has leveraged its nickel industry expertise to support the leading Chinese NPI / stainless producer to be the first to use sulphide concentrate directly in a stainless steel process MOU signed in March 2013: RNC continues to share its downstream processing expertise RNC will assist Tsingshan to find sulphide concentrate feed to support Tsinghsan’s planned investment in plant & equipment Tsingshan will make offtake and partnership proposals once RNC has completed its feasibility study to Tsingshan’s satisfaction First time that nickel sulphide concentrate would be directly used to produce stainless steel (utilizing similar process announced by RNC on October 3, 2011) Tsingshan plant is also expected to be capable of handling nickel sulphide concentrate anticipated to be produced from Dumont Key Benefits for RNC Strategic alliance with one of the leading Chinese stainless steel producers and innovators in integrated NPI/stainless production Opens up downstream potential from small set of nickel smelters/refiners to much broader set of NPI producers Simpler downstream process, effective elimination of refining step, and opportunity for greater competition provides potential for lower TC+RC costs / higher realizations Potential offtake and project partner www.royalnickel.com 22 New Nickel Supply — NPI – Next Wave? Nickel sulphide concentrates into NPI/SS production Tsinghan Group is a leading Chinese stainless and NPI producer and one of the fastest growing stainless companies in the world – has been a pioneer in production & use of NPI. Source: Tsingshan www.royalnickel.com 23 12 New Nickel Supply Sulphides — A Potential Answer, but Few Projects in Pipeline Nickel sulphides are an attractive source of nickel production, but the pipeline is largely empty as there have been few new large scale discoveries. RNC’s Dumont project and First Quantum’s Enterprise projects are among the few large scale projects that could be in production by 2015–2016 Over last several decades, the only large greenfield discoveries have occurred when exploration was occurring for other metals: Voisey’s Bay (diamonds), Kabanga (gold), Enterprise (copper) Sulphides have a number of inherent advantages over laterites Anglo American’s recent massive sulphide discovery in northern Finland is the only large greenfield nickel discovery made during a nickel‐focused exploration program in recent decades Typically use standard mine/mill facilities utilizing commonly used technology Inherently less energy intensive Less capital intensive as smelting/refining facilities don’t typically need to be constructed In the mid‐1990s, Mt. Keith showed that large scale, lower grade, ultramafic nickel deposits could be profitably developed Further growth in sulphide nickel production will likely come from large scale, lower grade deposits (following similar moves in both the copper and gold industries) such as RNC’s Dumont project, one of few large scale projects that could be in production by 2015‐2016 First Quantum’s recent rapid commissioning (Q2-2012: startup, Q3-2012: commercial production) of its Kevitsa project demonstrates how lower grade (~0.25%) nickel sulphide projects can be successfully developed www.royalnickel.com 24 New Nickel Supply Fundamental Issue: An Empty “Project Cupboard” The fundamental issue facing the nickel industry by 2015–2016 is an empty “project cupboard” At the beginning of the last decade, prior to the significant run‐up in nickel prices, the “project cupboard” was very full with many projects known for decades Today’s picture is very, very different, setting the stage for an exciting nickel cycle Laterite (ferronickel) Laterite (HPAL) Sulphide Project Cupboard 2001 (20+kt) TOTAL: 500+ kt Project Cupboard 2012 (20+kt) TOTAL: 100+kt Barro Alto Koniambo Onca Puma Tagaung Taung Ambatovy Goro Ramu Ravensthorpe Weda Bay Talvivaara* Kabanga Voisey’s Bay Weda Bay Dumont Enterprise Kabanga Laterite (leach) Sulphide *bioheapleaching process www.royalnickel.com 25 13 Summary ‐ Nickel Market NOT Ready for the Next Turn By mid‐decade, the nickel market has the potential to once again face supply shortfalls even greater than 2005–2007 China is going to need 1+ MILLION tonnes more nickel annually during this decade (Rest of world will also need more) Current projects under construction only provide ½ the requirement (at best) A largely empty “project cupboard” underpinned by 35+ years of underdevelopment has resulted in the current set of projects under construction cleaning out the project “cupboard” NPI has supplied more than 2/3 of nickel growth since 2005 and will likely struggle to provide more nickel during next cycle as Indonesia (the “Saudi Arabia” of the nickel market) has restricted ore exports and Chinese cost pressures increase By 2015–2016, only a few new large scale projects, such as RNC’s Dumont and First Quantum’s Enterprise sulphide nickel projects, will be ready to meet the world’s growing demand for nickel www.royalnickel.com 26 14