COURSE AND PRODUCT CATALOG

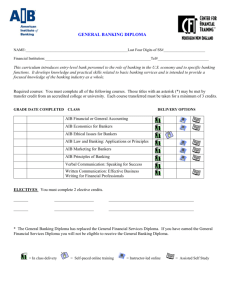

advertisement