Results Review, 16 May 2014

Malaysian Airline System (MAS MK)

Sell (Maintained)

Transport - Aviation

Market Cap: USD1,088m

Target Price:

Price:

MYR0.19

MYR0.21

Macro

Risks

A Tough Period

Growth

Value

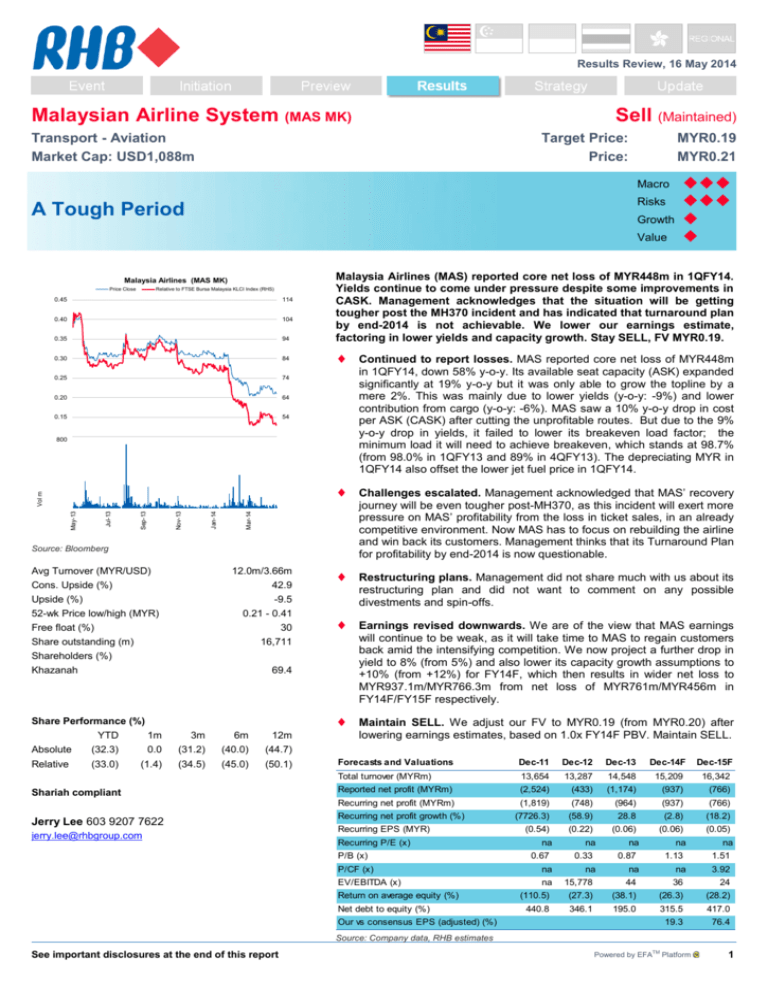

Malaysia Airlines (MAS MK)

Relative to FTSE Bursa Malaysia KLCI Index (RHS)

0.45

114

0.40

104

0.35

94

0.30

84

0.25

74

0.20

64

0.15

54

0.10

800

700

600

500

400

300

200

100

44

Mar-14

Jan-14

Nov-13

Sep-13

Jul-13

Source: Bloomberg

Avg Turnover (MYR/USD)

Cons. Upside (%)

Upside (%)

52-wk Price low/high (MYR)

Free float (%)

Share outstanding (m)

Shareholders (%)

Khazanah

12.0m/3.66m

42.9

-9.5

0.21 - 0.41

30

16,711

YTD

69.4

Share Performance (%)

1m

3m

6m

12m

Absolute

(32.3)

0.0

(31.2)

(40.0)

(44.7)

Relative

(33.0)

(1.4)

(34.5)

(45.0)

(50.1)

Shariah compliant

Jerry Lee 603 9207 7622

jerry.lee@rhbgroup.com

Continued to report losses. MAS reported core net loss of MYR448m

in 1QFY14, down 58% y-o-y. Its available seat capacity (ASK) expanded

significantly at 19% y-o-y but it was only able to grow the topline by a

mere 2%. This was mainly due to lower yields (y-o-y: -9%) and lower

contribution from cargo (y-o-y: -6%). MAS saw a 10% y-o-y drop in cost

per ASK (CASK) after cutting the unprofitable routes. But due to the 9%

y-o-y drop in yields, it failed to lower its breakeven load factor; the

minimum load it will need to achieve breakeven, which stands at 98.7%

(from 98.0% in 1QFY13 and 89% in 4QFY13). The depreciating MYR in

1QFY14 also offset the lower jet fuel price in 1QFY14.

Challenges escalated. Management acknowledged that MAS’ recovery

journey will be even tougher post-MH370, as this incident will exert more

pressure on MAS’ profitability from the loss in ticket sales, in an already

competitive environment. Now MAS has to focus on rebuilding the airline

and win back its customers. Management thinks that its Turnaround Plan

for profitability by end-2014 is now questionable.

Restructuring plans. Management did not share much with us about its

restructuring plan and did not want to comment on any possible

divestments and spin-offs.

Earnings revised downwards. We are of the view that MAS earnings

will continue to be weak, as it will take time to MAS to regain customers

back amid the intensifying competition. We now project a further drop in

yield to 8% (from 5%) and also lower its capacity growth assumptions to

+10% (from +12%) for FY14F, which then results in wider net loss to

MYR937.1m/MYR766.3m from net loss of MYR761m/MYR456m in

FY14F/FY15F respectively.

Maintain SELL. We adjust our FV to MYR0.19 (from MYR0.20) after

lowering earnings estimates, based on 1.0x FY14F PBV. Maintain SELL.

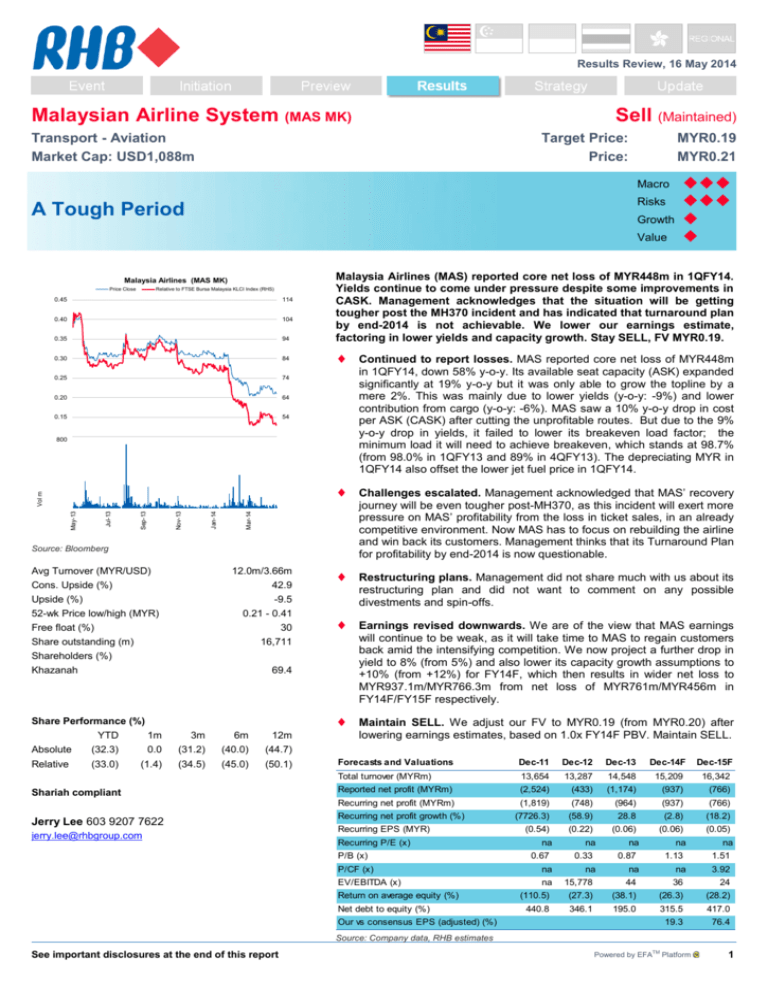

Forecasts and Valuations

Dec-11

Dec-12

Dec-13

Dec-14F

Dec-15F

Total turnover (MYRm)

13,654

13,287

14,548

15,209

16,342

Reported net profit (MYRm)

(2,524)

(433)

(1,174)

(937)

(766)

Recurring net profit (MYRm)

(1,819)

(748)

(964)

(937)

(766)

(7726.3)

(58.9)

28.8

(2.8)

(18.2)

(0.54)

(0.22)

(0.06)

(0.06)

(0.05)

Recurring net profit growth (%)

Recurring EPS (MYR)

Recurring P/E (x)

P/B (x)

na

0.67

P/CF (x)

na

EV/EBITDA (x)

na

Return on average equity (%)

Net debt to equity (%)

Our vs consensus EPS (adjusted) (%)

na

0.33

na

0.87

na

na

na

1.13

na

na

1.51

3.92

15,778

44

36

24

(110.5)

(27.3)

(38.1)

(26.3)

(28.2)

440.8

346.1

195.0

315.5

417.0

19.3

76.4

Source: Company data, RHB estimates

See important disclosures at the end of this report

3

.

3

0

.

1

0

0

.

1

0

0

Malaysia Airlines (MAS) reported core net loss of MYR448m in 1QFY14. .

0

Yields continue to come under pressure despite some improvements in 0

CASK. Management acknowledges that the situation will be getting 0

tougher post the MH370 incident and has indicated that turnaround plan

by end-2014 is not achievable. We lower our earnings estimate,

factoring in lower yields and capacity growth. Stay SELL, FV MYR0.19.

May-13

Vol m

Price Close

Powered by EFATM Platform

1

Malaysian Airline System (MAS MK)

16 May 2014

1QFY14 Results Highlights

Tough time ahead post-MH370. Management acknowledged that the MH370 effect

will be an uphill struggle and the Turnaround Plan for profitability by end-2014 is now

questionable. The sales of tickets had been slowing down even before 8 March

(MH370 incident) and MAS was targeting to make the shortfall during the MATTA

Fair, which was scheduled to be held 14-16 March. MAS withdrew from participating

in MATTA Fair post MH370, which means it has foregone future ticket sales. The

impact from the MH370 incident would mainly affect its load factor and profitability in

the future, as all the expenses related to the incident would be covered by insurance

companies.

Restructuring plans not revealed. Management indicated that there are

restructuring plans in place to improve the current situation but is not ready to share

yet. Guidance given was quite vague, but the main focus will be on rebuilding the

MAS brand name, reviving its sales channels after the two months of ‘black-out’,

leveraging on its alliances’ network and being more proactive and decisive in

capacity planning. Cost savings efforts will continue and will focus mainly in

productivity, fleet renewal and improve efficiency.

Other key highlights during conference call. Below are some other key highlights

from the conference call yesterday:

-

Targeted capacity growth reduced to 10-12% from 19% earlier, which we

have also factored in.

-

May increase fuel hedging level to 30% from current level of 23%, as

management is anticipating the jet fuel price is coming down this year.

-

Will continue to price its air fares dynamically to remain competitive in the

market

Maintain SELL. We foresee MAS earnings will continue to come under pressure.

Yield is expected to ease further with the intensified competition within the industry

and the MH370 incident has tarnished its flight safety track record, which may affect

its load factor. We are lowering our yield growth assumptions to -8% (from -5%), load

factor assumption to 78% (from 81%) capacity growth assumptions to +10% (from

+15%) for FY14F, which then results in wider net loss of MYR937.1m/MYR766.3m

from net loss of MYR761m/MYR456m in FY14F/FY15F respectively. We adjust our

FV to MYR0.19 (from MYR0.20) after lowering our earnings estimate and equity

value, based on 1.0x FY14F PBV. We await further developments on its restructuring

plans, which MAS indicated will be announced in the coming weeks, which will be a

key catalyst for a proven turnaround.

See important disclosures at the end of this report

2

Malaysian Airline System (MAS MK)

16 May 2014

Figure 1: 1QFY14 Results Table

FYE Dec (MYRm)

Revenue

- Passenger revenue & surcharges

- Cargo revenue & surcharges

- Other revenue

1QFY13

3435

2628

396

411

4QFY13

3870

2944

428

498

1QFY14

3575

2792

372

411

q-o-q (%)

-7.6

-5.2

-13.1

-17.5

y-o-y (%)

4.1

6.2

-6.1

0.1

Fuel cost

-1387

-1551

-1583

2.1

14.1

Non fuel cost

- Staff cost

- Leasing

- Maintenance

- Handling and landing

- Other non fuel cost

-2050

-590

-378

-227

-340

-515

-2278

-616

-323

-276

-376

-687

-2112

-600

-307

-213

-371

-621

-7.3

-2.6

-5.0

-22.8

-1.3

-9.6

3.0

1.7

-18.8

-6.2

9.1

20.5

-3

41.3

-119.8

-390.2

4282.8

EBITDA margin (%)

-0.1

1.1

-3.4

Depreciation & Amortisation

-196

-173

-236

36.4

20.7

EBIT

EBIT margin (%)

-198

-5.8

-132

-3.4

-356

-10.0

170.1

79.4

12

-99

3

28

-105

9

26

-122

7

-6.1

16.2

-22.2

108.4

22.9

121.9

3

-137

5

-103.8

61.1

-279

-8.1

-337

-8.7

-440

-12.3

30.4

57.7

0

0.0

-4

-0.1

-3

-0.1

-15.6

2162.1

0

-2

-1

-40.4

328.0

Net profit

Core net profit

-279

-282

-343

-206

-443

-448

29.3

118.1

58.8

58.8

Net Margin (%)

-8.1

-8.8

-12.4

EBITDA

Interest income

Interest expense

Share of profit from Associated

Companies/JV

EI

Pretax profit

Pretax profit margin (%)

Tax expense

Effective tax rate (%)

MI

Comment

Passenger yield declined

Fuel costs increased due to higher capacity and

weakening of MYR against USD, offsetting the

decrease in jet fuel price.

Due to the significant drop in yields, despite the

improved unit cost (due to non-profitable route

cuts), breakeven load factor was worse off.

Continued to be weak. Will be more challenging

post MH370 incident

Source: Company data

Figure 2: Operating statistics

ASK (million)

RPK (million)

Load factor (%)

Airline RASK (sen)

Rev/RPK (sen)

1QFY13

13,357

10,227

76.6%

24.1

24.8

4QFY13

15,565

12,699

81.6%

22.7

22.5

1QFY14

15,864

12,115

76.4%

20.9

22.5

q-o-q (%)

1.9%

-4.6%

y-o-y (%)

19%

18%

-7.9%

0.0%

-13%

-9%

Airline CASK (sen)

25.3

25.3

22.8

-9.9%

-10%

9.4

15.9

9

16.3

9.2

13.6

2.2%

-16.6%

-2%

-14%

98.0%

88.9%

98.7%

- Fuel

- Non fuel

Breakeven load

factor (%)

Source: Company data

See important disclosures at the end of this report

3

Malaysian Airline System (MAS MK)

16 May 2014

Financial Exhibits

Profit & Loss (MYRm)

Dec-11

Dec-12

Dec-13

Dec-14F

Total turnover

13,654

13,287

14,548

15,209

16,342

Cost of sales

(13,274)

(11,919)

(12,703)

(13,196)

(14,068)

1,845

2,014

2,274

Gross profit

Gen & admin expenses

Selling expenses

Other operating costs

380

1,368

Dec-15F

(506)

(610)

(1,079)

(939)

(957)

(1,080)

(849)

(1,025)

(1,188)

(1,284)

(499)

(488)

(390)

(461)

(438)

Operating profit

(1,706)

(580)

(649)

(574)

(405)

Operating EBITDA

(1,249)

255

361

547

(859)

(889)

(907)

Depreciation of fixed assets

Amortisation of intangible assets

Operating EBIT

(424)

1

(545)

(33)

(35)

(46)

(46)

(46)

(1,706)

(580)

(649)

(574)

(405)

Net income from investments

29

21

29

29

29

Interest income

29

54

114

114

114

Interest expense

(159)

(235)

(437)

(488)

(488)

Exceptional income - net

(705)

316

(210)

Pre-tax profit

-

-

(2,513)

(425)

(1,153)

(919)

(751)

Taxation

(8)

(6)

(16)

(13)

(10)

Minority interests

(3)

(2)

(5)

(5)

(5)

Profit after tax & minorities

(2,524)

(433)

(1,174)

(937)

(766)

Reported net profit

(2,524)

(433)

(1,174)

(937)

(766)

Recurring net profit

(1,819)

(748)

(964)

(937)

(766)

Source: Company data, RHB estimates

Cash flow (MYRm)

Operating profit

Dec-11

(1,706)

Dec-12

Dec-14F

Dec-15F

(580)

Dec-13

(649)

(574)

(405)

934

953

Depreciation & amortisation

457

580

904

Change in working capital

708

(312)

(806)

(541)

(311)

(551)

360

575

114

Operating cash flow

(1)

28

Interest received

(29)

(54)

(114)

114

Interest paid

153

235

437

488

Dividends received

141

138

(175)

(1,004)

Tax paid

(322)

(313)

(451)

(13)

(10)

Cash flow from operations

(597)

(305)

(855)

(55)

895

(3,576)

(4,790)

(3,661)

(2,000)

1,412

1,031

1,327

(2,164)

(3,759)

(2,334)

Capex

Other investing cash flow

Cash flow from investing activities

Dividends paid

Increase in debt

Other financing cash flow

(15)

1,811

(106)

(1)

5,689

(491)

(1)

114

(1,886)

488

(272)

(1,000)

114

(886)

-

-

560

-

-

4,352

-

-

Cash flow from financing activities

1,690

5,198

4,911

-

-

Cash at beginning of period

2,085

1,014

2,148

3,871

1,929

(1,071)

1,134

1,722

(1,941)

1,014

2,148

3,871

1,929

Total cash generated

Implied cash at end of period

9

1,938

Source: Company data, RHB estimates

See important disclosures at the end of this report

4

Malaysian Airline System (MAS MK)

16 May 2014

Financial Exhibits

Balance Sheet (MYRm)

Total cash and equivalents

Inventories

Accounts receivable

Other current assets

Total current assets

Total investments

Dec-11

Dec-12

Dec-13

Dec-14F

Dec-15F

1,014

2,148

3,871

1,929

1,938

362

331

254

261

277

1,268

1,259

1,596

1,669

1,793

110

49

105

105

105

2,755

3,787

5,826

3,965

4,114

175

182

216

216

216

9,074

12,854

14,615

15,623

14,881

Intangible assets

152

154

149

149

149

Total other assets

344

314

1,049

1,049

1,049

Tangible fixed assets

Total non-current assets

9,745

13,504

16,029

17,037

16,295

12,499

17,291

21,855

21,002

20,408

Short-term debt

1,379

1,458

1,254

1,254

1,254

Accounts payable

2,644

2,343

2,669

2,748

2,916

Other current liabilities

3,111

3,232

3,356

3,356

3,356

Total current liabilities

7,134

7,033

7,279

7,358

7,526

Total long-term debt

4,291

8,090

10,518

10,518

10,518

Total assets

Other liabilities

Total non-current liabilities

Total liabilities

Share capital

Retained earnings reserve

Other reserves

Shareholders' equity

19

30

6

6

6

4,309

8,120

10,524

10,524

10,524

11,443

15,153

17,803

17,882

18,050

3,342

3,342

1,671

1,671

1,671

(2,300)

(2,717)

-

1,498

1,498

1,498

1,498

2,330

865

(72)

1,043

2,123

4,034

3,097

Minority interests

14

15

18

23

Other equity

(0)

0

0

0

Total equity

(839)

28

-

1,056

2,138

4,052

3,120

2,358

12,499

17,291

21,855

21,002

20,408

Dec-11

Dec-12

Dec-13

Dec-14F

Dec-15F

5.2

(2.7)

9.5

4.5

7.4

Operating profit growth (%)

(1503.6)

(66.0)

12.0

(11.6)

(29.4)

Net profit growth (%)

(1176.5)

(82.9)

171.3

(20.2)

(18.2)

EPS growth (%)

(1176.5)

(82.9)

(45.7)

(20.2)

(18.2)

Bv per share growth (%)

(70.4)

103.7

(62.0)

(23.2)

(24.7)

Operating margin (%)

(12.5)

(4.4)

(4.5)

(3.8)

(2.5)

Net profit margin (%)

(18.5)

(3.3)

(8.1)

(6.2)

(4.7)

Return on average assets (%)

(20.2)

(2.9)

(6.0)

(4.4)

(3.7)

Return on average equity (%)

(110.5)

(27.3)

(38.1)

(26.3)

(28.2)

Total liabilities & equity

Source: Company data, RHB estimates

Key Ratios (MYR)

Revenue growth (%)

Net debt to equity (%)

440.8

346.1

195.0

315.5

417.0

Recurrent cash flow per share

(0.18)

(0.09)

(0.05)

(0.00)

0.05

Source: Company data, RHB estimates

See important disclosures at the end of this report

5

Malaysian Airline System (MAS MK)

16 May 2014

SWOT Analysis

oneworld alliance significantly boosts international

passengers feed

A price war may

ensue following

Malindo’s debut

Airlines in the

region are

becoming very

competitive

Delivery of its

A380s and its

alliance with

oneworld opens

up new growth

possibilities

Visit Malaysia

2014 bodes well

with the

carrier’s load

active strategy

High depreciation and interest expenses could

dampen its bottomline

Strong unionised workforce

Cost escalation may be greater than revenue growth

P/E (x) vs EPS growth

P/BV (x) vs ROAE

200

2,000%

1.6

20%

180

1,300%

1.4

3%

160

600%

140

-100%

1.2

-15%

-33%

0.8

-50%

-2,200%

0.6

-68%

60

-2,900%

40

-3,600%

0.4

-85%

-103%

-120%

P/E (x) (lhs)

Jan-11

Jan-15

0.0

Jan-14

-5,000%

Jan-13

0

Jan-12

-4,300%

Jan-11

20

0.2

EPS growth (rhs)

Source: Company data, RHB estimates

P/B (x) (lhs)

Jan-15

-1,500%

80

Jan-14

100

Jan-13

-800%

Jan-12

120

1.0

Return on average equity (rhs)

Source: Company data, RHB estimates

Company Profile

MAS is Malaysia's flagship carrier with a focus on SEA and Asia Pacific markets

See important disclosures at the end of this report

6

Malaysian Airline System (MAS MK)

16 May 2014

Recommendation Chart

Price Close

0.20

0.30

0.30

0.48

0.43

0.34

0.43

1.38

1.38

0.90

0.96

1.15

0.52

1.00

1.0

1.12

2.45

1.35

1.60

1.10

1.76

1.58

Recommendations & Target Price

2.10

1.2

NR

1.4

0.8

0.6

0.4

0.2

Buy

0.0

May-09

Neutral

Aug-10

Sell

Trading Buy

Nov-11

Take Profit

Not Rated

Mar-13

Source: RHB estimates, Bloomberg

Date

Recommendation

2014-02-19

Sell

Target Price Price

0.20

0.29

2013-12-02

Neutral

0.30

0.31

2013-11-19

Sell

0.30

0.33

2013-08-21

Neutral

0.34

0.35

2013-07-25

Trading Buy

0.43

0.31

2013-05-30

Neutral

0.43

0.39

2013-05-29

Buy

0.48

0.41

2013-05-20

Buy

1.00

0.41

2013-03-13

Buy

1.00

0.33

2013-03-01

Sell

0.52

0.34

Source : RHB estimates, Bloomberg

See important disclosures at the end of this report

7

RHB Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated: Stock is not within regular research coverage

Disclosure & Disclaimer

All research is based on material compiled from data considered to be reliable at the time of writing, but RHB does not make any representation or

warranty, express or implied, as to its accuracy, completeness or correctness. No part of this report is to be construed as an offer or solicitation of an offer

to transact any securities or financial instruments whether referred to herein or otherwise. This report is general in nature and has been prepared for

information purposes only. It is intended for circulation to the clients of RHB and its related companies. Any recommendation contained in this report does

not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This report is for the

information of addressees only and is not to be taken in substitution for the exercise of judgment by addressees, who should obtain separate legal or

financial advice to independently evaluate the particular investments and strategies.

This report may further consist of, whether in whole or in part, summaries, research, compilations, extracts or analysis that has been prepared by RHB’s

strategic, joint venture and/or business partners. No representation or warranty (express or implied) is given as to the accuracy or completeness of such

information and accordingly investors should make their own informed decisions before relying on the same.

RHB, its affiliates and related companies, their respective directors, associates, connected parties and/or employees may own or have positions in

securities of the company(ies) covered in this research report or any securities related thereto, and may from time to time add to, or dispose off, or may be

materially interested in any such securities. Further, RHB, its affiliates and related companies do and seek to do business with the company(ies) covered

in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies),

may sell them or buy them from customers on a principal basis and may also perform or seek to perform significant investment banking, advisory or

underwriting services for or relating to such company(ies), as well as solicit such investment, advisory or other services from any entity mentioned in this

research report.

RHB and its employees and/or agents do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arise

from any reliance based on this report or further communication given in relation to this report, including where such losses, loss of profits or damages are

alleged to have arisen due to the contents of such report or communication being perceived as defamatory in nature.

The term “RHB” shall denote where applicable, the relevant entity distributing the report in the particular jurisdiction mentioned specifically herein below

and shall refer to RHB Research Institute Sdn Bhd, its holding company, affiliates, subsidiaries and related companies.

All Rights Reserved. This report is for the use of intended recipients only and may not be reproduced, distributed or published for any purpose without prior

consent of RHB and RHB accepts no liability whatsoever for the actions of third parties in this respect.

Malaysia

This report is published and distributed in Malaysia by RHB Research Institute Sdn Bhd (233327-M), Level 11, Tower One, RHB Centre, Jalan Tun Razak,

50400 Kuala Lumpur, a wholly-owned subsidiary of RHB Investment Bank Berhad (RHBIB), which in turn is a wholly-owned subsidiary of RHB Capital

Berhad.

Singapore

This report is published and distributed in Singapore by DMG & Partners Research Pte Ltd (Reg. No. 200808705N), a wholly-owned subsidiary of DMG &

Partners Securities Pte Ltd, a joint venture between Deutsche Asia Pacific Holdings Pte Ltd (a subsidiary of Deutsche Bank Group) and OSK Investment

Bank Berhad, Malaysia which have since merged into RHB Investment Bank Berhad (the merged entity is referred to as “RHBIB”, which in turn is a whollyowned subsidiary of RHB Capital Berhad). DMG & Partners Securities Pte Ltd is a Member of the Singapore Exchange Securities Trading Limited. DMG &

Partners Securities Pte Ltd may have received compensation from the company covered in this report for its corporate finance or its dealing activities; this

report is therefore classified as a non-independent report.

As of 14 May 2014, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd do not have proprietary positions

in the securities covered in this report, except for:

a)

As of 14 May 2014, none of the analysts who covered the securities in this report has an interest in such securities, except for:

a)

Special Distribution by RHB

Where the research report is produced by an RHB entity (excluding DMG & Partners Research Pte Ltd) and distributed in Singapore, it is only distributed

to "Institutional Investors", "Expert Investors" or "Accredited Investors" as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not

an "Institutional Investor", "Expert Investor" or "Accredited Investor", this research report is not intended for you and you should disregard this research

report in its entirety. In respect of any matters arising from, or in connection with this research report, you are to contact our Singapore Office, DMG &

Partners Securities Pte Ltd

Hong Kong

This report is published and distributed in Hong Kong by RHB OSK Securities Hong Kong Limited (“RHBSHK”) (formerly known as OSK Securities Hong

Kong Limited), a subsidiary of OSK Investment Bank Berhad, Malaysia which have since merged into RHB Investment Bank Berhad (the merged entity is

referred to as “RHBIB”), which in turn is a wholly-owned subsidiary of RHB Capital Berhad.

8

RHBSHK, RHBIB and/or other affiliates may beneficially own a total of 1% or more of any class of common equity securities of the subject company.

RHBSHK, RHBIB and/or other affiliates may, within the past 12 months, have received compensation and/or within the next 3 months seek to obtain

compensation for investment banking services from the subject company.

Risk Disclosure Statements

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that

losses will be incurred rather than profit made as a result of buying and selling securities. Past performance is not a guide to future performance. RHBSHK

does not maintain a predetermined schedule for publication of research and will not necessarily update this report

Indonesia

This report is published and distributed in Indonesia by PT RHB OSK Securities Indonesia (formerly known as PT OSK Nusadana Securities Indonesia), a

subsidiary of OSK Investment Bank Berhad, Malaysia, which have since merged into RHB Investment Bank Berhad, which in turn is a wholly-owned

subsidiary of RHB Capital Berhad.

Thailand

This report is published and distributed in Thailand by RHB OSK Securities (Thailand) PCL (formerly known as OSK Securities (Thailand) PCL), a

subsidiary of OSK Investment Bank Berhad, Malaysia, which have since merged into RHB Investment Bank Berhad, which in turn is a wholly-owned

subsidiary of RHB Capital Berhad.

Other Jurisdictions

In any other jurisdictions, this report is intended to be distributed to qualified, accredited and professional investors, in compliance with the law and

regulations of the jurisdictions.

DMG & Partners Research Guide to Investment Ratings

Kuala Lumpur

Hong Kong

Singapore

Malaysia

Tel : +(60) 3 9280 2185

Fax : +(60) 3 9284 8693

19 Des Voeux Road

Central, Hong Kong

Tel : +(852) 2525 1118

Fax : +(852) 2810 0908

Tel : +(65) 6533 1818

Fax : +(65) 6532 6211

Buy: Share price may exceed 10% over the next 12 months

Trading Buy:Malaysia

Share price

may exceed 15% over theRHB

nextOSK

3 months,

however longer-term outlook remains uncertain

Research Office

Securities Hong Kong Ltd. (formerly known

DMG & Partners

Neutral: Share

mayInstitute

fall within

months

as 12

OSK

Securities

Securities Pte. Ltd.

RHB price

Research

Sdn the

Bhdrange of +/- 10% over the next

Take Profit:

Target

price One,

has been

attained. Look to accumulate at lower

Honglevels

Kong Ltd.)

Level

11, Tower

RHB Centre

10 Collyer Quay

Sell: Share price may

more than 10% over the next 12 months

Jalanfall

TunbyRazak

12th Floor

#09-08 Ocean Financial Centre

Lumpur

World-Wide House

Singapore 049315

Not Rated: Stock isKuala

not within

regular research coverage

DISCLAIMERS

Phnom

Penh

This research is issuedJakarta

by DMG & Partners Research Pte Ltd and it is forShanghai

general distribution only. It does not have any regard

to the

specific investment

objectives, financial situation and particular needs of any specific recipient of this research report. You should independently evaluate particular

PT RHB OSK and

Securities

Indonesia

(formerlyfinancial

known asadviser

RHB

OSK (China)

Advisory

Ltd. into any

RHBtransaction

OSK Indochina

Securities

Limited

(formerly

investments

consult

an independent

before

makingInvestment

any investments

or Co.

entering

in relation

to any

securities

or

PT OSKmentioned

Nusadana in this report.

(formerly known as OSK (China) Investment

known as OSK Indochina Securities Limited)

investment instruments

Securities Indonesia)

Plaza CIMB Niaga

Advisory Co. Ltd.)

Suite 4005, CITIC Square

No. 1-3, Street 271

Sangkat Toeuk Thla, Khan Sen Sok

Tel : +(6221) 2598 6888

Tel : +(8621) 6288 9611

Fax: +(855) 23 969 171

The information contained

herein has been obtained from sources 1168

we believed

to be reliable but we do not make any representation

or warranty nor

14th Floor

Nanjing West Road

Phnom Penh

accept any responsibility

or liability

as to its accuracy, completeness orShanghai

correctness.

are subject to change

Jl. Jend. Sudirman

Kav.25

20041Opinions and views expressed in this report

Cambodia

without notice.

Jakarta Selatan 12920, Indonesia

China

Tel: +(855) 23 969 161

Fax

: +(6221)

2598or6777

Faxof: +(8621)

6288

9633or sell any securities.

This report does

not

constitute

form part of any offer or solicitation

any offer

to buy

Bangkok

DMG & Partners Research Pte Ltd is a wholly-owned subsidiary of DMG & Partners Securities Pte Ltd, a joint venture between OSK Investment Bank

Berhad, Malaysia which have since merged into RHBRHB

Investment

Bank Berhad (the merged entity is referred to as “RHBIB” which in turn is a whollyOSK Securities (Thailand) PCL (formerly known

owned subsidiary of RHB Capital Berhad) and Deutsche Asiaas

Pacific

Holdings Pte

Ltd (a PCL)

subsidiary of Deutsche Bank Group). DMG & Partners Securities

OSK Securities

(Thailand)

Pte Ltd is a Member of the Singapore Exchange Securities Trading

Limited.

10th Floor,

Sathorn Square Office Tower

98, North Sathorn Road,Silom

Bangkok 10500

DMG & Partners Securities Pte Ltd and their associates, directors,Bangrak,

and/or employees

may have positions in, and may effect transactions in the securities

Thailand

covered in the report, and may also perform or seek to perform broking and

other corporate finance related services for the corporations whose securities

Tel: +(66) 2 862report.

9999

are covered in the report. This report is therefore classified as a non-independent

Fax : +(66) 2 108 0999

As of 14 May 2014, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd, do not have proprietary positions

in the subject companies, except for:

a)

As of 14 May 2014, none of the analysts who covered the stock in this report has an interest in the subject companies covered in this report, except for:

a)

DMG & Partners Research Pte. Ltd. (Reg. No. 200808705N)

9