YVR Strategic Analysis

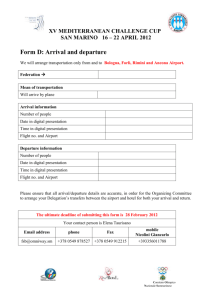

advertisement

STRATEGIC ANALYSIS BASM 502 –Corporate Strategy Carolyn Beaumont Kalpana Bisht Lucie Cornish Mihir Ghael 3/26/2013 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Contents Contents ........................................................................................................................................................ 1 EXECUTIVE SUMMARY .................................................................................................................................. 3 INDUSTRY ANALYSIS...................................................................................................................................... 4 Industry Overview ..................................................................................................................................... 4 Scope of Analysis....................................................................................................................................... 4 Industry Supply Chain ............................................................................................................................... 5 Porters Five Forces:................................................................................................................................... 7 Competitor Analysis .................................................................................................................................. 9 PESTEL Analysis ....................................................................................................................................... 10 Dynamic Industry Analysis ...................................................................................................................... 11 INTERNAL ANALYSIS OF YVR ....................................................................................................................... 13 Activity Analysis ...................................................................................................................................... 14 Value Chain of YVR .............................................................................................................................. 14 Secondary Activities ............................................................................................................................ 14 Primary Activities ................................................................................................................................ 17 SWOT Analysis......................................................................................................................................... 19 Resource Analysis.................................................................................................................................... 21 Benchmarking ......................................................................................................................................... 22 RECOMMENDATIONS ................................................................................................................................. 27 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 1 Strategic Analysis: YVR and the Global Airport Industry BASM 502 We would like to acknowledge the assistance of YVR and the UBC Sauder School of Business, without whom the following analysis would be less comprehensive. Thanks to David Gillen, Director of the Centre for Transportation Studies and the YVR Professor of Transportation Policy at the Sauder School of Business; Michael O'Brien, Corporate Secretary and Vice President of Strategic Planning and Legal Services at YVR and Mike Brown, Senior Planner in the Strategic Planning division at YVR met with our team on three separate occasions to provide clarification, answer questions and further expand our understanding of YVR, its operations and strategic direction. These conversations are referenced throughout the document. It is important to note that some facts, figures and opinions were recorded through personal conversations and may not reflect the official position of YVR or the Sauder School of Business. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 2 Strategic Analysis: YVR and the Global Airport Industry BASM 502 EXECUTIVE SUMMARY This analysis is a strategic review of the Vancouver International Airport Authority (YVR) and its position both within the greater Vancouver community and the Canadian and global airport industries. It is important to understand the history of YVR and the changes within the Canadian air transport sector to analyze where YVR is positioned compared to its competitors. Additionally, knowledge of the global airport industry, emerging market segments and differences among ownership and operations will help to provide insight on YVR’s competitive advantages and help to form the basis for recommendations. Key success factors for the airport industry include capital investments in infrastructure, physical location, frequency of aircraft movements, number of city pairings and connections to globally important locations, and balance of aeronautical and non-aeronautical revenues. Research suggests that the industry is mature, yet dynamic evidenced by increased security, pioneering visa-in-transit programs, the emergence of low-cost and long-distance carriers and changes in environmental regulations, fossil fuels and carbon emission schemes. Airports need to be cognizant of these changing aspects of the industry to remain successful and ensure that their short and long term strategic plans are dynamic enough to remain competitive. YVR is in a strong position both in North American and globally. Its focus on company culture provides it with the knowledge and leadership to retain its strategic position in the world’s top 10 airports. Additionally, its focus on capital investment in infrastructure and relationship building with airlines and contractors is another key to YVR’s success. YVR has developed such a strong position that it has expanded its operations to global consulting and ownership investment in other airports (beyond the scope of this analysis). The organization had been able to position itself strongly despite limiting regulations by Transport Canada and is a leader in lobbying for changes within the Canadian air transport industry. YVR should be able to maintain a strong position into the future, competing successfully in the global market. Future success depends on YVR capitalizing on its current assets and new opportunities to maintain its competitive advantage. In combination, these areas include: Diversifying risk and monitoring key players, expanding and formalizing lobbying activities, further developing the full-service model and infrastructure investments. Recommendations cover both short and long term planning and should allow YVR to maintain or improve its position within the airport industry. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 3 Strategic Analysis: YVR and the Global Airport Industry BASM 502 INDUSTRY ANALYSIS Industry Overview The global airport industry is just one sector of a much larger aviation industry that includes airlines, air freight, aircraft manufacturing, tourism and more. Airports globally are owned and operated in different structures and partnerships that vary by country. In North America, US airports are owned and funded by municipal governments and operated by a fixed-base operator (FBO), a commercial entity granted the operations by the city.1 Canadian operations were previously government owned by Transport Canada, but starting in 1994, the Federal government leased the airport land to private, not-for-profit organizations to run.2 UK airports are privately owned companies, formerly grouped under the British Airport Authority, but recently splitting up. The sector is a mature industry that is growing in conjunction with personal and business travel and increased global shipment of goods. While growth declined in 2001 and in 2008 due to political and economic events, overall airport traffic jumped 4.7% in 2012 and 3.5% in 5 years3 Scope of Analysis The global airport industry is inclusive of all organisations that own & operate international, national or civil airports and public flying fields. Additionally, support operations including aircraft refuelling, aircraft parking, hangar space, air traffic control, baggage handling, cargo services and others relating to, or located on airport property are included in the industry however these services are usually provided by outside contractors. Due to the nature of the information available, the scope of the following analysis of the industry and of YVR includes all flight related airport operations for both passenger & cargo services. While a major source of revenue for YVR and other airports, non-aeronautical revenues such as retail and other contracted services are not directly under the control of the airport authority. All airports operate differently, contracting and controlling different operations. However, in this report it is assumed that Canadian competitors (YYZ and YYC) operate and contract similar services. 1 IBIS World Industry Report H4912-GL –Global Airport Operation. Jan 2013. Gillen, D. (2013, March 6). Director of the Centre for Transportation Studies and the YVR Professor of Transportation Policy (Sauder School of Business). 3 IBIS World Industry Report H4912-GL –Global Airport Operation. Jan 2013. 2 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 4 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Industry Supply Chain An understanding of the airport supply chain is key to understanding YVR’s operations and their ability to differentiate themselves strategically from competitors. Globally, the airport supply chain is summarized in Figure 1 which shows the key players and economic drivers that affect the supply chain. Crude oil prices, the industrial production index, world GDP and tourism have a major impact on air traffic, operational costs and passenger ticket prices which ultimately affect the industry as a whole. Figure 1. Airport Supply Chain The major players in an airport’s supply chain are Airport suppliers Airport operator Airlines and air cargo operators Passengers and freight Airport suppliers play a critical role in the supply chain. These include government agencies, contract service providers, fuel suppliers, and construction and engineering firms. Suppliers play a pivotal role in an airport’s operations because all other players rely heavily on them for services. Airport operators comprise of airline staff, ground-handling staff, government employees, security personnel and more. Airports provide immigration, customs, security, air traffic control, and passenger and cargo services. Flexibility and reliability of these services is a key success factor. Airlines and air cargo operators are responsible for the safe transport of passengers and cargo. Their role is to operate aircrafts and provide pre- and in-flight services to passengers. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 5 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Passengers and freighters are the ones who pay for the services provided. Passengers go through a series of procedures and checks while utilizing airport services ranging from check-in service, security checks to airline lounge service and more. Handling Agents Customs Security / Police Concessionaires Airport Authorities Airport Operator Air Traffic Control Immigration Government Inspections Freight Forwarders Figure 2. Passenger & Freight Process Flow Figure 2 shows the key players that interact with airport operators to deliver services to passengers and freight. It is imperative for operators to share information and collaborate with these stakeholders to deliver services effectively to customers. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 6 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Porters Five Forces: Figure3. Porter’s Five Forces Industry Rivalry: (Medium) Industry rivalry for passengers and cargo potentially comes from airports in nearby large cities that can compete on price of tickets, frequency and timing of flights, and connecting hubs and city pairs. Rivalry for airlines is from airports with similar strategic advantage such as location, size and scale of operations. Additionally, government control of air service agreements and airline city pairs increases rivalry between countries and decreases the ability of airports to create a competitive advantage. Supplier Power: (Low - High) The construction & engineering industry that undertakes the development & infrastructure upgrades of airports worldwide has low differentiation. Some contracted suppliers such as retail, food services, parking and airlines have low differentiation however other suppliers including customs & border services, security, and air traffic control are monopolies and thus have C. Beaumont, K. Bisht, L. Cornish, M. Ghael 7 Strategic Analysis: YVR and the Global Airport Industry BASM 502 significant power in the industry. Ground handling services also have high supplier power as there are only a few competitors in the industry and can exert a significant amount of control over operations at YVR. Buyer Power (Medium) Passengers –Traditionally passengers have had little power because there are few competitors within a reasonable travel distance. However as small, low-cost airports increase and airlines can fly farther and ticket prices are decreasing, buyers are increasingly gaining power as they are willing to travel farther for airline travel. Airline Industry -Airlines are primary users of airport services. Both the industries are dependent on each other and a major portion of airport revenues come from airlines. They have some power, especially as new aircraft development allows flights to travel farther without stopping, opening up previously inaccessible city pairs. However in Canada the government controls air-service agreements in conjunction with airlines and negotiates them one-on-one directly with other countries and airline competitors. Airports are excluded from these discussions. Air Freight Logistics Industry -This industry has grown significantly over the last decade or so. The industry relies heavily on airport services and is one of the major sources of revenue for many airports. On the west coast however, cargo logistics are increasingly difficult due to the time difference with the major east coast business centers so YVR, SeaTac & LAX are less reliant on cargo revenues. Commercial Real Estate Industry -One of the major beneficiaries of the era of airport modernization has been the Commercial Real Estate Industry. Real estate and retail rental at airports has grown substantially over the years contributing close to 50% of airport’s revenues. As the airline industry becomes increasingly commoditized, airports need to compete on fullservice amenities by renting space to retail and food service outlets. However, there is low differentiation in this industry and so they have little buyer power. Substitutes (Low-Medium) Road, Rail and Waterway -Road, rail and waterway transport using cars, buses, high speed rail or ships provide an alternate mode of transport over short or long distances for both cargo and passengers. These modes of transport in emerging markets are cheaper and more convenient. In developed nations; however, with highly competitive airline industry, flights are often cheaper and more convenient than trains and boats. Busses are cheaper but long, uncomfortable and not the obvious choice for passengers. These modes of transport take longer than air travel over long distances. Video- conferencing and Online Technology-With advances in Internet and wireless technology, more and more businesses prefer video-conferencing and paperless transactions over travel to far off destinations because it is cheaper, saves time and is convenient. Barriers to Entry: (High) Due to the large amount of infrastructure and capital investment required by airports, in addition to government regulations, the threat of potential entrants into the market is low. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 8 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Recently, smaller, low-cost, no frills airports have emerged in smaller cities such as Bellingham, Buffalo and Abbotsford that provide cheaper services for alternative airlines. In some cases these are poaching traffic from large airports, however worldwide, most airports see these smaller locations as generated traffic that would not have purchased tickets from a full-service airport. Competitor Analysis Competitors are those North American airports that compete for airline traffic with YVR. With advances in airline technology, flights are able to travel farther, therefore bypassing previous refuelling locations and creating new competitors for the Asian market including Chicago O’Hare. YVR4 Toronto (YYZ)5 Chicago O’Hare (ORD)6 SeaTac (SEA) 7 Calgary (YYC)8 Business Model Not for profit ; operated by Vancouver Airport Authority Not for profit ; operated by Greater Toronto Airports Authority Owned and operated by Port of Seattle (Municipal government) Not for profit; operated by Calgary Airport Authority Strategic Advantage Located on west coast; gateway to Asia Commercial capital of Canada; Hub for Air Canada Municipal Government owned. Operated by City of Chicago Department of Aviation. Hub for American Airlines and United Airlines; strong international presence. Lower 9 airport tax. Growing importance as a business hub; attracts a lot of business travelers Contribution to GDP (B) Revenues (M) International Connectivity $ 1.9 $ 24 $ 38 Located on West Coast; proximity to sea making it an attractive destination for cargo. Lower airport tax. $ 13.2 $ 369.2 10 locations in Asia, 4 in Europe $ 290.1 1 location in Asia, 6 in Europe. 17 $ 879.2 Close to 20 destinations in Europe, 6 in Asia and 1 in Middle East. 66.8 $ 483.2 5 locations in Asia, 5 in Europe and 1 in Middle East ( UAE ) Passenger traffic annually (M) Cargo traffic annually $ 1,137,592 Over 20 destinations in Europe, 10 in Asia and 2 in Middle East 33 31 12.8 224000 tons 492171 tons 1443569 tons 346000 tons 100-200000 10 tons $6 Figure 4. YVR’s direct North American competitors 11 (2011 figures) 4 Vancouver Airport Authority 2011 Annual and Sustainability report GTAA Annual Report 2011 6 http://www.flychicago.com/OHare/EN/AboutUs/Facts/Performance-Data.aspx 7 http://www.portseattle.org/About/Organization/Pages/default.aspx 8 YYC-Annual report 2011 9 http://en.wikipedia.org/wiki/O'Hare_International_Airport 10 http://www.yyc.com/en-us/media/factsfigures/factsheet.aspx 5 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 9 Strategic Analysis: YVR and the Global Airport Industry BASM 502 PESTEL Analysis Airports do not compete in isolation and are subject to differing global factors depending on location. Therefore, it is important to consider political, economic, social, technological, environmental and legal implications on airports when examining competitive advantages. Political In Canada ASAs are developed in conjunction with airlines and Government (Transport Canada). 12 Airports are not involved. Previously a government monopoly, Transport Canada protects national carrier Air Canada despite declaring bankruptcy in 2003 and being at risk of a second bankruptcy less than 10 years later. Airspace blocks are governed by countries and subject to negotiation and agreements (currently undergoing major changes). The majority of airports worldwide are fully governmentowned, while others are owned by a shared public-private entity or privately owned. Technological Electronic visas and Visa-intransit increase the ease of travel. Increased security measures cause longer connections and decreases the ease of travel. Infrastructure changes, to accommodate new A380 and other new aircraft models, create a competitive advantage for the airports that invest in new infrastructure. The industry experiences a moderate level of technological change on both the passenger Economic Industry revenue has increased 3.5% to $120.3 billion, including a 4.9% jump in 2012. This stems from passenger numbers recovering 4.7% and operators 13 increasing prices. Expansion in developing economies, primarily in the Middle East and Asia. Greater number of privately run airports lead to efficiency gains and wider profit margins. High fuel prices dampen air cargo demand. Airport industry is in the mature phase of its economic life cycle It costs a Canadian carrier three times as much to land a plane at a Canadian airport compared 14 with a major European airport. Social An increase in available leisure time for consumers will encourage higher participation in air travel especially for cashrich, time-poor tourists, or those wishing to visit remote areas and thus demand for airport operators. As unemployment declines people will have less time to spend on leisure activities such as travel, however business travel may increase. International events like the World Cup and the Olympic Games will further contribute to rising passenger volumes. An increase in tourist activity boosts demand for airport operations. Environmental Fuel prices increase as the global price of oil does and the airline industry is one of the most reliant on fossil fuels. Noise pollution is a significant concern of municipalities surrounding airports and causes restrictions on flight arrival and departure time, affecting the competitive advantage of airports connecting with east coast and European cities. The carbon output of airlines and thus airports is fairly significant and when flights are Legal (Intersects with political, economic and environmental factors significantly.) There are significant legal regulations surrounding air traffic safety and security. Tougher regulations on greenhouse gas emissions raise prices for airlines and airports and may be a deciding factor when choosing between two competitive airport destinations. 11 Vancouver Airport Authority 2011 Annual and Sustainability report Gillen, D. (2013, March 6). Director of the Centre for Transportation Studies and the YVR Professor of Transportation Policy (Sauder School of Business). 13 IBIS World Industry Report H4912-GL –Global Airport Operation. Jan 2013. 14 http://www.conferenceboard.ca/economics/hot_eco_topics/default/08-1006/clipping_the_wings_of_canada_s_aviation_industry.aspx 12 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 10 Strategic Analysis: YVR and the Global Airport Industry and airline sides. Runway technology is highly advanced at major airports, and is important to minimizing wear and tear on aircraft when departing and landing. Technological developments in self-serve kiosks for check in are helping clear queues and reducing wait times for passengers and airlines. BASM 502 price competitive, passengers are generally unwilling to pay additional costs to purchase offsets. The contamination of surrounding soil due to jet fuel spills, burning and ground leakage is a concern. Environmental events (volcano, ash cloud, earthquakes, and tsunami) affect air travel and thus airports. Figure 5. PESTEL of global airports. Dynamic Industry Analysis The airport industry will continue to grow as the rate of air transportation use grows. Industry revenue is expected to grow at an annualized rate of 3.9% to $ 145.7 billion15. Passenger and cargo traffic is set to increase particularly in developing countries increasing revenues for the industry. Global Airport Operation Industry Revenue 8 % change in Revenue 6 4 2 0 2008 2010 2012 2014 2016 2018 -2 Figure 6. Industry Revenue Graph 16 Airports are investing in new infrastructure projects and technology to expand their current capacity to handle cargo and passenger traffic, increase safety standards and provide customers with a whole new shopping and entertainment experience. After the economic recession in 2008, the industry has continued to grow but is still vulnerable to key drivers such as GDP and fuel prices. Competition is 15 16 IBIS World Industry Report H4912-GL –Global Airport Operation. Jan 2013. IBIS World Industry Report H4912-GL –Global Airport Operation. Jan 2013. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 11 Strategic Analysis: YVR and the Global Airport Industry BASM 502 expected to grow in the industry with increase in number of airports as air travel increasingly becomes commoditized. The number of low cost airports in growing cities is expected to rise competing against the more established high end airports in larger cities. As demand for energy increases, fuel prices will continue to remain volatile increasing steadily each year. Environmental and government regulations will become more stringent because of increased focus on environmental issues and safety standards. These factors will increase the operational cost of airports as well as airlines and as a result airfares will increase but increased competition in these industries and improvements in fuel efficiency and passenger capacity of aircrafts will keep fares low commensurate to income and inflation. Emerging markets in Asia, Middle East and South America will continue to fuel the growth of the industry with growth in middle class population, high disposable income and a growing economy. These markets will attract tourist and business travelers from across the globe. With increase in demand for air travel, the airline and airport industry in these markets is poised to become more competitive. Governments in countries such as China and India have made huge investments in the airport industry to increase the number of airports, expand current facilities, and improve infrastructure and raise safety standards at key airports. Advances in technology have made aircrafts bigger and more fuel efficient enabling them to carry more number of passengers over longer distances. In future, this will lead to more number of direct flights over long distances bypassing airports which would have previously been an in-transit destination. Improvements in air traffic control technology means increased number of flights in a given airspace allowing for increased traffic and flight paths while adhering to safety standards. With growing impetus on reducing environmental impact and government regulations over safety standards, technology will play a key role in achieving these goals. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 12 Strategic Analysis: YVR and the Global Airport Industry BASM 502 INTERNAL ANALYSIS OF YVR The internal analysis of YVR is divided into three parts; an analysis of activities, an analysis of resources, and benchmarking. This helps to explain how YVR was able to move over 17 million passengers in 201117 and how they can meet future increases in air traffic. Figure 7. YVR Operations 17 Vancouver Airport Authority 2011 Annual and Sustainability Report C. Beaumont, K. Bisht, L. Cornish, M. Ghael 13 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Activity Analysis Value Chain of YVR Figure 8. YVR’s current activities Secondary Activities Infrastructure: The main infrastructure components for YVR’s value chain are explained below: Financial System: As YVR is a non-profit corporation and has no access to shareholder equity, they fund their growth and expansion needs with debt. Equity can be cheaper than debt financing; however, not having shareholders allows YVR to make long term plans and projects without focusing on short term evaluations. The financial model and community focus also creates a unique advantage for YVR when dealing with government, because they are viewed as being unbiased and only interested in community well-being. This increases YVR’s ability to influence policies and regulations in favor for the airport. Accounting: YVR has a ‘dual till’ system under which the two main revenue generators, aeronautical and non-aeronautical business, are divided into distinct income and expenditure accounts. A third source of revenue is the Airport Improvement Fee (AIF) that is collected from passengers by the airlines on behalf of the airport to generate capital for capital intensive projects. The dual till system ensures that income from the aeronautical side of the business is used for aeronautical expenditure, leaving the non-aeronautical income to provide for non-aeronautical expenditure and to make up company profits. Most airports have a single till system where all revenues of an airport are combined; however, this leaves airlines covering a larger portion of the costs and results in higher landing fees. YVR's dual till system has better control of revenues C. Beaumont, K. Bisht, L. Cornish, M. Ghael 14 Strategic Analysis: YVR and the Global Airport Industry BASM 502 and can offer superior long term contracts to air carriers with regards to landing fees and other costs. Legal Affairs: YVR is restricted by regulation from the government. Bilateral Air Service Agreements (Fig. 5) limit YVR’s ability to attract foreign airlines to Vancouver. Canada also has regulations that limit foreign ownership of Canadian airlines to 25%, decreasing the competitiveness of the Canadian airline industry and reducing available airlines to operate from YVR. YVR has been successful in lobbying the Government of Canada to allow the adoption of the China Transit Trial that reduces the requirement for Chinese citizens to obtain a transit visa when connecting through YVR. This allows for more economical flights between YVR and China by increasing the volume of travelers on the route. Management: The Vancouver Airport Authority (VAA) board is comprised of directors from government and the community. Transport Canada owns the airport land and leases it to VAA to operate YVR as a “first class international airport”.18 The current ground lease has been extended until 2072 and requires YVR to pay Transport Canada rent based on 12% of airport revenues.19 20 YVR has a five tiered planning process to guide and manage the development and operations of the airport in the short, medium and long term.21 A set of strong corporate governance structures, policies and procedures ensures that YVR’s business is conducted responsibly. Human resource management: At the end of 2011 the airport authority employed 396 people, 306 of which were member of the Public Service Alliance of Canada (union)22. YVR recognizes the value and importance of their employees and uses the following four values as a guide for their corporate culture.23 - Promotion of collaboration and team work - Accepting accountability - Pursuit of creativity - Results driven focus Employee development is promoted and the YVR target is to provide employees with an average of 35hrs of training per year (they exceeded this in 2011 with an average of 45hrs per employee)24. Training activities include environmental management, cross-functional training, personal development, safety and technical training. 18 Vancouver Airport Authority 2011 Economic Report Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). 20 Vancouver Airport Authority 2011 Economic Report 21 Vancouver Airport Authority 2011 Annual and Sustainability Report 22 Vancouver Airport Authority 2011 Annual and Sustainability Report 23 Vancouver Airport Authority 2011 Annual and Sustainability Report 24 Vancouver Airport Authority 2011 Annual and Sustainability Report 19 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 15 Strategic Analysis: YVR and the Global Airport Industry 2007 BASM 502 2008 Total training and 21,698 22,985 apprenticeship hours Average training/apprenticeship 58 55 hours per full-time equivalent position Figure 9. YVR Employee Development 2009 2010 2011 16,695 16,462 17,200 40 42 45 The airport authority has developed various safety initiatives and strategies that enable them to reduce and maintain low levels of work-related injuries. These safety initiatives are extended beyond YVR’s own employees to include everyone at the airport. Figure 10. YVR Work-related Injuries In 2011 YVR introduced a new performance management program to align employee objectives with the YVR’s annual business plan and help to further develop an environment for open communication, coaching, and feedback.25 Technological Development: YVR is considered as an industry leader and pioneer of technologies that simplify passenger travel and reduce wait times. This means looking at how lead users and early adopters are altering the airport’s service offering and using it as inspiration.26 Some of these technological developments are listed below: Common Use Terminal Equipment (CUTE) - 1996: This system allows the airlines to share hardware and plug in to the airport’s host computers.27 25 Vancouver Airport Authority 2011 Annual and Sustainability Report. Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). 27 YVR Future Travel Experience Fact Sheet. 26 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 16 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Common Use Self-Service (CUSS) Check-in - 2002: Using this service, customers self-check-in and print their boarding passes for multiple airlines from one machine. YVR was the first airport in the world to introduce CUSS check-in kiosks.28 On Board Check-in - 2003: Through this service, airline boarding passes are delivered directly to the cabin of cruise ship passengers, and baggage is tagged on board the cruise ship and delivered directly to the airport.29 CUSS Baggage Check-in - 2007: YVR expanded CUSS to allow passengers to print their own luggage tags.30 Automated Border Clearance (ABC) -2009: This service automates the process of crossing the border into Canada (reduced customer wait time from 90 min to 15 min) was a partnership between CBSA and YVR. 31 Procurement: The Vancouver Airport Authority has concentrated on enabling its employees to do what they best can and contracting out other aeronautical and non-aeronautical services to other specialized suppliers. YVR also focuses on attracting more airlines to increase its aeronautical revenue. The acquisition of services and goods at YVR is done through competitive bidding (open contract) or through best value purchasing.32 YVR only makes exceptions to the way it allocates contracts under specific circumstances. Primary Activities Inbound Logistics: We have considered inbound logistics as the activities that are specific to arriving flights. The airport provides Canada Boarder Services Agency (CBSA) with space to provide customs services for passengers and cargo arriving from international flights. YVR also invested $300 Million to extend the sky train to the airport to improve accessibility to and from the airport and at the same time helped YVR promote sustainability.33 Operations: Airport operations are the activities YVR performs for both arriving and departing flights. These activities include cargo, seaport, ground handling, and baggage handling activities. As previously mentioned, YVR choses to contract out a number of specialized activities including ground handling services to other companies (Handlex, Servisair, and Swissport) to operate at the airport and provide services to airlines without their own ground handling capabilities.34 YVR has chosen to take responsibility for the baggage handling inside the terminal building, but once the baggage leaves the building it is the responsibility of the airline’s chosen ground handling providers to load and unload it from the planes.35 28 YVR Future Travel Experience Fact Sheet YVR Future Travel Experience Fact Sheet 30 YVR Future Travel Experience Fact Sheet 31 YVR Future Travel Experience Fact Sheet 32 Vancouver Airport Authority 2011 Annual and Sustainability Report 33 Vancouver Airport Authority 2011 Annual and Sustainability Report 34 www.yvr.ca 35 Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). 29 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 17 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Outbound Logistics: Outbound logistics are activities specific to departing flights, such as passenger security, de-icing, re-fueling, and passenger check-in/boarding. YVR provides airlines with the space and equipment for passenger check-in and boarding; however, it is the airlines that provide the service to passengers, not YVR. YVR also contracts out the mandatory passenger screening/security to G4S.36 The airlines are responsible for purchasing their own fuel and have created a consortium that purchases fuel and manages fuel logistics. It was in YVR’s best interest to invest in a fuel system that was installed under the apron in order to improve safety at the airport. As a result, they own the equipment that is being used for re-fueling planes; however, they do not generate any revenue from it and view it as a benefit they provide to airlines.37 PLH Aviation Services has the contract for aircraft refueling services at YVR.38 YVR has also chosen to control the de-icing contracts in order to improve efficiencies in operations. YVR selects a single provider of de-icing services (Aeromag) that airlines pay directly based on services used.39 YVR has again chosen to purchase the de-icing equipment in order to ensure that the proper investments are being made and views it as a value added service to airlines.40 Marketing & Sales: YVR markets advertising opportunities for businesses by highlighting that they provide a captive audience and have over 17 million passengers traveling through the airport. A variety of advertising services are available including signage, information kiosks, floor displays, and flight information video screens.41 YVR also needs to market their services to the public to reduce passenger leakage to Bellingham and Seattle.42 Service: YVR views itself as a “full-service” airport and positions itself to provide the highest level of service and customer experience as possible.43 These services enhance the passenger experience at YVR and include shopping, food & beverage, duty free, hotel, free and unlimited Wi-Fi, and various other services. YVR has some of the best retail selection in North America, for example the first Victoria secret in B.C. opened at YVR44. They also have the second largest duty-free space in North America with over 56,000 square feet in 10 stores.45 YVR is specifically targeting its retail to match customer demands, such as the rare whisky and cognac business that is popular with the Chinese market.46 YVR has also moved away from its previous overpricing strategy and instead now insists that stores offer “street prices” using 36 YVR Website Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). 38 YVR Website 39 YVR Website 40 Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). 41 YVR Website 42 O’Brien, M. (2013, March 8). Corporate Secretary and Vice President of Strategic Planning and Legal Services (YVR). 43 Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). 44 B.C.’s first Victoria’s Secret opens at YVR (http://www.straight.com/life/bcs-first-victorias-secret-opens-yvr 37 45 YVR reaches beyond the sky with expanding retail operations (http://www.vancouversun.com/reaches+beyond+with+expanding+retail+operations/7096001/story.html#ixzz2ObcJKLJq) 46 YVR reaches beyond the sky with expanding retail operations (http://www.vancouversun.com/reaches+beyond+with+expanding+retail+operations/7096001/story.html#ixzz2ObcJKLJq) C. Beaumont, K. Bisht, L. Cornish, M. Ghael 18 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Robson Street as a reference.47 This translates into the second highest consumer spending in international terminals in North America. On average $20.11 per passenger is spent before boarding flights from YVR.48 YVR is opening an outlet mall with 97 shops by 2014 that will create jobs in the community, generate more revenue for YVR, and possibly act as a disruptor for outlet stores in the US.49 The Fairmont Vancouver Airport Hotel is directly connected to YVR and provides lodging, spa, and conference facilities for YVR’s customers. Echoing YVR’s “full-service” mantra, the hotel has been voted as the best airport hotel in North America in both 2011 and 2012.50 SWOT Analysis In addition to understanding YVR’s value chain, it is important to categorize the activities, resources and assets that contribute to YVR’s market position and whether they add to or subtract from its competitive advantage both now and in the future. 47 YVR reaches beyond the sky with expanding retail operations (http://www.vancouversun.com/reaches+beyond+with+expanding+retail+operations/7096001/story.html#ixzz2ObcJKLJq) 48 YVR reaches beyond the sky with expanding retail operations (http://www.vancouversun.com/reaches+beyond+with+expanding+retail+operations/7096001/story.html#ixzz2ObcJKLJq) 49 50 YVR Website Skytrax World Airport Awards (http://www.worldairportawards.com/) C. Beaumont, K. Bisht, L. Cornish, M. Ghael 19 Strategic Analysis: YVR and the Global Airport Industry Strengths Strategically located – gateway to Asia - Pacific, particularly China Independent board of directors – incentive to work towards the welfare of the stakeholders Not-for-profit model gives them greater lobbying power and possible tax exemptions. Not having shareholders means YVR can make long term decisions without worrying about short term evaluations. Dual-till model gives them a better understanding of sources of revenue Increased emphasis on safety, security and sustainability helps to reduce cost and increase trust levels among passengers. Credit rating of AA ( second highest in the industry) gives them easy access to capital Considered as industry leader and pioneer of technology. Credited with several operational innovation using technology such as on- board check in and automated border clearance Opportunities Improvements in infrastructure and use of advanced technology to provide state-of-the art services to passengers. Infrastructure expansion to handle growing passenger and aircraft traffic in the future Increase non-aeronautical revenues by providing superior value-add services such as retail, food and entertainment and parking. Air travel is fast becoming the preferred mode of transport presenting an opportunity for YVR to tap into. Growth of Asian economies will increase air travel to and from Vancouver which YVR can potentially benefit from. BASM 502 Weaknesses Lack of free space limits future expansion of infrastructure Not having shareholders means YVR has to raise capital through debt to fund investments YVR Operates in a highly regulated industry where most decisions are made by the government, therefore it lacks the power to take decisions that are in its best interest YVR relies heavily on contractors with monopoly powers to provide services to passengers which lead to lesser control in airport’s operations. Threats Increased competition from low cost airports such as Bellingham leading to passenger leakage. Growing business importance of other major cities such as Calgary Lack of space on the Sea Island could restrict YVR’s expansion plans raising environmental concerns Greater lobbying power lies with the airports in the east such as Toronto and Montreal which could work against their business interest. Profitability depends on several external factors beyond YVR’s control which makes them vulnerable to changes in economic and political environment. The SWOT analysis is aligned with industry view of YVR as a currently strong airport with a good future outlook. However, it is vulnerable to a number of threats that are both controllable and uncontrollable by YVR. Considering these when planning for the future is imperative. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 20 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Resource Analysis Resources are assets that help perform YVR’s activities and can be categorized into tangible and nontangible resources. Tangible resources are physical and financial resources. As with any large airport YVR has a high percentage of their assets as tangible assets, however, YVR also has a healthy financial position. Some of their main tangible resources include: Cash on Hand: $66,626,000 on December 31, 2011 Credit Rating: AA according to Standard and Poor AA (low) - Dominion Bond Rating Services Investments: $52,570,000 – in subsidiary Vantage on December 31, 2011 Runways: North Runway (08L/26R) – 3030m x 61m South Runway (08R/26L) – 3505m x 61m Crosswind Runway (12/30) – 2225m x 61m Terminals: Main terminal = Domestic (DTB) & International & Trans-border (ITB) - Approx. 3.5 million square feet - 51 bridged gates + 16 ramp loading gates South Terminal (STB) – 8 ramp loading positions & common use floatplane dock Parking: Parkade (3 levels) Economy Parking Lot South Parking Lot JetSet Parking Lot (formerly- Long-Term) Retail shopping space: Approx. 166,000 square feet of retail space Baggage handling system: Bags travel at a rate of 1.2m/s Ground Run-up Enclosure: Approx. 1,950 sound-absorbing panels Cargo Village: YVR handled 228,000 tonnes of cargo in 2012 Figure 11. YVR’s Tangible Resources. 51 52 53 54 55 51 Vancouver Airport Authority 2011 Annual and Sustainability Report YVR Website 53 Vancouver International Airport: Quick Facts 2012 54 YVR Cargo 1992-2013 55 Airport Guide (http://airportguide.com/airport/Canada/British_Columbia/Vancouver-CYVR-YVR/runways.php) 52 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 21 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Intangible Resources: are resources which are not physical in nature. It is YVR’s intangible assets that allow YVR to continue to innovate and be a leader within the community. Their main intangible assets include: Leadership: Approximately 160 years of combined YVR airport authority experience on the current executive leadership team Human Resources: YVR has 396 employees Operations at YVR support 23,600 direct jobs 17 million passengers in 2011 Technology: 4 significant new technologies introduced since 1992 rd Reputation: Ranked as the best airport in North America for the 3 year in a row in 2012 (Skytrax World Airport Awards) Ranked as the 9th best airport in the world in 2012 (Skytrax World Airport Awards) 83% of Metro Vancouver residents gave the overall impression of YVR 4 out of 5 or higher in 2011. Benchmarking The key performance benchmarking areas for the airport are: Traffic activity - Total passengers, cargo, & operations. Physical facilities - Number of runways, land area, taxiways, terminals, gates, parking space Aeronautical related charges - Landing and take-off fees, aircraft apron, parking and gate fees Design of the airport and efficiency of operations Airport industry is highly competitive and in order to attract more customers (both passengers and airlines), an airport needs to perform well in all the above mentioned parameters. However, it is also important that an airport manages its funds well because the capital investments in an airport have slow return on investments. Therefore, how and when the capital is invested is important. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 22 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Figure 12. Strategic Capital Investment of Infrastructure YVR’s strategy (Fig.12) is to delay the influx of capital in the system until as close as possible to when it is needed, this gives them an early return on investments and frees up capital faster. This strategy of capital investment and infrastructure development at YVR has helped them churn capital quickly and stay low on debt. Almost all airports provide similar services and have similar supply chain components (Fig. 1), thus benchmarking airports on operational or supply chain parameters would not have brought clarity to performance. Thus, we benchmarked YVR’s financial performance against their competitors (Toronto, Calgary, Seattle and Chicago). The number of passengers travelling through YVR has been steady since 2002 and is expected to grow despite that Settle and Bellingham are offering lower airfares. Chicago has the highest number of passengers travelling through. Calgary’s airport at the same time has the lowest number of passengers, but is growing quickly due in part to Calgary’s growth as business center. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 23 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Figure 13. Airport passenger traffic. Because aeronautical and non-aeronautical services are the major revenue generators for airports it is important to decide on how to account for them both. In the case of YVR, a key advantage is their decision to operate as a dual till model, which is unique to them among their major competitors with only SeaTac following a similar model. Referencing Fig. 4 it is important to remember the different business models of North American competitors. Calgary Revenue $ 290,064 EBITDA $ (123,425) Net income $ (239,410) Shareholders' equity $ 152,334 Total debt $ 1,244,560 $ 1,494,727 Total assets Figure 14. Selected financial data Chigaco Seattle Toronto $ 679,402 $ 483,172 $1,137,592 $ 443,040 $ 415,968 $1,073,412 $ (5,191) $ 107,750 $ (36,412) $1,392,546 $2,912,124 $ (719,758) $7,338,756 $3,510,594 $7,710,530 $9,480,843 $6,660,419 $7,199,891 for YVR and competitors. YVR $ 369,262 $ 198,781 $ 59,060 $1,087,874 $ 547,389 $1,766,954 Calgary Chigaco Seattle Toronto YVR ROS -82.54% -0.76% 22.30% -3.20% 15.99% ROE -130.86% -0.29% 1.95% 5.42% 1.68% ROA -16.02% -0.05% 1.62% -0.51% 3.34% Asset turnover 0.194 0.072 0.073 0.158 0.209 Financial leverage 817% 527% 121% -1071% 50% Figure 15: Selected financial metrics for YVR and competitors. Figures 14 and 15 demonstrate that YVR was in good financial shape in 2011. It has the least debt compared to other airports and its net income is positive. Both Seattle and YVR have similar financial performance compared to others. The high return on sales represents high operational efficiency of the airports in terms of profit produced per dollar of sales. Similarly, ROE indicates the net income returned as a percentage of shareholders equity. Since Canadian airports are non-profits their shareholders equity is equal to net assets, and thus ROE represents the return on net asset of the airport. ROA is the C. Beaumont, K. Bisht, L. Cornish, M. Ghael 24 Strategic Analysis: YVR and the Global Airport Industry BASM 502 return on total asset and accounted by the net income generated by the firm. YVR is generating the maximum profit relative to its total asset which is positive. Equally, the low financial leverage of YVR shows its low dependence on debt financing which also strengthens its financial position. Figure 16. Relationship between operations, assets and capital Figure 16 represents the relation between operating efficiency (determined by ROS), asset utilization (determined by asset turnover) and strength of capital structure (determined by financial leverage). The position of the bubble is determined by the ROS and asset turnover and size is determined by financial leverage. YVR’s dual till model is helping them to keep their debt low and run their operations efficiently. Seattle is YVR’s closest competition and has been a both a disruption and simulator to YVR’s business by causing passenger “leakage” but also stimulating the overall number of passengers traveling. YVR is out performing their Canadian competititors; however, it is important to note that Calgary is currently investing heavily into a 2 billion expansion plan. Figure 17. Benchmarking In Figures 17 through 21, benchmarking of YVR and its competitors on finacial parameters clearly show that YVR is finacially very strong which gives them advantage to make decisions more independently. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 25 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Seattle also follows a similar revenue model and is on par with YVR. Calgary appears to be ina difficult finacial situation, however this is likeley due to the execution of their investment-heavy expansion plan currently underway. Figures 18-21. Financial Benchmarking C. Beaumont, K. Bisht, L. Cornish, M. Ghael 26 Strategic Analysis: YVR and the Global Airport Industry BASM 502 RECOMMENDATIONS YVR’s ability to maintain its top 10 global position is contingent on factors both within and beyond its control. It is imperative that YVR continues to plan strategically in the future and recommendations for future development fall into four main categories: Diversify Risk and monitor key players Diversifying Risk: Currently YVR is the second largest hub for Air Canada (AC) after Toronto airport; however Air Canada continues to face financial difficulties since late 2000. Air Canada had huge liquidity risk in its Q1 2009 and had problems conserving cash for its 2010 operations. Air Canada is YVR’s largest carrier and thus highly dependent on AC for aeronautical revenue. YVR should diversify its risk by becoming a hub for other airlines. As WestJet is a growing competitor it is an attractive option for YVR. Monitor loss to Bellingham/Seattle: Figure 22: Increase in household ticket purchases 56 Recently, YVR has lost passenger traffic to Bellingham (BLI) due to its close location and lower fares. BLI can be termed as “The Classic Disruptor” to YVR by stealing away passengers. YVR currently loses up to 1 million passenger trips to US airports annually. Figure 22 shows the percentage growth of Vancouver households that fly since 1953. Since early 2000, passenger traffic rose steeply from 35% in 2000 to 46% by the end of 201057. 75% of this growth is attributed to fare generation58 leaving 25% of the 1M passenger trips being poached from YVR. YVR has several options to curb this leakage: 1. Buy or invest in Bellingham 56 Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). 58 Brown, M. (2013, March 20). Senior Planner, Strategic Planning (YVR). 57 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 27 Strategic Analysis: YVR and the Global Airport Industry BASM 502 2. Create its own disruptor i.e. build a low cost terminal. 3. Ignore and focus on its own strategy Currently, the best option for YVR would be to focus on its own strategy by growing organically. YVR’s competitive advantage is the full- service it provides to its passengers so it should concentrate on providing the additional value-added services included in these recommendations. Expand and formalize lobbying operations Government regulations: To maintain its competitive advantage in the face of growing Asian expansion and increasing destination cities for airlines, YVR needs to continue to push for changes to the current Transport Canada regulations. It is recommended that YVR establishes a dedicated team or department to continue to lobby Transport Canada and other global air transport groups. It would be to YVR’s advantage if airports could participate in the negotiation of ASA’s and the expansion of city pairs alongside the Canadian government and airlines. YVR would also benefit from relaxation of the regulations surrounding rights of establishment and foreign ownership of airlines (which maintains 75% of a Canadian-based airline must be Canadian owned) which currently protects Air Canada and WestJet’s duopoly on domestic flights. Tour Operations: Additionally, the lobbying group could address regulations in the tourism industry which would also benefit both YVR and Vancouver as a tourist destination. Currently, tour operators in BC, Ontario and Quebec are required to be located within the province59. This prohibits foreign tour operators and airlines from offering tour-packages from YVR and therefore discourages them from choosing Vancouver as a destination, reducing flights and passengers to the city. Cargo-In-Transit: YVR had success in increasing airport traffic with the visa-in-transit program. We recommend lobbying for a similar program for cargo. One of the reasons for YVR low cargo volumes is because of the added complication of clearing customs, however, if a similar exemption was made for cargo only passing through the airport, YVR would be able to increase its attractiveness for cargo routes between Asia and the USA because they would be able to send products to/from both Canada and the US on the same planes. Further develop full-service model Develop commercial space for passengers and community: Non-aeronautical revenues are an important part of financial solvency for airports. As a result, YVR should develop commercial space, making it more attractive to passengers. YVR is currently developing a mall with 94 designer outlets to attract tourists and the local community. Opening public access to retail 59 Gillen, D. (2013, March 6). Director of the Centre for Transportation Studies and the YVR Professor of Transportation Policy (Sauder School of Business). C. Beaumont, K. Bisht, L. Cornish, M. Ghael 28 Strategic Analysis: YVR and the Global Airport Industry BASM 502 shops (like Schiphol airport) and pushing security nearer to boarding gates (as in Singapore) will result in increased non aeronautical revenues and possible indirect increase in aeronautical revenues as more passengers choose YVR. Increase transportation options: YVR can further increase their full-service airport model by increasing the transportation options to and from the airport. We recommend looking at the option of creating a “cell phone” parking lot to ease congestion created by passenger pick-ups. With widespread mobile use passengers are now able to call people picking them up to meet them at the arrival gates. However, because it is hard to predict both the exact arrival time of the passenger and driving time to the airport, people picking up passengers from YVR often drive around in circles at the airport, creating excess emissions, or chose to park illegally in areas that cause increased congestion. By creating a designated “cell phone” parking lot on or close to Sea Island, YVR will make it more convenient for passenger pick-ups, reduce emissions, and at the same time could generate revenue by offering retail and food services to those waiting (Starbucks etc.). Another option to improve access would be a partnership with Car2Go that would see the creation of Car2Go parking in the parkade. YVR could generate revenue from Car2Go and at the same time would not be cannibalizing their revenues from parking because the passengers who use Car2Go would not normally park at the airport. Business services: Business customers have low price sensitivity and as a result are an ideal match for YVR’s full-service model; however, Vancouver is not a major business hub in Canada and as a result we recommend that YVR focus on increasing its attractiveness to business travelers transferring through the airport. One method would be to create dedicated lines through customs for business travelers connecting from an international flight. Another option could be to have a priority luggage carousel for business class making it easier and faster to get through the airport. An additional benefit is that with every minute they are not spending waiting they are more likely to spend money in the airport60. Tourist Attraction: YVR is an airport that is reflective of the culture and environment of Western Canada. It is one of the few airports that immediately upon landing broadcasts the city, culture and beauty of Vancouver. It is also developing a large retail presence both within the airport and in nearby Richmond and was a significant investor in the Canada Line rapid transit. Therefore it is recommended that YVR furthers its development as a unique tourist destination in addition to just being a transport hub. YVR is working in 2013 to expand Flight Path Park a popular destination for plane enthusiasts, to be a view point and environmental park for local residents, tourists and employees on Sea Island. By developing a future waterfront park on the North side of Sea Island and expanding existing summer children’s and family programs, YVR can become a destination for locals and tourists encouraging more non-aeronautical revenue. 60 Brownlow, N. (2013, March 25) Sr. VP of Revenue Management & Information Services. InterVISTAS Consulting. C. Beaumont, K. Bisht, L. Cornish, M. Ghael 29 Strategic Analysis: YVR and the Global Airport Industry BASM 502 Infrastructure investments Install fuel pipeline: Currently, most of YVR’s fuel requirements are delivered via a 40km pipeline owned by Trans Mountain61, supplying fuel from a Chevron facility in Burnaby. The pipeline is not sufficient to meet peak demand requirements and therefore YVR also ships fuel from a BP/ARCO refinery at Cherry Point, Washington via tanker truck. This transport method has increased safety concerns, traffic congestion, and carbon emissions, and is unsustainable. Trans Mountain’s pipeline is old and being the only source of supply any disruptions could impact YVR’s operations. Upgrading the pipeline or installing a new one would involve huge investments while supply uncertainty remains. VAFFC currently owns a wharf facility in Richmond on the south arm of the Fraser River62 which could store fuel delivered by barge or taker. A new pipeline connecting to YVR airport will increase the reliability of fuel supply and minimize environmental impact and safety risks. However, development is currently opposed by the City of Richmond and may be subject to environmental conflict too. Extending north runway: Currently, the North runway is used primarily for arrivals, restricting YVR’s capacity of aircrafts. Extending the facility to also handle departures would increase YVR’s runway capacity and double its departure capacity63. To extend the runway, YVR will have to build a north-south taxiway allowing for simultaneous take-off and landing on both runways. Extending the length of the North runway will allow long distance aircrafts to use the runway for departures. Having two entirely functional runways will help YVR manage peak hour traffic more efficiently and cater to the expected increase in traffic, generating additional aeronautical revenue. 61 VAFFC – www.vancouverairportfuel.cawww.vancouverairportfuel.ca VAFFC – www.vancouverairportfuel.cawww 63 YVR: Your Airport 2027: 20-year Master Plan 62 C. Beaumont, K. Bisht, L. Cornish, M. Ghael 30