low-cost competition

advertisement

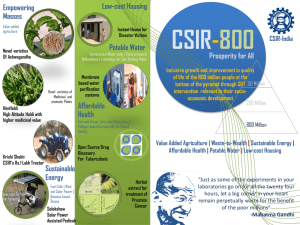

– EXECUTIVE SURVEY RESULTS Low-cost competition is a growing challenge to Nordic-based industrial companies. These companies, traditionally focusing on premium offers, find it challenging to be competitive in low-end segments. Therefore, they tend to ignore the problem as long as it does not affect the core business. However, given enough time to grow lowcost competitors will eventually threaten premium segments as well. Three key issues to address The findings in this newsletter are based on a study performed by Triathlon Consulting Group, where 35 executives from Nordic-based industrial companies were interviewed. The study shows that in order to compete with low-cost actors, three key questions have to be addressed: 1 What strategy needs to be adopted? 1. 2 How to mitigate the challenge of low-cost competition in mature markets? 2. On a high level, strategies against low-cost competition are decided by their focus on providing performance value, relational value and price value. In practice, a company will rely on a mix of these value strategies. Performance value strategies aim for superior product performance, such as applications and quality. Relational value strategies focus on deepening the long-term relation with a customer through a solutions NEWSLETTER LOW-COST COMPETITION CHOOSING LOW-COST COMPETITION STRATEGY and aftermarket-driven approach. Finally, price value strategies achieve competitiveness by offering the lowest possible price. Performance Strategy Relation Price Strategies against low-cost competition STUDY INSIGHTS: Strategy for mature markets effective, less so for developing markets The studied companies are not very concerned about low-cost competition in markets where customers are interested in performance value and relational value, since low-cost actors are largely unsuccessful in competing on those terms. In such mature markets, mitigating the potential future challenge from low-cost competition before it arrives is a priority. However, the study indicates that low-cost competition is more troublesome in markets where most customers are mainly interested in price value. Finding ways to become competitive on price is thus a key challenge for companies wanting to beat low-cost competition, especially in developing markets. Q1 2015 3 How do you compete with low-cost actors in developing markets? 3. 1 Emphasizing relational value to prevent low-cost actors from entering your markets NEWSLETTER The study suggests that the best way to raise barriers for low-cost competition to enter a market is to work with relational value strategies. Establishing close ties to customers, and ideally integrating into their processes, can make it very difficult for low-cost competitors to enter since they tend to want to sell their products in volume with a minimum of investment in relations. Top performers educate their customers MITIGATING THE CHALLENGE OF LOW-COST COMPETITION IN MATURE MARKETS Act before it is too late The study shows that low-cost actors often start in marginal markets and segments, where economies of scale can be achieved before moving on to more attractive ones. At this stage, many simply ignore the low-cost competition. However, this is a crucial time for action, where the possibilities of preparing for the entry of low-cost competition are still open before it is too late. Unless proactive measures are taken, low-cost competitors can attack companies’ mature markets with highly price-competitive offers from their strong positions in developing markets. At first, this might only attract customers looking for the lowest possible price. Over time however, the low-cost competitors will incrementally improve the performance and quality of their offers, eventually becoming good enough for most customers while retaining a cost advantage. The companies that are most successful in competing with low-cost competitors invest in educating customers about the value of their offers, as well as in helping them understand that their offers can meet needs the customers didn’t yet know they had. For example, many companies work with educating their customers about the differences in reliability when comparing to a low-cost actor, often revealing hidden costs due to quality problems. Conversely, quality assurance coupled with extensive aftermarket services allow some companies in the study to point to significantly better total lifecycle costs and cost of ownership, something that is not apparent when looking only at the sticker price. Waking up to the challenge Many companies in the study have yet to experience the effects of low-cost competitor entry into their mature markets. Because of this, there is a lack of appreciation of the problem and what can be done to deal with it. However, the companies often point to the likelihood of increased low-cost competition in the years to come. This trend underlines the urgency and need to act quickly once low-cost competition starts appearing on the horizon. Low-cost competitors build scale in developing markets first China Other Developing Markets Western Markets Example of typical low-cost competitor expansion strategy Q1 2015 2 MEETING LOW-COST COMPETITION IN DEVELOPING MARKETS The study suggests the following steps for successfully overcoming low-cost competition in developing markets: Even if margins are unattractive, carefully consider if exiting is aligned with the company’s long term strategy before doing so. Instead, the potential of growing with developing markets over time should be taken into consideration. Use separate low-end brand Review the possibility to use a separate low-end brand with the freedom to become competitive in the low-end. This opens the possibility of allowing the low-end brand to focus on cost optimization without risking brand dilution. Future growth in developing markets Although many companies confess to be struggling against low-cost competition in developing markets, such markets are also the most likely source of future growth. Viable strategies against low-cost competitors in developing markets are therefore a high priority. Don’t exit NEWSLETTER The companies participating in the study are more or less untroubled by low-cost competition in mature markets. However, competing on price is more common in developing markets and this is where low-cost competition becomes problematic. The offers of low-cost competitors are well-suited for these markets and the investigated companies struggle, both to offer prices in line with the low-cost competitors’ and to communicate the value of their more premium offers. Leverage all your resources While a separate low-end brand prevents brand dilution and allows to establish brand recognition as price-value focused, there is nothing to stop it from taking advantage of the resources of the entire company. The companies participating in the study have access to infrastructure and support that is not available to low-cost competitors. Deal with it sooner rather than later The idea of competing mainly on price while incrementally improving capabilities is hardly new, although globalization has made differences in price levels to become steeper than perhaps ever before. Low-cost competition is likely to continue to be an issue for Nordic-based industrial companies for the foreseeable future and it would be wise to address that issue headon sooner rather than later. Q1 2015 3 Triathlon Consulting Group Triathlon Consulting Group is a growing management consultancy dedicated to operations improvement with a prestigious track record. Our clients are well known large multinational companies, mainly within technology intensive industries. Triathlon is partner owned, independent and hence a truly reliable consulting partner in operations improvement. NEWSLETTER Nordic office (HQ) Klippan 3B 414 51 Göteborg Sweden +46 31 704 12 90 Europe office 95 Cours Lafayette 69006 Lyon France +33 472693843 Russia office ul. Bakhrushina 32/1 115054 Moscow Russia +7 495 221 87 86 Asia office Metlife Kabutocho Bldg. 3F 5-1 Kabutocho Chuo-ku Nihonbashi 103-0026 Tokyo Japan +81 3 5847 7936 By combining innovation and best practice, we develop substantial value to our clients through long-term relationship and genuine understanding of business needs in the industries we operate within. Triathlon’s core business is our clients’ ‘out of the ordinary’ operational management issues. Strategy Operations Finance Developing strategies and governance to reach objectives Improving operations by combining innovation and best practice Setting up business structure and control to support strategy and operations Need a success story of your own? – Triathlon develops your business Q1 2015 4