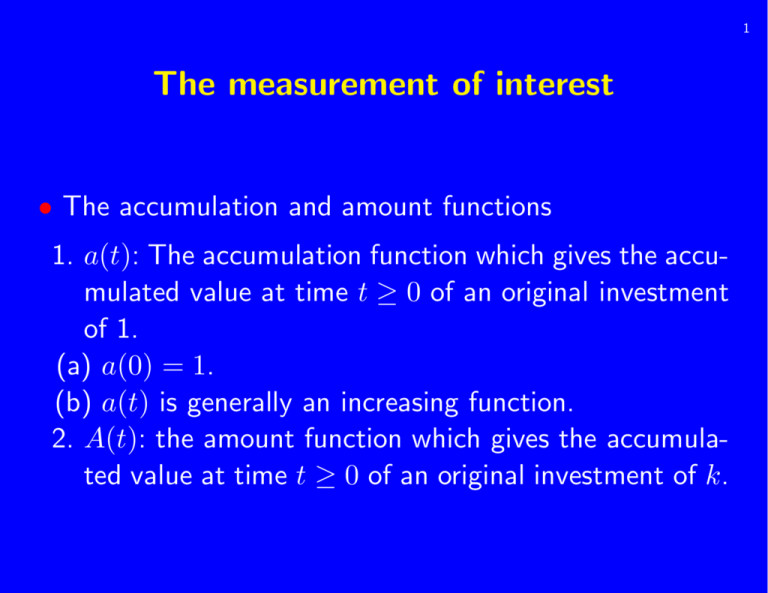

The measurement of interest

advertisement

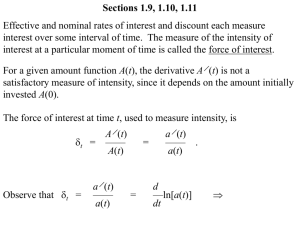

1 The measurement of interest • The accumulation and amount functions 1. a(t): The accumulation function which gives the accumulated value at time t ≥ 0 of an original investment of 1. (a) a(0) = 1. (b) a(t) is generally an increasing function. 2. A(t): the amount function which gives the accumulated value at time t ≥ 0 of an original investment of k. 2 Then we have A(t) = k · a(t) and A(0) = k 3 The effective rate of interest The effective rate of interest i is the amount of money that are unit invested at the beginning of a period will earn during the period, where interest is paid at the end of the period. equivalently, i = a(1) − a(0) ⇐⇒ a(1) = 1 + i (1 + i) − 1 a(1) − a(0) A(1) − A(0) I1 = = = = i a(0) A(0) A(0) 4 Let in be the effective rate of interest during the nth period from the date of investment. Then we have A(n) − A(n − 1) In in = = for integral n ≥ 1. A(n − 1) A(n − 1) 5 Simple interest a(t) = 1 + it for integral t ≥ 0. The accruing of interest according to this pattern is called simple interest. A more rigorous mathematical approach to the definition of a(t) is a(t + s) = a(t) + a(s) − 1 for t ≥ 0 and s ≥ 0. 6 0 a (t) = = = = = a(t + s) − a(t) lim s→0 s [a(t) + a(s) − 1] − a(t) lim s→0 s a(s) − 1 lim s→0 s a(s) − a(0) lim s→0 s a0(0), a constant. 7 Thus, Z r a0(r)dr = 0 Z r a0(0)dr 0 a(t) − a(0) = t · a0(0) a(t) = 1 + t · a0(0). Since a(1) = 1 + i, we have a(1) = 1 + i = 1 + a0(0) =⇒ a0(0) = i. Thus, a(t) = 1 + it for t ≥ 0. 8 Compound interest The theory of compound interest handles this problem by assuming that the interest earned is automatically reinvested. i.e., a(t + s) = a(t) · a(s) for t ≥ 0 and s ≥ 0. a(t + s) − a(t) a (t) = lim s→0 s 0 9 a(t) · a(s) − a(t) = lim s→0 s a(s) − 1 = a(t)lim s→0 s = a(t) · a0(0). Thus d a0(t) = ln a(t) = a0(0). a(t) dt 10 t d a0(0)dr ln a(r)dr = 0 dr 0 0 ln a(t) − ln a(0) = t · a (0) Z t Z ln a(t) = t · a0(0) since ln a(0) = 0. And a(1) = 1 + i, we have ln a(1) = ln(1 + i) = a0(0). Thus, ln a(t) = t ln(1 + i) = ln(1 + i)t =⇒ a(t) = (1 + i)t t ≥ 0. 11 Present value and the discount function We have seen that an investment of 1 will accumulate to 1 + i at the end of one period. The term 1 + i is often called an accumulation factor. It is often necessary to determine how much a person must invest initially so that the balance will be 1 at the end of one period. The answer is (1 + i)−1. We define a new symbol v, such that 1 v= 1+i 12 The term v is often called a discount factor. How much a person must invest in order to accumulate an amount of 1 at the end of t periods. The answer is the reciprocal of the accumulation function a−1(t), since a−1(t)a(t) = 1. We will call a−1(t) the discount function. Thus, 1 • For simple interest: a (t) = 1 + it −1 13 1 t = v • For compound interest: a (t) = (1 + i)t −1 14 The effective rate of discount The effective rate of discount d is the ratio of the amount of interest (sometimes called the “amount of discoun” or just “discount”) earned during the period to the amount invested at the end of the period. Let dn be the effective rate of discount during the nth period from the date of investment. Then In A(n) − A(n − 1) = dn = A(n) A(n) In may be commonly called either the “amount of 15 discount” or the “amount of interest”. 16 The relation between i, d and v d =⇒ i − id = d =⇒ d(1 + i) = i i = 1−d i 1 1+i 1 d = =i = − 1+i 1+i 1+i 1+i = iv = 1−v d = iv 17 = i(1 − d) = i − id i − d = id However, it is possible to define simple discount in a manner analogous to the definition of simple interest. Consider a situation in which the amount of discount earned during each periods is constant. Then, the original principal which will produce an accumulated 18 value of 1 at the end of t periods is a−1(t) = 1 − dt for 0 ≤ t < 1/d. This contrasts with compound discount, in which case the present value is a−1(t) = v t = (1 − d)t for t ≥ 0.