Batavia Stock Focus

29 June 2012

Unilever Indonesia

Expansion Set to Tap Growing Demand

•

Solid 1Q12 result

The company (UNVR) booked 17% yoy revenue increase in 1Q12 to Rp 6.6

trillion, supported by 18% growth in home & personal care division and

12% growth in F&B division. EBIT increased 19% to Rp 1.6 trillion, resulting

in slight increase in EBIT margin from 23.3% to 23.8%. In the bottom line,

net profit increased 18% to Rp 1.2 trillion, reflecting 25% of our FY12

estimate and Bloomberg consensus estimate. As a market leader, it is

better able to adjust selling prices whenever input cost increases. However,

we still see threat of competition that may force the company to increase

advertisement and promotion spending in the future.

•

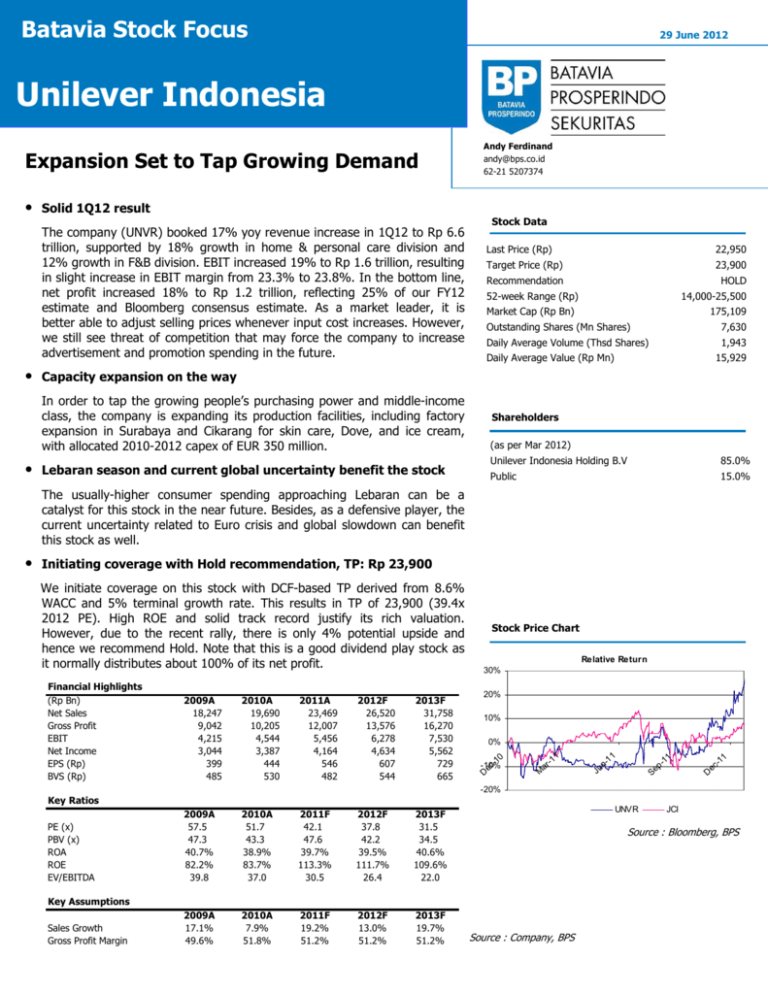

Stock Data

Last Price (Rp)

22,950

Target Price (Rp)

23,900

Recommendation

HOLD

52-week Range (Rp)

14,000-25,500

Market Cap (Rp Bn)

175,109

Outstanding Shares (Mn Shares)

7,630

Daily Average Volume (Thsd Shares)

1,943

Daily Average Value (Rp Mn)

15,929

Capacity expansion on the way

In order to tap the growing people’s purchasing power and middle-income

class, the company is expanding its production facilities, including factory

expansion in Surabaya and Cikarang for skin care, Dove, and ice cream,

with allocated 2010-2012 capex of EUR 350 million.

•

Andy Ferdinand

andy@bps.co.id

62-21 5207374

Lebaran season and current global uncertainty benefit the stock

Shareholders

(as per Mar 2012)

Unilever Indonesia Holding B.V

85.0%

Public

15.0%

The usually-higher consumer spending approaching Lebaran can be a

catalyst for this stock in the near future. Besides, as a defensive player, the

current uncertainty related to Euro crisis and global slowdown can benefit

this stock as well.

•

Initiating coverage with Hold recommendation, TP: Rp 23,900

We initiate coverage on this stock with DCF-based TP derived from 8.6%

WACC and 5% terminal growth rate. This results in TP of 23,900 (39.4x

2012 PE). High ROE and solid track record justify its rich valuation.

However, due to the recent rally, there is only 4% potential upside and

hence we recommend Hold. Note that this is a good dividend play stock as

it normally distributes about 100% of its net profit.

Financial Highlights

(Rp Bn)

Net Sales

Gross Profit

EBIT

Net Income

EPS (Rp)

BVS (Rp)

2009A

18,247

9,042

4,215

3,044

399

485

2010A

19,690

10,205

4,544

3,387

444

530

2011A

23,469

12,007

5,456

4,164

546

482

2012F

26,520

13,576

6,278

4,634

607

544

2013F

31,758

16,270

7,530

5,562

729

665

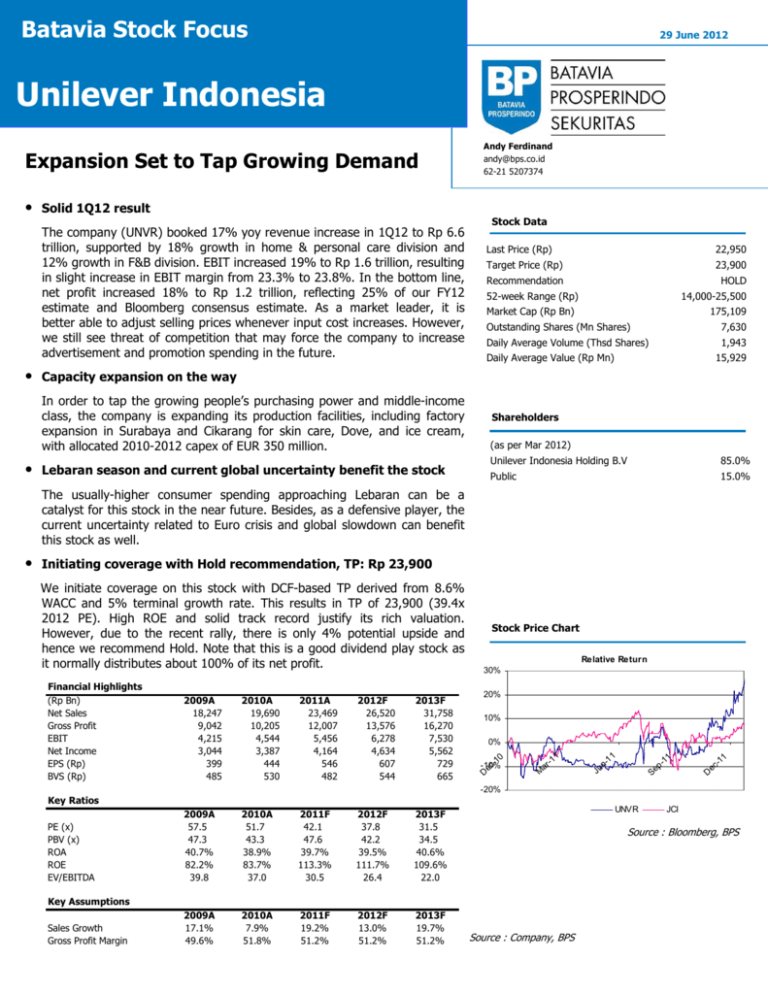

Stock Price Chart

Relative Return

30%

20%

10%

0%

10

c-10%

De

ar

M

-1

1

11

nJu

11

pSe

11

cDe

-20%

Key Ratios

PE (x)

PBV (x)

ROA

ROE

EV/EBITDA

2009A

57.5

47.3

40.7%

82.2%

39.8

2010A

51.7

43.3

38.9%

83.7%

37.0

2011F

42.1

47.6

39.7%

113.3%

30.5

2012F

37.8

42.2

39.5%

111.7%

26.4

2013F

31.5

34.5

40.6%

109.6%

22.0

2009A

17.1%

49.6%

2010A

7.9%

51.8%

2011F

19.2%

51.2%

2012F

13.0%

51.2%

2013F

19.7%

51.2%

UNVR

Source : Bloomberg, BPS

Key Assumptions

Sales Growth

Gross Profit Margin

JCI

Source : Company, BPS

Batavia Stock Focus

Industry View

•

Expecting increase in purchasing power going forward

We view that the current global economic slowdown and Euro crisis do not affect local economy significantly. The flight of

investors to USD as safe haven may depreciate IDR, however BI is currently much more aggressive and has higher foreign

reserves to maintain currency stability. We view that GDP growth can still book more than 6% in this year. On the other

hand, relatively high national food stock, weakening global commodity prices, and unlikely increase in subsidized fuel price

may give downward pressure on inflation. Hence, purchasing power can increase and it is good for consumer industry.

GDP Growth

BI Rate and Inflation

8

10

(%)

(%)

7

6

5

5

0

Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan07 07 08 08 09 09 10 10 11 11 12

4

3

2007

2008

2009

2010

2011

Inflation (YoY)

1Q12

Source : Bloomberg, BPS

BI Rate

Source : Bloomberg, BI

Consumer Confidence Index

125

120

115

110

105

100

95

90

Worry on fuel price increase

Confidence rebounds

Index above 100 indicates optimism

Jan-11

•

Apr-11

Jul-11

Oct-11

Jan-12

Source : BI

Apr-12

Middle-income class on the rise

According to World Bank, Indonesia’s middle income class has risen significantly. In 2003, 37.7% of the total population

was the middle income class. In 2010, this class occupied 56.5% of the total population or about 134 million of people. The

remainder was mostly low income class with daily spending of lower than USD 2. The profile of this middle class is shown

on the pie chart. This is consistent with the growing GDP per capita, which booked 4-yr CAGR of 17%.

GDP per Capita

Profile of Middle Income Class by Daily

Spending, 2010

USD

USD 6-10 USD 10-20

2%

9%

USD 5-6

21%

USD 2-4

68%

Source : World Bank

2

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

2007

2008

2009

2010

2011

Source : World Bank, BPS

Batavia Stock Focus

•

Tough competition remains

The increasing middle income class and relatively low barrier to entry, such as relatively light regulation, have been a

magnet that attracts foreign consumer players. The industry has currently a huge number of players. In home & personal

care, there are Lion Wings, P&G, OT, Kao, and Unilever. Meanwhile in F&B, Heinz, Nestle, Indofood, and Unilever are

among the big players. Besides that, the nature of some products which are easily substituted makes competition even

tougher. Therefore, product innovation and rejuvenation remain an important factor.

Category

Toothpaste

Hair Care

Skin Care

Dishwashing

Detergent

Ice Cream

Ketchup

Some Well-known Products

Pepsodent, Ciptadent, Colgate, Formula, Smile Up,

Fresh & White

Pantene, Rejoice, Head & Shoulder, Sunsilk, Clear,

Emeron, Zinc

Emeron, Lux, Lifebuoy, Dove, Nuvo, Giv

Sunlight, Mama Lemon

Attack, Rinso, So Klin

Wall's, Campina, Woody, Haagen Dazs

Bango, Indofood, ABC

Source : BPS

Company View

•

A market leader, established in 1933

The company was established in 1933 under the name of Lever’s Zeepfabrieken N.V. in Angke, Jakarta. It grew through

organic and inorganic way and became a market leader in many categories of consumer goods. It currently has 2 revenue

segments, namely home & personal care and food & beverages. The former presently contributes 75% of revenue.

•

Strong inorganic growth

A lot of significant acquisitions have been done along the years.

1933

▼ Established under the name of Lever's Zeepfabrieken N.V. in Angke, Jakarta

1981

▼ Went public and listed 15% of shares in Jakarta and Surabaya Stock Exchange

1990

▼ Acquired The Sari Wangi

1992

▼ Entered ice cream business

1999

▼ Acquired fabrics conditioner and household care business

2000

▼ Acquired Kecap Bango

2004

▼ Acquired Knorr

2008

▼ Acquired Buavita and Gogo

Established the biggest skin care factory in Asia in Bekasi

2011

▼ Acquired Sara Lee

Source : Company, BPS

3

Batavia Stock Focus

•

Extensive operating facilities

Source : Company

•

Operational and Financial Review

UNVR is a market leader in many categories, such as skin care, hair care, skin cleansing, deodorants, oral care, tea, and ice

cream. At present, about 95% of the products are sold domestically and the rest is exported. In toothpaste segment, based

on Industry Ministry as reported by ICN Data Consult, national toothpaste production capacity was 92,000 ton in 2010.

UNVR contributed 56,500 ton or 61% of it with Pepsodent as the leading brand.

As a market leader in many categories, the company is better able to adjust selling prices whenever material cost

increases. It also has currency hedging to protect against sharp currency movement. Related to production cost, the

company keeps maintaining low cost such as through local-based supply and use of technology. As a result, it can maintain

profit margin as shown in the graph on the following page.

Currently, the company is expanding its production facilities with allocated capital expenditure of EUR 350 million for 20102012. The graph on the next page shows capex over previous year sales increased from about 4% to more than 7%. That

expansion includes factory expansion for skin care, ice cream, and Dove. Revenue from both divisions, namely home &

personal care and food & beverages is to increase. This is inline with the company’s plan to double the revenue by 2020

and make Indonesia as a production base for Asia.

4

Batavia Stock Focus

Division Revenue

Profitability

20,000

25,000

20,000

(Rp bn)

(Rp bn)

15,000

10,000

5,000

15,000

10,000

5,000

-

-

2008

2009

2010

Home & Personal Care

2011

2008

Food & Beverages

2009

Net Sales

Source : Company, BPS

2010

EBIT

2011

Net Profit

Source : Company, BPS

Capex/Previous Year Sales

Profit Margin

8.0%

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

2008

2009

2010

2011

Source : Company, BPS

2008

2009

2010

2011

Source : Company, BPS

SWOT Analysis

•

Strength

•

•

•

•

Foreign-owned company faces increasing resistance towards acquisition and domination in local consumer

market

Growing middle-income class and higher purchasing power

High potential export market

Weakness and Threat

•

•

5

Strong financial performance with zero debt

Opportunity

•

•

•

Long operational experience

Weakness

•

•

Market leader with well-known brand names

Stiffer competition as barrier to entry is relatively low

Relatively high threat of product substitutes

Batavia Stock Focus

Valuation

•

Rich valuation justified

Based on 8.6% WACC and 5% terminal growth rate, our DCF-based model arrives at TP of 23,900 (39.4x 2012 PE). High

ROE and strong track record justify the rich valuation.

Peer Comparison

Market Cap

(Rp bn)

175,109

42,365

32,944

38,846

19,547

118,716

53,294

UNVR

INDF

ICBP

KLBF

MYOR

GGRM

CPIN

Last Price

(Rp)

22,950

4,825

5,650

3,825

25,500

61,700

3,250

2012 PE

2012 PBV

2012 EV/EBITDA

42.2

2.0

2.8

4.9

6.8

4.3

6.7

26.4

4.9

8.4

12.0

16.7

14.1

13.7

37.8

12.1

14.4

19.2

29.3

21.1

17.8

Source : Bloomberg, BPS

Historical Rolling PE

PBV vs ROE

45

50.0

40

UNVR

PE

35

40.0

+1 Stdev

25

+2 Stdev

PBV

Ave

30

-1 Stdev

20

-2 Stdev

15

10

Dec-09

Jun-10

Dec-10

Jun-11

30.0

20.0INDF, GGRM, MYOR,

ICBP, KLBF

10.0

CPIN

0.0%

50.0%

Dec-11

100.0%

ROE

Source : Bloomberg

Source : Bloomberg, BPS

Financial Summary

Interim Result

(Rp Bn)

Net Sales

COGS

Gross Profit

EBIT

Net Income

GPM

EBIT Margin

NPM

4Q11

1Q12

6,147

3,030

3,117

1,405

1,139

6,604

3,288

3,316

1,570

1,163

51%

23%

19%

50%

24%

18%

%Chg qoq

7%

9%

6%

12%

2%

1Q11

1Q12

%Chg yoy

5,668

2,780

2,888

1,323

987

6,604

3,288

3,316

1,570

1,163

50%

24%

18%

17%

18%

15%

19%

18%

52%

23%

17%

FY12

26,520

12,944

13,576

6,278

4,634

% Acc

25%

25%

24%

25%

25%

51%

24%

17%

Source : Company, BPS

6

Batavia Stock Focus

Financial Forecast

(Rp Bn)

2009

2010

2011

2012F

2013F

18,247

9,205

9,042

4,827

4,215

34

4,248

(1,205)

1

3,044

19,690

9,485

10,205

5,661

4,544

3

4,546

(1,161)

2

3,387

23,469

11,462

12,007

6,551

5,456

120

5,576

(1,411)

(1)

4,164

26,520

12,944

13,576

7,298

6,278

(73)

6,205

(1,570)

(1)

4,634

31,758

15,488

16,270

8,740

7,530

(82)

7,448

(1,885)

(1)

5,562

Balance Sheet

Current Assets

Cash and Equivalents

Receivables, Net

Inventories, Net

Other Current Assets

Non-current Assets

Fixed Assets

Intangibles

Others

Total Assets

Current Liabilities

Loans

Payables

Others

Non-current Liabilities

LT Debt

Other Non-current Liabilities

Total Liabilities

Minority Interests

Shareholders' Equity

Capital

Retained Earnings

Others

3,602

858

1,258

1,340

146

3,883

3,036

741

106

7,485

3,589

0

1,430

2,159

187

0

187

3,776

6

3,703

92

3,531

81

3,748

318

1,568

1,574

289

4,952

4,149

708

95

8,701

4,403

190

1,817

2,396

250

0

250

4,653

3

4,045

92

3,873

81

4,446

336

2,076

1,813

221

6,036

5,314

646

76

10,482

6,474

699

2,434

3,341

326

0

326

6,800

4

3,677

92

3,504

81

4,658

195

2,210

1,991

261

7,085

6,395

614

76

11,742

7,265

1,300

2,749

3,216

326

0

326

7,591

4

4,148

92

3,975

81

5,671

330

2,646

2,383

312

8,040

7,381

583

76

13,712

8,306

1,300

3,289

3,717

326

0

326

8,632

4

5,076

92

4,903

81

Cash Flows Statement

CFO

Net Income

Depreciation

Changes in Working Capital

Other Changes

CFI

Capex

Others

CFF

Changes in Debt

Dividend Payment

Adjustments and Others

Changes in Cash

Forex Effect

3,281

3,044

163

135

(61)

(700)

(629)

(71)

(2,436)

0

(2,442)

6

145

(9)

3,619

3,387

180

(63)

114

(1,310)

(1,273)

(37)

(2,848)

190

(3,044)

7

(538)

(2)

5,462

4,164

254

883

161

(1,433)

(1,420)

(13)

(4,011)

509

(4,532)

12

18

0

4,804

4,634

332

(163)

0

(1,382)

(1,414)

32

(3,563)

601

(4,164)

0

(141)

0

6,129

5,562

405

162

0

(1,360)

(1,391)

31

(4,634)

0

(4,634)

0

135

0

Ratio

Current Ratio

Cash Ratio

Quick Ratio

Gross Profit Margin

EBIT Profit Margin

Net Profit Margin

ROE

ROA

Sales Growth

EBIT Growth

Net Profit Growth

Capex/Previous Year Sales

100.4%

23.9%

59.0%

49.6%

23.1%

16.7%

82.2%

40.7%

17.1%

22.8%

26.5%

4.0%

85.1%

7.2%

42.8%

51.8%

23.1%

17.2%

83.7%

38.9%

7.9%

7.8%

11.3%

7.0%

68.7%

5.2%

37.3%

51.2%

23.2%

17.7%

113.3%

39.7%

19.2%

20.1%

22.9%

7.2%

64.1%

2.7%

33.1%

51.2%

23.7%

17.5%

111.7%

39.5%

13.0%

15.1%

11.3%

6.0%

68.3%

4.0%

35.8%

51.2%

23.7%

17.5%

109.6%

40.6%

19.7%

19.9%

20.0%

5.2%

Income Statement

Net Sales

COGS

Gross Profit

Total Operating Expenses

EBIT

Non-Operating Income

Pre-tax Income

Tax Expenses

Minority Interests

Net Income

7

Head Office

Chase Plaza, 12th Floor

Jl.Jend.Sudirman Kav 21, Jakarta 12920

Tel : +62-21 520 7374

Fax : +62-21 2598 9821

www.bps.co.id

Research Team

Andy Ferdinand

Senior Analyst

andy@bps.co.id

Parningotan Julio

Analyst

julio@bps.co.id

Yasmin Soulisa

Analyst

yasmin@bps.co.id

Wisnu Karto

Analyst

wisnu@bps.co.id

Hasan

Research Associate

hasan@bps.co.id

Rukan Grand Puri Niaga Jl. Puri Kencana Blok K6 No.2P

Palembang

Branches

Jakarta

Jakarta Barat 11610

Tel: +62 21 58351562

Bandung

Fax: +62 21 58351563

Tel : +62 711 375600

Jl.Jend Gatot Subroto No.47 C

Yogyakarta

Bandung 40262

Tel : +62 22 87340273

Medan

Fax : +62 22 87340274

Makassar

Semarang

Thamrin Square Blok C-12 Jl.Thamrin No.5 Semarang

Semarang 50244

Fax : +62 31 5689568

Jl.Kahuripan No.5

Tel : +62 24 3516161 Fax : +62 24 3518546

Solo

Malang 65119

Tel : +62 341 358889

Ruko Ruby I No.9 Jl. Boulevard Panakukang Mas

Tel : +62 411 430959 (hunting) 455038 (sales) Fax : +62 411 432376

Surabaya 60281

Malang

Fax : +62 274 544 800

Makassar 90222

Fax : +62 61 4523013

Ruko Darmo Square Blok B No.8 Jl.Raya Darmo 54-56

Tel : +62 31 5623445

Jl Magelang No 91

Tel : +62 274 580 299

Medan 20157

Surabaya

Fax : +62 711 376855

Yogyakarta 55242

Jl.Ir Djuanda No.16-J

Tel : +62 61 4562262

Jl.Rajawali No. 1174 D

Palembang 30113

Jl. Slamet Riyadi No.217

Tel : +62 71 662425 Fax : +62 71 662424

Fax : +62 341 353797

Batavia Prosperindo Sekuritas Investment Ratings: BUY – expected total return of 10% or more; HOLD – expected total return of -10% to 10%;

SELL – expected total return of -10% or less. Expected total return is defined as 12-month total return (including dividends).

DISCLAIMER

The information contained in this report has been taken from sources we deem reliable, however, PT. Batavia Prosperindo Sekuritas or its affiliates, cannot

guarantee its accuracy and completeness.

The views expressed in this report accurately reflect personal views of the analyst(s) about the subject securities or issuers and no part of the compensation of

the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations and/or views in this report. Nothing in this report

constitutes a representation that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances.

This report is published solely for information purposes and should not be considered as a solicitation or an offer to buy or sell any securities.

Neither PT. Batavia Prosperindo Sekuritas nor any of its affiliates and/or employees accepts any liability for any direct or consequential losses arising from any use

of this publication. Copyright and database rights protection exists in this publication and it may not be reproduced, distributed and/or published by any person

for any purpose without prior consent of PT. Batavia Prosperindo Sekuritas. All rights are reserved.

Our report is also available at

Bloomberg, BPSJ <GO>

ISI Emerging Market, www.securities.com