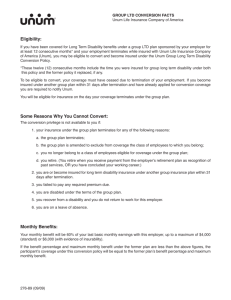

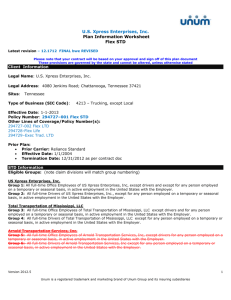

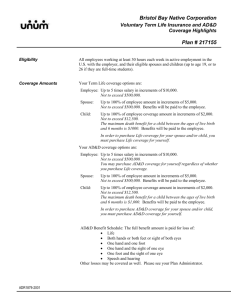

Unum Life and AD&D Certificate

advertisement