UFCU's Wheels 101 Buyer's Guide - University Federal Credit Union

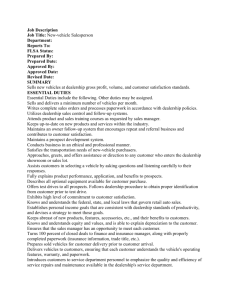

advertisement