Craft Beer Makers Object to Ontario Retail System - WSJ.com#printMode

Dow Jones Reprints: This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or customers,

use the Order Reprints tool at the bottom of any article or visit www.djreprints.com

See a sample reprint in PDF format.

RUNNING A BUSINESS

Order a reprint of this article now

APRIL 27, 2011

Fight Brews in Craft Beer

Small-Batch Makers Say Ontario Retail System Is Stacked in Favor of Big Rivals

By DAVID KESMODEL

TORONTO—Small brewers in Ontario are pushing for changes to one of the world's more unusual beer-selling

environments.

About 80% of retail beer sales in Ontario occur in a chain of stores that's jointly owned by Canada's three largest

brewers: Anheuser-Busch InBev NV, Molson Coors Brewing Co. and Sapporo Holdings Ltd. Between them, those

brewing giants account for about 88% of Canada's beer sales.

Known as the Beer Store, the retail network is partly a relic of

provincial alcohol laws that date to the post-Prohibition era.

Critics of the system, including smaller brewers and some

consumers, complain that the big brewers' control of the Beer

Store gives them a competitive advantage.

Elsewhere in Canada, retail outlets aren't controlled by brewing

companies.

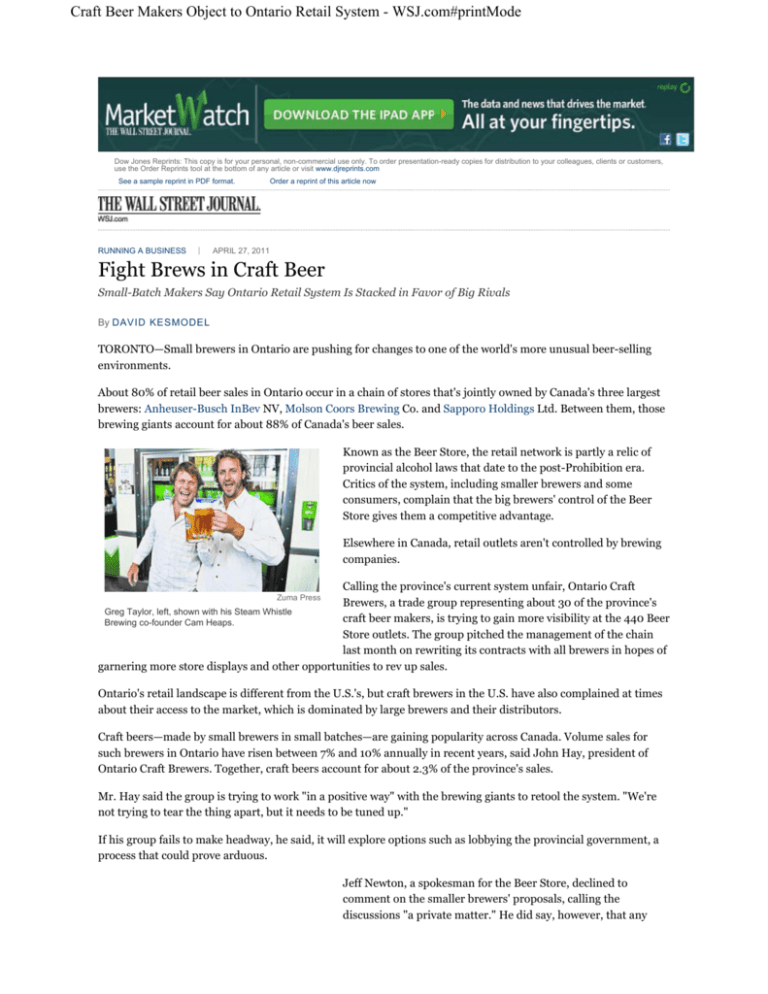

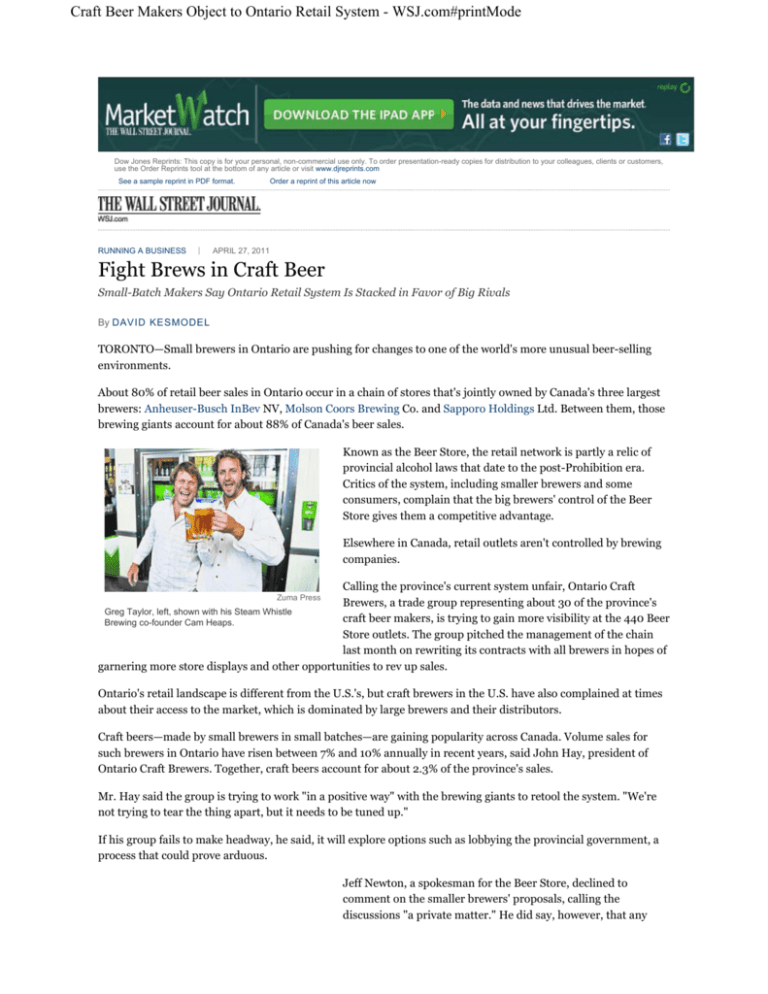

Calling the province's current system unfair, Ontario Craft

Brewers, a trade group representing about 30 of the province's

Greg Taylor, left, shown with his Steam Whistle

craft beer makers, is trying to gain more visibility at the 440 Beer

Brewing co-founder Cam Heaps.

Store outlets. The group pitched the management of the chain

last month on rewriting its contracts with all brewers in hopes of

garnering more store displays and other opportunities to rev up sales.

Zuma Press

Ontario's retail landscape is different from the U.S.'s, but craft brewers in the U.S. have also complained at times

about their access to the market, which is dominated by large brewers and their distributors.

Craft beers—made by small brewers in small batches—are gaining popularity across Canada. Volume sales for

such brewers in Ontario have risen between 7% and 10% annually in recent years, said John Hay, president of

Ontario Craft Brewers. Together, craft beers account for about 2.3% of the province's sales.

Mr. Hay said the group is trying to work "in a positive way" with the brewing giants to retool the system. "We're

not trying to tear the thing apart, but it needs to be tuned up."

If his group fails to make headway, he said, it will explore options such as lobbying the provincial government, a

process that could prove arduous.

Jeff Newton, a spokesman for the Beer Store, declined to

comment on the smaller brewers' proposals, calling the

discussions "a private matter." He did say, however, that any

Craft Beer Makers Object to Ontario Retail System - WSJ.com#printMode

brewer can get its products into the Beer Store by paying a listing

fee, and smaller brewers pay lower handling fees for their

products. He notes that the open system differs from traditional

retail environments in Quebec and the U.S., where smaller

brewers often struggle to get their products on store shelves.

"The system as it exists contributes significantly to enabling so

many of these guys to thrive," Mr. Newton said, referring to the

craft beer makers.

David Kesmodel of the Wall Street Journal

Small brewers say big-name beers, like Coors Light,

have a competitive advantage in Ontario, where 80%

of retail beer sales occur in a chain of stores jointly

owned by Canada's three largest brewers.

"They have complete, unfettered access to all our stores in a

market of 13 million people," Mr. Newton said. Sales from

Ontario's smaller brewers rose 8% by volume in the chain last

year, compared to flat performance for all beer, he said.

Greg Taylor, co-founder of Toronto's Steam Whistle Brewing, one of the province's leading craft brewers, said "it's

great" that all brewers can get into the Beer Store. "The problem is, there's an imbalance of opportunity to market

your products within those stores," he said. He would like more opportunities, for instance, to have Steam

Whistle's products showcased in displays in store lobbies.

At about 60% of the Beer Store outlets, consumers go to a counter to order beer from a menu, akin to ordering at

a fast-food restaurant. Mr. Hay of the craft beer trade group said that format favors bigger brewers with large

advertising budgets.

At the other 40% of Beer Store outlets, where consumers pick their beer from coolers or pallets, shelf space is

generally allocated based on market share. That means a customer is more likely to see a lot of Coors Light than a

Canadian craft brew.

Any retooling of the Beer Store could have wider repercussions for brewers and consumers in Ontario, which is

the largest province for beer sales in Canada, accounting for 36% of the country's sales by volume.

Ontario's retail system dates to the end of the province's own Prohibition era in 1927. The provincial government

controlled wine and liquor sales but left domestic beer to private operators. Over the years, consolidation in the

brewing industry whittled the number of brewers that owned the retail network to just Anheuser, Molson and

Sapporo.

In the U.S., post-Prohibition rules generally bar brewers from owning retail operations, a framework designed

partly to curb anticompetitive practices.

In Ontario, beer, wine and liquor aren't available in grocery, convenience and mass-merchandise stores.

Consumers wanting to buy liquor or wine to take home generally must shop at one of about 600 stores run by the

Liquor Control Board of Ontario. Those stores sell beer, too, but mostly in smaller package sizes.

Canada's beer market is valued at $16 billion, according to market-research firm Euromonitor International.

Molson Coors and Anheuser's Labatt unit each have about 42% market share, while Japan's Sapporo, which

bought Canada's Sleeman Breweries Ltd. in 2006, has about 4%.

Molson Coors and Labatt referred questions about the retail system to the Beer Store.

Write to David Kesmodel at david.kesmodel@wsj.com

Copyright 2011 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by

copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit

www.djreprints.com