:KDW0DNHVWKH+LVWRU\RI&DSLWDOLVP1HZVZRUWK\"

Seth Rockman

Journal of the Early Republic, Volume 34, Number 3, Fall 2014, pp.

439-466 (Article)

3XEOLVKHGE\8QLYHUVLW\RI3HQQV\OYDQLD3UHVV

DOI: 10.1353/jer.2014.0043

For additional information about this article

http://muse.jhu.edu/journals/jer/summary/v034/34.3.rockman.html

Access provided by Western Ontario, Univ of (12 Nov 2014 10:16 GMT)

Review Essay

What Makes the History of Capitalism Newsworthy?

SETH ROCKMAN

Capitalism Takes Command: The Social Transformation of NineteenthCentury America. Edited by Michael Zakim and Gary J. Kornblith.

(Chicago: University of Chicago Press, 2012. Pp. viii Ⳮ 358. Cloth,

$97.00; paper $32.00.)

Capitalism may be in crisis as an economic system, but it is thriving as a

subject within the historical profession. The ‘‘history of capitalism’’ now

organizes a book series at Columbia University Press, a seminar program

at the Newberry Library, a MOOC at Cornell University, a graduate

field at University of Georgia, and a tenure line at Brown University.

Undergraduate courses on American capitalism are filling lecture halls

at Princeton, Florida, and Loyola University Chicago, while the New

School for Social Research has launched its new Heilbroner Center for

Capitalism Studies. The topic has provided thematic unity to recent

annual meetings of the Social Science History Association and the Organization of American Historians. In the American Historical Association’s state-of-the-field volume American History Now, the history of

capitalism stands alongside established subfields like women’s history

and cultural history. A front-page article last year in the New York Times

carried the headline, ‘‘In History Class, Capitalism Sees Its Stock Soar.’’1

Seth Rockman is associate professor of history at Brown University. He thanks

Julia Ott, Lukas Rieppel, Sandy Zipp, and JER editor David Waldstreicher for

helpful advice with this essay.

1. Jennifer Schuessler, ‘‘In History Class, Capitalism Sees Its Stock Soar,’’ New

York Times, Apr. 7, 2013, A1; Sven Beckert, ‘‘History of American Capitalism,’’

in American History Now, ed. Eric Foner and Lisa McGirr (Philadelphia, 2011),

314–35. In addition to the Beckert overview, other recent assessments of the field

Journal of the Early Republic, 34 (Fall 2014)

Copyright 䉷 2014 Society for Historians of the Early American Republic. All rights reserved.

................. 18599$

$CH5

07-22-14 10:26:43

PS

PAGE 439

440

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

‘‘This is news?’’ one could hear many early republic historians ask

with incredulity. The study of capitalism has long been a central concern

of our field. Forty years ago, the ‘‘new labor history’’ began recovering

the experiences of the first generation of American wage laborers in communities like Paterson, Rockdale, and Lowell. Very soon, artisans of

every trade had a historian to recount their declining economic power in

the face of capitalism’s rise. Graduate students in the 1980s cut their

teeth on farmers’ account books and rural mentalités, and few qualifying

exam lists lacked a section on ‘‘the transition to capitalism’’ debate. The

generation coming of age in the 1990s had ‘‘the market revolution’’

looming over its head, and in the wake of a Journal of the Early Republic

special issue on capitalism in 1996, social historians continued to argue

with Gordon Wood and Joyce Appleby over the compatibility of capitalism and democracy. Over the last decade, SHEAR conferences have

featured sessions on capitalism as a force of liberation or destruction, as

a top-down or bottom-up phenomenon, and as ideology or a structure.

As often as not, experienced commentators have alerted younger

presenters to the classic works of Samuel Rezneck, Oscar and Mary

Handlin, or George Rogers Taylor, extending the field’s historiographical genealogy ever deeper into the past. If academic generations define

themselves against their immediate predecessors, how many ‘‘revisionist’’

include Jeffrey Sklansky, ‘‘The Elusive Sovereign: New Intellectual and Social

Histories of Capitalism,’’ Modern Intellectual History 9 (Apr. 2012), 233–48;

Sklansky, ‘‘Labor, Money, and the Financial Turn in the History of Capitalism,’’

Labor: Studies in Working-Class History of the Americas 11 (Spring 2014), 23–46;

Kenneth Lipartito, ‘‘Connecting the Cultural and the Material in Business History,’’ Enterprise & Society 14 (Dec. 2013), 686–704; Louis Hyman, ‘‘Why Write

the History of Capitalism?’’ Symposium Magazine, July 8, 2013, http://www

.symposium-magazine.com/why-write-the-history-of-capitalism-louis-hyman; Noam

Maggor et al., ‘‘Teaching the History of Capitalism,’’ http://studyofcapitalism

.harvard.edu/node/132. In addition to providing themes for national meetings, the

history of capitalism has organized a number of recent conferences: ‘‘Calculating

Capitalism,’’ Columbia University, Apr. 25–26, 2014; ‘‘Histories of American

Capitalism,’’ Cornell University, Nov. 6–8, 2014; ‘‘Capitalizing on Finance: New

Directions in the History of Capitalism,’’ Huntington Library, Apr. 12–13, 2013;

‘‘Capitalism in America: A New History,’’ University of Georgia, Feb. 18, 2012;

‘‘The New History of American Capitalism,’’ Harvard University, Nov. 18–19,

2011; ‘‘Power and the History of Capitalism,’’ New School of Social Research,

Apr. 15–16, 2011; ‘‘Slavery’s Capitalism: A New History of American Economic

Development,’’ Brown University and Harvard University, Apr. 7–9, 2011.

................. 18599$

$CH5

07-22-14 10:26:44

PS

PAGE 440

Rockman, HISTORY OF CAPITALISM

•

441

historians have humbly discovered that their scholarly grandparents had

in fact been exploring the same questions half a lifetime earlier? This

‘‘new’’ history of capitalism might be a testament to good branding

(appropriately) rather than original insight, less a new field than a fad.

Scholars identifying themselves with the ‘‘new’’ history of capitalism—

and I count myself in these ranks—make no pretense of having discovered a new field. Many historians working under this rubric are quick

to credit their undergraduate teachers and graduate advisors: Elizabeth Blackmar, Barbara Fields, and Eric Foner at Columbia, or JeanChristophe Agnew and Michael Denning at Yale, to name only two

clusters of influential faculty who have been talking about capitalism for

decades. For those interested in parlor games, younger historians of capitalism can reach Agnew or Blackmar in about half the steps required to

get to Kevin Bacon. Columbia- and Yale-trained students have been at

the forefront of institutionalizing the history of capitalism elsewhere;

none with more success than Sven Beckert, whose Program on the Study

of Capitalism at Harvard has placed recent graduates into faculty positions at University of North Carolina–Chapel Hill, UC–Berkeley, Cornell

University, and University of Pennsylvania. Yet, not all roads lead back

to Cambridge, let alone New Haven and Morningside Heights, with the

field’s institutional genealogy looking less like a family tree than an overgrown forest of departments, centers, and programs. Consider the range

of affiliations of doctoral students receiving funding from the Library

Company of Philadelphia’s Program in Early American Economy and

Society or appearing on now-ubiquitous history-of-capitalism conference

panels. Complicating matters further, many of the dissertations (recent

and underway) in the field are directed by faculty members who do not

identify themselves primarily as historians of capitalism; take, for example, William Cronon and Thomas Sugrue, two graduate mentors better

identified with the respective subfields of environmental and urban history. But even doctoral advisors coming to history of capitalism through

the more predicable routes of labor and business history—Nelson

Lichtenstein and Colleen Dunlavy, for instance—would offer idiosyncratic accounts of the field’s origins. Sven Beckert might highlight the

importance of Europeanists like Eric Hobsbawm, William H. Sewell, Jr.,

and E. P. Thompson in shaping a field that nonetheless maintains a

distinctive Americanist lineage. One imagines Richard John making a

compelling case for Alfred Chandler as history of capitalism’s progenitor,

while the New Labor history of Herbert Gutman and David Montgomery

................. 18599$

$CH5

07-22-14 10:26:45

PS

PAGE 441

442

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

would feature prominently for Jefferson Cowie, Rosemary Feurer, and

Scott Reynolds Nelson. William J. Novak, Robin Einhorn, and Brian

Balogh might credit American Political Development (a move in 1980s

and 1990s political science and sociology toward the history of institutions) with redirecting historians’ gaze toward the state’s role in the

economy. A dozen other historiographies might appear in competing

accounts of the field’s genealogy. Suffice it to say, the contours of the

field stretch beyond just a handful of programs and advisors.

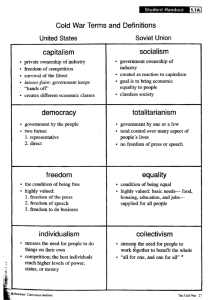

What makes the history of capitalism newsworthy is less institutional

than intellectual, as the field has opened new vistas on the past by pursuing its questions differently from an earlier scholarship. First, the current

scholarship has minimal investment in a fixed or theoretical definition of

capitalism. Few works in the field begin with an explicit statement of

what the author means by capitalism. If the goal is to figure out what

capitalism is and how it has operated historically, scholars seem willing

to let capitalism float as a placeholder while they look for ground-level

evidence of a system in operation. The empirical work of discovery takes

precedence over the application of theoretical categories: A question like

‘‘What might men’s grooming products or Congressional tariff debates

tell us about capitalism?’’ organizes the inquiry, not ‘‘What does capitalism tell us about razors and rate schedules?’’ Recent work shows little

interest in demarcating certain economic activities or actors as precapitalist or proto-capitalist relative to a predetermined standard of actual

capitalism. By extension, ‘‘transitions’’ are not an overarching preoccupation of the recent scholarship, with less attention given to the timing

of a ‘‘market revolution,’’ shifts between modes of production, or the

contrast between Gemeinschaft and Gesellschaft. As the turmoil of the

current global economy has revealed a system wildly inconsistent with

theorized accounts of ‘‘pure’’ capitalism—it isn’t like the state has become

less relevant to the economy today than it was in 1750 or that free markets have ended human trafficking—historians have shown greater comfort with the ambiguities of early America capitalism. Once-essential

boundaries, as between mercantilism and capitalism, diminish in importance as scholars recognize the state’s geopolitical interest in organizing

markets and generating revenue up through the present day. Likewise,

the space between moral economy and market economy appears less

obvious as historians assert that culture (implicit in traditionalism of the

former) also governs the latter despite its presumed profit-maximizing

rationality. The new scholarship embraces the ‘‘varieties of capitalism,’’

................. 18599$

$CH5

07-22-14 10:26:46

PS

PAGE 442

Rockman, HISTORY OF CAPITALISM

•

443

to use the title of an influential volume in political science on the mutability of capitalism across chronologies and geographies.2

Secondly, recent scholarship alters the periodization of U.S. history,

with particular consequence for early republic specialists who have long

claimed capitalism’s story, or at least its rise, as their own. After all, ours

is the era of the Erie Canal, de-skilled artisans, and trans-Atlantic radicals, plus three major panics and a bank war!3

Stealing some of our thunder, the history of capitalism tends to situate

the early United States in the sweep of an early modern global history

defined by commercial integration, the fiscal–military state, and the valorization of instrumental knowledge. For example, commodity studies like

Jennifer Anderson’s Mahogany: The Costs of Luxury in Early America

and Sven Beckert’s Empire of Cotton: A Global History dexterously

bridge the eras of colonization and industrialization. Other scholars have

similarly deepened the field’s chronological range: Recent syntheses by

Joyce Appleby and Christopher Tomlins span more than three centuries.4

The more specialized scholarship on U.S. capitalism rarely confines

itself to the decades between the American Revolution and the Civil War.

Jonathan Levy’s Freaks of Fortune: The Emerging World of Capitalism

and Risk in America begins with the 1841 Creole slave revolt and ends

in the Progressive Era. Scott Reynolds Nelson’s A Nation of Deadbeats:

2. Peter Hall and David Soskice, eds., Varieties of Capitalism: The Institutional

Foundations of Comparative Advantage (New York, 2001). For commentary, see

‘‘ ‘Varieties of Capitalism’ Roundtable,’’ Business History Review 84 (Winter

2010), 637–74; Richard Deeg and Gregory Jackson, ‘‘Towards a More Dynamic

Theory of Capitalist Variety,’’ Socio–Economic Review 5 (Jan. 2007), 149–79.

3. For the best recent overview, see John L. Larson, The Market Revolution in

America: Liberty, Ambition, and the Eclipse of the Common Good (New York,

2010). Some of the early republic’s claims on capitalism were articulated in Alfred

F. Young, ed., Beyond the American Revolution: Explorations in the History of

American Radicalism (DeKalb, IL, 1993); and especially Michael Merrill, ‘‘Putting

‘Capitalism’ in its Place: A Review of Recent Literature,’’ William and Mary

Quarterly 52 (Apr. 1995), 315–26.

4. Jennifer Anderson, Mahogany: The Costs of Luxury in Early America (Cambridge, MA, 2012); Sven Beckert, Empire of Cotton: A Global History (New York,

2014); Joyce Appleby, The Relentless Revolution: A History of Capitalism (New

York, 2010); Christopher Tomlins, Freedom Bound: Law, Labor, and Civic Identity in Colonizing English America, 1580–1865 (New York, 2010).

................. 18599$

$CH5

07-22-14 10:26:46

PS

PAGE 443

444

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

An Uncommon History of America’s Financial Disasters starts with

William Duer in debtors’ prison in 1792 and concludes during the New

Deal. Paul Lucier’s excellent book on scientific entrepreneurs and the

energy industry runs from 1820 to 1890, Caroline Fisk’s award-winning

history of intellectual property travels from 1800 to 1930, and two recent

dissertations on accounting (1750–1880) and actuarial science (1830–

1930) boast chronologies that defy the neat bookends of the early republic. Indeed, neither the American Revolution nor the Civil War plays a

determinative role in these narratives, marking a departure from an earlier historiography depicting capitalism as the consequence of the former

and the cause of the latter.5

Third, consistent with its disavowal of theoretical definitions and

recalibrated chronologies that span the Civil War, the new scholarship

recognizes slavery as integral, rather than oppositional, to capitalism. Of

course, slavery has long been central to debates over British capitalism,

beginning with the 1944 publication of Eric Williams’s Capitalism and

Slavery. Although the United States also had an industrial revolution

reliant upon slave-grown cotton, the American historiography had generally considered slavery as a bounded regional economy, marking the

South as a laggard, rather than a leader, in national economic development.6

A wave of new scholarship, however, has positioned southern slaveholders as architects of a capitalist system predicated on commodity

5. Jonathan Levy, Freaks of Fortune: The Emerging World of Capitalism and

Risk in America (Cambridge, MA, 2012); Scott Reynolds Nelson, A Nation of

Deadbeats: An Uncommon History of America’s Financial Disasters (New York,

2012); Paul Lucier, Scientists and Swindlers: Consulting on Coal and Oil in

America, 1820–1890 (Baltimore, 2008); Catherine L. Fisk, Working Knowledge:

Employee Innovation and the Rise of Corporate Intellectual Property, 1800–1930

(Chapel Hill, NC, 2009); Caitlin C. Rosenthal, ‘‘From Memory to Mastery:

Accounting for Control in America, 1750–1880,’’ PhD diss., Harvard University,

2012; Daniel B. Bouk, ‘‘The Science of Difference: Developing Tools of Discrimination in the American Life Insurance Industry, 1830–1930,’’ PhD diss.,

Princeton University, 2009.

6. Eric Williams, Capitalism and Slavery (Chapel Hill, NC, 1944); Joseph E.

Inikori, Africans and the Industrial Revolution in England: A Study in International Trade and Economic Development (New York, 2002). On the absence of

slavery in American economic history, see Seth Rockman, ‘‘The Unfree Origins

of American Capitalism,’’ in The Economy of Early America: Historical Perspectives and New Directions, ed. Cathy Matson (University Park, PA, 2006), 335–61.

................. 18599$

$CH5

07-22-14 10:26:47

PS

PAGE 444

Rockman, HISTORY OF CAPITALISM

•

445

production, entrepreneurship, technological innovation, and lengthy

chains of trans-Atlantic finance. The framework of ‘‘Second Slavery’’—

highlighting slavery’s nineteenth-century regeneration in Brazil, Cuba,

and the U.S. under ‘‘modern’’ regimes of industrial management—has

proven especially productive. By dislodging wage labor as the sine qua

non of capitalism, historians of capitalism are able to consider labor

exploitation in a wider range of contexts, and especially to appreciate the

interdependence of plantation agriculture and factory production. Slavery also functioned as property regime in which, to quote one scholar,

slaves were worked ‘‘financially as well as physically’’ to store and transfer wealth, to access credit, and to stabilize an under-regulated system of

paper money. Relative to other subfields of U.S. history, the history of

capitalism may be the place where slavery assumes the most central position within the larger national narrative.7

Fourth, the new scholarship on capitalism integrates a variety of subfields and methodologies under one capacious heading. If nothing else,

the study of capitalism has woven together business history, labor history, economic history, political economy, and the history of economic

7. Bonnie Martin, ‘‘Slavery’s Invisible Engine: Mortgaging Human Property,’’

Journal of Southern History 76 (Nov. 2010), 817–66, quote on 866. Exemplary

recent work includes Caitlin C. Rosenthal, ‘‘From Memory to Mastery: Accounting for Control in America, 1750–1880,’’ Enterprise & Society 14 (Dec. 2013),

732–48; Joshua D. Rothman, Flush Times and Fever Dreams: A Story of Capitalism and Slavery in the Age of Jackson (Athens, GA, 2012); Michael O’Malley,

Face Value: The Entwined Histories of Money and Race in America (Chicago,

2012), esp. 44–82; Walter Johnson, River of Dark Dreams: Slavery and Empire

in the Cotton Kingdom (Cambridge, MA, 2013), esp. 252–54. One theoretical

touchstone is Ian Baucom, Specters of the Atlantic: Finance Capital, Slavery, and

the Philosophy of History (Durham, NC, 2005). For ‘‘Second Slavery,’’ see Dale

W. Tomich, Through the Prism of Slavery: Labor, Capital, and World Economy

(Lanham, MD, 2004); Anthony E. Kaye, ‘‘The Second Slavery: Modernity in the

Nineteenth–Century South and the Atlantic World,’’ Journal of Southern History

75 (Aug. 2009), 627–50; Daniel Rood, ‘‘Plantation Technocrats: A Social History

of Knowledge in the Slaveholding Atlantic World, 1830–1860,’’ PhD diss., University of California–Irvine, 2010; David R. Roediger and Elizabeth D. Esch, The

Production of Difference: Race and the Management of Labor in U.S. History (New

York, 2012), 19–63. For an overview of this historiography, see Seth Rockman,

‘‘Slavery and Capitalism,’’ Journal of the Civil War Era 2 (Mar. 2012), 5, and

online supplement at http://journalofthecivilwarera.com/forum-the-future-of-civilwar-era-studies/the-future-of-civil-war-era-studies-slavery-and-capitalism/.

................. 18599$

$CH5

07-22-14 10:26:48

PS

PAGE 445

446

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

thought, and in doing so, has sought to revitalize subfields that (to put it

politely) had fallen out of favor in the profession. Many un-cool topics—

tariffs, infrastructure, marine insurance—are now hot. But the redemption of these subjects is neither a rear-guard action, nor a repudiation of

the last thirty years of social and cultural history. To the contrary, the

history of capitalism has shown such strength precisely for its embrace

of critical theory and the experiences of workers, consumers, and entrepreneurs removed from the seats of power. For the early republic, just

consider well-received books like Scott Sandage’s Born Losers: A History

of Failure in America, Stephen Mihm’s Nation of Counterfeiters: Capitalists, Con Men, and the Making of the United States, Jane Kamensky’s

The Exchange Artist: A Tale of High-Flying Speculation and America’s

First Banking Collapse, and Brian Luskey’s On the Make: Clerks and the

Quest for Capital in Nineteenth-Century America. Rosanne Currarino

has recently identified the early republic as the most fertile site of a new

‘‘history of cultural economy,’’ by which she means the re-appropriation

of the economic past by scholars willing to interrogate ‘‘the economic’’

as a cultural and linguistic construction. Evaluating cultural history more

generally, James W. Cook foregrounds the history of capitalism for its

innovative melding of ‘‘signs and structures.’’ As if to convey the blending of disparate methodologies, Cornell’s Louis Hyman has offered

‘‘Foucault and regressions’’ as the ultimate aspiration of the field.8

Finally, the history of capitalism fundamentally functions as critique,

but not in ways that align with a single intellectual tradition or school of

political thought. Scholars working in the field are dubious of the neoclassical orthodoxies that prevail in Economics departments, especially

presumptions of utility-maximizing humans and self-regulating markets

inexorably moving towards equilibrium. Many of the fundamentals of

8. Rosanne Currarino, ‘‘Toward a History of Cultural Economy,’’ Journal of

the Civil War Era 2 (Dec. 2012), 564–85; James W. Cook, ‘‘The Kids Are Alright:

On the ‘Turning’ of Cultural History,’’ American Historical Review 117 (June

2012), 746–71; Hyman as quoted in New York Times, Apr. 7, 2013. On cultural

history as a methodology for the economic past, start with the Journal of Cultural

Economy, especially its ‘‘Fictions of Finance’’ special issue, 6 (2013). See also Per

H. Hansen, ‘‘Business History: A Cultural and Narrative Approach,’’ Business

History Review 86 (Winter 2012), 693–717; and two canonical articles: Timothy

Mitchell, ‘‘Fixing the Economy,’’ Cultural Studies 12 (Jan. 1998), 82–101; and

Susan Buck-Morss, ‘‘Envisioning Capital: Political Economy on Display,’’ Critical

Inquiry 21 (Winter 1995), 434–67.

................. 18599$

$CH5

07-22-14 10:26:49

PS

PAGE 446

Rockman, HISTORY OF CAPITALISM

•

447

Marxism appear equally teleological, especially a stadial theory of history

that predetermines capitalism’s rise and fall. To be sure, a focus on ‘‘the

commodity’’ and the presumption of a relationship between market,

state, and society betray the field’s debt to Marx, but recent scholarship

has shied away from Marxist terminology; half-jokingly, one might call

the field Marxish since its commitment to that tradition often begins and

ends with the project of demystifying capitalism. At the most basic level,

the field’s intervention is to de-naturalize capitalism, to provide the history of a system that the dominant culture depicts as timeless and irresistible, even in the midst of crisis. Whether they take their cues from David

Harvey, Cedric J. Robinson, or scholars writing under the standard of

subaltern studies, from the photography of Allan Sekula, or from a spell

of post-collegiate employment in management consulting, historians of

capitalism refuse to give ‘‘markets’’ a trans-historical agency. ‘‘The market’’ is a euphemism for actual economic actors (people) and institutions

(law and culture) that shape how economic power is exerted and experienced. Indeed, state power is never far from the surface, with attention

particularly focused on the role of law in setting the rules under which

economic activity takes place; for that reason, history of capitalism and

political economy often appear as synonymous in calls-for-papers and

job listings.

The history of capitalism might be thought of as comparable to Science Studies (or STS), an enterprise that similarly seeks to de-naturalize

processes that appear inevitable under the heading of ‘‘progress.’’ Both

undertakings interrogate their very subjects—science, capitalism—as contested terrain on which claims to authority and social power are made

and exercised. Presuming nothing to be inevitable, historians of capitalism and STS scholars embed what they study in a matrix of social relations, cultural practices, and institutional arrangements operating under

specific, yet always contingent, historical circumstances. The recent

financial crisis promoted cross-fertilization between the fields, as scholars

in the sociology, philosophy, and history of science like Donald MacKenzie and Philip Mirowski have interrogated economics, capitalism’s

legitimating discourse, as a form of knowledge production complicit in

creating the phenomena it purports to describe.9

9. Donald MacKenzie, An Engine, Not a Camera: How Financial Models Shape

Markets (Cambridge, MA, 2006); MacKenzie, Material Markets: How Economic

Agents Are Constructed (New York, 2009); MacKenzie, Fabian Muniesa, and Lucia

Siu, eds., Do Economists Shape Markets? On the Performativity of Economics

................. 18599$

$CH5

07-22-14 10:26:49

PS

PAGE 447

448

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

Akin to historians of science who consider patronage, laboratory

space, and the prevailing political climate as essential to new discoveries

in chemistry or physics, historians of capitalism have also been drawn to

questions of infrastructure—less in the literal sense of the roads and wires

facilitating commerce and more in the sense of the submerged architecture—material, legal, and ideological—that makes a highway system or

telecommunication network plausible in the first place. Like the popular

David Macaulay books that rip the skin off a skyscraper or the walls

off a castle, the current scholarship presumes that behind something as

‘‘simple’’ as a dollar bill or a phone bill there’s an entire universe waiting

to be revealed. With an eye toward technology in the broadest sense of

the word, the field’s governing questions are more likely ‘‘How does it

work?’’ than ‘‘What does it mean?’’

Other commentators might stress a different set of scholarly moves at

the heart of the new history of capitalism. It is certainly in dialogue with

efforts to revitalize business history and labor history, projects clearly

articulated by the editors of leading journals in both fields. Walter A.

Friedman and Geoffrey Jones re-launched Business History Review in

2010 with a call for ambitious, multidisciplinary work in dialogue with

interlocutors other than the ghost of Alfred Chandler. On the pages of

Labor: Studies in Working-Class History of the Americas, Leon Fink connected the robustness of the field to a newfound willingness to engage

‘‘the surrounding political economy of state and business enterprise.’’ It

will not suffice to pin workers’ struggles on the abstraction of capital-C

Capital, nor on a set of caricatured plutocrats resembling Mr. Burns from

The Simpsons; the best work in the field understands factory owners,

shop-floor supervisors, and anti-labor politicians as multifaceted actors

operating from complex motives.10

(Princeton, NJ, 2007); Philip Mirowski, Never Let a Serious Crisis Go to Waste:

How Neoliberalism Survived the Financial Meltdown (New York, 2013); Mirowski,

More Heat than Light: Economics as Social Physics, Physics as Nature’s Economics

(New York, 1991). See also Mary S. Morgan, The World in the Model: How Economists Work and Think (New York, 2012); Trevor Pinch and Richard Swedberg,

eds., Living in a Material World: Economic Sociology Meets Science and Technology

Studies (Cambridge, MA, 2008); Margaret Schabas, The Natural Origins of Economics (Chicago, 2005).

10. Walter A. Friedman and Geoffrey Jones, ‘‘Business History: Time for

Debate,’’ Business History Review 85 (Spring 2011), 1–8. For a similar exhortation, see the ‘‘Forum on Method and Concept in Business History,’’ Enterprise &

Society 14 (Sept. 2013), 435–510, especially Christine Meisner Rosen, ‘‘What Is

................. 18599$

$CH5

07-22-14 10:26:50

PS

PAGE 448

Rockman, HISTORY OF CAPITALISM

•

449

The history of capitalism is also clearly in conversation with the New

Institutional Economics. Both stress the socially constructed constraints

that organize production, distribution, and consumption; but while

economists like Paul A. David or Douglass C. North would credit formal

and informal institutions with reducing transactional uncertainty, historians of capitalism would implicate law and culture in the unequal prospects and liabilities that disparate actors carry into the marketplace.11

Finally, capitalism’s history is an urgent concern for some legal scholars and political scientists, especially those working under the auspices

of International Political Economy (IPE). Disputing economists’ claims

that markets summon money into being as an arbitrary marker of value

to facilitate exchange, scholars like Christine Desan argue that currency

is a product of public governance and an expression of political authority

that shapes what is understood as ‘‘the market’’ in a given society and

how it functions.12

A decade ago, readers of the Journal of the Early Republic previewed

some features of the history of capitalism in a special issue entitled,

‘‘Whither the Early Republic?’’ There, James L. Huston anticipated that

‘‘governance and attention to the actual functioning of the marketplace’’

would increasingly organize scholarship under the capacious label of

‘‘political economy.’’13

Business History?’’ 475–85. For labor history, see Leon Fink, ‘‘The Great Escape:

How a Field Survived Hard Times,’’ Labor: Studies in Working-Class History of

the Americas 8 (Spring 2011), 109–15 (quote on 112).

11. Douglass C. North, ‘‘Institutions,’’ Journal of Economic Perspectives 5

(Winter 1991), 97–112; Paul A. David, ‘‘Why Are Institutions the ‘Carriers of

History’?: Path Dependence and the Evolution of Conventions, Organizations,

and Institutions,’’ Structural Change and Economic Dynamics 5 (1994), 205–20.

12. Christine Desan, Making Money: Coin, Currency, and the Coming of Capitalism (New York, forthcoming); Desan, ‘‘The Market as a Matter of Money:

Denaturalizing Economic Currency in American Constitutional History,’’ Law

and Social Inquiry 30 (Winter 2005), 1–60; Desan and many others are featured

in ‘‘Money Matters: The Law, Economics, and Politics of Currency,’’ special issue

of Theoretical Inquiries in Law 11 (Jan. 2010). Historically oriented works in

International Political Economy include Barry Eichengreen, Globalizing Capital:

A History of the International Monetary System (Princeton, NJ, 2008); Mark Blyth,

Great Transformations: Economic Ideas and Institutional Change in the Twentieth

Century (New York, 2002).

13. James L. Huston, ‘‘Economic Landscapes Yet to be Discovered: The Early

Republic and Historians’ Unsubtle Adoption of Political Economy,’’ Journal of

the Early Republic 24 (Summer 2004), 219–31 (quote on 221). For an excellent

................. 18599$

$CH5

07-22-14 10:26:50

PS

PAGE 449

450

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

In the same volume, David Waldstreicher, Amy Dru Stanley,

Stephanie Smallwood, and Walter Johnson planted slavery and its attendant ideology of white supremacy squarely at the heart of early republic

capitalism. But more importantly, their essays developed one of the

watchwords of the new history of capitalism: commodification. As Smallwood explained, ‘‘We know a great deal about commodities and their

fetishization, but commodification—the process by which things are made

into commodities—remains less rigorously interrogated.’’ Accordingly,

the history of capitalism must dismantle the black box that obscures the

substantial work involved in transforming aspects of the material world

into exchangeable units. Very quickly, commodification directs attention

to the social production of knowledge. Standards for measuring, grading,

and pricing, for example, can never be presupposed, but emerge in contests over authority and expertise, whether regarding the legitimacy of

any quantitative metric or the legitimacy of the technology deployed in

rendering it or representing it. At bottom, commodification is a discursive process in which language and the means of its transmission—think

of an early modern prices current, the legalistic formality of a contract,

or a written IOU from the government—do the epistemological work of

creating goods that can be bought, sold, and consumed. These insights

inform much of the new scholarship and help explain the particular

interest in the account book as a bedrock technology of capitalism and

in money as a semiotic system.14

testament to political economy, see Richard R. John, guest editor, ‘‘Ruling Passions: Political Economy in Nineteenth–Century America,’’ Journal of Policy

History 18, no. 1 (2006), 1–20. See also Nancy Beadie, Education and the Creation of Capital in the Early American Republic (New York, 2010); Lindsay

Schakenbach, ‘‘From Discontented Bostonians to Patriotic Industrialists: The

Boston Associates and the Transcontinental Treaty, 1790–1825,’’ New England

Quarterly 84 (Sept. 2011), 377–401; Gautham Rao, ‘‘The Creation of the American State: Customhouses, Law, and Commerce in the Age of Revolution,’’ PhD

diss., University of Chicago, 2008; Ariel Ron, ‘‘Developing the Country: ‘Scientific Agriculture’ and the Roots of the Republican Party,’’ PhD diss., University of

California–Berkeley, 2012; David H. Schley, ‘‘Making the Capitalist City: The

B&O Railroad and Urban Space in Baltimore, 1827–1877,’’ PhD diss., Johns

Hopkins University, 2013; Stephen Chambers, ‘‘The American State of Cuba:

The Business of Cuba and U.S. Foreign Policy, 1797–1825,’’ PhD diss., Brown

University, 2013.

14. David Waldstreicher, ‘‘The Vexed Story of Human Commodification Told

By Benjamin Franklin and Venture Smith,’’ Journal of the Early Republic 24

................. 18599$

$CH5

07-22-14 10:26:51

PS

PAGE 450

Rockman, HISTORY OF CAPITALISM

•

451

Standing alongside commodification in the scholarship is another

processual noun: financialization. By recovering the vast amount of cultural, legal, and technological work involved in making securities markets, scholars have rethought the histories of investment, savings, and

risk. Although the term financialization is often associated with the dominance of the ‘‘financial services industry’’ in the late twentieth century,

historians see a transformational moment in England’s early modern

‘‘Financial Revolution’’ when sovereign debt proliferated and personal

and commercial credit migrated from ledger books into circulating

financial instruments that could be assigned, exchanged, repackaged into

investment opportunities for third parties, and ultimately disassociated

from such material referents as a bushel of grain or plot of land; one

scholar has posited ‘‘credit fetishism’’ as a useful label for this process of

abstraction. The allure of future revenue streams predicated on past acts

of money-lending required new temporal horizons, a new mathematics

for calculating depreciation and probability, and new understandings of

mortality mediated through insurance policies and trusts. The chains

of credit between large investment houses, state-chartered banks, and

(Summer 2004), 268–78; Amy Dru Stanley, ‘‘Wages, Sin, and Slavery: Some

Thoughts on Free Will and Commodity Relations,’’ ibid., 279–88; Stephanie

Smallwood, ‘‘Commodified Freedom: Interrogating the Limits of Anti–Slavery

Ideology in the Early Republic,’’ ibid., 289–98 (quote on 291); Walter Johnson,

‘‘The Pedestal and the Veil: Rethinking the Capitalism/Slavery Question,’’ ibid.,

299–308. The word commoditization also appears in the literature, as in Igor

Kopytoff, ‘‘The Cultural Biography of Things: Commoditization as Process,’’

in The Social Life of Things: Commodities in Cultural Perspective, ed. Arjun

Appadurai (New York, 1986), 64–94. On account books, ledgers, and the broader

turn to quantification, see Anthony G. Hopwood and Peter Miller, eds., Accounting as Social and Institutional Practice (New York, 1994); Peter Miller, ‘‘Calculating Economic Life,’’ Journal of Cultural Economy 1 (2008), 51–64; Stephanie

Smallwood, Saltwater Slavery: A Middle Passage from Africa to American Diaspora (Cambridge, MA, 2008), 33–64; Caitlin Rosenthal, ‘‘Storybook-Keepers:

Narratives and Numbers in Nineteenth-Century America,’’ Common–place: The

Interactive Journal of Early American Life 12 (Apr. 2012), http://common-place.org/vol-12/no-03/rosenthal/; Jacob Soll, The Reckoning: Financial Accountability and the Rise and Fall of Nations (New York, 2014). On money, see Marieke

de Goede, Virtue, Fortune, and Faith: A Genealogy of Finance (Minneapolis, MN,

2005), xxv; Deborah Valenze, The Social Life of Money in the English Past (New

York, 2006); Mary Poovey, Genres of the Credit Economy: Mediating Value in

Eighteenth- and Nineteenth-Century Britain (Chicago, 2008).

................. 18599$

$CH5

07-22-14 10:26:52

PS

PAGE 451

452

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

entrepreneurial borrowers rendered property ownership into a social

fiction, one whose flimsiness was all too often revealed whenever the

chain broke. This was especially vivid in the financing of slavery, to

which scholars attribute such macroeconomic crises as the South Sea

Bubble and the Panic of 1837, as well as the personal tragedies of countless enslaved families left at the mercy of the auctioneer’s gavel whenever

a planter went bankrupt. By following the money—whether to a farmer’s

mortgage owned by the Massachusetts Hospital Life Insurance Company

or to an annuity generating income for a London widow based on a

minute fractional share of a West Indian plantation—historians of capitalism resist ‘‘investment’’ as a natural economic concept floating above

social relations, cultural production, and political economy. The concept

of financialization, like that of commodification, attests to the field’s abiding interest in de-naturalizing the entire range of goods and services that

might otherwise be presupposed as inherent to ‘‘the economy.’’ As processes suggesting the agency of human beings rather than the autonomous

operations of market forces, both terms impel scholars to excavate the

relations of power that underlay what can be bought and sold (and by

whom and on what terms) at a given moment in history.15

It would be hard to find a better introduction to the history of capitalism than Capitalism Takes Command, edited by Michael Zakim and

15. For the early modern period, see Carl Wennerlind, Casualties of Credit:

The English Financial Revolution, 1620–1720 (Cambridge MA, 2011), 230 (for

credit fetishism); William Deringer, ‘‘Calculated Values: The Politics and Epistemology of Economic Numbers in Britain, 1688–1738,’’ PhD diss., Princeton University, 2012; Eli Cook, ‘‘The Pricing of Everyday Life,’’ Raritan 32 (Winter

2013), 109–21. For the nineteenth century, see Tamara Plakins Thornton, ‘‘ ‘A

Great Machine’ or a ‘Beast of Prey’: A Boston Corporation and Its Rural Debtors

in an Age of Capitalist Transformation,’’ Journal of the Early Republic 27 (Winter

2007), 567–97; Jessica M. Lepler, The Many Panics of 1837: People, Politics, and

the Creation of a Transatlantic Financial Crisis (New York, 2013); Nicholas

Draper, The Price of Emancipation: Slave-Ownership, Compensation, and British

Society at the End of Slavery (New York, 2010). For the twentieth century, the

term is often associated with Greta R. Krippner, ‘‘The Financialization of the

American Economy,’’ Socio-Economic Review 3 (May 2005), 173–208; Louis

Hyman, Debtor Nation: The History of America in Red Ink (Princeton, NJ, 2011);

Gerald Davis, Managed by the Markets: How Finance Re-Shaped America (New

York, 2009). More generally, Aaron Carico and Dara Orenstein, ‘‘The Fictions of

Finance,’’ Radical History Review 118 (Winter 2014), 3–13; David Graeber, Debt:

The First 5,000 Years (New York, 2011).

................. 18599$

$CH5

07-22-14 10:26:53

PS

PAGE 452

Rockman, HISTORY OF CAPITALISM

•

453

Gary J. Kornblith. The volume reflects the field’s multigenerational character, situating foundational scholars of early republic social history

alongside the mid-career standard-bearers of cultural history, intellectual

history, and political economy. An explicit homage to Siegfried Giedion’s Mechanization Takes Command and with gestures toward Karl

Polanyi’s The Great Transformation, the book considers ‘‘the long nineteenth century,’’ attentive to the massive disjunctures of the Civil War

and Reconstruction but not bound by them or indeed, by any other

major milestones in American political history. These essays are consistent with a number of general trends in the field: resistance to a fixed

definition of capitalism, relative indifference to the ‘‘worlds that were

lost’’ perspectives of an earlier ‘‘transition’’ literature, attentiveness to

slavery, ambitious blending of methods and subfields, and a preoccupation with unmasking the hidden operations of commodification and

financialization. The editors position the volume as ‘‘a collective attempt

to ‘bring the economy back’ into American social and cultural history’’

(7), but the book’s greater effect is showcasing the value of social and

cultural history for understanding the economic past, especially in

‘‘arguing that there was nothing natural, preordained, or predictable’’

(7) about capitalism’s American incarnation. By title, Capitalism Takes

Command indicates that something specific happened over the course of

the nineteenth century, elegantly formulated as ‘‘capital’s transformation

into an ‘ism’ ’’ (1). The logic and law of business spilled over from the

realm of economic exchange to organize society and its politics, everyday

practices, and culturally dominant understandings of self. To explain

how, the editors suggest a new set of questions to guide historical

inquiry: not ‘‘Who built America?’’ but rather ‘‘ ‘Who sold America?’

or perhaps more to the point, ‘Who financed those sales?’ ’’ (12). The

subsequent essays show the fruitfulness of such an approach, but also

expose the vulnerabilities of a volume lacking any contribution invested

in that once-classic hallmark of the history of capitalism: proletarianization.

To be sure, steering clear of factory-based wage labor can also be seen

as one of the book’s most productive gambits. An earlier scholarship

had timed capitalism’s arrival to the moment when industry supplanted

agriculture as the centerpiece of the economy. Capitalism presumptively

came late to the United States as frontier farms lured would-be yeoman

families westward; the land served as an impediment to, if not a bulwark

................. 18599$

$CH5

07-22-14 10:26:53

PS

PAGE 453

454

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

against, capitalism. The essays in Capitalism Take Command argue otherwise, making western lands—so readily rendered into securities—

capitalism’s strength rather than its weakness. This is a move associated

with the New Western History of the 1980s and 1990s, an influence on

the history of capitalism too rarely acknowledged. Christopher Clark

makes the expropriation of Indian lands foundational to American capitalism, as conquered territories became private property that sustained a

credit economy in purchase mortgages for farms and advances on the

crops that would soon follow. Clark does not use the fashionable ‘‘settler

colonialism’’ to collapse imperialism, capitalism, and white supremacy

into one totalizing force of dispossession; instead he considers an American version of ‘‘primitive accumulation’’ (36) in which common white

families gained access to private property at the expense of Native people

but soon found that land ownership left them more, not less, vulnerable

to market forces they could not control. Indeed, these settler families

organized politically against the more visible beneficiaries of their toil:

eastern financiers, commodity speculators, and railroad barons. Clark

finds multiple nineteenth-century capitalisms, including an admittedly

ambivalent agrarian one that continued to rely upon family labor and

local networks of exchange. He conveys his own ambivalence about

placing farming families under the rubric of capitalism, even as he

foregrounds the agricultural sector as the driver of nineteenth-century

economic development.

American farms did not merely produce unrivaled amounts of grain

and cotton: They also generated a host of securities that launched the

American financial services industry. Elizabeth Blackmar begins this

story with the commonplace observation that ‘‘when someone died,

property changed hands’’ (93). The patriarchal system of inheritance

that had long disciplined sons during a man’s life and sustained his

widow upon his death gave way to a new kind of estate administration,

one relying on the intermediation of large corporations to provision survivors and future generations with revenue from pooled investments.

Probate courts encouraged estate executors to liquidate real and chattel

property and to invest the resulting funds; put differently, sell the farm,

park the money in a trust company, and then collect one’s patrimony in

a regularized share of the trust’s returns from loaning money at interest

to scores of other families trying to buy a farm. Enterprises like New

York Life Insurance and Trust Company (chartered 1830) endeavored

to protect and grow family wealth, but controversies arose over their turn

................. 18599$

$CH5

07-22-14 10:26:54

PS

PAGE 454

Rockman, HISTORY OF CAPITALISM

•

455

away from mortgages toward more speculative investments like railroad

stocks: Was this a dereliction of fiduciary responsibility? Or was the

greater dereliction in failing to seize upon lucrative investment opportunities? Although courts and legislatures in the 1850s and 1860s

steered investment back toward land, new real-estate trusts funneled family wealth into late-nineteenth-century urban development. Downtown

office buildings and other commercial properties now generated a stream

of rents for the beneficiaries of the deceased, but also for the trusts’

own directors, managers, and in some cases, shareholders. Longstanding

practices designed to protect widows and orphans ultimately blurred

‘‘family property and corporate property’’ (117), as patriarchal security

and investment securities became irrevocably intertwined.

Jonathan Levy adds a further wrinkle to this story of ‘‘financial systemization,’’ namely the life insurance policies that purported to protect the

‘‘landed independence’’ of farming families. To establish a farm on the

Great Plains in the 1870s and 1880s required substantial capital, and so

settlers took loans to meet the high start-up costs. But because a mortgaged farm was not a secure asset to bequeath to one’s wife and children,

many men availed themselves of life insurance to provide for dependents

in the case of death or injury. This was more than a ‘‘hedge,’’ but a

reconceptualization of value in the era of liberal self-ownership: ‘‘a mortgaged farmer’s human capital was his most valuable asset’’ (53–54), not

the land on which he practiced subsistence agriculture. A man might

have difficulty owning a farm, but he owned his own life and could sell

it as ‘‘risk’’ to an insurance firm. Here’s where it gets interesting: Where

did those insurance companies park all the premiums that flowed eastward from western farmers? In debenture bonds that clustered western

farm mortgages into a single investment product backed by real property

(the farms) and insulated against the default of any one particular farmer.

‘‘As the mortgage and insurance markets systematized and intersected,’’

explains Levy, ‘‘western farmers became both agents and objects of a

newly abstract power’’ (41). The New England Mortgage Security Company and other firms responsible for these new financial instruments

held western farmers to a rigid payment schedule, one that generated

substantial stress for working families and a resigned sense that farming

was no different from any other business in its urgent focus on generating

income to meet bills. Levy does not glorify the independence of the

antebellum yeomanry, but over the subsequent decades ‘‘[l]anded wealth

................. 18599$

$CH5

07-22-14 10:26:54

PS

PAGE 455

456

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

became a dematerialized abstraction’’ and western farmers ‘‘became cogs

within an increasingly complex financial system’’ (41).

Convoluted networks of finance had a longer history in the slaveholding South. In 1828, Baring Brothers began marketing the bonds of a

state-chartered Louisiana bank to European investors. Thanks to favorable legislation, the bank’s bonds were guaranteed by Louisiana’s taxpayers. Using the money it raised abroad through these bond sales, the

Louisiana bank made loans to local slaveholders, who used the very

slaves they were purchasing with the loans as collateral. In this way,

Louisiana’s slaves, coerced into producing cotton under a regime of

intensifying violence and readily converted into cash on the auction

block, sustained a trans-Atlantic chain of credit. This process was

repeated numerous times in neighboring states and involved a number

of prominent European banking houses. Foreign capital—not to mention,

foreign demand for cotton—helped launch an economic boom, but at

immeasurable human costs to enslaved men and women, who endured a

second middle passage to the southwestern frontier, then an intensified

labor regime in the cotton fields, and finally the forced sales accompanying the bust that arrived in 1837. ‘‘The financialization of American slavery,’’ argues Edward E. Baptist, ‘‘. . . turned people into numbers, the

values of their bodies and labor into paper, chopped them, recombined

them by legislative fiat, carried them in suitcases across the ocean, and

sold them to people on other continents—some of whom undoubtedly

believed that they believed in emancipation’’ (90–91). In an essay explicitly engaging the 2008 financial crisis, Baptist recreates an earlier

moment when the ‘‘collusion of state and financial elites’’ (72–73) lowered regulatory checks on the securities market and normalized rampant

speculation. Baptist places slavery at the center of the Panic of 1837, and

reminds readers that the fictions of finance had real consequences of

unimaginable horror in the lives of American slaves. Connecting the

social history of the plantation to trans-Atlantic high finance, Baptist’s

polemical and unsparing essay is the must-read of the volume.

The volume’s other essay on slavery is Amy Dru Stanley’s exploration

of ‘‘slave breeding’’ and ‘‘free love,’’ two slurs in antebellum political

speech that posited North and South as fundamentally different even as

the national economy of cotton bound them closer together. Sectional

partisans used these loaded terms to articulate the boundaries of the

................. 18599$

$CH5

07-22-14 10:26:54

PS

PAGE 456

Rockman, HISTORY OF CAPITALISM

•

457

market, resisting its intrusion on sacred intimate relations. Forced reproduction was a recurring theme in abolitionist exposes of slavery’s immorality, contributing to emerging northern understandings of freedom as

predicated on individual choice and self-ownership. Love featured

prominently in this discourse, especially once slaveholders seized on it

to construct their discourse of paternalism and an accompanying critique

of northern society as unnatural in its privileging of consent over obligation. ‘‘On both sides of the Mason-Dixon line, therefore, love became a

potent measure of the opposition between slavery and freedom,’’

observes Stanley. ‘‘While proslavery doctrine exalted bondage as love,

abolitionism validated the right of self-owning persons to love freely’’

(136). Likewise, enslaved men and women constructed their own

notions of freedom around love and the ability to choose marriage partners for themselves. Although the essay disavows the empirical question

of slave breeding as a plantation practice, it conclusively invests slaveholders in slaves’ reproduction. ‘‘Especially in disputes over inheritance,

contract, and debt, masters and would-be masters told of aspiring to

grow slaves, not just crops’’ (137), so long as the word ‘‘breeding’’ was

never uttered aloud. Such disassociation did crucial work in creating

what might be called the South’s capitalist culture. Abolitionists’ fixation

on breeding set the terms of the North’s engagement with the market,

making it possible to define freedom as a matter of the heart and not

merely the pocketbook. Yet this too was self-delusion, as northerners

lacked the capacity to see their commercial economy (especially their

textile mills) as remotely connected to the South’s growing population of

slaves.

The cultural history of capitalism revels in such ironies, with Tamara

Plakins Thornton’s essay on the aesthetics of commercial infrastructure

a case in point. Thornton follows American tourists to the docks of

London and Liverpool where they encountered massive warehousing

complexes of such scale that only the language of the sublime could

describe them. This was a peculiar aesthetic response, for the sublime

belonged to the natural world and conveyed a kind of pleasurable terror

appropriate to witnessing an erupting volcano from a safe distance. But

a shipping depot? As ‘‘spectacles of rationalized economic activity’’

(172), the British docks exuded a transcendent power to summon and

organize the wealth of the world on a scale beyond the comprehension

of any single individual. ‘‘The docks stood as an aesthetic marker of

................. 18599$

$CH5

07-22-14 10:26:55

PS

PAGE 457

458

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

emerging capitalist values: security, regularity, precision, impersonality’’

(196), and the kinds of Americans who might travel there and record

their observations were precisely those who might find pleasure in the

view. In other words, Thornton locates one of capitalism’s legitimating

discourses, wherein ‘‘[s]ailors, laborers, pilferers, and smugglers, storms

and tides, conflict and risk—all fade before the sublime vision of a perfect

mechanism’’ (198). These erasures situate capitalism outside the realm

of politics, using the association with nature’s vast power to suggest that

resistance is futile. Although Thornton does not pursue the contemporary analogy, her essay could very well be about twenty-first-century

container ships: massive, seemingly unmanned, storing vast outpourings

of human labor in bland steel boxes, organizing global supply chains

with a relentless efficiency, and also strangely beautiful.16

If capitalism found legitimacy in a visual aesthetic, those critiquing it

took inspiration from a literary one: melodrama. Jeffrey Sklansky, who

recently published one of the field’s most useful historiographical essays

in Modern Intellectual History, here reconstructs the political world of

William Leggett, the 1830s New York City democrat and fierce opponent

of state-chartered banks. Before becoming an editor and essayist, Leggett

had begun his career as an actor, which provided him ‘‘a repertoire of

settings, characters, plots, themes, and standards that enabled him to

find transcendent significance in the politics of corporations and currency’’ (201). Melodrama rose to popularity by virtue of its moral certainties, and from a young age Leggett saw the world in clear terms of

right versus wrong, good versus evil. Entering journalism in 1829, Leggett became a spokesman for New York’s workingmen and received (but

declined) the Locofoco nomination for mayor in 1836. The transformation of the urban economy proved incredibly disruptive for the city’s

artisans, but what alarmed Leggett was not the wage system, but rather

‘‘the rise of paper money and the marble-columned banks from whence

it flowed’’ (200). For Leggett, market relations could serve as a force of

16. The Forgotten Space, directed by Allan Sekula and Noël Burch (2010;

Amsterdam), DVD; Rose George, Ninety Percent of Everything: Inside Shipping,

the Invisible Industry that Puts Clothes on Your Back, Gas in Your Car, and Food

on Your Plate (New York, 2013). The parallels between nineteenth-century global

commerce and the current Wal-Mart economy are explored in Nelson Lichtenstein, ‘‘The Return of Merchant Capitalism,’’ International Labor and

Working-Class History 81 (Spring 2012), 8–27.

................. 18599$

$CH5

07-22-14 10:26:56

PS

PAGE 458

Rockman, HISTORY OF CAPITALISM

•

459

liberation, unless corrupted by private corporations wielding state charters and issuing currency that lacked a basis in reality. Melodrama’s preference for transparency lent itself perfectly to attacking paper money as

a kind of misrepresentation, while also dividing the world into honest

laborers and the corrupt bankers who sought to defraud them. Leggett

and other 1830s commentators situated ‘‘the money question’’ in popular politics, not some esoteric realm of financial expertise. Even before

the dire conditions of the Panic of 1837, men like Leggett attributed

economic instability to political misrule, thereby summoning a reassuring

belief ‘‘that proper representation could reconcile older republican principles with new market practices, agrarian democracy with industrial

capitalism’’ (220). Melodrama may have relied on stark dichotomies, but

Sklansky reminds historians that Jacksonian-era political thought could

not be reduced to simple pro-market and anti-market positions.17

The prototypical figure of capitalism’s ambiguous reception was the

urban clerk, a striver with questionable prospects who Michael Zakim

calls ‘‘a model citizen of market society’’ (224). In a captivating essay,

Zakim places the clerk at the center of an organizational revolution predicated on paperwork. Capitalism’s paper technologies of invoices, inventories, and permits ‘‘turned the office into arguably the most important

production site in the industrializing economy’’ (229), for it was here (in

a Foucaultian turn) that clerks invented the ‘‘the market’’ through their

means of administering it. Zakim is particularly interested in the ‘‘production of capitalist knowledge’’ and the material forms of its organization and dissemination, topics that have brought the history of capitalism

into conversation with new scholarship in history of the book and science studies. A host of ‘‘commercial colleges’’ had emerged by the 1860s

to teach young men to handle a ledger, and this ‘‘capitalist pedagogy’’

made penmanship into both an ‘‘industrial technology’’ and ‘‘a highly

mobile form of property readily purchased on the open market at competitive prices’’ (242). A quick and clear hand was touted as a clerk’s

best prospect for upward mobility, but in the end, the clerk would never

be more than a hand, a replaceable worker ‘‘mass producing for an economy dependent on an exploding amount of information’’ (247). Still, his

particular form of work was indispensible not merely to the rise of the

bureaucratic office associated with Max Weber’s capitalist modernity nor

17. See note 1, above.

................. 18599$

$CH5

07-22-14 10:26:56

PS

PAGE 459

460

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

to our present-day fascination with the ‘‘knowledge economy,’’ but to ‘‘a

redefinition of industry to mean the making of profits rather than the

making of things’’ (224). For Zakim, capitalism did not cause, but was

the product of a massive epistemological shift, albeit one relying less

upon treatises of political economy and more upon the 1840s equivalent

of Excel for Dummies.18

The administrative restructuring of firms into multidivisional units to

seize upon the proliferation of commercial information characterized

Gilded Age capitalism, but as Sean Patrick Adams argues, the transformational moment was a generation earlier during the Civil War era.

Northern states issued corporate charters at an unprecedented pace during the war, and while general incorporation laws had become common

over the previous decades, new provisions allowed firms greater autonomy to raise capital and particularly to operate in other states. For example, Massachusetts chartered seventy mining corporations in 1863 and

1864 to seek coal, copper, and gold in faraway Pennsylvania, Michigan,

and California. States offered corporations greater leeway in the name of

wartime exigencies, but soon came to depend on corporate taxes to meet

wartime expenses. New taxes on corporate income (and not merely fixed

property) comprised a growing percentage of state revenue, thus tying

the fiscal health of states like Massachusetts and Pennsylvania to the wellbeing of their corporations. No firms were more important to this political economy than the railroads, which prospered during the war under

18. Miles Ogborn, Indian Ink: Script and Print in the Making of the English

East India Company (Chicago, 2007); Adrian Johns, ‘‘Ink,’’ in Materials and

Expertise in Early Modern Europe: Between Market and Laboratory, ed. Ursula

Klein and E. C. Spary (Chicago, 2009), 101–24; Jacob Soll, ‘‘From Note-Taking

to Data Banks: Personal and Institutional Information Management in Early Modern Europe,’’ Intellectual History Review 20, no. 3 (2010), 355–75; Josh Lauer,

‘‘From Rumor to Written Record: Credit Reporting and the Invention of Financial

Identity in Nineteenth-Century America,’’ Technology & Culture 49 (Apr. 2008),

301–24; John J. McCusker, ‘‘The Demise of Distance: The Business Press and

the Origins of the Information Revolution in the Early Modern Atlantic World,’’

American Historical Review 110 (Apr. 2005), 295–321; Ben Kafka, ‘‘Paperwork:

The State of the Discipline,’’ Book History 12 (2009), 340–53; Kafka, The Demon

of Writing: Powers and Failures of Paperwork (New York, 2012); Markus Krajewski, Paper Machines: About Cards and Catalogs, 1548–1929 (Cambridge, MA,

2011); Christoph Hoffman and Barbara Wittman, ‘‘Introduction: Knowledge in

................. 18599$

$CH5

07-22-14 10:26:57

PS

PAGE 460

Rockman, HISTORY OF CAPITALISM

•

461

the combined support of government contracts and reduced regulation.

The triumph of corporate interests was, in Adams’s estimation, ‘‘a domination born of wartime circumstances’’ (276). This future was augured

in West Virginia, a compelling place to see wartime policymakers create a

business-friendly regime from scratch. In its concessions to corporations,

West Virginia’s constitutional framers typified the broader northern

tendency ‘‘to construct an institutional framework that would attract

investment from across the nation, maintain strong ties with important

railroads, and abdicate significant regulatory prerogative in the interests

of keeping their states ‘capital friendly’ ’’ (274). The Civil War was hardly

bad for business (as economic historians had once argued), but ‘‘effected

an emancipation of an altogether different kind in the Northern states’’

(251).

There is one outlier in Capitalism Takes Command, an essay that

underscores the different sensibilities of traditional economic historians.

Robert E. Wright gives the corporation an earlier prominence in American capitalism by tracing the growing sums of money that antebellum

firms raised through the sale of securities. Here, high levels of investment

make sense because corporations make sense: They allow for economies

of scale, vertical integration, research and development, reduced production costs; and they channel capital to where it could do the most good.

‘‘Many Americans,’’ explains Wright, ‘‘. . . realized that corporations

were engines of economic growth and an arena where the upstart United

States led the world’’ (162). True, the 1830s witnessed the vilification of

the corporation in political discourse, but if enough people had truly

thought corporations evil, the quantity of money invested in them would

have gone down rather than up. Wright fashions an early republic ‘‘ownership society’’ in which American clamored for more corporations in

order to create more investment opportunities. ‘‘Ownership was

unequal—the rich could of course afford to own more shares and bigger

policies than the poor could—but it was open to all on equal terms’’

(161). Like the present-day high school janitor who ranks among the

‘‘investor class’’ by virtue of his municipal pension, the early republic

domestic servant whose employer deposited her weekly wages in a

the Making: Drawing and Writing as Research Techniques,’’ Science in Context

26 (June 2013), 203–13.

................. 18599$

$CH5

07-22-14 10:26:58

PS

PAGE 461

462

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

mutual savings bank (lest she spend them inappropriately) could already

take pleasure in her ‘‘indirect corporate stock and bond ownership’’

(161).19

The only losers that Wright can identify in this new world of finance

are investors themselves, who sometimes saw potential income from their

investments sapped by ‘‘agency costs’’ associated with inefficient corporate governance. Wright has no use for the cultural work necessary to

create a popular culture of investment, taking it instead as a human proclivity simply awaiting an available outlet. Panics and corporate malfeasance have no part in the story, for if widows losing their life savings

at the hands of corrupt bank directors mattered in some larger way, then

aggregate rates of investment would have fallen—and again, they didn’t.

Unique among contributors to the volume, Wright seeks neither to denaturalize capitalism, nor to unmask its relations of power.20

So indifferent is Wright to capitalism’s human costs as documented

over generations of social history that the reader becomes nostalgic for

social history’s master narrative of struggle and resistance. And that’s

when the reader confronts the relative absence of privation in the volume

as a whole. Except for the collateralized slaves of Baptist’s essay, capitalism seems to generate anxiety but not real hardship, a sense of resignation but not a politics of outrage. This is a capitalism born without blood

19. For a comparable example of the gulf between traditional economic history

and the considerations of power and culture that characterize the history of capitalism, see Ann M. Carlos and Frank D. Lewis, Commerce by a Frozen Sea: Native

Americans and the European Fur Trade (Philadelphia, 2010).

20. On the obstacles to making investment culturally legitimate and politically

viable, see Alex Preda, ‘‘The Rise of the Popular Investor: Financial Knowledge

and Investing in England and France, 1840–1880,’’ Sociological Quarterly 42

(Spring 2001), 205–32; Bryna Goodman, ‘‘Things Unheard of East or West:

Colonialism, Nationalism, and Cultural Contamination in Early Chinese

Exchanges,’’ in Twentieth–Century Colonialism and China: Localities, the Everyday and the World, ed. Bryna Goodman and David S. G. Goodman (New York,

2012), 57–77; Peter Knight, ‘‘Reading the Ticker Tape in the Late NineteenthCentury American Market,’’ Journal of Cultural Economy 6 (2013), 45–62; Julia

C. Ott, When Wall Street Met Main Street: The Quest for an Investors’ Democracy

(Cambridge MA, 2011); Robert E. Shalhope, The Baltimore Bank Riot: Political

Upheaval in Antebellum Maryland (Urbana, IL, 2009); Courtney Fullilove, ‘‘The

Price of Bread: The New York City Flour Riot and the Paradox of Capitalist Food

Systems,’’ Radical History Review 118 (Winter 2014), 15–41.

................. 18599$

$CH5

07-22-14 10:26:58

PS

PAGE 462

Rockman, HISTORY OF CAPITALISM

•

463

dripping from its gaping maw, a capitalism that floats above the messiness of class conflict. In a thoughtful afterword, Jean-Christophe Agnew

identifies the tradeoffs involved in building capitalism’s history on ‘‘the

ordinary material practices that habituated Americans to the new systemic rules of capitalism as a market forms of life, and that did so in way

of which most Americans at the time were only dimly and bemusedly

aware’’ (279). The sense of contingency at the heart of the history of

capitalism project can disappear from view if capitalism is effectively a

non-event. And without state violence, the anomie of factory labor, and

the hunger pains of grinding poverty, a capitalism built upon the imperceptible processes of commodification and financialization is a capitalism

that appears the product of inexorable and irresistible forces; in other

words, it becomes re-mystified, not de-mystified.21

One remedy, as Agnew notes, would be to introduce more individual

capitalists into the story, specific actors to combat the anonymity that

prevails in the volume. Recent work in the field has brought an anthropological eye to nineteenth-century elites, situating their financial strategies in a range of domestic arrangements, intellectual engagements, and

cultural blindspots. Works like Richard White’s Railroaded: The Transcontinentals and the Making of America are hardly flattering portraits of

capitalist heroes, but even the most prudent men of finance like Nathaniel Bowditch and Lewis Tappan led lives reflecting the central conflicts

of nineteenth-century America. Early republic scholars might be surprised to learn that Cornelius Vanderbilt’s career was far more interesting

in the first half of the nineteenth century than in the era of the Robber

Barons; born in 1794, the young Vanderbilt was the foremost pilot in

the tri-state area during the War of 1812 and by the 1840s had built

what still functions as the Northeast Corridor’s transportation network.

John Jacob Astor and the fur trade have received more popular than

scholarly attention, but following eastern capital westward to places like

Astoria would have the further advantage of engaging Native Americans

as participants in the history of capitalism.22

21. These criticisms are also articulated in Carico and Orenstein, ‘‘Fictions of

Finance.’’

22. Barbara M. Tucker and Kenneth H. Tucker, Jr., ‘‘The Limits of Homo

Economicus: An Appraisal of Early American Entrepreneurship,’’ Journal of the

Early Republic 24 (Summer 2004), 208–18; Andrew M. Schocket, ‘‘Thinking

about Elites in the Early Republic,’’ Journal of the Early Republic 25 (Winter

2005), 547–55; Thornton, ‘‘ ‘A Great Machine’ or a ‘Beast of Prey’ ’’; Lauer,

................. 18599$

$CH5

07-22-14 10:26:58

PS

PAGE 463

464

•

JOURNAL OF THE EARLY REPUBLIC (Fall 2014)

Another remedy, of course, is to pay more attention to labor, whether

in its workbench materiality, its trans-Pacific organization (an important

topic in the global history of unfree labor), or its unwaged performance

in the service of social reproduction. The concept of the Industrial Revolution has largely disappeared from the history of capitalism, but there

remains much to discover by grounding a history of innovation in shopfloor discoveries and contests over work processes and intellectual

property. As the history of energy regimes is now attracting scholarly

attention, historians might focus on the labor relations structuring the

extraction of petroleum, whale oil, camphene, coal, and guano. The

question of what capitalism did for (or, to) women is a longstanding

subject of inquiry, but scholars continue to find new insights from women’s participation in the formal and informal sectors of the urban economy. Indeed, working people’s strategies in the informal sector may

reveal a competing history of finance and speculation. Because the early

republic labor market was so functionally dependent on categories of

social difference, work provides the clearest vantage on capitalism’s

investments in patriarchy and white supremacy.23

‘‘From Rumor to Written Record’’; T. J. Stiles, The First Tycoon: The Epic Life

of Cornelius Vanderbilt (New York, 2009); James R. Fichter, So Great a Proffit:

How the East Indies Trade Transformed Anglo–American Capitalism (Cambridge,

MA, 2010); Rachel Tamar Van, ‘‘Free Trade and Family Values: Kinship Networks

and the Culture of Early American Capitalism,’’ PhD diss., Columbia University,

2011; Richard White, Railroaded: The Transcontinentals and the Making of Modern America (New York, 2011); Eric Jay Dolin, Fur, Fortune, and Empire: The

Epic History of the Fur Trade in America (New York, 2010); David Igler, The

Great Ocean: Pacific Worlds from Captain Cook to the Gold Rush (New York,

2013). On the larger relationship of Native Americans to the history of capitalism,

see Alexandra Harmon, Colleen O’Neill, and Paul C. Rosier, ‘‘Interwoven Economic Histories: American Indians in a Capitalist America,’’ Journal of American

History 98 (Dec. 2011), 698–722. See also Nancy Shoemaker, ‘‘Mr. Tashtego:

Native American Whalemen in Antebellum New England,’’ Journal of the Early

Republic 33 (Spring 2013), 109–32.

23. On workbench mentality, see David Jaffee, A New Nation of Goods: The

Material Culture of Early America (Philadelphia, 2010); Jeff Horn, Leonard N.

Rosenband, and Merritt Roe Smith, eds., Reconceptualizing the Industrial Revolution (Cambridge, MA, 2010), 17–18; Fisk, Working Knowledge. On energy