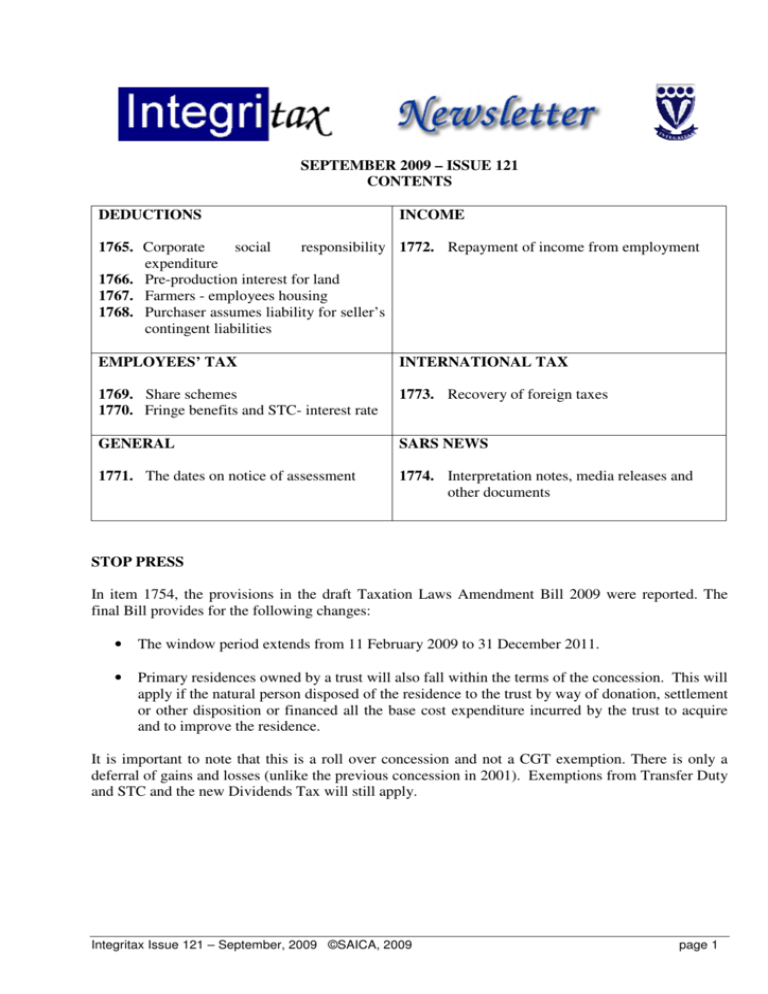

SEPTEMBER 2009 – ISSUE 121

CONTENTS

DEDUCTIONS

INCOME

1765. Corporate

social

responsibility 1772. Repayment of income from employment

expenditure

1766. Pre-production interest for land

1767. Farmers - employees housing

1768. Purchaser assumes liability for seller’s

contingent liabilities

EMPLOYEES’ TAX

INTERNATIONAL TAX

1769. Share schemes

1770. Fringe benefits and STC- interest rate

1773. Recovery of foreign taxes

GENERAL

SARS NEWS

1771. The dates on notice of assessment

1774. Interpretation notes, media releases and

other documents

STOP PRESS

In item 1754, the provisions in the draft Taxation Laws Amendment Bill 2009 were reported. The

final Bill provides for the following changes:

•

The window period extends from 11 February 2009 to 31 December 2011.

•

Primary residences owned by a trust will also fall within the terms of the concession. This will

apply if the natural person disposed of the residence to the trust by way of donation, settlement

or other disposition or financed all the base cost expenditure incurred by the trust to acquire

and to improve the residence.

It is important to note that this is a roll over concession and not a CGT exemption. There is only a

deferral of gains and losses (unlike the previous concession in 2001). Exemptions from Transfer Duty

and STC and the new Dividends Tax will still apply.

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 1

DEDUCTIONS

1765. Corporate social responsibility expenditure

For some years there has been doubt concerning the deductibility of corporate social responsibility

(CSR) payments by companies.

The decision to make such contributions may be driven by the need to meet the requirements of the

Black Economic Empowerment scorecard, in particular, the minimum requirements of the socioeconomic development category of the BEE Codes of Good Conduct that business undertakings

should expend not less than 1 % of their net profit after tax on CSR projects.

A binding class ruling was published by SARS on 12 May 2009, (BCR 002) which deals with the

deductibility of CSR expenditure to be incurred in order to meet these minimum requirements by a

particular group of taxpayers.

Application was made for the issue of a ruling to a group of companies to permit companies within

the group to make contributions to a scheme that will provide educational bursaries to needy

recipients in communities deserving of assistance. SARS was requested to issue a ruling that the

expenditure in question will be allowable as a deduction in terms of section 11(a) of the Income Tax

Act No 58 of 1962 and not prohibited in terms of section 23(g) (which prohibits the deduction to the

extent that the expenditure is not laid out for purposes of trade).

The ruling permits the particular class of taxpayers, comprising of a resident holding company and its

wholly-owned subsidiary companies, to claim the deduction in respect of the relevant CSR

expenditure incurred in the period from 8 August 2008 to 27 August 2013.

The ruling is only binding as between SARS and the relevant class of taxpayers to which it was

issued. Nevertheless it is an indication that SARS will regard expenditure on corporate social

responsibility programmes as tax deductible in appropriate circumstances.

PricewaterhouseCoopers

IT Act: s 11(a) s 23(g)

BEE Codes of Good Conduct

1766. Pre-production interest for land

In order to claim a deduction of expenditure in terms of the general deduction formula contained in

section 11(a) read with section 23(g) of the Income Tax Act No. 58 of 1962 (the Act), it is a

requirement that the expenditure be incurred for the purposes of the taxpayer’s “trade”. This “trade”

requirement is also contained in several of the sections providing specific deductions, such as section

24J(2) which provides a deduction in respect of interest expenditure.

In the context of property developers, depending on the factual scenario, interest expenditure incurred

prior to the development of the property may not be deductible in terms of the general deduction

formula, as it may not comply with the “trade” requirement. For example, the court has held in ITC

697 [1950] 17 SATC 93, that interest expenditure relating to a period in which an old building was

demolished and a new building erected was not deductible as it was not laid out for the purposes of

trade. In this regard the court held as follows:

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 2

“It seems to me that until the asset becomes an asset capable of producing income any expenditure

upon it is of a preliminary nature and is not deductible, because the rates and interest were not laid

out exclusively or at all, in point of fact, for the purposes of trade. If a taxpayer has no asset with

which he can trade then he cannot be trading...”

The Act, however, makes specific provision for the deduction of certain pre-production expenditure in

the year of assessment during which the trade commences in terms of section 11(bA), section 11(bB)

and section 11A.

Section 11(bA) is applicable in respect of pre-production interest expenditure incurred in relation to

certain specified assets, including amongst others “any machinery, plant, building or any

improvements to a building”. It has been held by the court in Income Tax Case No. 1619 [1996] 59

SATC 309, that the reference to “buildings” in section 11(bA) does not include land. Property

developers may accordingly rely on section 11(bA) to obtain a deduction of interest expenditure

incurred prior to the commencement of trade in respect of the acquisition of buildings. However, no

such deduction will be allowed in respect of the interest expenditure incurred to acquire land. Where a

property developer acquires property with the intention to demolish the existing buildings, the cost of

the buildings is likely to be negligible and the purchase price and the interest costs in respect of the

funding thereof, will relate mostly to the cost of the land.

Section 11(bB) is available in respect of interest expenditure incurred for purposes of acquiring

“machinery, plant, aircraft, implement, utensil, article or livestock” and does not provide relief to

property developers.

Editorial comment: The Taxation Laws Amendment Bill 2009 deletes section 11(bB).

Section 11A provides for a deduction of expenditure incurred prior to the commencement of trade, in

the year of assessment in which the trade commences (subject to certain limitations). In order for

section 11A to find application, it must be shown that the pre-production interest expenditure would

have been allowed as a deduction in terms of section 11 (other than section 11(x)), section 11B or

section 11D, had the expenditure been incurred after the taxpayer commenced carrying on the relevant

trade.

Currently, interest is deductible in terms of section 24J(2) if it is incurred after the commencement of

trade. On a literal interpretation, section 11A will, accordingly, not find application in respect of preproduction interest, as the interest would not have been deductible in terms of section 11.

However, section 11A was inserted into the Act by the Revenue Laws Amendment Act No. 45 of

2003 with effect from 1 January 2004. At that time, section 24J was merely a timing section and did

not operate as a charging section which provided for the deduction of interest. Interest was deducted

in terms of section 11(a) and section 24J was applied to determine the amount of interest which may

be deducted in each year of assessment.

Section 24J was amended by the Revenue Laws Amendment Act No. 32 of 2004 with effect from 1

January 2005, so that section 24J thereafter operated as the charging section and a deduction of

interest is to be claimed in terms of section 24J(2) (and not section 11(a)).

Accordingly, at the time when section 11A was introduced, and when it became effective, interest was

deductible in terms of section 11(a). Interest expenditure on the cost of acquiring land would

accordingly have been deductible in terms of section 11(a) had the taxpayer’s trade commenced at the

time when the interest was incurred, and section 11A would have applied. This would allow the

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 3

taxpayer to claim a deduction of pre-production interest incurred in respect of the cost of acquiring

land, in the year of assessment when the taxpayer’s trade commenced.

When section 24J was amended to operate as a charging section, it had the consequential effect that

section 11A no longer applied to pre-production interest in respect of land. There is no indication in

the Explanatory Memorandum to the Revenue Laws Amendment Act, 2004 in terms of which section

24J was amended that such a consequence was intended. After a discussion with National Treasury, it

appears that this was indeed an oversight and unintended and that the legislation will be amended to

rectify the situation.

Should section 11A be amended accordingly, property developers will be entitled to claim a deduction

of interest expenditure incurred in respect of the acquisition cost of land prior to the commencement

of trade, in the year of assessment when trade commences. It should be noted that a deduction in terms

of section 11A will be “ring-fenced” and may not be applied against the income derived from any

other trade. If the interest expenditure exceeds the income derived from the relevant trade, it may be

carried forward and set-off against the income derived from that trade in the following year of

assessment.

It also remains to be seen whether the expected amendment will apply retrospectively as the interest

expenditure in relation to projects which began trading prior to the amendments may not otherwise be

deductible.

Edward Nathan Sonnenbergs

Editorial comment: This proposal is now in the Taxation Laws Amendment Bill 2009.

IT Act: s 11(a), s 11(x), s 11(bA), s 11(bB), s 11A, s 11B, s 11D, s 23(g) and s 24J

Revenue Laws Amendment Act No. 32 of 2004

1767. Farmers – employees housing

Of the many tax benefits available only to farmers, and not to other taxpayers, in terms of the Income

Tax Act, No 58 of 1962 (the Act), one of the most valuable is the right to claim an outright tax

deduction in terms of paragraph 12 of the First Schedule to the Act for various kinds of capital

expenditure, such as expenditure incurred in building dams, installing irrigation systems and

constructing roads and bridges.

A farmer has hitherto also been entitled to deduct expenditure incurred in constructing housing for his

employees. This, of course, was a considerable incentive for farmers to provide good quality housing

for employees, and farm workers benefited accordingly.

Abruptly, without fanfare and without explanation, the Revenue Laws Amendment Act No 60 of 2008

amended the Act to provide that, as from 21 October 2008, such expenditure in respect of the

construction of employee housing ceased to be tax-deductible as farming capital expenditure.

The deduction of farming capital expenditure is contingent on there being taxable income from

farming in the year of assessment in which the expenditure is incurred. To the extent that the capital

expenditure exceeds current income, the excess is carried forward for deduction as farming capital

expenditure in future years.

The effect of the amendment is that farmers are now required to claim a deduction in respect of

employee housing on the same basis as other taxpayers. In essence the farmer must own at least five

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 4

units that are used for the purposes of a trade carried on in the Republic. He may claim a deduction

equal to 5% of the cost of erection or improvement of any such unit incurred on or after 1 October

2008. An additional annual deduction equal to a further 5% of the cost may be claimed if the unit

qualifies as “low cost residential housing”.

“Low cost residential unit” means a housing unit located in the Republic costing not more than R250

000 and in respect of which a rental (if charged) of not more than 1 % of such cost per month is

levied.

Expenditure on repairs to the housing of a farmer’s employees remains deductible in the year in which

incurred; it is only expenditure on construction, additions or improvements to such housing that has

been affected by the amendment.

There has been no comment from organised agriculture in regard to this amendment, and it is difficult

to assess its impact on farmers in general in these circumstances.

PricewaterhouseCoopers

IT Act: s 1 “low cost residential unit”, First Schedule par 12

Revenue Laws Amendment Act No. 60 of 2008

1768. Purchaser assumes liability for seller’s contingent liabilities

A decision of the Johannesburg Tax Court handed down on 14 May 2009 (Cases 12323 and 12324;

not yet reported) raises fundamental issues of great importance in regard to the tax-deductibility of

contingent liabilities which are assigned by the seller to the purchaser where a business is sold as a

going concern.

In such a scenario, the seller will usually cease trading once the sale of the business has been

completed. Naturally therefore, the seller wishes to divest himself of all contingent liabilities, so that

his business entity can be wound up with a clean slate.

The facts of this particular case were that, in 2004 a large retail company had sold its business, as a

going concern, to another large retail concern.

The agreement of sale recorded that the purchase price of the business, as a going concern, was “an

amount equal to the sum of R800 million and the rand amount of the liabilities”.

The “liabilities” were defined as “all the liabilities arising in connection with the business” in respect

of any period prior to the effective date.

At the date of the sale of the business, certain “liabilities” were contingent, that is to say they were

liabilities that had not given rise — and might never give rise — to accrued legal liabilities for the

seller. These contingent liabilities consisted of post-retirement medical aid benefits for the seller’s

staff, contingent long-term bonuses for such staff, and obligations to carry out repairs in respect of

certain leases. The total amount of such contingent liabilities, which the purchaser agreed to assume,

as part and parcel of the sale, amounted to some R17 million.

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 5

SARS issued an additional assessment

Following the sale, SARS issued an additional assessment in respect of the seller for the year in which

the business had been sold. In that additional assessment, SARS disallowed an amount of some R23

million which had been claimed by the seller as a deduction in respect of contingent liabilities taken

over by the purchaser.

The seller contested the disallowance of all but R4 million of the disputed deductions.

In essence, the seller claimed that it was entitled to deduct from its taxable income, in terms of section

11(a) of the Income Tax Act No 58 of 1962 (the Act), the amounts of three underlying contingent

liabilities, namely some R9.8 million in respect of post-retirement medical aid benefits for staff, some

R6 million in respect of long-term bonuses for staff, and R900 000 in respect of “full repairing leases”

— in total, approximately R17 million.

SARS disallowed these deductions claimed by the seller

In short, SARS contended that the seller’s contingent liabilities, assumed by the purchaser in terms of

the agreement for the sale of the business as a going concern, were not deductible by the seller

because these expenditures did not satisfy any of the several criteria contained in the general

deduction formula of the Act, as expressed in section 11(a), which reads as follows:

“For the purpose of determining the taxable income derived by any person from carrying on any

trade, there shall be allowed as deductions from the income of such person so derived ... expenditure

and losses actually incurred in the production of the income, provided such expenditure and losses

are not of a capital nature”.

SARS also argued that the expenditures in question fell foul of the negative criteria for deductibility in

section 23(e) (which bars the deduction of income carried to a reserve fund or capitalised), section

23(f) (which bars the deductibility of expenditure incurred in respect of amounts which do not

constitute “income”, as defined in the Act), and section 23(g) (which bars the deductibility of

expenditure not outlaid for the purposes of trade).

The seller’s contentions

The seller argued that it was entitled to deduct the contingent liabilities that had been taken over by

the purchaser. There were several bases on which this argument was put forward.

The first basis was that, on a proper construction of the agreement, the seller had forgone part of the

selling price in return for the purchaser’s assuming the contingent liabilities, and that the amount so

forgone constituted “expenditure actually incurred” within the meaning of section 11(a).

The second basis was that the seller had, in effect, incurred expenditure in order to rid itself of

anticipated or contingent revenue expenses, and that there was judicial precedent to support the

proposition that expenditure incurred for such a purpose was, itself, of a revenue nature, and qualified

for deduction.

The court accepted that, if the seller had retained the business and had continued to trade, the

contingent liabilities in question would have become deductible by the seller as and when they

became unconditional.

The court also accepted that salary and other benefits paid by an employer to employees are ordinarily

incurred “in the production of income” and are thus deductible. The court also accepted that,

ordinarily, benefits such as post-retirement medical aid subsidies and long-term bonuses are designed

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 6

to attract and retain high-quality staff and to provide incentives to them to render good service for the

benefit of the business, and therefore satisfy the criteria for tax-deductibility. The court accepted that

the seller would have been entitled to deduct these expenses as and when they became unconditional.

The seller conceded that expenditure is not deductible so long as it remains contingent, and that it

becomes deductible only if and when the liability becomes unconditional. The seller argued, however,

that the terms of the sale of the business gave rise to “incurred expenditure” equal to the contingent

liabilities in issue. This argument was based on the proposition that there had been a “diminution of

the seller’s patrimony”, which was identical to a “loss”, as contemplated in section 11(a).

The seller elaborated on this argument, contending that the phrase, expenditure and losses actually

incurred as laid down in section 11(a) — “is a deliberately wide one which is intended to cover all

actual, quantifiable diminutions or prejudicial effects suffered by the taxpayer’s patrimony and that

the diminution of a taxpayer’s patrimony will very often arise from liabilities undertaken by the

trader”.

The seller argued that expenditure and losses is an economic or commercial concept, rather than one

strictly confined to law and legal obligations.

In response to this argument, the court pointed out that, even if this proposition were accepted, the

economic consequences of the sale of the business in question were such that the purchaser took on

the risk, and the seller was relieved of the risk, that the contingent liabilities in question would

materialise.

Hence, said the court, the agreement resulted in an increase in the seller’s patrimony, rather than a

decrease, because —

“ The truth is that if one takes a holistic economic and commercial view of the transaction ... there

was no diminution of the [seller’s] patrimony: the contrary is true; and if one looks strictly at the

assignment of obligations, including the contingent liabilities of the [seller] to the purchaser, as if this

was a ‘stand-alone’ transaction, [the seller] suffered no loss; ... the purchaser took on the risk and the

[seller] was relieved of the risk that the contingent liabilities in question would materialise.”

The court said that the claimed deductions would constitute “expenditure”, within the meaning of

section 11(a), only if one accepted the seller’s construction of the agreement as being that the seller

had “paid” the purchaser an amount equivalent to the contingent liabilities in order to be relieved of

the seller’s liabilities.

However, said the court, even if this interpretation of the agreement were accepted (despite being in

conflict with the seller’s accounting records) it did not overcome the difficulty faced by the seller. The

difficulty was that the liabilities in question had not yet become unconditional on the date when the

business was sold and the liabilities were transferred to the purchaser. Until the liabilities were

uncontingent, they did not constitute expenditure that had been “incurred”, as interpreted in the 1986

Appellate Division decision in Nasionale Pers Bpk v KBI [1986] 48 SATC 55.

The court also held that, even if the contingent liabilities in question could be regarded as expenditure,

such expenditure had not been incurred by the seller “in the production of the income”, as required by

section 11(a), because the expenditure was linked to income earned by the seller prior to the sale of

the business, and not to income that would be generated by the sale.

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 7

The “notional expenditure” represented by the contingent liabilities in issue, said the court, had been

incurred —

“in order to induce [the purchaser] to assume the liabilities, rather than incurred in the production of

income prior to the sale of the business”.

Moreover, said the court, even if all these difficulties which stood in the way of the seller’s arguments

being accepted could be overcome, the “expenditure” in issue was of a capital nature (and therefore

not deductible) since the consequence of the sale was that the seller ceased trading, and the

expenditure therefore ceased to have the requisite link to the seller’s income-earning operations.

Furthermore, said the court, the expenditure in question had not been laid out for the purposes of the

seller’s trade, and the expenditure therefore fell foul of section 23(g), as the transaction in question

was undertaken for the purpose of disposing of the seller’s business and bringing its trading activities

to an end.

The court pointed out that, if SARS were to succeed on any one of the grounds relied upon for its

contention that the expenditure or loss in question failed to satisfy the criteria for deductibility in

section 11(a) or section 23, the result would be that the expenditure would not be deductible.

In the result, the court held that the seller’s claim for deduction of the contingent liabilities in question

failed to satisfy any of the criteria in section 11(a) and section 23. The court therefore upheld SARS’s

disallowance of those deductions.

PricewaterhouseCoopers

IT Act: s 11(a), s 23(e), s 23(f) and s 23(g)

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 8

EMPLOYEES’ TAX

1769. Share schemes

Employers and employees alike would be well advised to take note of the recent changes to the tax

regime relating to share incentive schemes. The Revenue Laws Amendment Act, 2008, (the RLAA)

contains various amendments to section 8C of the Income Tax Act No 58 of 1962 (the Act) which will

affect the taxation of these schemes and structures.

Section 8C previously sought to regulate schemes where an employee received shares in a company,

either for full value or at a discount. For example Director A is offered 100 shares in Company A at a

discount of 25%. Although Director A receives the shares today he may only sell them if he remains

an employee of Company A for a period of five years (lock-up period). Upon expiry of the lock-up

period Director A acquires unrestricted ownership of the shares and may sell them at will.

The Act provides that Director A will not be taxed at the date of the offer and receipt of the shares but

rather upon the vesting of the shares (i.e. when he acquires unrestricted ownership). The amount

subject to taxation will be the amount by which the market value of the shares at the date of vesting

exceeds the consideration paid by Director A at the time of the offer. This gain is included in Director

A’s remuneration and is taxed as revenue via the payroll. Any gain realised on a subsequent sale of

the shares will generally be taxed as a capital gain in the director’s hands.

The prior definition of ‘equity instrument’ only referred to shares and share options or financial

instruments convertible to shares, so many employers have sought to avoid section 8C as a whole by

implementing structures where employees would never actually receive shares.

Instead, employees received units or similar instruments, not convertible to shares, the value of which

was linked to the shares. An example of such a scheme would be where an employee share trust owns

the shares, and employees are offered units or rights to the value of the shares held by the trust without

the right to acquire the actual shares. Certain phantom share schemes also offer some form of

incentive the value of which is linked to the actual share value determined over a period. At the end of

the lock-up period the employee merely receives a cash amount calculated with reference to the share.

By using these schemes employers could offer their employees incentives without having to fall

within the taxing provisions of section 8C as the employees never received ‘equity instruments’ as

defined.

The RLAA effectively closed this loophole by expanding the definition of ‘equity instrument’ to

include –

“any contractual right or obligation the value of which is determined directly or indirectly with

reference to a share or member’s interest.”

This addition effectively brings into the ambit of section 8C all schemes which utilise some form of

derivative to calculate the value of the incentive but never provide the employee with the right to

actually acquire shares. Consequently, in the trust example mentioned above, an employee will now

be taxed in terms of section 8C.

The definition of ‘restricted instrument’ was also expanded. An instrument is regarded as restricted if

it contains a restriction covering rights of forfeiture by the employee or the acquisition of the

instrument, by the issuer for instance, at a price lower than market value. In the above example

Director A’s shares were restricted as he could not freely dispose of the shares during the lock-up

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 9

period. An instrument will now also be restricted if the taxpayer employee is “penalised financially in

any other manner for not complying with the terms of the agreement for the acquisition of that equity

instrument”. As an example of this, instead of saying that if the employee leaves employment within

three years from the date of acquiring the shares the company would buy the shares back for only R1,

when their market value might be R100; the rules say that the company will buy back the shares at

market value but the employee would have to pay a financial penalty of R99. The financial effect is

the same but previously it was arguable that the second did not result in the shares being restricted

instruments.

As regards capital distributions, any capital distributions received by a taxpayer in respect of a

restricted equity instrument must be included in the taxpayer’s income for the tax year during which

the amount is received or accrued. Effectively, these distributions are taxed as ordinary revenue in the

same manner as any amount which arose from a disposal of a restricted equity instrument. Luckily,

other sections of the Act prevent these amounts from being taxed again as capital gains.

The above amendments came into operation on 21 October 2008.

As a result of the amendments, employers should revisit their schemes to determine whether any

capital distributions or equity instruments were offered subsequent to that date. Going forward,

employers will have to ensure that their share schemes are taxed correctly as units in an employee

trust, for instance, which are offered in 2009 will not attract the same tax treatment as those offered in

the prior year. Furthermore, care should be taken with equity instruments which have financial

penalties for not complying with the employer’s terms for issuing the shares.

Effective communication to employees is also essential to ensure employees make informed decisions

when electing to participate in these schemes.

Cliffe Dekker Hofmeyr

IT Act: s 8C

Revenue Laws Amendment Act No. 60 of 2008

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 10

1770. Fringe benefits and STC-interest rate

If inadequate interest is charged to an employee (including working directors) on loans (other than for

the purpose of furthering his own studies) in excess of R3 000 from his employer (or associated

institution), tax on the fringe benefit may be payable.

Unless interest is charged at the “official” rate or greater, the employee is deemed to have received a

taxable fringe benefit calculated as being the difference between the interest actually charged and

interest calculated at the “official” rate.

For employees’ tax purposes, the tax deduction must be made whenever interest is payable. If not

regularly, then on a monthly basis for monthly paid employees, weekly for weekly paid employees,

etc.

In general, only distributions of income from a company / close corporation are subject to STC. To

the extent that there are profits/reserves available for distribution, loans or advances to or for the

benefit of a shareholder / member will be deemed to be dividends subject to STC unless interest at the

“official” rate (or market related rate in the case of foreign currency loans) is payable on the loan or

fringe benefits tax is payable on an interest free (or subsidised interest) loan to an employee.

The “official” rate of interest was reduced for both the above purposes from 8,5% per annum to 8%

per annum with effect from 1 September 2009.

The “official” rate of interest over the past 5 years is as follows With effect from 1 March 2004

With effect from 1 September 2004

With effect from 1 September 2005

With effect from 1 September 2006

With effect from 1 March 2007

With effect from 1 September 2007

With effect from 1 March 2008

With effect from 1 September 2008

With effect from 1 March 2009

With effect from 1 June 2009

With effect from 1 July 2009

With effect from 1 September 2009

-

9,0% p.a.

8,5% p.a.

8,0% p.a.

9,0% p.a.

10,0% p.a.

11,0% p.a.

12,0% p.a.

13,0% p.a.

11,5% p.a.

9,5% p.a.

8,5% p.a.

8,0% p.a.

Horwath Zeller Karro

IT Act: s 64C(4)(d), par 1, definition "official rate of interest" of the Seventh Schedule, par 11

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 11

GENERAL

1771. The dates on a notice of assessment

Taxpayers will receive an assessment from the Commissioner: South African Revenue Service

(SARS) once SARS has processed the tax return submitted by the taxpayer. The notice of assessment,

Form IT34, issued to the taxpayer will reflect the taxable income derived by the taxpayer for the

particular year of assessment and will indicate whether the taxpayer is required to pay tax to SARS or

is entitled to a refund from SARS.

The notice of assessment reflects three different dates thereon, namely:

•

•

•

Date.

Due date.

Second date.

The date reflected on the notice of assessment is usually the date on which the notice was processed

on the SARS computer system and that date does not have any significance under the provisions of

the Income Tax Act, No 58 of 1962, as amended (the Act).

However, the “due date” and “second date” reflected on the notice of assessment are of significance to

taxpayers.

The “due date” is customarily the first day of a month and is highly significant to taxpayers for

various reasons, which are dealt with below.

Section 1 of the Act contains a definition of “date of assessment”, which is defined to mean:

“The date specified in a notice of such assessment as the due date or, where a due date is not so

specified, the date of such notice”.

Under section 107A of the Act, the Minister of Finance, in consultation with the Minister of Justice

and Constitutional Development, was required to promulgate rules governing objections and appeals

against assessments issued by SARS to taxpayers. From a review of those rules, it is apparent that

taxpayers are required to lodge an objection against an assessment within 30 business days of the date

of the assessment, that is, the due date thereof.

The taxpayer is entitled to proper reasons for assessments issued by SARS and where the taxpayer is

of the opinion that SARS has failed to supply adequate written reasons for the decisions made, as

contained in the assessment, the taxpayer is entitled to request reasons for that assessment within 30

days of the due date of the assessment.

Thus, the due date of the assessment notice issued to the taxpayer is critical in triggering the objection

process available to a taxpayer who wishes to dispute an assessment.

In addition, the due date is important in establishing whether the assessment has been issued in

conformity with the rules governing the finality of assessments, regulated under section 79 of the Act.

In principle, assuming that the taxpayer has made full and proper disclosure in the tax return

submitted to SARS, the assessment becomes final and binding vis-à-vis SARS after the elapse of three

years from the due date of the assessment issued to the taxpayer.

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 12

Where, for example, SARS has issued an assessment to the taxpayer for the 2004 tax year, with a due

date of 1 March 2005, SARS would have been entitled to amend that assessment prior to 29 February

2008. Where, however, SARS issues a revised assessment with a due date of 1 March 2008 or later,

the taxpayer is entitled to challenge the lawfulness of that assessment on the basis that it has been

issued in contravention of section 79 of the Act. Where, however, SARS can show that the taxpayer

has not supplied a full and proper tax return, the taxpayer will not succeed in arguing that the

assessment has become final and binding.

Furthermore, a taxpayer is precluded from applying for a refund beyond a period of three years after

the due date of the assessment under the provisions contained in section 102 of the Act. It is,

therefore, not possible for a taxpayer to approach SARS after the elapse of three years, to request that

a refund be made to the taxpayer.

The “second date” contained on the notice of assessment is the date by which the taxpayer must pay

the amount reflected as payable to SARS. Usually, the second date is the last day of a month, unless

that falls on a week-end or public holiday, in which case it would be the immediately preceding day,

that is, the last working day of the month.

Where a taxpayer fails to pay any tax due to SARS by the second date of the assessment, interest

becomes payable by the taxpayer under the provisions contained in section 89(2) of the Act. It must be

remembered that where the tax is not paid on or before the second date, interest is levied from the due

date. For example, where an assessment is issued with a due date of 1 June 2009 and a second date of

30 June 2009 and the taxpayer only settles the tax on 3 July 2009, interest is charged from 1 June

2009 to 3 July 2009.

Should the tax reflected as payable on the notice of assessment not be paid by the second date,

interest, at the prescribed rate, currently a rate of 10.5% per annum will be payable from the due date

specified on the notice. Thus, taxpayers are usually afforded an interest-free period of 30 days from

the due date to the second date of the assessment within which to effect payment of the assessed tax

payable to SARS.

Normally, assessments are issued to taxpayers by SARS with the due date set as the first day of a

particular month and with the second due date being the last working day of that same month. Where,

however, SARS issues a so-called “local or urgent” assessment, the assessment may contain a due

date that is the same as the second date. This has the result that the interest-free period normally

granted to a taxpayer is eliminated and SARS would, usually, issue such assessments in investigation

or fraud cases where SARS is concerned that the taxpayer may seek to dissipate assets prior to the

date on which the tax will normally become payable.

Currently, the Act does not define the second date contained on the notice of assessment, as is the case

with the due date referred to above.

Recently, the question of the second date contained on assessments became an issue to taxpayers in

light of the fact that SARS chose to issue a significant number of 2008 assessments to taxpayers with

the second date of 20 March 2009.

Historically, the second date on the notice of assessment has always been the last working day of a

particular month and it was, therefore, something of a surprise to tax practitioners and taxpayers to

suddenly start receiving notices of assessments reflecting a second date other than the last working

day of the month.

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 13

SARS issued a notice explaining the payment dates for income tax assessments on 5 March 2009 and

indicated that the second date of 20 March 2009 was correct and that income tax assessments,

reflecting tax payable, had to be paid by that date.

SARS advised that in granting additional time for the submission of income tax returns via e-Filing,

which were originally due on 23 January 2009 and subsequently extended to 5 February 2009, at the

request of tax practitioners, SARS was mindful of the fact that the later submission date would result

in a second date for payment of assessed tax on the final day of SARS’ own financial year, namely, 31

March 2009.

SARS pointed out in its notice that taxpayers are usually granted a period of at least six weeks in those

cases where assessments are finalised before the 15th of the month in which to pay the assessed tax

due. Where assessments are finalised after the 15th of the month, taxpayers are usually given until the

end of the second month, that is, a period of up to 10 weeks within which to pay the tax due.

SARS indicated that when granting additional time for the submission of 2008 income tax returns, it

was decided to grant a period of two months for the payment of assessed tax, after the original filing

date of 23 January 2009 which, in its opinion, allowed ample time for payment without putting undue

pressure on the finalisation of its year-end.

It is most regrettable that SARS did not announce, at the time that the extension was granted to

taxpayers, that the date of payment for the 2008 assessments would be moved from the usual date of

31 March 2009 to 20 March 2009. It is unfortunate that the Act does not, itself, define the second date

of assessments and it is recommended that the Act should be amended to clarify the position.

Taxpayers are entitled to just administrative action under the provisions of section 33 of the

Constitution of the Republic of South Africa, Act 108 of 1996 and it is highly questionable whether

SARS’ decision to move the payment date to 20 March 2009 and advise to taxpayers thereof only on

5 March 2009, complied with the constitutional imperative of just administrative action. SARS

should, as a minimum, have informed taxpayers when the extension for submission of 2008 tax

returns via e-Filing was granted, that the payment date or second date would be brought forward to 20

March 2009.

It is suspected that a number of taxpayers who received assessments reflecting a second date of 20

March 2009 did not realise that the date by which tax should be paid was, in fact, 20 March 2009 and

proceeded to pay the tax on 31 March 2009, as has been the norm for many years. Some taxpayers

will, no doubt, be in for a nasty surprise in that they will become liable for interest with effect from 1

March 2009 until the tax was actually paid to SARS.

In conclusion, therefore, taxpayers need to remember the relevance and importance of the various

dates contained on the notice of assessment and the legal consequences that flow therefrom.

Edward Nathan Sonnenbergs

IT Act: s 1 definition of “date of assessment”, s 79, s 89(2), s 102 and s 107A

Constitution of the Republic of South Africa, Act 108 of 1996: s 33

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 14

INCOME

1772. Repayment of income

It often occurs that an employee is given a lump sum or is paid a monthly salary which must be

refunded if an employee does not continue to work for his employer. When such payments are made,

they are generally taxable in full. However, up until 2009 if an employee was required to repay the

amount in terms of a contract of employment, then the repayment was not deductible meaning that

many individuals were faced with an unwelcome tax liability in respect of income that they had to

repay. This situation, whilst most unfair, has been tested by the courts on a number of occasions,

which have quite correctly found against the taxpayer for a number of technical reasons. The typical

scenarios which gave rise to these awful consequences included the following:

•

•

•

New mums who decide to refund maternity leave pay and not to return to work.

Lecturers on sabbatical who choose to buy themselves out of future time commitments.

Highly marketable employees who are poached and need to refund previous "golden hello" takeon payments.

Close but no cigar

Fortunately, the law was appropriately amended in 2009. People who have to repay amounts that were

previously paid to them, and subjected to PAYE, can claim the amount repaid as a deduction against

income in the tax year in which they have to repay the amount. People who find alternative

employment will now generally land up being square, but the hardest hit of all - the mum who decides

to work no more - will be out of pocket at the very time it is probably least affordable.

Take the case of Mary, whose employer allows her to take 6 months maternity leave, from September

on half pay of R15 000 per month. She is however required to return to work for at least a year after

her maternity leave, otherwise she must refund the maternity pay. The R15 000 attracts PAYE of

approximately 30% so Mary is left with R10 500 per month for 6 months, being R63 000 in total.

Come the end of the six months, (being 1 March and the first day of the new tax year), Mary decides

to stay at home to look after her six month old bundle of joy and is quite happy to refund her

employer. However, Mary now has a problem. She does not owe her ex - employer R63 000, but

R90 000. The taxes suffered of R27 000, will be lost forever, unless Mary decides to rejoin the

workforce some day or has some other form of income in the new year or subsequent years, to absorb

the deduction.

Take now the case of Ben. He is a high-flying derivatives trader much sought after in the banking

sector. Bank B poaches him from Bank A for a lump sum of R5 million, on condition that he stays

there for 2 years. Before the 2 years are up Bank C comes along and offers Ben a take-on payment of

R8 million which allows him to buy himself out of his previous contract as well as granting him an

incentive to move. This all works out quite neatly for Ben as he is not leaving the workforce. Sure, the

original R5 million would have attracted PAYE of R2 million, but Ben gets a R5 million tax

deduction in the new year, arising from the new rules relating to refunded income. He will, in all

likelihood be granted a directive that PAYE need only be deducted against R3 million of the new

incentive of R8 million, as the first R5 million is shielded by an allowable deduction.

Government’s response

The circumstances such as those of Mary were put before the Portfolio Committee on Finance (PCOF)

last year, and the response was as follows.

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 15

“Noted but not accepted. The commentators are essentially asking for the carry-back of deductions

(and the refund of tax beyond that which is owed for a particular year) which requires the re-opening

of prior year returns. While we have sympathy with the issues raised, this form of change will require

significant system changes. Few countries allow for the re-opening of prior year assessments in these

circumstances because of system implications.”

Where to now?

The comments are acknowledged, but it is questioned whether this really would entail such significant

system changes. Given the tax mountains that have been moved in the last 15 years, surely this would

not be more than a tweak. Besides this, carry-back provisions in other contexts are very widely used

and is a popular balancing mechanism used on a world-wide basis, a mechanism which South Africa

has thus far chosen to ignore. For example, many countries allow construction companies to carry

back tail-end expenses to previous years so as to offset against income. In the absence of any

correction, employees such as Mary will continue to face this hazardous anomaly. Employer and

employees alike should thus carefully consider alternative mechanisms, so as to avoid this unfortunate

consequence.

BDO Spencer Steward

IT: Act: s 11(a), s 11(nA) and s 11(nB)

Revenue Laws Amendment Act No. 60 of 2008

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 16

INTERNATIONAL TAX

1773. Recovery of foreign taxes

At common law, the courts of the Republic will not entertain a claim by a foreign government for

taxes due to it and will not enforce a foreign judgment for such taxes.

However, section 108 of our Income Tax Act empowers the National Executive to enter into

agreements with the governments of foreign countries with a view to preventing or mitigating double

taxation and for reciprocal assistance in the collection of tax.

Most of the double tax agreements entered into by the Republic contain provisions for such reciprocal

assistance.

In the absence of such an agreement, there are no legal means for the enforceability, within the

Republic, of a tax debt due to a foreign country.

Where there is such an agreement, the tax due to the foreign country can be collected in South Africa

in terms of the procedure laid down in section 93 of our Income Tax Act.

Section 93 has recently been replaced in its entirety

The Revenue Laws Second Amendment Act 61 of 2008 replaced the old section 93 in its entirety. The

wording of the new provision differs significantly from that of the old.

In terms of the new provision, if the Commissioner has, in accordance with arrangements made with

any foreign government by an agreement entered into as contemplated in section 108, received a

request for the collection from any person in the Republic of an amount alleged to be due by him

under the tax laws of such other country, the Commissioner may, by notice in writing, call on such

other person to state, within a specified period, whether or not he admits liability for such amount or

for any lesser amount.

If such a person admits liability, or fails to respond to the notice, or denies liability but the

Commissioner, after consultation with the competent authority of such other country, is satisfied that

the liability for such amount is not disputed in terms of the laws of such other country, or is so

disputed only to delay or frustrate collection of the amount alleged to be due, or that there is a serious

risk of dissipation or concealment of assets by such person, then the Commissioner may by notice in

writing require such person to pay the amount in question on a specified date, for transmission to the

competent revenue authority in such other country.

If such person fails to comply with such a notice, the amount in question may be recovered, for

transmission to the competent authority in such other country, as if it were a tax payable under this

Act. In other words, SARS can proceed to file a notice with the clerk of the court in terms of section

91(1)(b) of the Income Tax Act, which then has the effect of a civil judgment, and can be enforced in

the same way as such a judgment.

These draconian provisions allow for a fast-track process to recover taxes due to a foreign country

from a person who is in the Republic, and involves a more summary process than the provisions of

section 93 in its old form.

Under the old provisions, the person in question only became liable for the tax due to the other

country if the president of the Tax Court certified that he had afforded that person the opportunity of

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 17

presenting his case, and that on the information submitted to him, the amount in question appeared to

be payable by such person.

Only then was the Commissioner empowered to issue a notice to the person concerned requiring him

to pay the specified amount.

Under the new section 93, all that is required to impose liability for the foreign tax is that the

Commissioner must “after consultation with” the competent authority of the foreign country be

“satisfied” either that liability for the tax is not disputed or that it is disputed only to delay or frustrate

collection of the tax, or that that there is a serious risk of dissipation or concealment of assets by such

person.

Constitutional aspects of proceedings under section 93

Whether the new section 93, or any action taken in terms of the section, will survive a constitutional

challenge is debatable.

Even if the section does not infringe the constitutional Bill of Rights, it seems clear that if the

Commissioner were, after the requisite “consultation” with the revenue authorities of the foreign

country, to declare himself “satisfied” that the tax in question was indeed due to the foreign country,

this decision would constitute “administrative action” as envisaged in the Promotion of

Administrative Justice Act 3 of 2000, and the person declared liable for the tax would have the

remedies provided for in that Act.

This Act requires that any administrative action be “procedurally fair”. What this entails depends on

the circumstances of each case but, in terms of section 3(2)(b) of that Act, SARS would have to give

the person in question adequate notice of the proposed declaration of liability for the tax due to the

foreign country and a reasonable opportunity to make representations.

The person in question would be entitled, in terms of section 5 of that Act, to request reasons for the

decision, and to take that decision on review in terms of section 6(1).

PricewaterhouseCoopers

IT Act: s 91(1)(b), s 93 and s 108

Revenue Laws Second Amendment Act No. 61 of 2008

Promotion of Administrative Justice Act 3 of 2000: s 3(2)(b), s 5 and s 6(1)

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 18

SARS NEWS

1774.

Interpretation notes, media releases and other documents

25 September 2009 Media Release: SARS Customs Durban raids detain 400 tons of goods

16 September 2009 Legal & Policy: Interpretation Note: No. 47 (Issue 2): Section 11(e) of the

Income Tax Act, 1962: Wear-and-tear or depreciation allowance – send your comments to

policycomments@sars.gov.za by 9 October 2009

16 September 2009 Media Release: Update on Tax Season 2009

16 September 2009 Media Release: SARS Customs seizes marijuana destined for the United

Kingdom in Durban

15 September 2009 Media Release: Clean up of VAT register under way

14 September 2009 VAT Notice: VAT vendors not meeting certain requirements suspended

9 September 2009 Media Release: SARS Update in Industrial Action

9 September 2009 Media Release: Bruma Lake counterfeit DVD bust nets three suspects

7 September 2009 Legal & Policy: Section C of Part 3 to Schedule No. 1 - Filament Lamps

Your comments are herewith kindly invited on the attached draft Schedule amendment. Comments

can be sent to Samantha Authar (sauthar@sars.gov.zamailto:sauther@sars.gov.za) before/on 14

September 2009.

6 September 2009 Procurement: Request for Proposal (RFP) RFP 05 /2009: Fiscal Marker to be

added to Illuminating kerosene for the South African Revenue Service - Closing date: 6 October

2009, 11:00

6 September 2009 Customs Notice: Customs Contingency Plan for Industrial Action 7 September

2009

1 September 2009 PAYE Public Release: Business Requirement Specification: PAYE

Reconciliation 2010 - Public Release 1 September 2009

31 August 2009 Legal & Policy: Notice: Determination of interest rate for purposes of paragraph

(a) of the definition of “Official rate of interest” in paragraph 1 of the Seventh Schedule to the

Income Tax Act, 1962 (GG No 32546 - 31 August 2009)

Readers are reminded that the latest developments at SARS can be accessed on their website

http://www.sars.gov.za

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 19

Editor:

Editorial Panel:

Mr M E Hassan

Mr KG Karro (Chairman), Dr BJ Croome, Mr MA Khan, Prof KI Mitchell,

Prof L Olivier, Prof JJ Roeleveld, Prof PG Surtees.

The Integritax Newsletter is published as a service to members and associates of the South African

Institute of Chartered Accountants (SAICA) and includes items selected from the newsletters of firms

in public practice and commerce and industry, as well as other contributors. The information

contained herein is for general guidance only and should not be used as a basis for action without

further research or specialist advice. The views of the authors are not necessarily the views of SAICA.

All rights reserved. No part of this Newsletter covered by copyright may be reproduced or copied in

any form or by any means (including graphic, electronic or mechanical, photocopying, recording,

recorded, taping or retrieval information systems) without written permission of the copyright holders.

Integritax Issue 121 – September, 2009 ©SAICA, 2009

page 20