Iron Ore Swaps: Cleared Volume Takes Off

advertisement

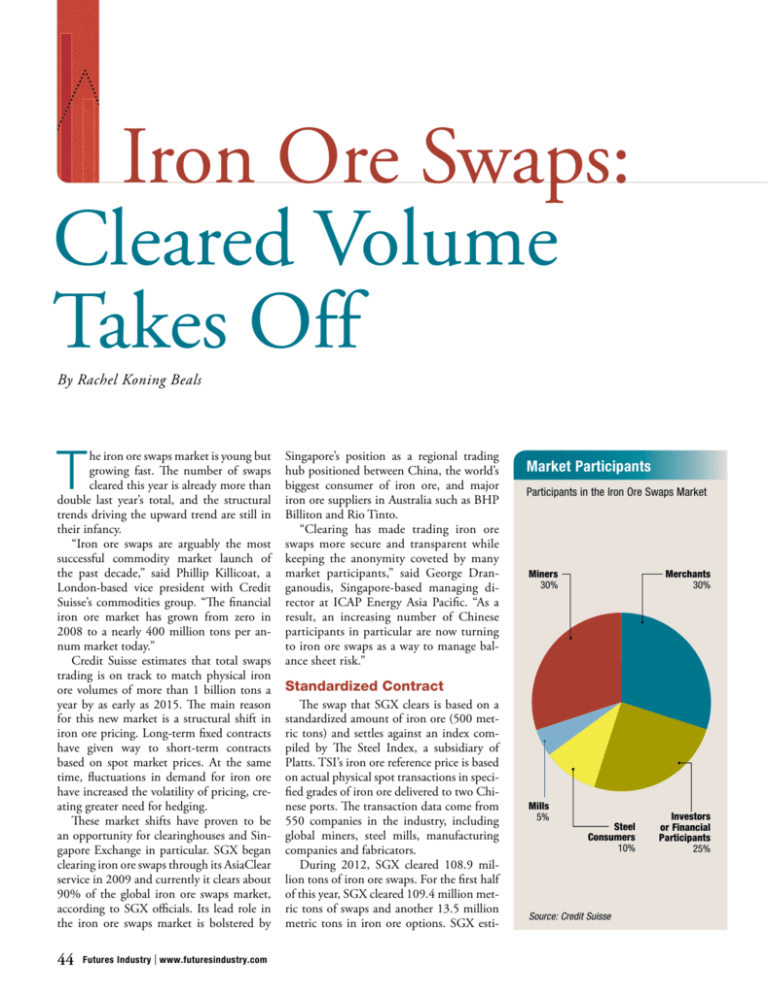

Iron Ore Swaps: Cleared Volume Takes Off By Rachel Koning Beals T he iron ore swaps market is young but growing fast. The number of swaps cleared this year is already more than double last year’s total, and the structural trends driving the upward trend are still in their infancy. “Iron ore swaps are arguably the most successful commodity market launch of the past decade,” said Phillip Killicoat, a London-based vice president with Credit Suisse’s commodities group. “The financial iron ore market has grown from zero in 2008 to a nearly 400 million tons per annum market today.” Credit Suisse estimates that total swaps trading is on track to match physical iron ore volumes of more than 1 billion tons a year by as early as 2015. The main reason for this new market is a structural shift in iron ore pricing. Long-term fixed contracts have given way to short-term contracts based on spot market prices. At the same time, fluctuations in demand for iron ore have increased the volatility of pricing, creating greater need for hedging. These market shifts have proven to be an opportunity for clearinghouses and Singapore Exchange in particular. SGX began clearing iron ore swaps through its AsiaClear service in 2009 and currently it clears about 90% of the global iron ore swaps market, according to SGX officials. Its lead role in the iron ore swaps market is bolstered by 44 Futures Industry | www.futuresindustry.com Singapore’s position as a regional trading hub positioned between China, the world’s biggest consumer of iron ore, and major iron ore suppliers in Australia such as BHP Billiton and Rio Tinto. “Clearing has made trading iron ore swaps more secure and transparent while keeping the anonymity coveted by many market participants,” said George Dranganoudis, Singapore-based managing director at ICAP Energy Asia Pacific. “As a result, an increasing number of Chinese participants in particular are now turning to iron ore swaps as a way to manage balance sheet risk.” Market Participants Participants in the Iron Ore Swaps Market Miners 30% Merchants 30% Standardized Contract The swap that SGX clears is based on a standardized amount of iron ore (500 metric tons) and settles against an index compiled by The Steel Index, a subsidiary of Platts. TSI’s iron ore reference price is based on actual physical spot transactions in specified grades of iron ore delivered to two Chinese ports. The transaction data come from 550 companies in the industry, including global miners, steel mills, manufacturing companies and fabricators. During 2012, SGX cleared 108.9 million tons of iron ore swaps. For the first half of this year, SGX cleared 109.4 million metric tons of swaps and another 13.5 million metric tons in iron ore options. SGX esti- Mills 5% Steel Consumers 10% Source: Credit Suisse Investors or Financial Participants 25% mates that its combined swap and options volume is equivalent to 31% of the underlying physical market. Building on its success with iron ore swaps, SGX began offering clearing for iron ore options in September 2012. Volume was quite low initially but began to take off this year, and as of June 27,000 contracts had been cleared. A large proportion of options open interest belongs to relatively sophisticated international traders, but a growing number of Chinese participants are trading iron ore options as an insurance policy against price volatility, according to ICAP’s Dranganoudis. SGX also has introduced a futures version of the iron ore swap contract in April 2013, largely in response to global financial reforms. These contracts so far have been lightly traded relative to the cleared swaps and options even though they can be traded over the counter and are fully risk-fungible with their equivalent swaps, with identical settlement prices and margins. “Clients desire a clearing model which can adapt to regulatory shifts, and therefore ing training programs with the China Iron and Steel Association. In addition, Hong Kong Exchanges and Clearing and its subsidiary the London Metal Exchange signed an agreement in June with the China Beijing International Mining Exchange to cooperate and exchange information, including information related to trading and clearing iron ore derivatives. SGX AsiaClear’s acceptance of clearing for multiple transaction modes allows the service to bridge different regulatory requirements and regimes as these evolve,” said Michael Syn, head of derivatives at SGX. Other clearinghouses also offer clearing for iron ore derivatives, notably CME Group, ICE Clear Europe, Indian Commodity Exchange, LCH.Clearnet and NOS Clearing, but none are anywhere near SGX in terms of market share. A different sort of competitor is on the horizon, however. China’s Dalian Commodity Exchange announced in July plans to launch iron ore futures contracts by year-end. DCE is primarily an agricultural futures exchange, but it is developing several steel-related contracts. In 2011 it began trading futures on coke, one of the primary ingredients along with iron ore in the production of steel, and in March it began trading futures on coking coal, the raw material for making coke. To help build an iron ore futures market, DCE is working with China Beijing International Mining Exchange, a quasi-public entity that operates a spot market for iron ore, and has been conduct- Structural Shift Until a few years ago, prices for iron ore were set through annual negotiations among the world’s biggest miners and producers. That system came under pressure after 2003, when China took over from Japan as the world’s largest importer of iron ore. As China’s iron ore requirements outpaced supply, a nascent spot market grew to supply marginal tonnage to the country’s steel mills, providing visibility on short-term prices for the first time. By 2008 large gaps had emerged between spot market prices and the annual contracts, and some steel producers in China defaulted on their contracts. In response, several large Cleared Iron Ore Swaps and Options at SGX Volume measured in number of contracts 60,000 Swaps Volume Options Volume Open Interest 50,000 40,000 30,000 20,000 y-1 3 Ma r-1 3 Ma -13 Jan 12 -12 No v- 2 -12 Sep Jul y-1 -12 11 r-1 2 Ma Ma Jan No v- -11 Sep -11 Jul y-1 1 Ma -11 10 r-1 1 Ma Jan No v- -10 Sep t-1 0 Jul y-1 Ma r-1 0 Ma Jan -10 0 0 10,000 Source: SGX Futures Industry | September 2013 45 mining companies switched to shorter pricing cycles starting in 2010. Initially the miners attempted to set prices based on the average price in the preceding quarter, but this soon broke down, and pricing is now based on spot market reference prices. (See “Steel Futures Forge Ahead” in the January 2011 issue of Futures Industry.) “The conflict between spot and longterm contract prices spelled doom for the annual system, which in 2010 was replaced by contracts based on spot price indices published by independent pricing agencies,” said Oscar Tarneberg, senior iron ore analyst at TSI. “The shift toward indexlinked pricing, coupled with rising spot market volatility, supported the development of the iron ore swaps market which arose to deal with the increase in price risk.” The field of participants in the iron ore swaps market ranges from producers to miners to consumers and financial institutions. According to Credit Suisse and SGX, miners account for 30% of volumes in iron ore swaps, merchants another 30%, mills as much as 5%, steel consumers 10%, and investors or financial participants about 25% (see Market Participants chart.) 46 Futures Industry | www.futuresindustry.com According to several industry experts, market share among banks and other financial institutions is on the rise. Banks and trade houses enter into iron ore swaps to manage their exposure to customers that hold physical iron ore positions. “Their involvement in the market will continue to grow as the market matures and physical trade participants become better informed about risk management and hedging,” said SGX’s Syn. Speculative traders such as hedge funds use iron ore swaps to arbitrage across related commodity markets such as freight or to take a position on construction trends in China, a key indicator for steel consumption. “Many macro funds trade the iron ore swaps market as a means of expressing views on China’s gross domestic product, housing, and the health of the Asian commodity markets,” said ICAP’s Dranganoudis. Additionally, speculators within the Chinese domestic market tend to follow the price spread between steel rebar futures traded on the Shanghai Futures Exchange and SGX iron ore as a directional market indicator and arbitrage opportunity. More importantly, there are signs that commercial hedgers are entering the mar- ket. “The share of steel consumers and steel mills is growing,” said Credit Suisse’s Killicoat. “Eighteen months ago, steel consumers [such as construction firms] weren’t participating in the financial iron ore market at all. Now, they make up about 10%. Downstream steel consuming segments are becoming more active as they tend to be more sophisticated users of other commodities derivatives to hedge their input price risk.” ICAP’s Dranganoudis sees potential for the iron ore swaps market on the scale of what has already taken hold in the coal market. There are some 800 metric tonnes of seaborne physical coal traded globally that generates a derivatives market of around 2.5 to 3 billion metric tonnes annually. If the ratio is extrapolated to iron ore, today’s 1.2 billion metric tonnes physical market would equate to a 3 billion metric tonnes liquid swaps market—a multiple of 20 to 30 times today’s trading volume. “We are only at the tip of the iceberg in terms of the potential of this fast developing market,” he said. .............. Rachel Koning Beals is a Chicago-based writer and editor.