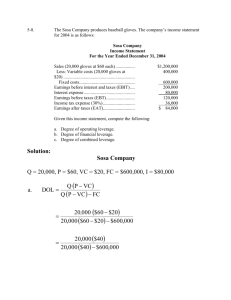

Financial Leverage: The Case Against DFL

advertisement