Incremental Analysis and Decision-making Costs

advertisement

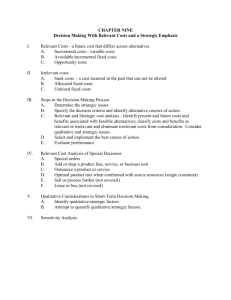

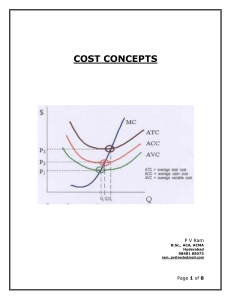

Management Accounting Incremental Analysis and Decision-making Costs Nature of Incremental Analysis Decision-making is essentially a process of selecting the best alternative given the available information for comparison of strengths and weaknesses of each alternative. If there exists no alternative to the current course of action, then there is no decision to be made. However, it is rare regarding any course of action for there not be alternatives. In personal decision-making, factors other than income and expenses such as qualitative factors may be more important than cost in deciding. However, in business decisions are generally made by identifying the alternative with the most revenue or the least cost. Incremental analysis is a decision-making tool in which the relevant costs and revenues of one alternative are compared to the relevant costs and revenues of another alternative. Relevant costs may be defined as those future costs that are different between alternatives. Costs that are the same are considered irrelevant. Incremental analysis is sometimes called differential costing, marginal costing, or relevant costing. Incremental analysis is basically a worksheet technique in which the relevant costs of one alternative are listed in one column and the relevant costs of another alternative are listed in an adjacent column. Frequently, an optional third column is used to show the difference in the costs. The differences in relevant costs are called incremental costs. Technically, incremental cost may be defined as the difference between the sum of the relevant costs of two alternatives. In short, it is a tool for choosing between two alternatives. The best decision is the one with the least amount of relevant costs or the greatest relevant revenue. Incremental analysis is not an optimization technique. Rather it is a tool for using appropriate cost concepts to measure and evaluate the relevant cost inputs. It is basic tool for measuring the difference in revenues or costs between two alternatives. Incremental analysis is a tool which first requires that the appropriate costs be identified and then measured. | 161 162 | CHAPTER NINE • Incremental Analysis and Decision-making Costs Under appropriate circumstances, incremental analysis is a tool for evaluating decision alternatives such as: • Keep or replace • Make or buy • Sell now or process further • Lease space or continue operations • Continue or discontinue product line • Accept or reject special offer • Change credit terms • Open new territory • Buy or lease As a tool, incremental analysis can be used in all areas of a business. The tool is just as useful in the area of marketing as it is in the area of production. The objective in using incremental analysis is to identify the alternative with the least relevant cost or the most relevant revenue. The difference in the sum of relevant costs is either called incremental cost or net benefit. Consequently, the alternative with a favorable incremental cost (sometimes called net benefit) is the desirable alternative. Since this tool relies strictly on estimated costs/revenues and because the margin of error can be significant, different computations of incremental cost should be made based on different cost assumptions. Both optimistic and pessimistic arrays of cost data should be used. Incremental analysis is an ideal tool for what-if analysis. The basic problem with incremental analysis, as commonly used, is that the time period in which costs are incurred or revenue realized is usually ignored. Consequently, a major weakness of the technique is that the time value of money is not considered. Technically, there is a major different between two identical costs if one is incurred at the beginning of a period and the other is incurred at the end of the period. For many of the decisions listed above, the use of present value concepts may be appropriate. Therefore, The Management/Accounting Simulation incremental analysis software program that comes with the student software package is innovative in that it has present value and net-of-tax cash flow options. The use of present value with incremental analysis is discussed more in depth at the end of this chapter. Also, chapter 12 presents an in depth discussion of using present value in incremental analysis. Relevant and Irrelevant Costs The most important concept to understand in using incremental analysis is relevant costs. In any decision involving two alternatives, the irrelevant cost may always be ignored. Only relevant costs must be identified and included in the analysis. Relevant costs are often defined as follows: 1. Those future costs that will be different under available alternatives. 2. Those costs that would be changed by making the decision. 3. Costs that will be different between two alternatives. Management Accounting The key element in these definitions of relevant costs is that between the two alternatives each cost should be different in amount. Secondly, the cost must be a future cost. Historical costs, as will be explained, are always irrelevant and may be safely excluded from the analysis; To illustrate, suppose a company is about to make a decision to purchase six months of office supplies. The needed supplies can be purchased from supplier A for $5,000 and from Supplier B for $4,800. However, Supplier B is in another state and, if the purchase is made from supplier B, the company must pay freight in the amount of $300. Also, the company has $500 of supplies on hand. One approach is to include all costs including irrelevant costs: Supplier A ––––––––– Cost of supples to be purchased $5,000 Cost of supplies on hand 500 Freight ______ $5,500 ______ Supplier B ––––––––– $4,800 500 300 ______ $5,600 ______ Difference ––––––––– $200 -0(300) _____ ($100) _____ In the above analysis, the cost of supplies to be purchased is relevant because there is a difference of $200 in favor of buying from supplier B. The cost of supplies on hand is irrelevant for two reasons: (1) the cost is the same and (2) it is a past cost already made. Supplies on hand are not a future cost, even though it will be a future expense. Regardless from which supplier the supplies are purchased, the same amount of past supplies cost will appear as an operating expense in the future. In a similar manner, incremental revenue is the difference in future revenue that would result by choosing one alternative over another. Again, the revenue must be a future revenue and the revenue between the two choices must be different in amounts. To illustrate, assume that we have the opportunity to rent some unused office space for $500 a month to two prospective tenants, Tenant A and Tenant B. Prospective Tenant A is willing also to pay for an estimated utility bill of $50 per month but tenant B is not. Monthly rental revenue Payment of utilities Tenant A –––––––– $500 $ 50 ––––– $550 ––––– Tenant B –––––––– $500 0 ––––– $500 ––––– Difference ––––––––– $ 0 $ 50 ––––– $ 50 ––––– The above comparison of revenue clearly shows the monthly rental revenue of $500 to be irrelevant as to which tenant is accepted for occupancy because it is rent that is the same between both alternatives. The inclusion of the monthly revenue | 163 164 | CHAPTER NINE • Incremental Analysis and Decision-making Costs does not help make the decision; otherwise the amount is still important. However, the payment of utilities is clearly relevant because of the difference in willingness to pay between prospective tenant A and tenant B. The decision criterion when using incremental analysis is simply this: the alternative should be chosen that has the least total relevant cost or the greatest total relevant revenue. The key to using incremental analysis correctly is the ability to distinguish between relevant costs and revenues. Examples of relevant and irrelevant costs are the following: Relevant ––––––––– Future costs that are not the same Opportunity costs Trade-in allowance Cost of new assets Irrelevant –––––––––– Allocated fixed cost (e.q., depreciation) Future costs that are the same Historical costs (Sunk costs) Sunk Costs - Two costs that are often misunderstood or used incorrectly in incremental analysis are sunk costs and opportunity costs. Sunk costs are, first of all, always irrelevant costs. They maybe excluded in any analysis or cost comparison review. Sunk costs are historical costs; that is, past expenditures. Because they are expenditures already made the expenditure can not be changed. To incur or not incur is not an option now. Examples of a sunk cost are cost of fixed assets such as buildings or equipment. By the same token, depreciation is also a sunk cost. The book value of a fixed asset (cost - accumulated depreciation) is also a sunk cost. To illustrate, assume that an asset currently in use (old asset) has a book value of $1,000 and that this piece of equipment is tentatively under review for replacement. The purchase price of the new asset is $5,000 and is estimated to have a useful life of 10 years. The old asset can also last 10 years with some repairs now and then. The operating expenses of the old asset is now $800 per year but the new asset is projected to have only an operating expenses of $200 per year. The old asset has no trade-in value. The alternatives are to keep the old asset or to replace it. The replacement should take place if the relevant costs of replacing is less than the relevant costs of keeping. 10 Years Basis –––––––––––––– ––––––––––––––––– ––––––––– Keep Old Asset Purchase New Asset Difference Cost of new asset $ 5,000 ($5,000) Book value of old asset $ 1,000 1,000 0 Operating expenses $ 8,000 2,000 6,000 –––––– ––––––– –––––– $ 9,000 $ 8,000 $1,000 ––––––– –––––– –––––– The difference of $1,000 is a net benefit of purchasing and replacing the old asset with the new asset. However, since the book value of the old asset is shown in both columns and is, therefore, the same between both alternatives, the book value of the old asset is irrelevant. You may wonder how this is so? If the old asset is kept, then Management Accounting the book value of $1,000 will be shown on the books as depreciation cost over the remaining life of the old asset. If the new asset is purchased, then the book value of the old asset will be recorded as a $1,000 loss. In either event, an expense of $1,000 during the next 10 years will be recorded. Whether the old asset is replaced or not, the cost of the old asset results in a deduction from revenue in the same amount either as depreciation or a loss from the trade-in. Opportunity Costs - Opportunity costs are always relevant to making decisions; however, the concept of opportunity cost is somewhat abstract and difficult to understand because it is not an out-of-pocket cost. Following are some commonly used definitions of opportunity cost: 1. Earnings that would be realized if the available resources would be put to some other use. 2. Alternative earnings that might have been obtained if the productive good, service, or capacity had been applied to some other alternative use. The definition preferred in this chapter is the following: opportunity cost is the amount of revenue forgone (given up) by not choosing one alternative over another. The key word for understanding opportunity cost is not “cost” but “revenue forgone”. For example if you decide to take a vacation rather than invest $5,000 in a savings account that earns 6% per annum, then the opportunity cost is the interest you could have earned. At 6% interest you could have earned $300 for a full year. Therefore, the decision to take a vacation should include as a cost the interest that was not earned Other examples of opportunity cost may be given. If you have been given a choice of two jobs and job A pays $60,000 per year and job B pays $55,000 per year, then the opportunity cost of accepting job A is $55,000. Other things equal, you are only $5,000 better off financially with job A. If you own land that could be sold for $100,000 and the land is not now earning any income other than appreciation in value, then there is an opportunity cost of not earning interest. Assuming you could earn at a minimum 6% interest in a CD, the opportunity cost of keeping the land and not selling is $6,000 per year. Interest in the amount of $6,000 is being forgone each year in favor of the land appreciating in value. You own a building that you can easily rent for $10,000 a month. If you decide to use the building to open a business for yourself, then you incur an opportunity cost in the amount of $10,000, (rent given up, forgone, or sacrificed) by going into business. If you are a student and you spend 30 hours a week in class and in studying, there is an opportunity cost of being a student. The opportunity cost is the income you could be earning by working rather than attending class or studying. Fixed and Variable Costs - Costs in management accounting are often assumed to be either fixed or variable. The classification of a cost as either fixed or variable does not necessarily mean the cost is relevant or irrelevant. Whether a fixed cost or a variable cost is relevant or irrelevant depends on the whether the cost is different | 165 166 | CHAPTER NINE • Incremental Analysis and Decision-making Costs between the two alternatives. However, variable costs are always relevant, if there is a different in volume between the two alternatives. For example, assume that machine B is being considered to replace machine A and that the purchase of machine B would increase production capacity and also sales by 50%. If current production and sales is 1,000 units (full capacity) and selling price is $100, then production and sales would increase to1,500 units. Currently, cost of goods sold is $80 per unit. Based on these assumptions, the following analysis may be prepared: Machine A Machine B (Volume = 1,000) (Volume = 500) ––––––––––––– ––––––––––– Sales ($10,000) ($15,000) Cost of goods sold $ 8,000 $12,000 ––––––– –––––––– ($ 2,000) ($ 3,000) ––––––– –––––––– Difference (500) ––––––––– $5,000 ( $4,000) ––––––– $1,000 ––––––– Note: For simplistic purposes, the cost of machine B was ignored. However, in order to make the decision, the cost of machine B must be included as a relevant cost. In this particular case, both sales and cost of goods sold are relevant. However, had volume not been greater with the machine B, then sales and cost of goods sold would have been the same and, therefore, irrelevant. Then other cost or revenue factors would have had to be found to make the decision. Whether a fixed cost or variable cost is relevant then depends more on the circumstances than the nature of the cost. Incremental Analysis Model The basic incremental analysis model used in this program may be mathematically summarized as follows: IC i = = RCia - RCib - n - ∑RCia - ∑RCib 1,n relevant costs of alternative A relevant costs of alternative B number of relevant cost items Incremental analysis is a flexible tool. Data may computed and presented for the life of a decision alternative on a per period basis such as a month or year. This procedure would require the relevant cost items to be divided either by the number of years of the number of months in the life of the assets under consideration. Incremental analysis does not require that irrelevant data be included. However, at the option of the analyst irrelevant costs may be included. The inclusion of irrelevant data will in no way affect the ultimate decision. The action of classifying an expense as irrelevant or relevant does not mean that the irrelevant cost is not important. In fact, in the execution of the decision, it may be very important. To illustrate, assume that you are about to go to a movie and you are in the midst of choosing which movie theater to attend. You have narrowed your Management Accounting choices to movie A and movie B and you want to see the movie which will cost the least. You have made the following cost analysis: Movie A Movie B Difference ––––––– ––––––– ––––––––– Cost of popcorn $3.00 $3.50 ($ .50) Large drink $3.50 $4.25 ($ .75) Transportation cost $1.00 .75 $ .25 ––––– ––––– –––––– $7.50 $8.50 ($1.00) ––––– ––––– –––––– The net benefit of attending movie A is $1.00. The cost of tickets is $8.00, the same at each movie theater. Therefore, since the ticket cost is the same, you have correctly omitted this irrelevant cost from your analysis. Consequently, you decide in favor of movie A and you put $7.50 in your pocket. However, at this point taking only $7.50 would be a mistake since the total cost of attending movie A would be $15.50. The execution of the decision requires this amount. The cost of the tickets is only irrelevant in making the decision but not irrelevant in the execution of the decision. Use of Present Value in Incremental Analysis The above discussion of incremental analysis was based on the assumption that the timing of expenditures was not important and, therefore, can be ignored. In most instances, this is most likely true, however, there may be decisions where even though two alternatives involve identical future costs, the timing of when the expenditures are actually made is the important factor. The student software package for The Management/Accounting Simulation contains a set of management accounting tools. One of these tools is an incremental analysis tool that contains a present value option. When present value and net-of-tax options are selected, this program becomes a highly sophisticated tool requiring considerable skill to use. Each cost or revenue must be analyzed in terms of the following questions: 1. Does this cost affect both pre-tax net cash flow and taxable income? For example, a disallowed expense for tax purposes would affect pre-tax net cash flow but not taxable income. For example, the incurrence of a $200 disallowed expenditure for tax purposes would decrease pre-tax net cash flow. However this disallowance would not cause a change in taxable income. In other words, additional expenditures for disallowed tax deductions would not change taxable income. 2. Does this cost affect only taxable income? Some cost items such as depreciation or losses have no affect on pre-tax net cash flow. However, after-tax net cash flow is increased by such items. Also, tax credits affect net cash flow after-tax but not before. Items that affect only taxable income must be explicitly designated as having such affect. Since the present value calculations are always based on cash flows, then the tax treatment of cost items is critically important. Tax treatment of items can either | 167 168 | CHAPTER NINE • Incremental Analysis and Decision-making Costs increase or decrease the amount of cash after tax. The effect of taxes on cash flows and cash flows before and after taxes is discussed in chapter 12. The Keep or Replace Decision The keep or replace decision is very common in most businesses. Some examples of the keep or replace decision are the following: 1. Keep old car or replace with a new car 2. Keep old computer or buy a new computer 3. Keep old copy machine or buy a new copy machine 4. Keep old factory equipment or replace with new If replacements results in an substantial increase in net income immediately or within a few years, then replacement should be seriously considered and most likely made. In making this kind of decision, the following steps are involved: Step1 Obtain cost data for both the Keep Decision and the Replace Decision. a. Cost of old (book value) b. Cost of new equipment c. Trade-in allowance of old equipment d. Salvage value of new equipment e. Operating costs of old and new equipment Step 2 Prepare a work sheet with columns showing the relevant costs of the Keep decision and the Replace decision. Step 3 Compute incremental cost (sometimes called net benefit). Only relevant costs need be included in the analysis; however, no harm is done by including the irrelevant costs. The book value of the old asset is always irrelevant and may be excluded, if desired. Trade-in allowance is always relevant. The analysis may be made on a per year basis or a total years basis. If made on a per year basis, then the cost of the new asset must be divided by its useful life. An illustrative Example of the Keep or Replace Decision The K. L. Widget company is seriously contemplating replacing some old cutting department equipment with more modern and efficient equipment. The book value of the old equipment is $50,000. The new equipment, if purchased, will cost $100,000. A $10,000 trade-in allowance will be granted by the seller of the new equipment. The salvage value of the new equipment at the end of its life in 10 years is estimated to be $5,000. The salvage value of the old asset, if kept, is $2,000. The operating cost of the old equipment has been averaging around $13,000 per year. The new equipment is expected to reduce the operating cost to an average of $2,000 per year. The new equipment, if purchased, will be purchased totally on credit and the total amount of interest that would be paid in 10 years is approximately $25,000. Management Accounting One approach to using incremental analysis would be as follows: Total Life Basis (10 years) ––––––––––––––––––––––––––––––––––––– Keep Old Buy New Equipment Equipment Difference –––––––––––––––––– ––––––––– Cost of old equipment (book value) $50,000$50,000 0 Cost of new equipment$100,000($100,000) Trade-in allowance($10,000) $10,000 Salvage value ($2,000)($5,000) $3,000 Operating costs (total 10 years) $130,000$20,000 $10,000 Interest on loan$25,000($ 25,000) ––––––– –––––––– ––––––––– $178,000 $180,000 ($ 2,000) In the above example, notice that the book value of the old equipment was included. However, this cost may be excluded since it is irrelevant to the decision. In the above example: a. The relevant costs of keeping is $128,000. b. The relevant cost of buying new equipment is $130,000. c. The irrelevant cost included in both alternatives is $50,000 d. The net benefit or incremental cost of keeping the old equipment is $2,000. e. Sunk cost in the analysis is $50,000 (book value of old equipment). Suppose in the above example management had decided to use cash on hand to buy the new equipment. Would the answer be different concerning interest. No, if internal financing is used, then the opportunity cost of the on hand cash used must be included. Let us assume that the company can earn 6% interest. In this event, the interest given up or sacrificed would approximately be the same as the interest paid. Practical Applications of Incremental Analysis Incremental analysis is a practical and commonly used tool by both individuals and businesses regarding many different kinds of decisions. As individuals, we weigh the cost of many decisions such as what car to buy, whether or own a home or rent, and continue to paint our house or put on vinyl siding. The same is true in business. Incremental analysis is used in all functions of the business on a daily basis both formally and informally. The use of incremental analysis does not guarantee that the best decision has been made; However, it does provide a framework for organizing relevant data and looking at the decision to be made from a broader and more analytical perspective. Summary Incremental analysis can be a powerful tool in evaluating various type of decisions. Incremental analysis in a way of presenting relevant information in a direct comparison mode so as show the net benefit of making a particular decision. It is should be | 169 170 | CHAPTER NINE • Incremental Analysis and Decision-making Costs remembered that incremental analysis is no better than the quality of information available for analysis. Incremental analysis is a tool that focuses on certain basic concepts including the following: Incremental analysis Relevant and irrelevant costs Opportunity costs Sunk costs Depreciation Fixed and variable costs Direct and indirect Common costs Salvage value Trade-in allowance Net benefit It is important that accountants and management have a basic understanding of these concepts. Q. 9.1 Define the following terms: a. b. c. d. e. f. g. h. Relevant cost Irrelevant cost Incremental analysis Sunk cost Incremental cost Opportunity cost Direct cost Indirect cost Q. 9.2 Explain the steps in using incremental analysis. Q. 9.3 Give at least three examples of opportunity cost. Q. 9.4 Give several examples of sunk costs. Q. 9.5 Explain the difference between the majority and minority view of sunk costs. Q. 9.6 List at least eight types of decisions for which incremental analysis an appropriate tool. Q. 9.7 If new equipment is purchased, then the old equipment will be sold for $10,000 and a loss of $2,000 will in incurred. Is the loss a relevant cost? Is the proceeds from the sale of the old machine relevant? Q. 9.8 If a new territory is opened the company will use a warehouse in this territory that it owns. The company now receives annual rental revenue of $50,000. Is the rental value of the warehouse relevant or irrelevant? Why? Q. 9.9 Under what circumstances is it important to know the amount of irrelevant costs? Q. 9.10 Explain how the introduction of income taxes into the analysis can make a historical cost relevant. Management Accounting Exercise 9.1 • Matching of Cost Concepts and Costs Required: Match each cost with the appropriate cost. More than one cost concept may be applicable. Cost Concepts 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Inescapable Escapable Incremental Sunk Opportunity Variable Fixed Relevant Irrelevant Semi-variable Costs A. President’s salary B. Factory workers’ wages C. Installation cost of new machine D. Cost of old machine E. Monthly rental value of warehouse F. Repairs and maintenance Machine A $2,000 Machine B $2,000 G. Utilities Machine A $1,500 Machine B $2,000 Exercise 9.2 • Keep or Replace You have been provided the following keep or replace decision information: Old Machine New Machine Cost $50,000 $100,000 Salvage value $10,000 $ 5,000 Trade-in allowance $15,000 ––––– Remaining useful life10 years10 years Labor costs (annual) $20,000 $ 5,000 Repairs and maintenance $ 5,000 $ 6,000 Utilities $ 1,000 $ 2,000 Interest rate* - 6% * Assume installment financing and estimate interest by computing average size of loan over life of machine. Required: Determine whether or not the old machine should be replaced. _____________________________________________________________________ _____________________________________________________________________ _____________________________________________________________________ | 171 172 | CHAPTER NINE • Incremental Analysis and Decision-making Costs Exercise 9.3 • Own or Lease You have been provided the following information concerning a lease or own decisions. If equipment is owned: Purchase price of equipment Repairs and maintenance (monthly) Utilities (monthly) Interest on financing (annual) Useful life of equipment (years) If equipment is leased: Monthly lease payments Repairs and maintenance (Cost is included in lease agreement) Utilities (monthly) $50,000 $ 100 $ 200 $ 1,500 10 $ $ 600 150 Required: Determine which is more desirable, own or lease? Exercise 9.4 • Sell now or Process Further You have been provided the following information concerning the sell now or process further decisions. Current production method cost data: Selling price $ 20 Units manufactured 100 Production capacity (units) 150 Labor hours required (per unit) 2 Manufacturing costs: Material (per unit) Factory labor (per unit) Fixed manufacturing overhead Variable manufacturing cost (per hour) $ 1.00 $15.00 $ 5.00 $ .50 Costs of Additional Processing: Labor hours (per unit) 1.0 Labor rate (per hour) $ 7.50 New selling price $30.00 *If the additional processing is undertaken the variable manufacturing cost rate will remain the same. Required: Use incremental analysis to determine whether processing further should be undertaken. Management Accounting Problem 9.1 • Incremental Analysis Problem: Keep or Replace The vice president of finance for the Acme Manufacturing Company authorized the company’s management accountant to collect data pertaining to the purchase of new manufacturing equipment. If purchased, the new equipment will replace old equipment. The following information was obtained from various sources by the accountant: Old Equipment New Equipment ––––––––––––– –––––––––––––– Book value of old equip. $50,000 List price of new equipment $150,000 Life of equipment (years) 5 5 Trade-in allowance (old) $15,000 Operating expenses (per year) $50,000 $ 5,000 Salvage value (end of life) $ 5,000 $ 10,000 If purchased, a 10%,5 year installment loan will be obtained. Interest will be paid annually. Required: 1. What is the incremental cost (net benefit) of the replace decision (purchasing the new equipment?) $_ ______________________________________ 2. What is the total relevant cost of the keep decision? _ $_________________________________________________________ 3. What is the total relevant cost of the replace decision? _ $_________________________________________________________ 4. What amount of cost in this problem may be considered to be sunk cost? _ $_________________________________________________________ 5. Assume that the company’s marginal tax rate is 40%. What is the incremental cost on an after-tax basis? $ _ __________________________________________________________ _ __________________________________________________________ _ __________________________________________________________ _ __________________________________________________________ _ __________________________________________________________ | 173 174 | CHAPTER NINE • Incremental Analysis and Decision-making Costs Problem 9.2 Make or Buy The Acme Manufacturing Company manufactures a product which requires component X. However, a supplier has offered to sell component X at $4.00 per unit. Acme’s cost in manufacturing 1,000 units this past year was reported by the management accountant as follows: Material $ 2,000 Insurance $200 Direct labor $ 1,000 Power and lights $500 Indirect labor $ 500 Depreciation (bldg.) $400 Gen. & admin. sal. $ 500 Note: all costs are presented on a per year basis. If the component is purchased, then material, direct labor, and indirect labor costs would be eliminated. Insurance and power and lights would be reduced by $50 and $100 respectively. General and administrative salaries would not change. The building in which component X is now manufactured can be leased for $1,000. Required: 1. What is the incremental cost if component X is purchased? $ ___________________________________________________ 2. What is the total relevant cost of the make decision? $ _ __________________________________________________ 3. What is the total relevant cost of the purchase decision? $ _ __________________________________________________ 4. What is the amount of the opportunity cost? $ ___________________ _ _____________________________________________________ 5. What is the total amount of escapable cost? $_ __________________ 6. What is the amount of opportunity cost in this analysis? $____________________________________________________ _____________________________________________________