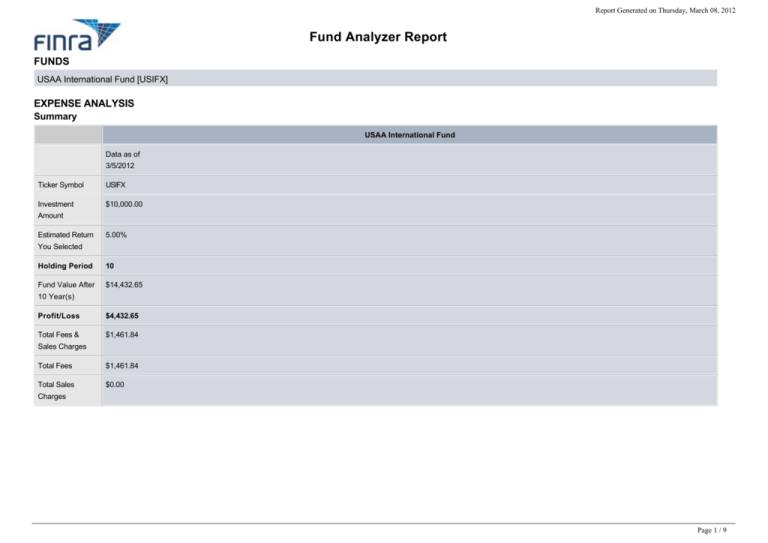

USAA International

advertisement

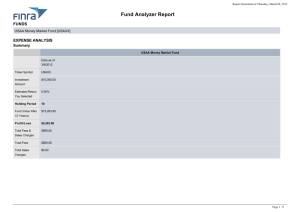

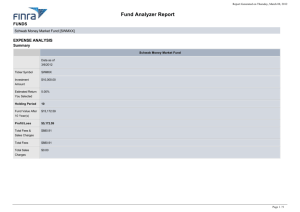

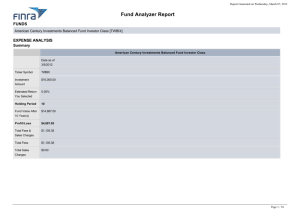

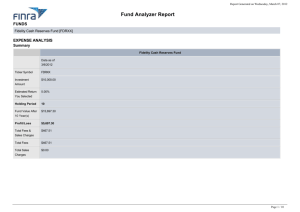

Report Generated on Thursday, March 08, 2012 Fund Analyzer Report FUNDS USAA International Fund [USIFX] EXPENSE ANALYSIS Summary USAA International Fund Data as of 3/5/2012 Ticker Symbol USIFX Investment $10,000.00 Amount Estimated Return 5.00% You Selected Holding Period 10 Fund Value After $14,432.65 10 Year(s) Profit/Loss $4,432.65 Total Fees & $1,461.84 Sales Charges Total Fees $1,461.84 Total Sales $0.00 Charges Page 1 / 9 Chart Page 2 / 9 Chart Details USAA International Fund Year Redeemed Value Profit/Loss Fees & Expenses 1 $10,373.72 $373.72 $123.25 2 $10,761.41 $761.41 $251.10 3 $11,163.59 $1,163.59 $383.74 4 $11,580.80 $1,580.80 $521.33 5 $12,013.60 $2,013.60 $664.06 6 $12,462.57 $2,462.57 $812.13 7 $12,928.32 $2,928.32 $965.73 8 $13,411.48 $3,411.48 $1,125.07 9 $13,912.70 $3,912.70 $1,290.36 10 Year(s) $14,432.65 $4,432.65 $1,461.84 11 $14,972.03 $4,972.03 $1,639.72 12 $15,531.56 $5,531.56 $1,824.25 13 $16,112.01 $6,112.01 $2,015.67 14 $16,714.15 $6,714.15 $2,214.25 15 $17,338.80 $7,338.80 $2,420.25 16 $17,986.79 $7,986.79 $2,633.95 17 $18,658.99 $8,658.99 $2,855.64 18 $19,356.32 $9,356.32 $3,085.61 19 $20,079.71 $10,079.71 $3,324.17 20 $20,830.13 $10,830.13 $3,571.65 Page 3 / 9 Annual Expense Comparison by Product and Share Class Annual Operating USAA International Fund 1.21% Expenses Prospectus Less than Average of Similar Foreign Stock Mutual Funds: 1.26% (77 Mutual Funds) Objective Morningstar Greater than Average of Similar Foreign Large Growth Mutual Funds: 1.11% (13 Mutual Funds) Category Morningstar Greater than Average of Similar Morningstar 3 Star-Rated (3-year) Mutual Funds: 0.97% (455 Mutual Funds) Rating (3-year) Page 4 / 9 Fund Details Investment USAA International Fund Foreign Stock Objective Ticker Symbol USIFX Class No Load Fund Classification Open-End Mutual Fund Morningstar Rating (3-year) Morningstar Style Box (Equities) Morningstar Style n/a Box (Bonds) Fund Phone Number 800-531-8722 Fund Web Site www.usaa.com Fund Documents View Prospectus Minimum Initial $3,000.00 Purchase Average Annual -2.57% Return: 1 Year Average Annual 0.37% Return: 5 Year Average Annual 7.94% Return: 10 Year Average Annual 7.50% Return: Page 5 / 9 Since Inception Convertible Share No - Fund does not convert Class Annual Operating 1.21% Expenses Sales Charge This fund does not have front-end sales charges Schedule (Front-End Load) or (Breakpoints) Contingent Deferred This fund does not have CDSC or back-end sales charges Sales Charges: (CDSC or Back-End Load) Redemption Fee This fund does not have redemption fees Schedule Page 6 / 9 FEE/DISCOUNT REPORT USAA International Fund [USIFX] Information has not been provided by the fund company. Please review the fund's prospectus or contact the fund company. Load Type Load Type Breakpoint Schedule ROA ROA Allowed ROA Inclusion ROA Allowed Across Brokers ROA by Relative ROA Calculation Methodology Front Load NAV Purchase Eligible for ROA LOI LOI Allowed LOI Minimum LOI Fulfillment Period LOI Fulfillment Calculation Methodology Front Load NAV Purchases Eligible for LOI? Retroactive LOI Allowed Retroactive LOI Period Sales Charge Waivers Page 7 / 9 NAV Repurchase Allowed NAV Repurchase Period Account Rules for NAV Repurchase Employee Purchase at NAV NAV Purchase if Wrap or Feebased Account Distribution Reinvestment CDSC CDSC Schedule CDSC Time Calculation Method CDSC Fee Calculation Method CDSC Waivers 12B-1 Fees Post Agreement Rate Redemption Fees Short-term trading redemption fee Short-term trading redemption fee waivers Other Redemption/Exchange Fees Page 8 / 9 Important: The Fund Analyzer was designed to help investors evaluate and compare investments in mutual funds, ETFs and ETNs. While it is a helpful tool, you should understand its limitations. The results generated by the Fund Analyzer are hypothetical. The Analyzer assumes that returns and expenses remain the same each year. Because returns and expenses vary over time, your results will be higher or lower than those shown. Sales loads do not apply to reinvested mutual fund dividends and other distributions, and the results reflect this fact. However, the results do not reflect the application of other fees that may apply, such as ETF commissions, exchange fees, or account maintenance fees. Had these fees been considered, your costs would be higher and account values lower. Results also do not reflect all the opportunities for waivers or discounts on sales charges on load funds. These waivers or discounts may be based on, for example, letters of intent, rights of accumulation, reinstatements or NAV transfer programs. If you are entitled to them, you should take them into account when estimating your actual expenses. Remember that selecting a fund involves more than just comparing fund expenses and fees. You should read a fund’s prospectus carefully before investing to learn about the fund’s investment objective, strategies, risks, and the taxes you may have to pay when you receive a distribution. As with any investment, make sure a fund’s objectives and goals are consistent with your own and assess how it will impact the diversification of your portfolio. Breakpoints: Mutual funds with front-end loads or sales charges enable you to reduce front-end charges as the amount of your investment increases to certain levels called “breakpoints.” While breakpoints vary from fund to fund, based on the investment amount you entered, you may be at or near a breakpoint. Please see the Fund Details report for additional details or if additional breakpoints will reduce the front-end sales charge further. For more information on breakpoints, please read our Investor Alert — Mutual Fund Breakpoints: A Break Worth Taking Brokers: The Fund Analyzer does not satisfy a broker’s obligation to assess the suitability of a particular investment for a particular investor. Brokers also are encouraged to review finra.org’s publications that outline a broker’s obligation to deliver breakpoint discounts, including Notice to Members 02-85 and FINRA’s online Webcast, “Mutual Funds: Share Classes & Breakpoint Discounts.” We hope you find our Fund Analyzer helpful. If you have any questions or ideas about how we can improve this tool, please email us. Data Services Provided By: Calculation Methods and Accuracy Audited By: Page 9 / 9