meet stern's new dean

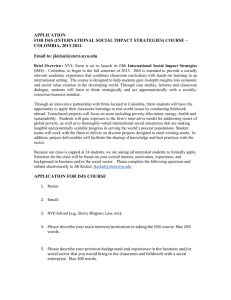

advertisement