FINRA FundAnalyzer Report

advertisement

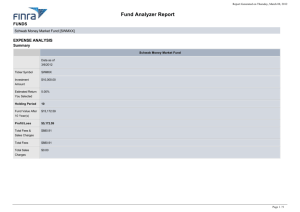

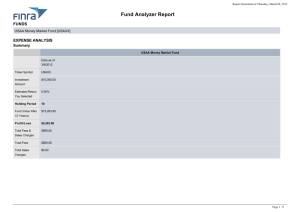

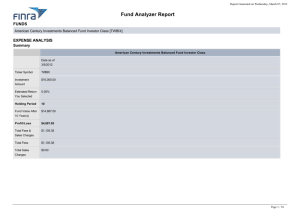

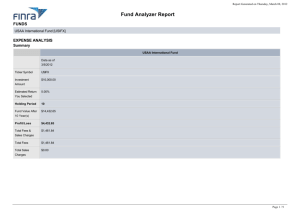

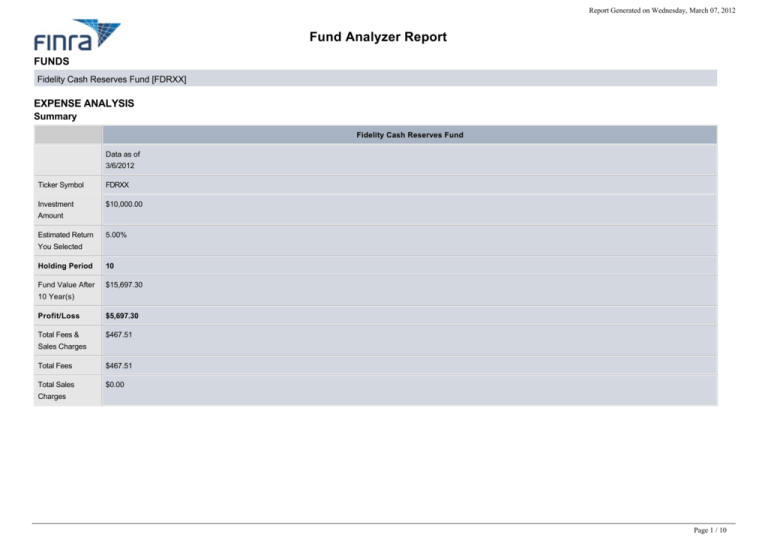

Report Generated on Wednesday, March 07, 2012 Fund Analyzer Report FUNDS Fidelity Cash Reserves Fund [FDRXX] EXPENSE ANALYSIS Summary Fidelity Cash Reserves Fund Data as of 3/6/2012 Ticker Symbol FDRXX Investment $10,000.00 Amount Estimated Return 5.00% You Selected Holding Period 10 Fund Value After $15,697.30 10 Year(s) Profit/Loss $5,697.30 Total Fees & $467.51 Sales Charges Total Fees $467.51 Total Sales $0.00 Charges Page 1 / 10 Chart Page 2 / 10 Chart Details Fidelity Cash Reserves Fund Year Redeemed Value Profit/Loss Fees & Expenses 1 $10,461.22 $461.22 $37.85 2 $10,943.72 $943.72 $77.44 3 $11,448.47 $1,448.47 $118.86 4 $11,976.50 $1,976.50 $162.19 5 $12,528.89 $2,528.89 $207.52 6 $13,106.75 $3,106.75 $254.93 7 $13,711.27 $3,711.27 $304.54 8 $14,343.66 $4,343.66 $356.43 9 $15,005.23 $5,005.23 $410.72 10 Year(s) $15,697.30 $5,697.30 $467.51 11 $16,421.30 $6,421.30 $526.92 12 $17,178.69 $7,178.69 $589.07 13 $17,971.02 $7,971.02 $654.08 14 $18,799.88 $8,799.88 $722.10 15 $19,666.98 $9,666.98 $793.25 16 $20,574.07 $10,574.07 $867.68 17 $21,522.99 $11,522.99 $945.55 18 $22,515.68 $12,515.68 $1,027.01 19 $23,554.16 $13,554.16 $1,112.22 20 $24,640.54 $14,640.54 $1,201.37 Page 3 / 10 Annual Expense Comparison by Product and Share Class Annual Operating Fidelity Cash Reserves Fund 0.37% Expenses Prospectus n/a Objective Morningstar n/a Category Morningstar n/a Rating (3-year) Page 4 / 10 Fund Details Investment Fidelity Cash Reserves Fund Money Mkt - Taxable Objective Ticker Symbol FDRXX Class n/a Fund Classification Money Market Fund Morningstar Rating n/a (3-year) Morningstar Style n/a Box (Equities) Morningstar Style n/a Box (Bonds) Fund Phone Number n/a Fund Web Site www.fidelity.com Fund Documents View Prospectus Minimum Initial $0.00 Purchase Average Annual n/a Return: 1 Year Average Annual n/a Return: 5 Year Average Annual n/a Return: 10 Year Average Annual n/a Return: Since Inception Convertible Share No - Fund does not convert Class Annual Operating 0.37% Expenses Sales Charge This fund does not have front-end sales charges Page 5 / 10 Schedule (Front-End Load) or (Breakpoints) Contingent Deferred This fund does not have CDSC or back-end sales charges Sales Charges: (CDSC or Back-End Load) Redemption Fee This fund does not have redemption fees Schedule Page 6 / 10 FEE/DISCOUNT REPORT Fidelity Cash Reserves Fund [FDRXX] Data as of 2/21/2012 Load Type Load Type No Load Breakpoint Schedule Breakpoint schedules do not apply for this fund ROA ROA Allowed No ROA Inclusion This fund is not included in ROA calculations ROA Allowed Not Applicable Across Brokers ROA by Relative Not Applicable ROA Calculation Not Applicable Methodology Front Load NAV Not Applicable Purchase Eligible for ROA LOI LOI Allowed No Not Applicable LOI Minimum LOI Fulfillment Not Applicable Period LOI Fulfillment Not Applicable Calculation Methodology Front Load NAV Not Applicable Purchases Eligible for LOI? Page 7 / 10 Retroactive LOI Not Applicable Allowed Retroactive LOI Unable to display value Period Sales Charge Waivers NAV Repurchase No Allowed NAV Repurchase Not Applicable Period Not Applicable Account Rules for NAV Repurchase Employee No Purchase at NAV NAV Purchase if No Wrap or Feebased Account Distribution Distributions can be automatically reinvested (same fund or across funds in same family)- sales charges do not apply Reinvestment CDSC CDSC Schedule CDSCs do not apply for this fund CDSC Time Not Applicable Calculation Method CDSC Fee Not Applicable Calculation Method CDSC Waivers Not Applicable 12B-1 Fees Post Agreement 12B-1 fees do not apply for this fund Rate Redemption Fees Short-term trading No short-term trading fees apply Page 8 / 10 redemption fee Short-term trading Not Applicable redemption fee waivers Other No non-short-term redemption fees Redemption/Exchange Fees No exchange fees Page 9 / 10 Important: The Fund Analyzer was designed to help investors evaluate and compare investments in mutual funds, ETFs and ETNs. While it is a helpful tool, you should understand its limitations. The results generated by the Fund Analyzer are hypothetical. The Analyzer assumes that returns and expenses remain the same each year. Because returns and expenses vary over time, your results will be higher or lower than those shown. Sales loads do not apply to reinvested mutual fund dividends and other distributions, and the results reflect this fact. However, the results do not reflect the application of other fees that may apply, such as ETF commissions, exchange fees, or account maintenance fees. Had these fees been considered, your costs would be higher and account values lower. Results also do not reflect all the opportunities for waivers or discounts on sales charges on load funds. These waivers or discounts may be based on, for example, letters of intent, rights of accumulation, reinstatements or NAV transfer programs. If you are entitled to them, you should take them into account when estimating your actual expenses. Remember that selecting a fund involves more than just comparing fund expenses and fees. You should read a fund’s prospectus carefully before investing to learn about the fund’s investment objective, strategies, risks, and the taxes you may have to pay when you receive a distribution. As with any investment, make sure a fund’s objectives and goals are consistent with your own and assess how it will impact the diversification of your portfolio. Breakpoints: Mutual funds with front-end loads or sales charges enable you to reduce front-end charges as the amount of your investment increases to certain levels called “breakpoints.” While breakpoints vary from fund to fund, based on the investment amount you entered, you may be at or near a breakpoint. Please see the Fund Details report for additional details or if additional breakpoints will reduce the front-end sales charge further. For more information on breakpoints, please read our Investor Alert — Mutual Fund Breakpoints: A Break Worth Taking Brokers: The Fund Analyzer does not satisfy a broker’s obligation to assess the suitability of a particular investment for a particular investor. Brokers also are encouraged to review finra.org’s publications that outline a broker’s obligation to deliver breakpoint discounts, including Notice to Members 02-85 and FINRA’s online Webcast, “Mutual Funds: Share Classes & Breakpoint Discounts.” We hope you find our Fund Analyzer helpful. If you have any questions or ideas about how we can improve this tool, please email us. Data Services Provided By: Calculation Methods and Accuracy Audited By: Page 10 / 10