Chapter 10-Financial Accounting Research

advertisement

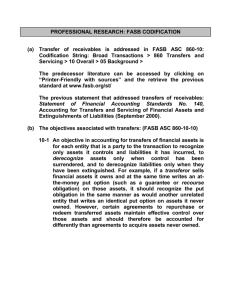

Federal Tax Research, Ninth Edition Page 10-1 Chapter 10-Financial Accounting Research ACCOUNTING FOR INCOME TAXES 1. Increasingly, tax professionals are finding that an understanding of financial accounting for income taxes is a required competency. 2. In order to determine the amount of tax expense reflected in the financial statements, tax professionals need to be capable of identifying both the tax treatment as well as the financial accounting treatment of transactions. THE FASB CODIFICATION 1. The Codification is the single source of authoritative U.S. GAAP for private companies. (In addition to the authoritative pronouncements in the Codification, the SEC and other bodies continue to issue regulations and laws applying to public companies). 2. FASB’s Accounting Standards Codification Research System (CRS) is based on topical areas rather than a standard’s based model of organization previously used. Each area represents a broad category of related guidance such as “Assets.” Areas are broken into topics, subtopics, sections and subsections. 3. The CRS can be browsed by topical area, or searched using the text search feature or by citation. OTHER SERVICES The CCH Accounting Research Manager (ARM) and RIA Financial Reporting Manager provide online databases that provide access to accounting, auditing, governmental and SEC authoritative literature as well as the FASB Codification. SUMMARY Tax professionals need an understanding of how to research not only the tax law but also financial accounting rules related to businesses. This chapter provides an overview of accounting for income taxes as well as a detailed description of the content, structure and use of the FASB Accounting Standards Codification System.