Do government purchases affect unemployment?

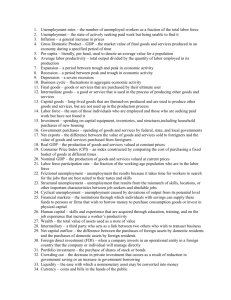

advertisement