Reference Prices as Determinants of Business‐to‐Business Price

advertisement

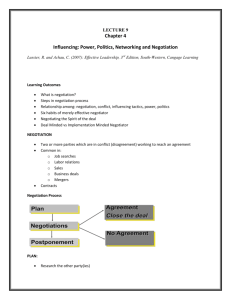

REFERENCE PRICES AS DETERMINANTS OF BUSINESSTO-BUSINESS PRICE NEGOTIATION OUTCOMES: AN EMPIRICAL PERSPECTIVE FROM THE CHEMICAL INDUSTRY DIRK C. MOOSMAYER RWTH Aachen University BJOERN SCHUPPAR Schuppar Consulting Ltd & Co KG FLORIAN U. SIEMS RWTH Aachen University Price negotiations in supply chain relationships often take place during annual pricing reviews. This study integrates transaction cost economics and reference price thinking from consumer behavior to understand better how a seller’s reservation price, aspiration price, and initial price offering might influence the ultimate settlement price. We apply ridge regression to negotiation data from 282 business relationships of a German chemicals supplier with customers in six client industries. Overall, the three determinants explain 86 percent of the variation in the settlement price. A seller’s reservation price is substantially less important than the aspiration price or the initial price offering. Although this outcome can be explained via a reference price perspective, transaction cost economics theory helps clarify the industry differences that determine the impact of reservation prices and initial price offerings on settlement prices. Keywords: business-to-business marketing; negotiation; buyer/supplier relationships; ridge regression; transaction cost economics INTRODUCTION Price negotiations in business relationships provide an opportunity to adjust prices to recent changes in material and process costs, as well as realize loyalty premiums. However, literature that approaches price negotiation from a supply chain management (SCM) perspective has been scarce and dispersed (Zachariassen 2008). Existing frameworks and models are mainly rooted in neoclassical thinking and transaction cost economics (TCE), neglecting a potential psychological perspective (Carter, Kaufmann and Michel 2007). Moreover, student experiments in the psychological negotiation domain (Krause, Terpend and Petersen 2006) require particular attention to internal validity (Bachrach and Bendoly 2011; Eckerd and Bendoly 2011) and may be limited in their external validity (Ste- 92 vens 2011). Finally, empirical approaches that use mail surveys in the SCM domain are likely to produce less innovative insights (Carter and Ellram 2003). To overcome these shortcomings, we integrate a TCE perspective with the reference price concept that is common in consumer behavior research and thus pursue a better understanding of price negotiations in supply chain relationships. With industrial price negotiation data from the chemical industry, we also overcome some methodological shortcomings of existing studies. In particular, we seek to understand how three reference prices — reservation, aspiration and initial price offering — influence the settlement price ultimately achieved in a negotiation. We begin by drawing on a TCE perspective on business relationships, then discuss negotiations in the Volume 48, Number 1 B2B Price Negotiation Outcomes supply chain. Thereafter, we explain adaption-level theory and prospect theory, which are common inputs to consumer-oriented reference price research, and use them to model the settlement price of price negotiations in a SCM context. To test our proposed model, we use price negotiation data obtained from salespeople at a German chemical producer. In discussing the results and relating them back to TCE and psychological negotiation literature, we derive implications for researchers and industrial sellers and buyers. PERSPECTIVES ON PRICE NEGOTIATIONS IN A SUPPLY CHAIN CONTEXT A Transaction Cost Perspective on Business Relationships A common method to investigate and explain business exchange relationships is TCE (e.g., Williamson 1996, 2008; Joshi and Stump 1999), which reflects the assumption that production costs are not influenced by the organization of the exchange (Williamson 1996). Accordingly, transaction costs, which result from preparing, negotiating and realizing a transaction, are the main unit of analysis. A transaction takes place if its transaction cost is lower than that of any alternative transaction (van Hoek 2000). In this context, a transaction’s asset specificity, uncertainty and frequency are relevant cost drivers (Ellram 1991). Asset specificity refers to the extent to which investments made to support a transaction have more value for that specific transaction than they would if used elsewhere (Lonsdale 2001). On the one hand, asset specificity constitutes the basis of cost advantages that result from joint action. On the other hand, it can lead to lock-in and operational and fiscal hostage taking. We reconsider this aspect carefully in the discussion section. Uncertainty results from “[un]anticipated environmental changes [that] consist of two types: changes in market factors (such as price) that impact demand or changes in technology” (McNally and Griffin 2004, p. 7). With regard to technological development and market factors, uncertainty provides the basis for regular renegotiations of specified transactions in a continuous relationship. We account for it in our basic approach of investigating annual pricing reviews. Finally, frequency describes the extent to which transactions are repeated on a regular basis, because “preserving continuity between a particular buyer–seller pair is the source of added value” in supply chains (Williamson 2008, p. 5). Transaction frequency offers a basic rationale for continuous business relationships and is thus inherent to our conceptual and empirical perspective. With increasing asset specificity, uncertainty and frequency, transaction partners likely begin to integrate their solution developments and implement joint activities. Williamson (1975, 2008) describes a path, from a simple market exchange to hybrid contracting to a hierarchy. If we consider annual price renegotiations in business-to-business (B2B) relationships, transactions represent hybrid contracting: The products are more specific than simple commodities, yet the degree of integration is not as strong as it would be in a hierarchy. Some transactions may be based on substantial regular basis (Schuppar 2006), but the partners’ positions are still distinct enough to require renegotiations on a regular basis. In previous SCM research, TCE has appeared in various applications with widespread empirical support, within and across diverse industries (Shelanski and Klein 1995; Rindfleisch and Heide 1997; Grover and Malhotra 2003; McNally and Griffin 2004; Halldórsson and Skjøtt-Larsen 2006). For example, by surveying 126 company representatives across different industries and cross-functionally, McNally and Griffin (2004) investigate joint action, or the act of contracting solutions instead of making one’s own. Although their results fail to attain some significance thresholds, they find that asset specificity, behavioral uncertainty and demand uncertainty are associated negatively with buying and positively with joint action. Moreover, relationship-oriented versus priceoriented compensation increases support for joint action. The basic rationale for moving from sourcing and selling in a free, unassisted market to hybrid contracting assumes that buyers and suppliers agree on a broader exchange of information based on credible commitments. Accordingly, a supplier would charge lower prices than in a free market (see arrow 1a in Figure 1), because all measures undertaken to fulfill demand, such as buying a new machine, have more time to amortize. In addition, buyers could pay prices higher than in the free unassisted market (see arrow 1b in Figure 1), because they do not need to provide safeguards to suppliers and because they avoid future search costs. These win–win relationships result in a larger negotiation space, determined by the buyer’s and seller’s reservation prices (Walton and McKersie 1965; Raiffa 1982; White, Valley, Bazerman, Neale and Peck 1994) that is called the bargaining zone. The bargaining zone also describes a transaction’s margin, which the parties distribute between themselves. In price negotiations, each party aims to increase its share of this margin (see arrow 2 in Figure 1). Negotiations in a B2B Context The tension between free market competition and collaborative joint action, inherent to TCE thinking, is also reflected in the general negotiation literature. January 2012 93 Journal of Supply Chain Management FIGURE 1 Reference Prices and Bargaining Zone (Stereotypical) 2a Seller negotiates for higher prices 1a Joint activity decreases seller’s reservation price Seller’s Initial Price Offering Seller’s Aspiration Price Seller’s Reservation Price $ or percentage price increase 0 Bargaining Zone $ or percentage price increase 0 Buyer’s Aspiration Price Buyer’s Reservation Price 2b Buyer negotiates for lower prices In negotiations, parties with (some) opposing interests make a joint business decision, often to purchase a certain amount of a specifiable product or service at a specifiable price. Integrative approaches that focus on joint outcomes thus can be contrasted with distributive approaches that aim to maximize individual outcomes (Lewicki, Saunders and Minton 2000). Integrative negotiations “bring two or more parties together to try to accomplish mutually beneficial outcomes, while meeting individual goals that may be at odds with the other negotiating parties’ goals” (Swaidan 2007, p. 163). In contrast, distributive negotiations are more competitive, involving “a process of potentially opportunistic interaction by which two or more parties, with some apparent conflict, seek to do better through jointly decided action than they could otherwise” (Lax and Sebenius 1986, p. 11). Ramsay (2004) empirically finds that most negotiations are distributive and ignore the potential for improved business processes that ultimately would lead to more profit through integrative negotiations. Similarly, Smeltzer, Manship and Rossetti (2003) find that integrative sourcing strategies rarely lead to integrative negotiations but rather produce negotiations that focus on optimizing the share of an outcome’s distribution. In contrast, conventional wisdom often assumes the strategies to be mutually exclusive (Walton and McKersie 1965), because integrative negotiations require information disclosure, whereas distributive negotiations build on informational differences. In this context, it appears valuable to separate sourcing from price negotiation. In line with TCE, we assume that business partners can pursue an integrated sourcing strategy. By defining more efficient sourcing processes, they reduce transaction costs and increase the bargaining zone. However, unlike Walton and McKersie (1965), we also assume that integrative sourcing 94 Joint activity 1b increases buyer’s reservation price strategies may coexist with distributive price negotiation strategies, within a single business relationship. In hybrid contracting relationships in particular (Williamson 2008), elements of more distributive market transactions integrate with features of more integrative joint actions. On the basis of in-depth interviews with key accounts, Zachariassen (2008) has suggested a matrix of sourcing strategies (arm’s-length versus partnership) and negotiation strategies (distributive versus integrative), in which he describes distributive negotiations in long-term partnerships as “manipulations,” such that negotiators apply partnership terminology (e.g. trust, mutual understanding) to obscure their distributive aims. Beyond these general negotiation strategies, SCMbased negotiation research sheds some light on other, diverse perspectives. Some studies at the relationship level investigate power (e.g., McHugh, Humphreys and McIvor 2003) and trust (e.g., Zaheer, McEvily and Perrone 1998). Others address the system level of business negotiations to consider communication (Karkkainen, Laukkanen, Sarpola and Kemppainen 2007) and price-building mechanisms, such as when Schoenherr and Mabert (2007) note bundling in bidding processes or Kaufmann and Carter (2004) study reverse auctions. Yeniyurt, Watson, Carter and Stevens (2011) add influences on an individual level to their study of electronic reverse auctions and find that the supplier’s need for cognition is associated negatively, whereas the number of prior auction failures and experience in the current auction (total bids and relative rank of the latest bid) are associated positively with suppliers’ propensity to continue bidding. Furthermore, Rinehart and Closs (1991) investigate purchasers’ personality as an individual influence. In their experimental approach, Wilken, Cornelissen, Backhaus and Schmitz (2010) include 119 student dyads and Volume 48, Number 1 B2B Price Negotiation Outcomes 41 key account manager dyads to explore the influence of cost information on sales managers’ negotiation behavior and negotiation outcomes: Full cost, rather than direct cost information increases sellers’ reference prices and leads to increased settlement prices. By focusing on the costs as determinants of prices, this study links to existing economic perspectives (e.g., Nash 1950, 1953; Tversky and Kahneman 1991) and the TCE perspective in particular. We integrate the TCE perspective with influences of individual price perceptions on the individual psychological level (e.g., Tversky and Kahneman 1981; Oliver, Balakrishnan and Barry 1994; Barry and Oliver 1996; Brenner, Koehler, Liberman and Tversky 1996), which makes Krause et al.’s (2006) insights into negotiation partners’ reservation prices, aspirational prices and initial price offerings of particular interest: In an experimental setting with 128 student teams, they find that the initial price offering has the strongest influence on settlement prices. We elaborate conceptually on this perspective by detailing the reference price concept from the consumer behavior domain, together with two of its dominant underlying theories. Reference Price Research A reference price is an individual price norm, applied when the person judges a price in the market (e.g., Winer 1986, 1988). A reference price may have a normative and predictive function (e.g., Rajendran and Tellis 1994; Kalyanaram and Winer 1995). Reference prices can explain consumer brand choice and reveal how consumer price perceptions may develop during and after a purchase. They commonly are differentiated by their sources, whether internal (i.e., derived from the mind and based on prior experience) or external (i.e., observed in a decision-making situation) (Mazumdar, Raj and Sinha 2005). Moreover, the reference price concept appears both in B2B marketing applications (e.g., Wilken et al. 2010) and beyond, such as in accounting (Mitter and Siems 2008) and human resource management (Siems, Goelzner and Moosmayer in press). Conceptually, reference prices are associated with expectations of acceptable adaptation levels (Monroe 1973) and aspiration perspectives (Klein and Oglethorpe 1987). Often applied to the domain of behavioral pricing (e.g., O’Neill and Lambert 2001), two social psychological theories appear of particular relevance in this context: adaption-level theory and prospect theory. The former assumes that judgments of perceived stimuli (e.g., observed prices) are based on a comparison of the stimuli with an internal adaption level that reflects recent experiences (Helson 1964). In the consumer domain, the prices last paid for a product, or internal memory-based references, constitute the dom- inant adaption levels (Winer 1986; Urbany, Bearden and Weilbaker 1988; Kalwani, Yim, Rinne and Sugita 1990; Kalwani and Yim 1992; Putler 1992; Greenleaf 1995; Kalyanaram and Winer 1995). For infrequently purchased products, external references, such as the prices paid by friends or recently observed during an active price search, gain more importance. In contrast, prospect theory (Kahneman and Tversky 1979) models the utility of a transaction as the sum of gains and losses, compared against a reference point, in which loss aversion leads to the overweighting of losses compared with gains of equal size. Prospect theory further assumes decreasing sensitivity, with increasing deviation of observed prices from references. Furthermore, reference prices and their framing have relevance for price negotiation outcomes (Bazerman, Magliozzi and Neale 1985; Nagel and Mills 1989; Wilken et al. 2010). The most important references are the negotiator’s reservation price, the aspiration price and the initial price offering, as we discuss further in the following section. MODEL DEVELOPMENT With our proposed model, we aim to explain the settlement price reached in price negotiations in continuous B2B relationships. Because the references possessed by a transaction partner usually are inaccessible to a negotiator, we focus on the seller’s reference points, without considering the buyer’s references. We also assume a hybrid contracting context, including a continuous relationship and somewhat customized products. We therefore investigate the percentage price change, compared with the current price. In our study context, the seller approaches the buyer with a prepared initial price offering during an annual pricing review. Influence of Reservation Price on Settlement Price The reservation price is the lowest price at which a seller is willing to sell. It is internal, so buyers and sellers know their own but rarely can access their partner’s. Some studies identify reservation prices as important determinants of settlement price (e.g., White et al. 1994; Kristensen and Gaerling 1997a), and they derive from two main sources: a company’s marginal production cost (Wilken et al. 2010) and its selling or sourcing alternatives (e.g., Wang and Zionts 2008). Such alternatives include the so-called best alternative to a negotiated agreement (Fisher and Ury 1981) or the market price, in the case of less specific products (White et al. 1994; Blount White, Thomas-Hunt and Neale 1996; Kristensen and Gaerling 1997b). Though internal to the seller, the reservation price is strongly influenced by aspects beyond the negotiator’s January 2012 95 Journal of Supply Chain Management control, such as the company’s cost base. Therefore, TCE predicts benefits of hybrid contracting agreements, which implicitly assume that cost changes allow renegotiations and can be shared. Nash (1950, 1953) also theorizes that negotiators settle somewhere in between both parties’ reservation prices, according to the so-called Nash equilibrium. Cost increases and related changes in reservation prices ceteris paribus result in a settlement price increase of half the change in the reservation price. Despite some support for the Nash equilibrium (e.g., White et al. 1994), the assumption of equal cost sharing by both negotiating partners may be overstated (e.g., Neale and Bazerman 1991, 1992). We thus model a positive influence of the reservation price on the settlement price and reconsider the degree of its impact. Influence of Aspiration Price on Settlement Price The aspiration price represents the best settlement a buyer or a seller can expect to achieve (Walton and McKersie 1965; Zetik and Stuhlmacher 2002), or the seller’s price target, which is an internal reference. But Kristensen and Gaerling (1997a) propose that a party’s aspiration price also reflects its estimate of its partner’s reservation price. A negotiator thus attempts to achieve the price at which the counterpart is still willing to contract. Sellers judge buyers’ counteroffers primarily in comparison with their aspiration price. In applying prospect theory (Kahneman and Tversky 1979), we predict that any price below the aspiration price prompts loss perceptions, whereas prices above that level indicate gains. Recall that losses are systematically overweighed (Skowronski and Carlston 1987; Baumeister, Bratslavsky, Finkenauer and Vohs 2001). Therefore, any price below the aspiration price should cause dissatisfaction and invoke efforts by the seller to move the price closer to its aspiration price. In contrast, prices above the negotiator’s aspiration price are gains and do not merit aggressive tactics. Accordingly, higher aspiration prices should result in higher settlement prices, in line with findings that show that negotiators with higher goals or aspiration prices achieve higher settlement prices (Pruitt 1981; Huber and Neale 1986, 1987; White and Neale 1994; Lim 1997). The asymmetric effort exerted to defend this reference price should lead settlement prices to move toward the reference price, such that this determinant should have a particularly strong impact. Influence of Initial Price Offering on Settlement Price The initial price offering constitutes a strategic informational cue, provided by one partner to the other (e. g. Raiffa 1982; Galinsky and Mussweiler 2001). Initial price offerings are the first numbers named in a negotiation; they provide the anchor on which further 96 negotiation is oriented and thus constitute a key element of competitive bargaining. Sellers determine their initial price offering before the negotiation starts (Krause et al. 2006); for buyers, it is the first price that requires a response. Research that investigates initial price offerings as triggers of counteroffers, which constitute the key elements of competitive bargaining processes, involves both anchoring and adjusting of both parties’ reference prices (Kahneman 1992). As strategic informational cues, initial price offerings also affect the counteroffer by giving the negotiation partner information that he or she can use to reassess an intended offer (Liebert, Smith, Hill and Keiffer 1968; Kristensen and Gaerling 1997c). A seller’s initial price offering thus should be regarded as a strong adaption level by the buyer, whose counteroffer should respond to that level. Because buyers, in the interest of keeping the negotiation going, likely respond with an offer that might be assimilated rather than contrasted, an increased initial price offering tends to raise subsequent offers in a negotiation. Thus, research shows a positive effect of the initial price offering on corresponding counteroffers (e.g., Yukl 1974; Kristensen and Gaerling 1997c) and ultimately the negotiation outcome (Pruitt and Carnevale 1993). Some research even has asserted that the initial price offering is the best predictor of settlement price (Van Poucke and Buelens 2002). We include a positive relationship from initial price offering to settlement price in our model, such that by integrating considerations of reservation price and aspiration price, we obtain: PS ¼ b0 þ b1R PR þ b1A PA þ b1I PI þ e; ð1Þ where PS is the settlement price, PR, seller’s reservation price; PA, seller’s aspiration price; PI, seller’s initial price offering; bjX, importance coefficients for determinant X in model j; and e, error term. Industry Influences Industry differences should affect price negotiations. Henke, Yeniyurt and Zhang (2009) note the relevance of power, especially in terms of pressure for price concessions in the automotive industry. Van Poucke and Buelens (2002) also show that competitive scenarios influence settlement prices. Together with industryspecific cost structures, such as varying dependence on raw materials, such influences describe the level of price increase likely to be realized in annual reviews in any industry. Accordingly, we assume that industry context affects the settlement price and conceptualize Di as the range of i different industry dummies. Furthermore, industries might differ in the relevance of their reference prices. Low asset specificity causes price transparency, and dependence on raw materials may increase the relevance of cost-oriented reasoning or reservation prices’ impact. Moreover, the relevance Volume 48, Number 1 B2B Price Negotiation Outcomes of variable, performance-related compensation varies by industry (e.g., Ely 1991). Higher variable portions in remuneration packages should increase negotiators’ desire to obtain a better price and thus the relevance of aspiration prices. The negotiation outcome also could be influenced by the reference used to evaluate a negotiator’s performance (e.g., market index, seller’s initial price offering). Accordingly, we integrate the multiplicative interaction terms proposed by Edwards and Lambert (2007) to develop our next model: PS ¼ b0 þ b2R PR þ b2A PA þ b2I PI þ b2i Di þ b2Ri PR Di þ b2Ai PA Di þ b2Ii PI Di þ e; ð2Þ where Di = set of I industry dummies, D1 DI. METHOD Approach In line with recommendations to use the most qualified informants to gather information (Kumar, Stern and Anderson 1993), we invited the sales staff of a global German chemical firm to record their negotiation data. To reduce the impact of individual differences in negotiation skills and increase motivation to participate, we provided each pricing manager with a 2-day negotiation training session prior to the data collection. These sessions covered general skills for price negotiations, such as the importance of the initial price offering, the need for a clearly defined aspiration price to develop a focused negotiation strategy, and the formulation of a reservation price to define limits. Thus, all negotiators were prepared to employ the three focal concepts. In addition, the training included updated market facts, arguments to support price increases and objection handling. Thus, participants accessed comparable levels of sales and negotiation knowledge, to reduce the influences of different skill levels and career backgrounds. Sample The trained personnel conducted 645 negotiations and provided complete data about 284 of them, resulting in a 44 percent response rate. We excluded two observations with negative gross margins, such that our final sample consisted of 282 responses. We chose the chemical industry for its economic relevance and its market, because chemical firms sell to clients in a broad range of industries. Our sample thus includes buyers from the metalwork (MET; n = 74), automotive (AUT; n = 78), packaging (PAC; n = 35), maintenance, repair and operating (MRO; n = 40), ecological sanitation (ESA; n = 15), and industrial assembly (INA; n = 40) industries. The research team had limited access to the negotiators during the process; we speculate that their high workload and the pressure of the negotiation situation can explain most missing items. As suggested by Little and Rubin (1987), we compared complete with incomplete observations; the three independent price variables were uncorrelated with the completeness of the observations (coded 0 or 1). That is, missing values do not lead to any substantial bias. Data Negotiations usually followed a four-step approach: (1) a personal phone call to indicate an upcoming official pricing announcement, (2) an official initial price offering in writing, (3) personal negotiation and settlement, and (4) confirmation of the reached agreement in writing. For each relationship, we collected the sellers’ aspiration and reservation prices prior to step 1. The initial price offering was recorded after it was communicated in step 2, and we collected the settlement price from the suppliers after they had sent out a confirmation letter to their buyers in step 4. These four measures all refer to relative price increases, compared with existing pricing schemes, and we treat them as decimal figures for our analysis. For example, an initial price offering asking for an increase of 7.5 percent appears as 0.075 in our analysis. We also collected the annual sales volume per customer (in 1,000,000€) and gross margin per customer (percentage) as control measures. We detail the measures in Table 1. Analyses The revealed correlations indicate strong relationships among the three independent price measures. When we apply ordinary least squares regression, we find strong collinearity among these independent variables as well. When we add interaction effects in Model 2, the variance inflation factor scores and condition indices exceed 100. This multicollinearity implies that the effects cannot be attributed to a specific determinant, standard errors increase, and the analyses are more likely to produce insignificant results. We consider four potential solutions (e.g., Hair, Black, Babin, Anderson and Tatham 2005; Greene 2011): (1) obtain more data, which is difficult and might not address the issue, because any effect can become significant if n is high enough; (2) drop a variable that causes collinearity, such as aspiration price, in which case our model would no longer represent developed theory; (3) use a reduced set of principal components constructed from the original variables, which reduces dimensions and thus is not appropriate for our model; or (4) apply ridge regression (Hoerl 1962; Hoerl and Kennard 1970), a special case of Bayesian regression that belongs to the wider set of generalized linear models (e.g., Hair et al. 2005). January 2012 97 98 Volume 48, Number 1 0.061 (0.028) 0.048 (0.026) 0.061 (0.031) 0.080 (0.030) 0.465 (0.635) 0.200 (0.141) 0.038 (0.021) 0.034 (0.026) 0.041 (0.029) 0.050 (0.036) 0.514 (0.692) 0.638 (0.157) 0.217 (0.470) 0.523 (0.223) 0.111 (0.128) 0.081 (0.095) 0.059 (0.070) 0.079 (0.091) 0.102 (0.105) 0.472 (0.214) 0.084 (0.104) 0.072 (0.106) 0.034 (0.017) 0.065 (0.084) 0.262 (0.336) 0.295 (0.135) 0.099 (0.071) 0.074 (0.066) 0.057 (0.065) 0.080 (0.078) 0.397 (0.857) 0.378 (0.155) 0.113 (0.105) 0.091 (0.094) 0.068 (0.084) 0.086 (0.082) 0.337 (0.631) 0.426 (0.222) 0.096 (0.097) 0.074 (0.080) 0.055 (0.064) 0.072 (0.075) 0.888*** 0.916*** 0.112 0.972*** 1 (3) 0.110 1 (4) 1 (5) (6) 0.379*** 0.392*** 0.400*** 0.406*** 0.010 1 0.110 0.917*** 0.923*** 0.129* 1 (2) 0.868*** 1 ESA INA MET ALL (1) (n = 15) (n = 40) (n = 74) (n = 282) Correlations In 1,000,000€; all other figures are percentages, in decimal terms. MRO, maintenance, repair & operating; PAC, packaging; AUT, automotive; ESA, ecological sanitation; INA, industrial assembly; MET, metalwork; ALL, overall sample. * p < 0.05. *** p < 0.001. a (1) Settlement price (2) Reservation price (3) Aspiration price (4) Initial price offering (5) Annual salesa (6) Gross margin MRO PAC AUT (n = 40) (n = 35) (n = 78) Mean Values (Standard Deviations) Variable Means, Standard Deviations and Correlations TABLE 1 Journal of Supply Chain Management B2B Price Negotiation Outcomes Ridge regression acknowledges that small changes in data may produce large changes in effect sizes in the case of multicollinearity, so data can be changed by adding a constant k to the regression matrix. By increasing k incrementally from 0 to 1 (based on normalized variables), the estimates initially vary substantially but then become more stable. This stability decreases the standard errors, though at the expense of systematic bias. Several approaches can help determine the optimal ridge regression parameter k (e.g. Hoerl, Kennard and Baldwin 1975; Lawless and Wang 1976). For our analyses, we used the generalized cross validation (GCV) parameter (Golub, Heath and Wahba 1979), which is appropriate for solving the issue of high standard errors. We then used the R statistics package (version 2.13.0; The R Foundation for Statistical Computing, Vienna) to determine the GCV value and estimated standard errors with a bootstrapping procedure, using 1,000 resamples. In Table 2, we list the estimates and their standard errors using a GCV parameter k of 0.0766 for Model 1 and 0.0218 in Model 2. RESULTS In Model 1, all three references contribute significantly to explaining the settlement price, with an adjusted R2 value of 0.86. Aspiration price with a ridge regression coefficient of 0.40 and initial price offering (0.36) appear to be comparably strong predictors of settlement price; reservation price (0.17) has a significant but substantially weaker impact. If we add industry considerations using the dummy variables, the general structure of the results receives further support from Model 2: Aspiration price (0.42) and initial price offering (0.43) are comparably strong and reservation price (0.19) has a substantially weaker impact on the settlement price. The impacts of the two control variables, annual sales volume and gross margin, are insignificant in both models, in support of the internal validity of the results. Moreover, in a reduced Model 1r without controls, the changes in the estimates and R2 are <0.01. Adding industry dummies and the interaction effects between industry variables and reference prices leads to an only marginal increase in the adjusted R2 (0.03), though it produced significant results with regard to the automotive, industrial assembly and metalwork industries. For example, in the automotive industry, reservation price has a weaker impact and initial price offering has a stronger impact, but the opposite situation emerges for the metalwork industry. The direct industry effect also becomes significantly positive. For industrial assembly, this direct effect and its interaction with the reservation price are significantly negative; all other effects are insignificant, though. DISCUSSION We started with two goals: to integrate TCE and the reference price concept from consumer behavior into a price negotiation context and to overcome the limitations of the dominant experimental and mail survey approaches to negotiation research. With regard to the impact of each reference price on the settlement price, we show that a seller’s aspiration price and the initial price offering have comparably strong impacts, whereas the reservation price has only limited impact. These findings add insights to existing research: If we were to assume rational negotiators and attempt to explain negotiation outcomes in a supply chain using only underlying costs (Williamson 1996), we would neglect some dominant individual psychological influences. Furthermore, experimental psychological approaches have ignored the negotiation context. The initial price offering is relevant, but prior studies have overestimated its importance as a negotiation anchor (e.g., Van Poucke and Buelens 2002), at the expense of the buyer’s aspirations. Our use of prospect theory to conceptualize the impact of aspiration price helps clarify the particular importance of this price: Any settlement below the aspiration price gets weighted very strongly, leading sellers to defend their aspiration price more vigorously. In contrast, gains take less weight, and sellers make less effort to defend their position when buyers make offers above their aspiration price. Moreover, because sellers’ reservation and aspiration prices are opaque to buyers, buyers who aim to discern a seller’s reservation price may prompt strong defense of the aspiration price and thus assume they have found the reservation price. Accordingly, psychological prospect theory helps explain the specific importance of sellers’ subjective aspirations. The value of reference prices for explaining a negotiation settlement also receives support from the importance of the initial price offering, which is an important subjective adaption level for a negotiation. With regard to reservation prices, we show that their direct impact on settlement price is limited. Regression weights below 0.2 indicate that actual B2B cost splits rarely follow Nash’s (1950) equal share proposal. Nevertheless, cost increases should affect personal aspirations and initial price offerings, so reservation prices’ impact might be mediated. In this sense, our finding that cost changes hardly affect negotiation results, if they are not converted into aspiration prices or initial price offerings, is critical. Finally, though it adds little to the explanation of settlement prices, traditional economic thinking can enhance our understanding of B2B price negotiations: TCE explains industry differences in the importance of the three reference prices. January 2012 99 Journal of Supply Chain Management TABLE 2 Regression Models Model 1 Model 2 GCV Ridge Factor k = 0.0766 GCV Ridge Factor k = 0.0218 R2 = 0.86; Ra2 = 0.86 R2 = 0.90; Ra2 = 0.89 B Constant Annual sales Gross margin Reservation price (RP) Aspiration price (AP) Initial price offering (IO) Industry influences1 MRO PAC AUT INA MET Interaction effects1 MRO9RP PAC9RP AUT9RP INA9RP MET9RP MRO9AP PAC9AP AUT9AP INA9AP MET9AP MRO9IO PAC9IO AUT9IO INA9IO MET9IO 4.5591014 0.025 0.005 0.172 0.397 0.364 SE Sig. B SE Sig. 0.022 0.022 0.024 0.044 0.054 0.051 NS NS NS 5.3391016 0.039 0.018 0.187 0.424 0.430 0.019 0.020 0.028 0.062 0.061 0.058 NS NS NS 0.036 0.023 0.101 0.127 0.255 0.081 0.074 0.055 0.048 0.052 NS NS NS 0.007 0.009 0.203 0.081 0.263 0.027 0.063 0.083 0.061 0.099 0.093 0.047 0.229 0.146 0.352 0.050 0.035 0.062 0.037 0.055 0.080 0.083 0.084 0.079 0.083 0.070 0.072 0.069 0.076 0.072 NS NS *** *** *** ** *** *** ** *** ** * *** NS NS NS NS NS NS NS ** NS *** 1 Dummy coded, with ecological sanitation as the reference industry. Ra2, adjusted R2; MRO, maintenance, repair & operating; PAC, packaging; AUT, automotive; INA, industrial assembly; MET, metalwork. NS, not significant. All significances based on one-paired t-tests. *** p < 0.001. ** p < 0.01. * p < 0.05. In particular, the interaction effects reveal notable differences in the importance of reservation price and initial price offering between industries. The reservation price has above-average importance for metalwork, an industry with limited asset specificity. As its product complexity is limited, negotiation outcomes are easy to compare against raw material price indexes and commodity stock prices. Negotiators then aim to beat the index, which represents their best alternative and thus a reservation price. The high price volatility 100 of these raw materials, such as ores, and dynamic prices also means that price agreements in this industry usually resemble a cost plus approach. Cost, a key determinant of the reservation price, accordingly has a strong impact on negotiation outcomes. In contrast, in the automotive and industrial assembly industries, reservation price exerts a below-average impact, whereas the impact of the initial price offering is stronger. The products sold in these industries are usually bespoke chemical formulations (chemical Volume 48, Number 1 B2B Price Negotiation Outcomes specialties), with high asset specificity and no clear price indexes. It is thus difficult for buyers to review prices, considering the sheer volume of chemical components. Thus, buyers shoot to “beat the supplier” rather than the index, and negotiation success is determined according to the supplier’s initial price offering. Initial price offerings thus constitute strong and important influences on further negotiation, and by presenting initial price offerings beyond their aspiration prices, sellers establish wider negotiation spaces. Prior literature has warned of the risk of lock-in effects for companies that contract for highly customized products and services (e.g., Lonsdale 2001; Narasimhan, Nair, Griffith, Arlbjørn and Bendoly 2009). Industries with higher asset specificity, for which we observe a lower relevance of reservation prices, should be particularly prone to such effects; our results provide some support for this view. Industries with high asset specificity and low reservation price impacts on settlement prices (e.g., automotive, general assembly) feature negative direct industry effects, an indication of strong buyer power. We observe the opposite effect in the metalwork industry. In our further effort to overcome the limitations of experimental and mail survey approaches, we find that 86 percent of the variation in settlement prices in continuous B2B relationships in the chemical industry can be explained by the three price references we study. This remarkably high explanatory power substantially exceeds that found in prior experimental approaches; for example, Krause et al. (2006) achieve an R2 value of 0.26 using the aspiration and reservation prices of sellers and buyers. We suggest two potential explanations for our model’s strong power. First, industrial sellers tend to have a very good sense of what to expect and thus effectively adjust their reference prices. Second, sellers who initiate the negotiations may have clearer goals and a stronger drive to reach them. We also note that we analyzed relative price increases and find no reason to anticipate that they depend on the history of absolute prices paid. Overall, these results suggest that existing research that has applied experimental designs has also underestimated the predictive power of sellers’ reference prices. The negotiators in our study all had extensive experience of more than 10 years with their company, and they all acted in real industry contexts that are responsive to differences in dependence on raw materials, power and cost transparency. In contrast, experimental respondents, and students in particular, may be unfamiliar with the negotiation context and have unrealistically large variance in their price perceptions. This point has been elaborated by Stevens (2011), who notes that student samples are appropriate for establishing internal validity with regard to universalistic issues but are inappropriate for establishing external validity when context-centered issues are the focus. As Min, LaTour and Jones (1995) suggest, product experience and involvement increase the predictive power of negotiators’ references. By using industrial negotiation data and considering industry differences, our approach thus increases accuracy, though at the expense of some generalizability (see also Weick 1979; Ketchen and Hult 2011). The increased external validity of our industrial negotiation data also is accompanied by reduced control in the data collection and limited opportunities to integrate control variables more comprehensively. Finally, a transaction’s size could grant one negotiation party a particular form of power; annual sales had no significant discernible impact, but our data do not permit us to make a conclusive judgment about these potential effects. Overall, we might still ask how TCE contributes to the model, particularly because the model elements that we derived from TCE do not substantially contribute to the model’s R2 value. Yet, we maintain that TCE plays a crucial role for improving our understanding of negotiation processes. TCE helps set the initial context for the investigated negotiations. Frequent exchanges are the basis for the relationship in which the considered negotiations take place. Uncertainty then provides a basis for annual price renegotiations, according to changes in the uncertain aspects such as raw material prices. Thus, TCE provides a valid context for describing the observed relationships as hybrid contracting and defining a bargaining zone within which to settle negotiations. Finding a settlement price within the bargaining zone remains a gap for which TCE cannot provide a full explanation though: Personal aspirations and psychological adoption levels established by sellers’ initial price offerings are important but neglected by TCE. Yet, once the aspirations and adoption levels have been identified as relevant drivers, TCE reasoning can help explain how these personal references influence the settlement price. For example, high asset specificity increases the importance of the relationship and thus the importance of the initial price offering as a reference that is internal to the relationship in which the negotiation takes place. Industrial Implications For selling companies, these results imply the need to actively manage aspiration prices applied by their sales personnel. Companies might provide clear goals for a specific relationship or per salesperson. Moreover, sales personnel should be trained to increase the individual aspiration prices that they believe they can implement. Prior research has shown that companies can influence negotiation outcomes by offering different cost information to sales personnel (Wilken et al. January 2012 101 Journal of Supply Chain Management 2010). Similarly, a company might influence negotiations by making the connection between its financial goals and eventual settlement prices more transparent to its own salespeople, to stimulate their aspirations. For individual sales representatives, our results suggest that expecting more might result in more. Thus, salespeople should undertake solid preparation to develop clear aspirations. Moreover, awareness of industry characteristics could help them understand which reference prices to manipulate to achieve a higher settlement price. Especially for sales to the automotive, packaging and industrial assembly industries, higher initial price offerings promise an effective means to achieve higher prices. For buyers, the results indicate that they often leave money on the table by reacting to sellers’ aspiration prices instead of sensing and responding to their reservation prices. Buyers could realize better results if they developed their own clear, well-founded aspirations. When both parties enter the negotiation equally well prepared, they should have clear subjective aspirations that they defend. The dominance of such subjective influences in B2B negotiations, together with the Nash equilibrium, should lead to an equilibrium point at the mean of the buyer’s and seller’s aspiration prices, instead of their reservation prices. Negotiators’ aspirations can be reinforced by their higher variable pay (Ely 1991). For buying organizations, our research suggests that negotiation outcomes improve if the buyer representative’s performance is evaluated against an objective measure, such as a market index external to the negotiation, rather than a measure related to the negotiation process, such as the seller’s initial price offering. However, we also recommend considering related influences on sourcing strategies, because price-oriented compensation can negatively influence relationship behavior (McNally and Griffin 2004). Research Implications Existing research in SCM has neglected individual perceptions and biases (Carter et al. 2007). Yet, we offer evidence that individual elements, such as a negotiator’s aspirations, substantially affect negotiation outcomes in the supply chain. By empirically integrating a behavioral perspective and the more traditional TCE perspective, we also suggest potential routes to understand such aspirations and their interactions with economic perspectives. For example, a negotiator’s prior experience, whether with negotiation in general, with the specific company, or with the specific counterpart, should have a significant effect. This claim receives support from Yeniyurt et al. (2011) who find that experience in a specific electronic reverse auction influences the suppliers’ further bidding behavior. Perceptions of the negotiation as 102 integrative or distributive (e.g., Krause et al. 2006), as well as of trust and power in the relationship, also may be relevant. Beyond the individual level, further research should investigate more explicitly how cost structure, dependence on raw materials, and the competitive environment of a company (Van Poucke and Buelens 2002) or industry (Henke et al. 2009) determine settlement prices. Yeniyurt et al. (2011) control for cost structure in their study and find only an insignificant impact, consistent with the limited relevance of the reservation price in our study. Nevertheless, our study offers some indication of a moderating role for cost structures; a dual-industry study, comparing high with low asset specificity contexts, might reveal more insight. Another type of dyadic approach that analyzes seller and buyer data related to a specific negotiation could add further value in this context — it would clarify buyer influences while also revealing new insight into the negotiation process. Investigating the influence of individual and social and psychological characteristics on negotiation results is also worth exploring. Research might consider negotiators’ age and gender (Min et al. 1995; Miles 2010), disciplinary backgrounds (e.g., business versus engineering degree), and company rank. The influence of negotiators’ ambition is relevant (e.g., Buelens and Van Poucke 2004; Agndal 2007); selfefficacy perceptions might further indicate how aspiration prices are derived and transform into higher settlement prices. These aspects appear closely related to performance-related pay and the question of whether a market index or the initial offer serves as the performance reference. Thus, investigating these aspects using industry data would offer relevant insights. CONCLUSION We have argued that TCE is reflected in sellers’ reservation prices, which reflect the raw material prices and alternative sales opportunities. Existing research has successfully applied TCE to explain when and why companies buy from another firm versus produce the necessary solution themselves. Yet, TCE also neglects individual psychological influences on the distribution of a transaction’s bargaining zone, a topic prominent in psychological theories of price perception that appear comprehensively in consumer pricing research. Our results suggest that adding psychological considerations to traditional neoclassical thinking increase understanding of negotiation processes in the supply chain. Moreover, transaction cost thinking contributes to help explain industry differences in the relevance of various determinants and thus may provide a better understanding of when particular individual biases are most likely to occur. Volume 48, Number 1 B2B Price Negotiation Outcomes REFERENCES Agndal, H. “Current Trends in Business Negotiation Research: An Overview of Articles Published 19962005,” SSE/EFI Working Paper Series in Business Administration No. 2007:003, Stockholm School of Economics, Stockholm, Sweden, 2007. Bachrach, D.G. and E. Bendoly. “Rigor in Behavioral Experiments — A Basic Primer for Supply Chain Management Researchers,” Journal of Supply Chain Management, (47:3), 2011, pp. 5-8. Barry, B. and R.L. Oliver. “Affect in Negotiation: A Model and Propositions,” Organizational Behavior and Human Decision Processes, (67:2), 1996, pp. 127-143. Baumeister, R.F., E. Bratslavsky, C. Finkenauer and K. D. Vohs. “Bad Is Stronger than Good,” Review of General Psychology, (5), 2001, pp. 323-370. Bazerman, M.H., T. Magliozzi and M.A. Neale. “Integrative Bargaining in a Competitive Market,” Organizational Behavior and Human Decision Processes, (34), 1985, pp. 294-313. Blount White, S., M.C. Thomas-Hunt and M.A. Neale. “The Price Is Right — Or Is It? A Reference Point Model of Two-Party Price Negotiations,” Organizational Behavior and Human Decision Processes, (68:1), 1996, pp. 1-12. Brenner, L.A., D.J. Koehler, V. Liberman and A. Tversky. “Overconfidence in Probability and Frequency Judgments: A Critical Examination,” Organizational Behavior and Human Decision Processes, (65:3), 1996, pp. 212-219. Buelens, M. and D. Van Poucke. “Determinants of a Negotiator’s Initial Opening Offer,” Journal of Business and Psychology, (19:1), 2004, pp. 23-35. Carter, C.R. and L.M. Ellram. “Thirty-Five Years of the Journal of Supply Chain Management: Where Have We Been and Where Are We Going?” Journal of Supply Chain Management, (39:1), 2003, pp. 3850. Carter, C.R., L. Kaufmann and A. Michel. “Behavioral Supply Management: A Taxonomy of Judgment and Decision-Making Biases,” International Journal of Physical Distribution & Logistics Management, (37:8), 2007, pp. 631-669. Eckerd, S. and E. Bendoly. “Introduction to the Discussion Forum on Using Experiments in Supply Chain Management Research,” Journal of Supply Chain Management, (47:3), 2011, pp. 3-4. Edwards, J.R. and L.S. Lambert. “Methods for Integrating Moderation and Mediation: A General Analytical Framework Using Moderated Path Analysis,” Psychological Methods, (12:1), 2007, pp. 1-22. Ellram, L.M. “Supply Chain Management: The Industrial Organization Perspective,” International Journal of Physical Distribution & Logistics Management, (21:1), 1991, pp. 13-22. Ely, K.M. “Interindustry Differences in the Relation Between Compensation and Firm Performance Variables,” Journal of Accounting Research, (29:1), 1991, pp. 37-58. Fisher, R. and W. Ury. Getting to Yes, Houghton-Mifflin, Boston, MA, 1981. Galinsky, A.D. and T. Mussweiler. “First Offers as Anchors: The Role of Perspective-Taking and Negotiator Focus,” Journal of Personality and Social Psychology, (81), 2001, pp. 657-669. Golub, G.H., C.G. Heath and G. Wahba. “Generalized Cross Validation as a Method for Choosing a Good Ridge Parameter,” Technometrics, (21), 1979, pp. 215-223. Greene, W.H. Econometric Analysis, 7th ed., Prentice Hall, Upper Saddle River, NJ, 2011. Greenleaf, E.A. “The Impact of Reference Price Effect on the Profitability of Price Promotions,” Marketing Science, (14:1), 1995, pp. 82-101. Grover, V. and M.D. Malhotra. “Transaction Cost Framework in Operations and Supply Chain Management Research: Theory and Measurement,” Journal of Operations Management, (21:4), 2003, pp. 457-473. Hair, J.F., B. Black, B. Babin, R.E. Anderson and R.L. Tatham. Multivariate Data Analysis, 6th ed., Prentice Hall, Upper Saddle River, NJ, 2005. Halldórsson, A. and T. Skjøtt-Larsen. “Dynamics of Relationship Governance in TPL Arrangements — A Dyadic Perspective,” International Journal of Physical Distribution & Logistics Management, (36:7), 2006, pp. 490-506. Helson, H. Adaption Level Theory, Harper and Row, New York, 1964. Henke J.W. Jr., S. Yeniyurt and C. Zhang. “Supplier Price Concessions: A Longitudinal Empirical Study,” Marketing Letters, (20), 2009, pp. 61-74. Hoerl, A.E. “Application of Ridge Analysis to Regression Problems,” Chemical Engineering Progression, (58), 1962, pp. 57-59. Hoerl, A.E. and R.W. Kennard. “Ridge Regression: Biased Estimation for Nonorthogonal Problems,” Technometrics, (2), 1970, pp. 109-120. Hoerl, A.E., R.W. Kennard and K.F. Baldwin. “Ridge Regression: Some Simulation,” Communication Statistics, (5), 1975, pp. 105-123. Huber, V.L. and M.A. Neale. “Effects of Cognitive Heuristics and Goals on Negotiator Performance and Subsequent Goal Setting,” Organizational Behavior and Human Decision Processes, (38), 1986, pp. 342-365. Huber, V.L. and M.A. Neale. “Effects of Self and Competitor Goals on Performance in an Interdependent Bargaining Task,” Journal of Applied Psychology, (72), 1987, pp. 197-203. Joshi, A.W. and R.L. Stump. “Transaction Cost Analysis: Integration of Recent Refinements and an Empirical Test,” Journal of Business-to-Business Marketing, (5:4), 1999, pp. 37-71. Kahneman, D. “Reference Points, Anchors, Norms, and Mixed Feelings,” Organizational Behavior and Human Decision Processes, (51:2), 1992, pp. 296312. January 2012 103 Journal of Supply Chain Management Kahneman, D. and A. Tversky. “Prospect Theory: An Analysis of Decision Under Risk,” Econometrica, (47), 1979, pp. 263-291. Kalwani, M.U. and C.K. Yim. “Consumer Price and Promotion Expectations: An Experimental Study,” Journal of Marketing Research, (29), 1992, pp. 90100. Kalwani, M.U., C.K. Yim, H.J. Rinne and Y. Sugita. “A Price Expectations Model of Customer Brand Choice,” Journal of Marketing Research, (27), 1990, pp. 251-262. Kalyanaram, G. and R. Winer. “Empirical Generalizations from Reference Price Research,” Marketing Science, (14:3), 1995, pp. 161-169. Karkkainen, M., S. Laukkanen, S. Sarpola and K. Kemppainen. “Roles of Interfirm Information Systems in Supply Chain Management,” International Journal of Physical Distribution & Logistics Management, (37:4), 2007, pp. 264-286. Kaufmann, L. and C.R. Carter. “Deciding on the Mode of Negotiation: To Auction or Not to Auction Electronically?” Journal of Supply Chain Management, (40:2), 2004, pp. 15-26. Ketchen D.J. Jr. and G.T.M. Hult. “Building Theory About Supply Chain Management: Some Tools from the Organizational Sciences,” Journal of Supply Chain Management, (47:2), 2011, pp. 12-18. Klein, N.M. and J.E. Oglethorpe. “Cognitive Reference Points in Consumer Decision Making,” Advances of Consumer Research, (14), 1987, pp. 183-187. Krause, D.R., R. Terpend and K. Petersen. “Bargaining Stances and Outcomes in Buyer-Seller Negotiations: Experimental Results,” Journal of Supply Chain Management, (42:3), 2006, pp. 4-15. Kristensen, H. and T. Gaerling. “Determinants of Buyers’ Aspiration and Reservation Price,” Journal of Economic Psychology, (18:5), 1997a, pp. 487503. Kristensen, H. and R. Gaerling. “The Effects of Anchor Points and Reference Points on Negotiation Process and Outcome,” Organizational Behavior and Human Decision Processes, (71:1), 1997b, pp. 8594. Kristensen, H. and T. Gaerling. “Adoption of Cognitive Reference Points in Negotiations,” Acta Psychologica, (97), 1997c, pp. 277-288. Kumar, N., L.W. Stern and J.C. Anderson. “Conducting Interorganizational Research Using Key Informants,” Academy of Management Review, (36:6), 1993, pp. 1633-1651. Lawless, J.F. and P. Wang. “A Simulation Study of Ridge and Other Regression Estimators,” Communication Statistics, (A5), 1976, pp. 307-323. Lax, D.A. and J.K. Sebenius. The Manager as Negotiator: Bargaining for Cooperation and Competitive Gain, The Free Press, New York, 1986. Lewicki, R.J., D.M. Saunders and J.W. Minton. Essentials of Negotiation, McGraw-Hill, Boston, MA, 2000. Liebert, R.M., W.P. Smith, J.H. Hill and M. Keiffer. “The Effects of Information and Magnitude of Ini- 104 tial Offer on Interpersonal Negotiation,” Journal of Experimental Psychology, (4), 1968, pp. 431-441. Lim, R.G. “Overconfidence in Negotiation Revisited,” International Journal of Conflict Management, (8:1), 1997, pp. 52-79. Little, R.J.A. and D.B. Rubin. Statistical Analysis With Missing Data, Wiley, New York, 1987. Lonsdale, C. “Locked-in to Supplier Dominance: On the Dangers of Asset Specificity for the Outsourcing Decision,” Journal of Supply Chain Management, (37:2), 2001, pp. 22-27. Mazumdar, T., S.P. Raj and I. Sinha. “Reference Price Research: Review and Propositions,” Journal of Marketing, (69:4), 2005, pp. 84-102. McHugh, M., P. Humphreys and R. McIvor. “BuyerSupplier Relationships and Organizational Health,” Journal of Supply Chain Management, (39:2), 2003, pp. 15-25. McNally, R.C. and A. Griffin. “Firm and Individual Choice Drivers in Make-or-Buy Decisions: A Diminishing Role for Transaction Cost Economics,” Journal of Supply Chain Management, (40:1), 2004, pp. 4-17. Miles, E.W. “Gender Differences in Distributive Negotiation: When in the Negotiation Process Do the Differences Occur?,” European Journal of Social Psychology, (40:7), 2010, pp. 1200-1211. Min, H., M.S. LaTour and M.A. Jones. “Negotiation Outcomes: The Impact of the Initial Offer, Time, Gender, and Team Size,” International Journal of Purchasing and Materials Management, (31:4), 1995, pp. 19-24. Mitter, C. and F.U. Siems. “Transfer Pricing for Internal Services and Products — The Link Between Accounting and Marketing.” In S. Rothenberger and F. Siems (Eds.), Pricing Perspectives. Marketing and Management Implications of New Theories and Applications, Palgrave Macmillan, Hampshire, 2008, pp. 206-221. Monroe, K.B. “Buyers’ Subjective Perceptions of Price,” Journal of Marketing Research, (10:1), 1973, pp. 70-80. Nagel, S.S. and M.K. Mills. “Multicriteria Dispute Resolution Through Computer-Aided Mediation Software,” Mediation Quarterly, (7:2), 1989, pp. 175189. Narasimhan, R., A. Nair, D.A. Griffith, J.S. Arlbjørn and E. Bendoly. “Lock-in Situations in Supply Chains: A Social Exchange Theoretic Study of Sourcing Arrangements in Buyer–Supplier Relationships,” Journal of Operations Management, (27:5), 2009, pp. 374-389. Nash, J.F. “The Bargaining Problem,” Econometrica, (18:2), 1950, pp. 155-162. Nash, J.F. “Two-Person Cooperative Games,” Econometrica, (21:1), 1953, pp. 128-140. Neale, M.A. and M.H. Bazerman. Cognition and Rationality in Negotiation, The Free Press, New York, 1991. Neale, M.A. and M.H. Bazerman. “Negotiating Rationally: The Power and Impact of the Negotiator’s Volume 48, Number 1 B2B Price Negotiation Outcomes Frame,” Academy of Management Executive, (6:3), 1992, pp. 42-51. Oliver, R.L., P.V.S. Balakrishnan and B. Barry. “Outcome Satisfaction in Negotiation: A Test of Expectancy Disconfirmation,” Organizational Behavior and Human Decision Processes, (60:2), 1994, pp. 252-275. O’Neill, R. and D. Lambert. “The Emotional Side of Price,” Psychology & Marketing, (18:3), 2001, pp. 217-237. Pruitt, D.G. Negotiation Behavior, Academic Press, New York, 1981. Pruitt, D.G. and P.J. Carnevale. Negotiation in Social Conflict, Open University Press and Pacific Grove, Buckingham, U.K., 1993. Putler, D.S. “Incorporating Reference Price Effects into a Theory of Consumer Choice,” Marketing Science, (11:3), 1992, pp. 287-309. Raiffa, H. The Art and Science of Negotiation, Belknap Press of Harvard University Press, Cambridge, MA, 1982. Rajendran, K.N. and G.J. Tellis. “Contextual and Temporal Components of Reference Price,” Journal of Marketing, (58:1), 1994, pp. 22-34. Ramsay, J. “Serendipity and the Realpolitik of Negotiations in Supply Chains,” Supply Chain Management: An International Journal, (9:3), 2004, pp. 219-229. Rindfleisch, A. and J.B. Heide. “Transaction Cost Analysis: Past, Present, and Future Applications,” Journal of Marketing, (61:4), 1997, pp. 30-54. Rinehart, L.M. and D.J. Closs. “Implications of Organizational Relationships, Negotiator Personalities, and Contract Issues on Outcomes in Logistics Negotiations,” Journal of Business Logistics, (12:1), 1991, pp. 123-144. Schoenherr, T. and V.A. Mabert. “The Effect of BuyerImposed Bidding Requirements and Bundle Structure on Purchase Performance,” Journal of Supply Chain Management, (43:1), 2007, pp. 27-39. Schuppar, B. Preismanagement – Konzeption, Umsetzung und Erfolgsauswirkungen im Business-to-BusinessBereich [Pricemanagement – Conception, application and profit impact in the business-to-business domain], Wiesbaden 2006. Shelanski, H.A. and P.G. Klein. “Empirical Research in Transaction Cost Economics: A Review and Assessment,” Journal of Law, Economics, and Organization, (11:2), 1995, pp. 335-361. Siems, F.U., H. Goelzner and D.C. Moosmayer. “Reference Compensation: A Transfer of Reference Price Theory to Human Resource Management,” Review of Managerial Science, in press (http://dx. doi.org/10.1007/s11846-010-0055-0). Skowronski, J.J. and D.E. Carlston. “Social Judgment and Social Memory: The Role of Cue Diagnosticity in Negativity, Positivity, and Extremity Biases,” Journal of Personality and Social Psychology, (52), 1987, pp. 689-699. Smeltzer, L.R., J.A. Manship and C.L. Rossetti. “An Analysis of the Integration of Strategic Sourcing and Negotiation Planning,” Journal of Supply Chain Management, (39:4), 2003, pp. 16-25. Stevens, C.K. “Questions to Consider when Selecting Student Samples,” Journal of Supply Chain Management, (47:3), 2011, pp. 19-21. Swaidan, Z. “Culture and Negotiation Ethics,” Review of Business Research, (7:5), 2007, pp. 162171. Tversky, A. and D. Kahneman. “Loss Aversion in Riskless Choice: A Reference-Dependent Model,” Quarterly Journal of Economics, (106:4), 1991, pp. 1039-1061. Tversky, A. and D. Kahneman. “The Framing of Decisions and the Psychology of Choice,” Science, (211:4481), 1981, pp. 453-458. Urbany, J.E., W.O. Bearden and D.C. Weilbaker. “The Effect of Plausible and Exaggerated Reference Price on Consumer Perceptions and Price Search,” Journal of Consumer Research, (15:1), 1988, pp. 95110. van Hoek, R.I. “The Purchasing and Control of Supplementary Third-Party Logistics Services,” Journal of Supply Chain Management, (36:4), 2000, pp. 1426. Van Poucke, D. and M. Buelens. “Predicting the Outcome of a Two-Party Price Negotiation: Contribution of Reservation Price, Aspiration Price and Opening Offer,” Journal of Economic Psychology, (23:1), 2002, pp. 67-76. Walton, R.E. and R.B. McKersie. A Behavioral Theory of Labor Negotiations: An Analysis of a Social Interaction System, McGraw-Hill, New York, 1965. Wang, J. and S. Zionts. “Negotiating Wisely: Considerations Based on MCDM/MAUT,” European Journal of Operational Research, (188), 2008, pp. 191-205. Weick, K.E. The Social Psychology of Organizing, 2nd ed., Addison-Wesley, Reading, MA, 1979. White, S.B. and M.A. Neale. “The Role of Negotiator Aspirations and Settlement Expectancies on Bargaining Outcomes,” Organizational Behavior and Human Decision Processes, (57:2), 1994, pp. 303317. White, S.B., K.L. Valley, M.H. Bazerman, M.A. Neale and S.R. Peck. “Alternative Models of Price Behavior in Negotiations: Market Prices, Reservation Prices, and Negotiator Aspirations,” Organizational Behavior and Human Decision Processes, (57:3), 1994, pp. 430-447. Wilken, R., M. Cornelissen, K. Backhaus and C. Schmitz. “Steering Sales Reps Through Cost Information: An Investigation into the Black Box of Cognitive References and Negotiation Behavior,” International Journal of Research in Marketing, (27:1), 2010, pp. 69-82. Williamson, O.E. “Outsourcing: Transaction Cost Economics and Supply Chain Management,” Journal of Supply Chain Management, (44:2), 2008, pp. 516. Williamson, O.E. Markets and Hierarchies: Analysis and Antitrust Implications, Free Press, New York, 1975. January 2012 105 Journal of Supply Chain Management Williamson, O.E. The Mechanisms of Governance, Oxford University Press, New York, 1996. Winer, R.S. “A Reference Price Model of Brand Choice for Frequently Purchased Products,” Journal of Consumer Research, (13:2), 1986, pp. 250256. Winer, R.S. “Behavioral Perspective on Pricing: Buyers’ Subjective Perceptions of Price Revisited.” In T.M. Devinney (Ed.), Issues in Pricing: Theory and Research. Lexington Books, Lexington, MA, 1988, pp. 35-57. Yeniyurt, S., S. Watson, C.R. Carter and C.K. Stevens. “To Bid or Not to Bid: Drivers of Bidding Behavior in Electronic Reverse Auctions,” Journal of Supply Chain Management, (47:1), 2011, pp. 60-72. Yukl, G.A. “Effects of the Opponent’s Initial Offer, Concession Magnitude, and Concession Frequency on Bargaining Behavior,” Journal of Personality and Social Psychology, (30:3), 1974, pp. 323335. Zachariassen, F. “Negotiation Strategies in Supply Chain Management,” International Journal of Physical Distribution & Logistics Management, (38:10), 2008, pp. 764-781. Zaheer, A., B. McEvily and V. Perrone. “The Strategic Value of Buyer-Supplier Relationships,” Journal of Supply Chain Management, (34:3), 1998, pp. 2026. Zetik, D.C. and A.F. Stuhlmacher. “Goal Setting and Negotiation Performance: A Meta-Analysis,” Group Process & Intergroup Relations, (5), 2002, pp. 3552. Business Marketing of RWTH Aachen University in Aachen, Germany. He has worked in the banking and consulting industries across Europe and Africa with Commerzbank, PricewaterhouseCoopers, The Boston Consulting Group and UBS. In his research Dirk investigates the impacts of individual values and biases on the economic and social performance of business. His two major areas of interest are pricing and price perceptions as well as values in management. Bjoern Schuppar (Dr. rer. pol., University of Mannheim) is the founder and managing partner of Schuppar Consulting Ltd. &. Co. KG in Duesseldorf, Germany. He has more than 10 years’ experience as a business consultant, and founded his own company in 2004. Dr. Schuppar has extensive experience in the chemical, construction, healthcare, retail and consumer goods industries, and provides consulting services in the areas of pricing, negotiation, sales management and purchasing. His clients include Bosch, Lanxess, Loctite and Siemens among others in the U.S., South America, Europe and South East Asia. Dr. Schuppar's publications include the book Price Management. Florian U. Siems (Dr. rer. Pol., University of Basel) is a junior professor and leads the Research Group for Management and Business-to-Business Marketing at RWTH Aachen University in Aachen, Germany. His research focuses on marketing strategy, relationship marketing, customer satisfaction and pricing management. Prior to his current position, Dr. Siems was professor of marketing, and headed the marketing department, at the Salzburg University of Applied Sciences in Salzburg, Austria. Dirk C. Moosmayer (Ph.D.) is a Researcher at the Research Group for Management and Business-to- 106 Volume 48, Number 1