Understanding Payroll Transactions on the TDR and DPE Reports

Understanding Payroll Transactions on the TDR and DPE Reports

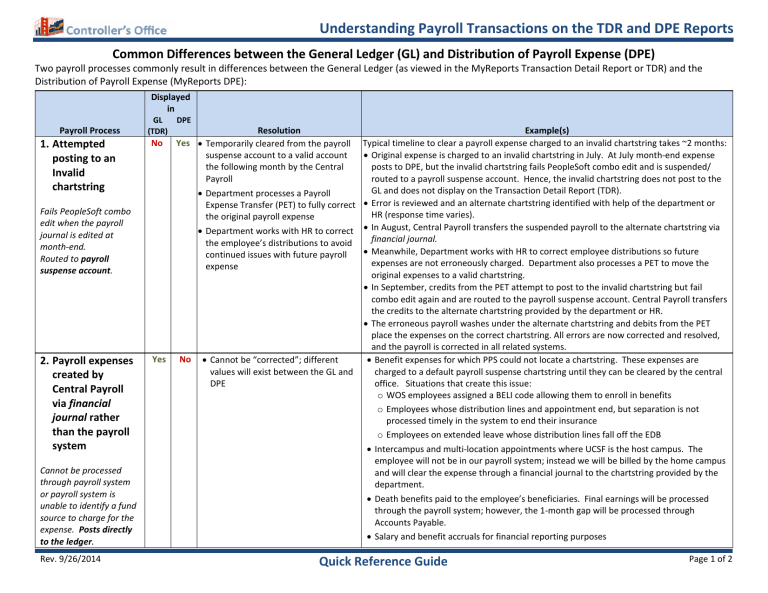

Common Differences between the General Ledger (GL) and Distribution of Payroll Expense (DPE)

Two payroll processes commonly result in differences between the General Ledger (as viewed in the MyReports Transaction Detail Report or TDR) and the

Distribution of Payroll Expense (MyReports DPE):

Payroll Process

1.

Attempted posting to an

Invalid chartstring

Fails PeopleSoft combo edit when the payroll journal is edited at month-end.

Routed to payroll suspense account .

Displayed in

GL

(TDR)

DPE

Resolution

No Yes • Temporarily cleared from the payroll suspense account to a valid account the following month by the Central

Payroll

• Department processes a Payroll

Expense Transfer (PET) to fully correct the original payroll expense

• Department works with HR to correct the employee’s distributions to avoid continued issues with future payroll expense

Yes No • Cannot be “corrected”; different values will exist between the GL and

DPE

Example(s)

Typical timeline to clear a payroll expense charged to an invalid chartstring takes ~2 months:

• Original expense is charged to an invalid chartstring in July. At July month-end expense posts to DPE, but the invalid chartstring fails PeopleSoft combo edit and is suspended/ routed to a payroll suspense account. Hence, the invalid chartstring does not post to the

•

GL and does not display on the Transaction Detail Report (TDR).

Error is reviewed and an alternate chartstring identified with help of the department or

HR (response time varies).

• In August, Central Payroll transfers the suspended payroll to the alternate chartstring via financial journal.

• Meanwhile, Department works with HR to correct employee distributions so future expenses are not erroneously charged. Department also processes a PET to move the original expenses to a valid chartstring.

• In September, credits from the PET attempt to post to the invalid chartstring but fail combo edit again and are routed to the payroll suspense account. Central Payroll transfers the credits to the alternate chartstring provided by the department or HR.

• The erroneous payroll washes under the alternate chartstring and debits from the PET place the expenses on the correct chartstring. All errors are now corrected and resolved, and the payroll is corrected in all related systems.

• Benefit expenses for which PPS could not locate a chartstring. These expenses are charged to a default payroll suspense chartstring until they can be cleared by the central office. Situations that create this issue: o

WOS employees assigned a BELI code allowing them to enroll in benefits

2.

Payroll expenses created by

Central Payroll via financial journal rather than the payroll system

Cannot be processed through payroll system or payroll system is unable to identify a fund source to charge for the expense. Posts directly to the ledger . o

Employees whose distribution lines and appointment end, but separation is not processed timely in the system to end their insurance o

Employees on extended leave whose distribution lines fall off the EDB

• Intercampus and multi-location appointments where UCSF is the host campus. The employee will not be in our payroll system; instead we will be billed by the home campus and will clear the expense through a financial journal to the chartstring provided by the department.

• Death benefits paid to the employee’s beneficiaries. Final earnings will be processed through the payroll system; however, the 1-month gap will be processed through

Accounts Payable.

• Salary and benefit accruals for financial reporting purposes

Rev. 9/26/2014

Quick Reference Guide

Page 1 of 2

Understanding Transactions on the TDR and DPE Reports

Tips on Identifying Payroll Transactions in the MyReports Transaction Detail Report (TDR)

You can limit your report to display only Payroll transactions by using the “Transaction Type” section of the Report Specific

Filters. To select only Payroll transactions, click Payroll to select it. The other items (all selected by default) are automatically deselected.

In addition to suppressing the other transaction types, you can select “Show Detail Columns” in the report to display the

Journal ID column. In the report view, (shown at left) check “Show Detail Columns” and then click the “Update” button.

Expenses processed through the DPE display with Journal ID PRXXD10 , where XX is the corresponding accounting period.

Entries from suspended payroll clean-up have journal ID PRXXD10X , which is the journal ID of the main payroll journal with an X added to the end.

The following example shows how these transactions are displayed in the Transaction Detail Report:

Quick Reference Guide

If you have questions regarding payroll differences between the GL and DPE, please contact COSolutionCenter@ucsf.edu

with a description of your issue.

Rev. 9/26/2014 Page 2 of 2