Earnings Per Share (EPS)

advertisement

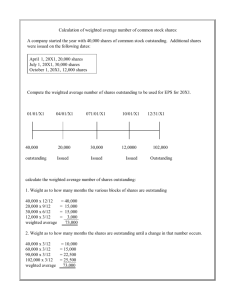

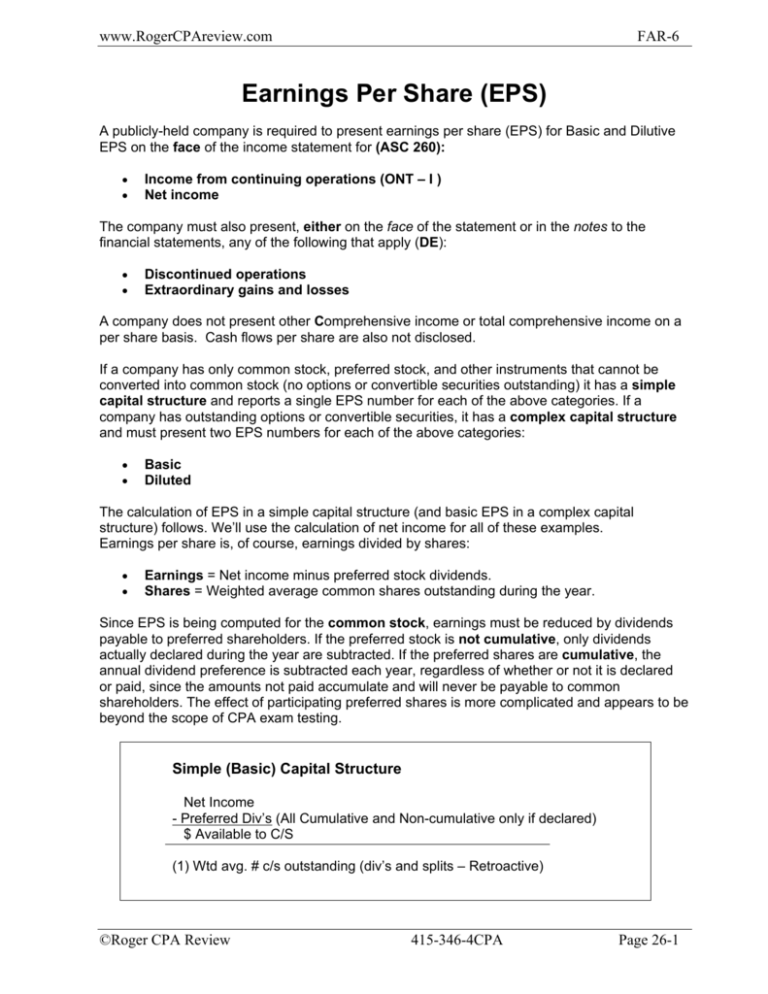

www.RogerCPAreview.com FAR-6 Earnings Per Share (EPS) A publicly-held company is required to present earnings per share (EPS) for Basic and Dilutive EPS on the face of the income statement for (ASC 260): x x Income from continuing operations (ONT – I ) Net income The company must also present, either on the face of the statement or in the notes to the financial statements, any of the following that apply (DE): x x Discontinued operations Extraordinary gains and losses A company does not present other Comprehensive income or total comprehensive income on a per share basis. Cash flows per share are also not disclosed. If a company has only common stock, preferred stock, and other instruments that cannot be converted into common stock (no options or convertible securities outstanding) it has a simple capital structure and reports a single EPS number for each of the above categories. If a company has outstanding options or convertible securities, it has a complex capital structure and must present two EPS numbers for each of the above categories: x x Basic Diluted The calculation of EPS in a simple capital structure (and basic EPS in a complex capital structure) follows. We’ll use the calculation of net income for all of these examples. Earnings per share is, of course, earnings divided by shares: x x Earnings = Net income minus preferred stock dividends. Shares = Weighted average common shares outstanding during the year. Since EPS is being computed for the common stock, earnings must be reduced by dividends payable to preferred shareholders. If the preferred stock is not cumulative, only dividends actually declared during the year are subtracted. If the preferred shares are cumulative, the annual dividend preference is subtracted each year, regardless of whether or not it is declared or paid, since the amounts not paid accumulate and will never be payable to common shareholders. The effect of participating preferred shares is more complicated and appears to be beyond the scope of CPA exam testing. Simple (Basic) Capital Structure Net Income - Preferred Div’s (All Cumulative and Non-cumulative only if declared) $ Available to C/S (1) Wtd avg. # c/s outstanding (div’s and splits – Retroactive) ©Roger CPA Review 415-346-4CPA Page 26-1 FAR-6 www.RogerCPAreview.com As an example of the computation of earnings for EPS purposes, assume a company has the following capital structure: 8% Preferred stock $400 Common stock 100 The company reports net income of $932 for the year and declares no dividends. If the preferred stock is not cumulative, common stock earnings are $932. If the preferred stock is cumulative, then the missed dividend of $400 x 8% = $32 accumulates and will be paid to the preferred shareholders eventually, reducing the earnings applicable to common stock to $932 - $32 = $900. It doesn’t matter if there are dividends in arrears from earlier years, since those amounts would have been subtracted in determining EPS of those earlier years, and wouldn’t be subtracted again this year. (1) Weighted Average number of shares of common stock outstanding - The determination of the number of shares to include in the denominator of the calculation can be very tricky. The amount to be used is the weighted average of the number of common shares outstanding during the year. As a result, shares sold to the public during the year must be prorated for the portion of the year they were outstanding. For example, assume the following facts applied to the client for the first two years of its existence: Issued, 1/1/X0 500 Issued, 7/1/X1 100 Issued, 10/1/X1 300 Outstanding, 12/31/X1 900 Although the number of shares outstanding at 12/31/X1 is 900, only 500 of these shares (those issued at the start of 20x0) were outstanding throughout 20x1. The 100 shares issued on 7/1/X1 were only outstanding for half of the year, and the shares issued 10/1/X1 for the final quarter of the year. The calculation of weighted average shares for 20x1 is: 500 x 12/12 = 500 100 x 6/12 = 50 300 x 3/12 = 75 Total 625 The reason for prorating shares issued during the year is that the funds received from issuance are only available for productive use by the corporation from that point on, not the entire year. This would not be the case, however, if shares are issued as a result of (Retroactive): x x x Stock dividends Stock splits Delayed issuance for earlier consideration (Stock Subscriptions) Page 26-2 415-346-4CPA ©Roger CPA Review www.RogerCPAreview.com FAR-6 In these cases, the shares are treated as if they had always been outstanding and are included at full amount for the current year. They are also included for earlier years that are shown in comparative financial statements. In the case of a reverse stock split, these would retroactively reduce shares outstanding for all periods presented. For example, assume that the 100 shares issued on 7/1/X1 were the result of a 20% stock dividend on the 500 shares outstanding previously. Since all shares are going to previous shareholders, they are treated as if they always had these additional shares. The calculation for 20x1 is: 500 x 1 = 500 100 x 1 = 100 300 x ¼ = 75 Total 675 Example: On 1/1 100,000 shares of C/S are outstanding. On April 1st, 80,000 shares are issued. On July 1st, a 10% stock dividend is issued. On September 1st, 18,000 shares of Treasury Stock are repurchased. On December 31st a 2 for 1 stock split occurs. Calculate the weighted average number of shares of C/S outstanding at 12/31. x x x x x 1/1 100,000 shares o/s x 100% = 100,000 4/1 80,000 shares issued x 9/12 = 60,000 7/1 10% dividend issued 160,000 x 10% = 16,000 9/1 18,000 shares of Treasury Stock repurchased x 4/12 = (6,000) 170,000 12/31 a 2 for 1 stock split occurs x 2 Weighted average number of c/s outstanding at 12/31 = 340,000 (2) The If-Converted Method - The calculation of diluted EPS (assume anyone who “could convert” does so) for a company with convertible Preferred stock or Convertible Bonds starts with the computation just discussed, which is called basic EPS. For convertible securities, the following adjustments are made in the calculation: x x Numerator – earnings are increased by the dividends or after-tax interest expense that would not have been due if the securities had been converted to common stock at the beginning of the year. Denominator – shares are increased by the additional number of common shares that would have been outstanding if the securities had been converted. The convertible preferred stock or convertible debt is assumed to have been converted at the beginning of the period, or at the time of issuance, whichever is later. No weighting is “required”. If the calculation results in an EPS number which is higher than the basic EPS number, then the security is anti-dilutive and not included in the reported diluted EPS. To determine whether or not an item is anti-dilutive, each item is considered separately in sequence from most to least dilutive. One would normally consider options and warrants first. ©Roger CPA Review 415-346-4CPA Page 26-3 FAR-6 www.RogerCPAreview.com Complex (Diluted) Capital Structure (Could convert) Net Income + (2) Preferred Div’s (not net of tax) + (2) Interest expense saved from convertible Bonds (net of tax) + (3) $0 (from Treasury stock) (1) Wtd avg. # c/s outstanding (div’s and splits – Retroactive) + (2) # of shares convertible security is converted into for both Pfd stock and convertible bonds (not weighted) + (3) Incremental # of C/S outstanding from Treasury stock method at average market price. (Not weighted) For example, assume that a company reporting $932 net income for the year has the following capital structure, which did not change during the year: Preferred stock, $100 par, 8% cumulative, 4 shares, each convertible into 10 shares of common stock $400 Common stock, $1 par, 100 shares 100 To calculate basic EPS: Earnings = Net income – PS dividends = $932 - $32 = $900 Shares = 100 Basic EPS = $900 / 100 = $9.00 If the preferred shares had been converted at the beginning of the year, the $32 in preferred dividends would not have been owed and there would have been 4 x 10 = 40 additional common shares. To calculate diluted EPS: Earnings = $900 + $32 = $932 Shares = 100 + 40 = 140 Diluted EPS = $932 / 140 = $6.66 The conversion of a bond (“if converted method”) requires considering the tax effect, since the reduction of interest expense is accompanied by an increase in taxable income. It is assumed that the conversion occurred at the beginning of the earliest period reported (or at the time of issuance, if later). For example, assume a client with $800 of net income and an effective tax rate of 30% had the following capital structure throughout the year: 6% Convertible bond, $1,000 face value, convertible into 20 shares of common stock $1,000 Common stock, $1 par, 200 shares 200 Page 26-4 415-346-4CPA ©Roger CPA Review www.RogerCPAreview.com FAR-6 Basic EPS is computed as follows: Earnings = $800 Shares = 200 Basic EPS = $800 / 200 = $4.00 The conversion of the bonds would have eliminated the $1,000 x 6% = $60 in interest expense, but would have increased taxes by $60 x 30% = $18, so the net savings is only $60 - $18 = $42. Diluted EPS is computed as follows: Earnings = $800 + $42 = $842 Shares = 200 + 20 = 220 Diluted EPS = $3.83 (3) The Treasury Stock Method - The effect of options on diluted EPS is to first increase the shares by the number that would have been issued if the options had been exercised, then decrease the shares by the number that could have been repurchased by the corporation (at the average CS market price during the year) with the proceeds from exercise. This is known as the treasury stock method. The exercise of options has no effect on earnings, since options pay no dividends or interest. If market prices change in the future, previously reported EPS should not be adjusted retroactively, leave it as it was reported. For example: If 40,000 options are issued at an option price of $15 per share when the average market price is $20 per share, what is the dilutive effect? 40,000 options which are convertible into 40,000 shares of c/s x $15 option price $600,000 600,000/$20 avg. mkt price = - 30,000 shares of treasury stock 10,000 shares dilutive effect. Another method of calculating the incremental number of shares outstanding is: Number of shares – (number of shares x exercise price) = additional shares outstanding Average market price 40,000 – (40,000 x $15) = 10,000 $20 EPS under IFRS EPS under IFRS is very similar to GAAP as you still report basic and diluted EPS on continuing operations and net income, however, EPS based on Extraordinary items are not reported. IFRS only acknowledges Preferred Dividends PAID for Basic EPS where GAAP acknowledges Preferred Dividends Declared (paid or not). ©Roger CPA Review 415-346-4CPA Page 26-5 FAR-6 www.RogerCPAreview.com CLASS QUESTION S 1. Strauch Co. has one class of common stock outstanding and no other securities that are potentially convertible into common stock. During 20X2, 100,000 shares of common stock were outstanding. In 20X3, two distributions of additional common shares occurred: On April 1, 20,000 shares of treasury stock were sold, and on July 1, a 2-for-1 stock split was issued. Net income was $410,000 in 20X3 and $350,000 in 20X2. What amounts should Strauch report as basic earnings per share in its 20X3 and 20X2 comparative income statements? a. b. c. d. 20X3 $1.78 $1.78 $2.34 $2.34 20X2 $3.50 $1.75 $1.75 $3.50 2. West Co. had earnings per share of $15.00 for 20X3 before considering the effects of any convertible securities. No conversion or exercise of convertible securities occurred during 20X3. However, possible conversion of convertible bonds, not considered common stock equivalents, would have reduced earnings per share by $0.75. The effect of possible exercise of common stock options would have increased earnings per share by $0.10. What amount should West report as diluted earnings per share for 20X3? a. $14.25 b. $14.35 c. $15.00 d. $15.10 3. Ute Co. had the following capital structure during 20X2 and 20X3: Preferred stock, $10 par, 4% cumulative, 25,000 shares issued and outstanding Common stock, $5 par, 200,000 shares issued and outstanding $ 250,000 1,000,000 Ute reported net income of $500,000 for the year ended December 31, 20X3. Ute paid no preferred dividends during 20X2 and paid $16,000 in preferred dividends during 20X3. In its December 31, 20X3 income statement, what amount should Ute report as basic earnings per share? a. $2.42 b. $2.45 c. $2.48 d. $2.50 4. Peters Corp.’s capital structure was as follows: December 31 20X3 20X2 Outstanding shares of stock: Common 110,000 110,000 Convertible preferred 10,000 10,000 During 20X3, Peters paid dividends of $3.00 per share on its preferred stock. The preferred shares are convertible into 20,000 shares of common stock and are considered common stock Page 26-6 415-346-4CPA ©Roger CPA Review www.RogerCPAreview.com FAR-6 equivalents. Net income for 20X3 was $850,000. Assume that the income tax rate is 30%. The diluted earnings per share for 20X3 is a. $6.31 b. $6.54 c. $7.08 d. $7.45 5. The if-converted method of computing earnings per share data assumes conversion of convertible securities as of the a. Beginning of the earliest period reported (or at time of issuance, if later). b. Beginning of the earliest period reported (regardless of time of issuance). c. Middle of the earliest period reported (regardless of time of issuance). d. Ending of the earliest period reported (regardless of time of issuance). 6. In determining earnings per share, interest expense, net of applicable income taxes, on convertible debt that is dilutive should be a. Added back to weighted-average common shares outstanding for diluted earnings per share. b. Added back to net income for diluted earnings per share. c. Deducted from net income for diluted earnings per share. d. Deducted from weighted-average common shares outstanding for diluted earnings per share. 7. Timp, Inc. had the following common stock balances and transactions during 20X6: 1/1/X6 Common stock outstanding 2/1/X6 Issued a 10% common stock dividend 7/1/X6 Issued common stock for cash 12/31/X6 Common stock outstanding 30,000 3,000 8,000 41,000 What were Timp’s 20X6 weighted-average shares outstanding? a. 30,000 b. 34,000 c. 36,750 d. 37,000 ©Roger CPA Review 415-346-4CPA Page 26-7 FAR-6 www.RogerCPAreview.com 8. The following information is relevant to the computation of Chan Co.’s earnings per share to be disclosed on Chan’s income statement for the year ending December 31: • Net income for 20X2 is $600,000. • $5,000,000 face value 10-year convertible bonds outstanding on January 1. The bonds were issued four years ago at a discount which is being amortized in the amount of $20,000 per year. The stated rate of interest on the bonds is 9%, and the bonds were issued to yield 10%. Each $1,000 bond is convertible into 20 shares of Chan’s common stock. • Chan’s corporate income tax rate is 25%. Chan has no preferred stock outstanding, and no other convertible securities. What amount should be used as the numerator in the fraction used to compute Chan’s diluted earnings per share assuming that the bonds are dilutive securities? a. b. c. d. $ 130,000 $ 247,500 $ 952,500 $1,070,000 9. On June 30, 20X8, Lomond, Inc. issued twenty $10,000, 7% bonds at par. Each bond was convertible into 200 shares of common stock. On January 1, 20X9, 10,000 shares of common stock were outstanding. The bondholders converted all the bonds on July 1, 20X9. The following amounts were reported in Lomond’s income statement for the year ended December 31, 20X9: Revenues Operating expenses Interest on bonds Income before income tax Income tax at 30% Net income $977,000 920,000 7,000 50,000 15,000 $ 35,000 What is Lomond’s 20X9 diluted earnings per share? a. $2.50 b. $2.85 c. $2.92 d. $3.50 10 Coffee Co. had the following information related to common and preferred shares during the year: Common shares outstanding, 1/1 700,000 Common shares repurchased, 3/31 20,000 Conversion of preferred shares, 6/30 40,000 Common shares repurchased, 12/1 36,000 Coffee reported net income of $2,000,000 at December 31. What amount of shares should Coffee use as the denominator in the computation of basic earnings per share? a. b. c. d. 684,000 700,000 702,000 740,000 Page 26-8 415-346-4CPA ©Roger CPA Review www.RogerCPAreview.com FAR-6 SOLUTIONS 1. (b) The formula for computing BEPS for a simple capital structure is: Net income – Applicable pref. stock dividends Weighted-average # of common shares outstanding Net income is $410,000 and $350,000 in 20X3 and 20X2, respectively, and there are no preferred dividends. The weighted-average number of common shares outstanding must be computed for 2003. Stock dividends and stock splits are handled retroactively for comparability. The 20X3 computation is Dates 1/1 to 3/31 4/1 to 6/30 7/1 to 12/31 Number of shares 100,000 x 2 = 200,000 (100,000 + 20,000) x 2 = 240,000 120,000 x 2 = 240,000 Fraction 3/12 3/12 6/12 WA 50,000 60,000 120,000 230,000 The 20X2 weighted-average of 100,000 is retroactively restated to 200,000 for comparability. Therefore, the BEPS amounts are: 20X3 $410,000 = $1.78 230,000 20X2 $350,000 = $1.75 200,000 2. (a) Diluted EPS takes into account the effect of all dilutive potential common shares that were outstanding during the period. Thus, the possible conversion of convertible bonds would be included because they are dilutive (i.e., EPS would be reduced), but the possible exercise of common stock options would not be included because they are antidilutive (i.e., EPS would be increased). Diluted EPS = $15.00 – $.75 = $14.25. 3. (b) The formula for basic earnings per share (BEPS) is: $500,000 10,000 Net Income Preferred Dividends 200,000 common shares outstanding = $2.45 In calculating the numerator, the claims of preferred shareholders against 20X3 earnings should be deducted to arrive at the 20X3 earnings attributable to common shareholders. This amount is $10,000 ($250,000 x 4%). During 20X2, the BEPS numerator would have been reduced by $10,000 even though no preferred dividends were declared, because the cumulative feature means that $10,000 of 20X2 earnings are reserved for, and will ultimately be paid to, preferred stockholders. In 20X3, the 20X2 dividends in arrears are paid, as well as $6,000 of the $10,000 20X3 preferred dividend. Even though only $6,000 is paid, the entire $10,000 is subtracted for reasons explained above. 4. (b) Diluted earnings per share is based on common stock and all dilutive potential common shares. To determine if a security is dilutive, EPS, including the effect of the dilutive security, must be compared to the basic EPS. In this case, basic EPS is $7.45. $850,000 (NI) – 30,000 (pref div) 110,000 shares ©Roger CPA Review = $7.45 415-346-4CPA Page 26-9 FAR-6 www.RogerCPAreview.com The effect of the convertible preferred stock is to increase the numerator by $30,000 ($3.00 dividend per share x 10,000 shares) for the amount of the preferred dividends that would not be paid (assuming conversion) and increase the denominator by 20,000 shares. This security is dilutive because it decreases the EPS from $7.45 to $6.54. $850,000 – 30,000 + 30,000 110,000 + 20,000 = $6.54 If the EPS increases due to the inclusion of a security, that security is antidilutive and should not be included. 5. (a) Per SFAS 128 (ASC 260), the if-converted method of computing earnings per share assumes that convertible securities are converted at the beginning of the earliest period reported or, if later, at the time of issuance. 6. (b) Per SFAS 128 (ASC 260), if convertible securities are deemed to be dilutive, then interest expense should be added back to net income when computing diluted earnings per share. 7. (d) The computation of weighted-average shares outstanding is Date 1/1 2/1 7/1 # of shares 30,000 3,000 8,000 x x x Fraction 12/12 = 12/12 = 6/12 = WA_ 30,000 3,000 4,000 37,000 The 3,000 shares issued as a result of a stock dividend are weighted at 12/12 instead of 11/12 because for EPS purposes stock dividends are treated as if they occurred at the beginning of the year. 8. (c) The requirement is to identify the amount that should be used as the numerator in the fraction used to compute diluted earnings per share. Because the bonds are convertible, the diluted earnings per share calculation requires interest expense (net of the tax effect) to be added back to net income. Interest expense on the bond is equal to $470,000 [($5,000,000 × 9%) + $20,000]. The tax effect is $117,500 ($470,000 × 25%). Therefore, the numerator is equal to $952,500 ($600,000 + $470,000 – $117,500). 9. (b) The effect of convertible bonds is included in diluted EPS under the “if converted” method, if they are dilutive. The bonds are dilutive as shown below. Basic EPS = $35,000 (1/2) 10,000 + (1/2) 14,000 (7% × $10,000) – 30% Incremental = per share = (7% × $10,000) 200 shares per bond effect = $2.92 $490 200 = $2.45 Since $2.45 < $2.92, the bonds are dilutive. Under “ if converted” method, the assumption is made that the bonds were converted at the beginning of the current year (1/1) or later in the current year if the bonds were issued during the current year. In this case, conversion is assumed for the first six months of 20X9 only because the bonds were actually converted on July 1. Under their assumed conversion, the numerator would increase because bond interest Page 26-10 415-346-4CPA ©Roger CPA Review www.RogerCPAreview.com FAR-6 expense would not have been incurred for the first six months of the year [1/2 ($14,000 – 30% × $14,000) = $4,900]. The denominator would increase because the 4,000 shares (20 × 200) would have been outstanding for the first six months of the year (4,000 × 6/12 = 2,000). Therefore, diluted EPS is $2.85. $35,000 + $4,900 12,000 + 2,000 = $39,900 14,000 = $2.85 10. (c) The denominator in basic earnings per share can be calculated as follows: Common shares outstanding, 1/1 700,000 × 12/12 = 700,000 Common shares repurchased, 3/31 (20,000) × 9/12 = (15,000) Conversion of preferred shares, 6/30 40,000 × 6/12 = 20,000 Common shares repurchased, 12/1 (36,000) × 1/12 = (3,000) Weighted-average common shares outstanding = 702,000 ©Roger CPA Review 415-346-4CPA Page 26-11 FAR-6 www.RogerCPAreview.com Task-Based Simulation 1 Analysis of Transactions Authoritative Literature Help Situation M Corporation was incorporated in 20x1. During 20x1, the company issued 100,000 shares of $1 par value common stock for $27 per share. During 20x2, the company had the following transactions. 1/2/x2 3/1/x2 7/1/x2 10/1/x2 12/1/x2 12/30/x2 Issued 10,000 shares of $100 par value cumulative preferred stock at par. The preferred stock was convertible into five shares of common stock and had a dividend rate of 6%. Issued 3,000 shares of common stock for legal service performed. The value of the legal services was $100,000. The stock was actively traded on a stock exchange and valued on 3/1/x2 at $32 per share. Issued 40,000 shares of common stock for $42 per share. Repurchased 16,000 shares of treasury stock for $34 per share. M Corp. uses the cost method to account for treasury shares. Sold3,000sharesoftreasurystockfor$29pershare. Declaredandpaidadividendof$0.20pershareoncommonstockanda6%dividendon thepreferredstock. During20x1,MCorporationhadnetincomeof$250,000andpaiddividendsof$28,000.During20x2M Corporationhadnetincomeof$380,000. IndicatetheimpactthatthetransactionsforMCompanyhaveonitsownerequityaccounts.Placethe appropriateamountsinthetablebelow.Ifanamountisnegative,showtheamountinparentheses. Date 1/01 1/2/x2 3/1/x2 7/1/x2 10/1/x2 12/1/x2 12/30/x2 12/31/x2 12/31/x2 Transaction Beginningbalance Issuepreferred stockatpar Issuecommon stockforservices Issuecommon stockforcash Repurchase treasurystock Selltreasurystock Declareandpay dividends Netincome EndingBalance Preferred stock APIC— Preferred stock Common stock APIC— Common stock Retained earnings Treasury stock APIC— Treasury stock Page 26-12 415-346-4CPA ©Roger CPA Review www.RogerCPAreview.com FAR-6 Task-Based Simulation 2 Calculation EPS Authoritative Literature Help M Corporation was incorporated in 20x1. During 20x1, the company issued 100,000 shares of $1 par value common stock for $27 per share. During 20x2, the company had the following transactions. 1/2/x2 Issued 10,000 shares of $100 par value cumulative preferred stock at par. The preferred stock was convertible into five shares of common stock and had a dividend rate of 6%. 3/1/x2 Issued 3,000 shares of common stock for legal service performed. The value of the legal services was $100,000. The stock was actively traded on a stock exchange and valued on 3/1/x2 at $32 per share. 7/1/x2 Issued 40,000 shares of common stock for $42 per share. 10/1/x2 Repurchased 16,000 shares of treasury stock for $34 per share. M Corp. uses the cost method to account for treasury shares. 12/1/x2 Sold 3,000 shares of treasury stock for $29 per share. 12/30/x2 Declared and paid a dividend of $0.20 per share on common stock and a 6% dividend on the preferred stock. During 20x1, M Corporation had net income of $250,000 and paid dividends of $28,000. During 20x2 M Corporation had net income of $380,000. Calculate basic earnings per share. Show the components of your solution in the following table: Numerator Denominator Basic earnings per share Calculate diluted earnings per share. Show the components of your solution in the following table: Numerator Denominator Diluted earnings per share Task-Based Simulation 3 Research Authoritative Literature Help You have been asked to research the professional literature to determine how to calculate diluted earnings per share. Place the citation for the excerpt from professional standards that provides this information in the answer box below. ©Roger CPA Review 415-346-4CPA Page 26-13 FAR-6 www.RogerCPAreview.com Task-Based Simulation Solution 1 Analysis of Transactions Date 1/01/x2 1/2/x2 3/1/x2 7/1/x2 10/1/x2 12/1/x2 12/30/x2 12/31/x2 12/31/x2 Authoritative Literature Transaction Beginning balance Issue preferred stock at par Issue common stock for services Issue common stock for cash Repurchase treasury stock Sell treasury stock Declare and pay dividends Net income Ending balance Preferred stock Help APIC— preferred stock Common stock 1,000,000 APIC— common stock 2,600,000 Retained earnings 222,000 Treasury stock APIC— treasury stock 1,000,000 3,000 93,000 40,000 1,640,000 (15,000) 1,000,000 0 143,000 4,333,000 (544,000) 102,000 (86,000) 380,000 501,000 (442,000) 0 Explanation of solutions • Preferred stock 10,000 × $100 = $1,000,000 • Value of services = Fair value of stock which is more reliable since stock is traded on the open market. 3,000 shares × $32 per share = $96,000 • Common stock: 40,000 shares of common stock × $1 par = $40,000 to common stock account; $40,000 × 41 = $1,640,000 to APIC • Treasury stock is recorded at cost. 16,000 shares × $34 per share = $544,000 • Treasury stock is reduced by the cost paid 3,000 × $34 per share = $102,000. There is a $5 per share loss on the treasury shares which is debited to retained earnings 3,000 shares × $5 = $15,000 • Dividends to preferred shareholders = 10,000 × $100 par = $1,000,000 × 6% = $60,000 preferred dividends • Dividends to common shareholders. Number of common shares outstanding equals 100,000 shares + 3,000 shares issued + 40,000 shares issued – 16,000 treasury shares purchased + 3,000 treasury shares reissued = 130,000 outstanding shares × $0.20 = $26,000. Therefore, total dividend is $86,000 Ending Balances • Preferred stock: Issued at par. 10,000 shares × $100 = $1,000,000 • Common stock: $100,000 + $3,000 + $40,000 = $143,000 • Additional paid-in capital—Common stock: $2,600,000 + $93,000 + $1,640,000 = $4,333,000 • Retained earnings: $250,000 – $28,000 = $222,000 at end of 2010 • Retained earnings for 20x2: $222,000 – $15,000 – $86,000 + $380,000 = $501,000 • Treasury stock: $544,000 – $102,000 = $442,000 Page 26-14 415-346-4CPA ©Roger CPA Review www.RogerCPAreview.com FAR-6 Task-Based Simulation Solution 2 Calculation EPS Authoritative Literature Help Numerator Denominator Basic earnings per share 320,000 118,750 2.6947 Explanation of solutions Numerator: $380,000 net income – $60,000 in preferred dividends = $320,000. Denominator – Weightedaverage common shares. # shares 100,000 3,000 40,000 (16,000) treasury shares 3,000 treasury shares sold Total WACS outstanding Date 1/1 3/1 7/1 10/1 12/1 Numerator Denominator Diluted earnings per share Time outstanding 12/12 10/12 6/12 3/12 1/12 WACS 100,000 2,500 20,000 (4,000) 250 118,750 380,000 168,750 2.2519 WACS outstanding: Basic EPS 118,750 + Convertible preferred (10,000 shares preferred × 5 shares common) 50,000 = 168,750. Task-Based Simulation Solution 3 Research Authoritative Literature ASC 260 10 ©Roger CPA Review 45 Help 16 415-346-4CPA Page 26-15