Pronouncements available for early adoption in

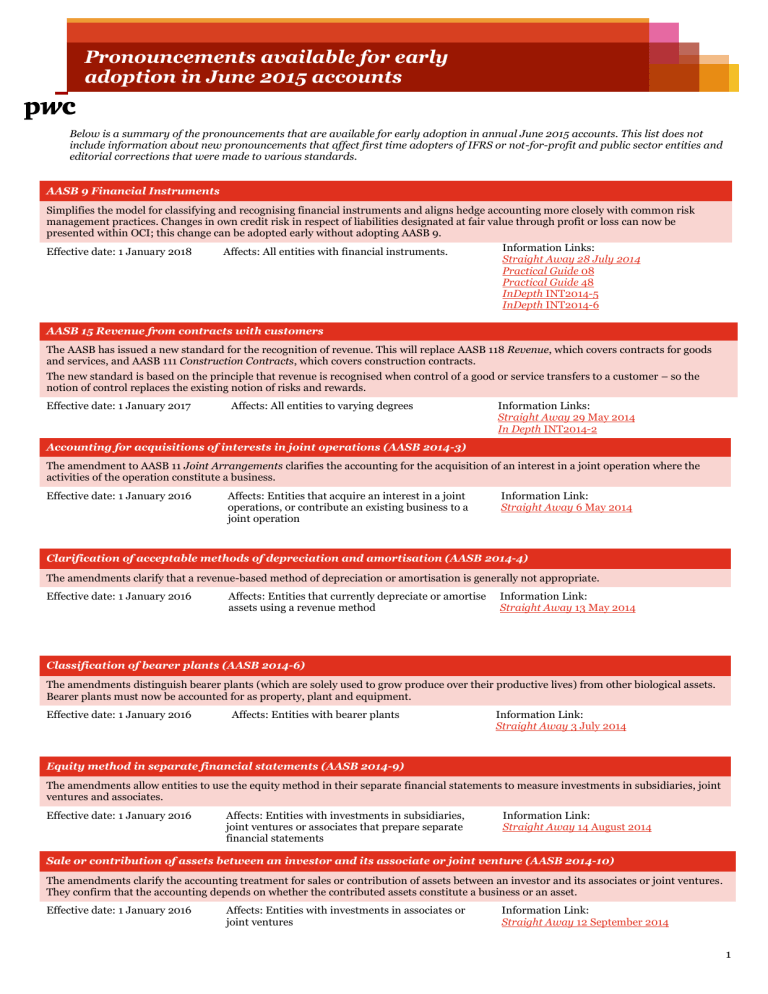

Pronouncements available for early adoption in June 2015 accounts

Below is a summary of the pronouncements that are available for early adoption in annual June 2015 accounts. This list does not include information about new pronouncements that affect first time adopters of IFRS or not-for-profit and public sector entities and editorial corrections that were made to various standards.

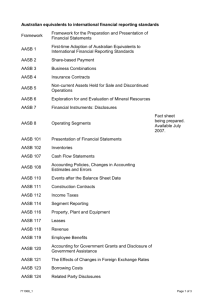

AASB 9 Financial Instruments

Simplifies the model for classifying and recognising financial instruments and aligns hedge accounting more closely with common risk management practices. Changes in own credit risk in respect of liabilities designated at fair value through profit or loss can now be presented within OCI; this change can be adopted early without adopting AASB 9.

Effective date: 1 January 2018 Affects: All entities with financial instruments.

Information Links:

Straight Away 28 July 2014

Practical Guide 08

Practical Guide 48

InDepth INT2014-5

InDepth INT2014-6

AASB 15 Revenue from contracts with customers

The AASB has issued a new standard for the recognition of revenue. This will replace AASB 118 Revenue , which covers contracts for goods and services, and AASB 111 Construction Contracts , which covers construction contracts.

The new standard is based on the principle that revenue is recognised when control of a good or service transfers to a customer – so the notion of control replaces the existing notion of risks and rewards.

Effective date: 1 January 2017 Affects: All entities to varying degrees Information Links:

Straight Away 29 May 2014

In Depth INT2014-2

Accounting for acquisitions of interests in joint operations (AASB 2014-3)

The amendment to AASB 11 Joint Arrangements clarifies the accounting for the acquisition of an interest in a joint operation where the activities of the operation constitute a business.

Effective date: 1 January 2016 Affects: Entities that acquire an interest in a joint operations, or contribute an existing business to a joint operation

Information Link:

Straight Away 6 May 2014

Clarification of acceptable methods of depreciation and amortisation (AASB 2014-4)

The amendments clarify that a revenue-based method of depreciation or amortisation is generally not appropriate.

Effective date: 1 January 2016 Affects: Entities that currently depreciate or amortise assets using a revenue method

Information Link:

Straight Away 13 May 2014

Classification of bearer plants (AASB 2014-6)

The amendments distinguish bearer plants (which are solely used to grow produce over their productive lives) from other biological assets.

Bearer plants must now be accounted for as property, plant and equipment.

Effective date: 1 January 2016 Affects: Entities with bearer plants Information Link:

Straight Away 3 July 2014

Equity method in separate financial statements (AASB 2014-9)

The amendments allow entities to use the equity method in their separate financial statements to measure investments in subsidiaries, joint ventures and associates.

Effective date: 1 January 2016 Affects: Entities with investments in subsidiaries, joint ventures or associates that prepare separate financial statements

Information Link:

Straight Away 14 August 2014

Sale or contribution of assets between an investor and its associate or joint venture (AASB 2014-10)

The amendments clarify the accounting treatment for sales or contribution of assets between an investor and its associates or joint ventures.

They confirm that the accounting depends on whether the contributed assets constitute a business or an asset.

Effective date: 1 January 2016 Affects: Entities with investments in associates or joint ventures

Information Link:

Straight Away 12 September 2014

1

Annual Improvements 2012-2014 (AASB 2015-1)

Amendments to clarify minor points in various accounting standards, including AASB 5 Non-current Assets Held for Sale and Discontinued

Operations , AASB 7 Financial Instruments: Disclosures , AASB 119 Employee Benefits and AASB 134 Interim Financial Reporting .

Effective date: 1 January 2016 Affects: All entities to varying degrees Information Link:

Straight Away 26 September 2014

Disclosure Initiative: Amendments to AASB 101 (AASB 2015-2)

Amendments to AASB 101 Presentation of Financial Statements that allow entities to use judgment in determining what information to disclose in financial statements.

Effective date: 1 January 2016 Affects: All entities to varying degrees Information Link: N/A

Amendments arising from the Withdrawal of AASB 1031 Materiality (AASB 2015-3)

Completes the withdrawal of references to AASB 1031 in all Australian Accounting Standards and Interpretations, allowing that Standard to effectively be withdrawn.

Effective date: 1 July 2015 Affects: All entities to varying degrees Information Link: N/A

©2015 PwC. All rights reserved. "PwC" refers to PwC, a partnership formed in Australia or, as the context requires, the PwC global network or other member firms of the network, each of which is a separate and independent legal entity.

2