berjaya group berhad

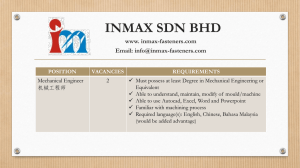

advertisement