Chapter 2 Additional Questions and Problems 1. The price of XYZ

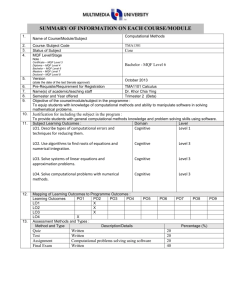

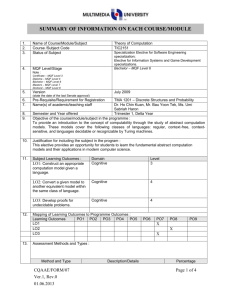

advertisement

Chapter 2 Additional Questions and Problems 1. The price of XYZ stock is $52 per share. Six-month European call and put options, both with a striking price of $45, are traded on the stock. The present value of the striking price, discounted at the current market rate of interest for six months, is $43. The market price of the call option is $11 per share. What should be the theoretical market price of the put? 2. Consider a one-year European call option with a striking price of $100. The price of the underlying stock is $108, and the risk-free rate of interest is 5 percent per year compounded annually. (In other words, $1 invested in a safe asset should be worth $1.05 after one year.) The stock pays no dividends. What is the lowest possible value for this call option, assuming the market for the option is efficient? 3. Consider the following information relevant to the pricing of one-year European put and call options on XYZ stock. Stock Price Striking price for put and call Market price of put Market price of call Risk-free interest rate $53.00 $50.00 $ 2.00 $ 8.00 5 percent per year compounded annually Determine whether the put and call options are priced correctly, given the pricing information shown in the table above. If you determine that the options are not priced correctly, describe a transaction that should provide you with an immediate arbitrage profit while guaranteeing that you will have a net payoff of zero one year from now at the time the options mature. Project Testing Put-Call Parity On Monday, January 7, 2002, options on Microsoft with the maturity dates shown below were available for trading. Also shown are risk-free rates for investing and borrowing through each date as of January 7. Days Risk-Free Risk-Free Actual until Investing Borrowing Option Maturity Date Maturity Rate (%) Rate (%) Jan 2002 January 18 11 1.73 2.03 Feb 2002 February 15 39 1.70 2.00 Apr 2002 April 19 102 1.71 2.01 Jul 2002 July 19 193 1.81 2.11 Jan 2003 January 17 375 2.40 2.70 Jan 2004 January 16 739 3.32 3.62 All interest rates are annualized, assuming annual compounding. Example present value calculation: Present value of $1 to be received from investing through July 19, 2002: 1 = 0.99056 1.0181193/ 365 On the web site for the textbook, http://www.rendleman.com/book, you should download the Excel file MICROSOFT PUT_CALL_JAN 7, 2002.xls to use in connection with this project. The file contains price data for all exchange-traded options in Microsoft as of 10:01 A.M., January 7, 2002. A portion of the data from the file is shown below. Stock Bid 69.70 Bid 02 Jan 30.00 (MQF AF-E) 02 Jan 35.00 (MQF AG-E) 02 Jan 40.00 (MQF AH-E) 02 Jan 45.00 (MQF AI-E) 02 Jan 50.00 (MSQ AJ-E) 02 Jan 55.00 (MSQ AK-E) 02 Jan 60.00 (MSQ AL-E) 02 Jan 65.00 (MSQ AM-E) 02 Jan 70.00 (MSQ AN-E) Ask Volume 69.71 6,326,600 Calls Ask Volume Open Int Bid Puts Ask Volume Open Int 39.5 39.9 0 1616 0 0.05 0 9697 34.5 34.9 0 1421 0 0.05 0 12829 29.6 29.9 0 4243 0 0.05 0 12677 24.6 24.9 0 11804 0 0.05 0 26208 19.6 19.9 5 19175 0 0.1 0 72228 14.6 14.9 20 25584 0 0.1 0 63059 64539 9.7 10 6 54899 0.05 0.15 10 5.1 5.3 123 68097 0.35 0.5 71 70630 1.55 1.7 457 124510 1.8 2 121 114868 For each option, a bid and ask price is given along with the volume of trading as of 10:01 and the open interest. Open interest represents the number of option contracts outstanding. For each maturity and striking price combination, compute the up-front cost of establishing a position involving stock, a call, a put and safe asset that will have a payoff of zero at maturity based on the following two put-call-parity-based pricing relationships: 0 = stock + put − call − pv ( strike ) 0 = call + pv ( strike ) − stock − put The first equation assumes you buy the stock, buy the put, write the call and borrow the present value of the striking price. The second equation assumes the opposite; you buy the call, buy a safe asset that will pay the striking price when the options mature, write the put and short the stock. When computing up-front costs assume all security purchases are made at ask prices and that all sales, writing positions, and borrowing is done at bid prices. If you find any arbitrage opportunities, see if you can come up with rational explanations.