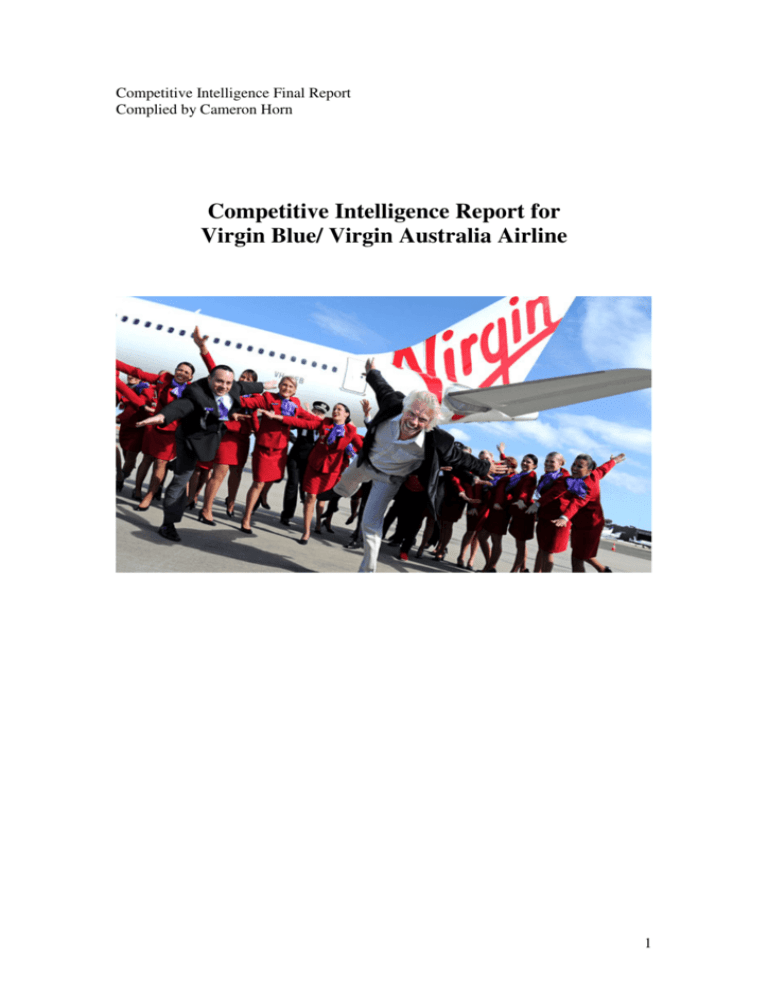

Competitive Intelligence Report for Virgin Blue/ Virgin Australia Airline

advertisement