Are you FOFA ready - Part 2 - April 2013

advertisement

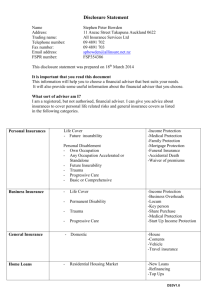

ARE YOU FOFA READY? Part 2 – Best interests and related duties In Part 1 of our FOFA advice, we addressed the new prohibition on conflicted remuneration. In this Part 2, we consider the new obligations on advisers providing personal advice to retail clients including duties to: • act in the best interests of the client; • provide appropriate advice; • warn the client if advice is based on incomplete or inaccurate information; and • prioritise the client’s interests. There will also be an obligation on licensees to take reasonable steps to ensure their representatives comply with their duties. These new obligations will come into effect from 1 July 2013. A failure to comply may result in fines against the authorised representative or licensee and or administrative sanctions such as banning orders or suspension / cancellation of your AFSL. Set out below is a brief summary of some key issues arising out of these changes. Separate obligations It is important to understand that the above obligations are separate and must be separately satisfied. It is a common misconception that complying with the “acting in the best interests of the client” obligation will satisfy all other obligations. Licensees and representatives should consider each of the obligations separately to ensure that their policies, procedures and actions comply. Will your client be in a better position if they follow your advice? One of the key issues ASIC will consider when assessing whether an adviser has complied with the best interests duty is whether a reasonable adviser would believe that the client is likely to be in a better position if the client follows the advice. ASIC will consider (as at the time the advice was given): • the position the client would have been in if they did not follow the advice; • the facts that the adviser had or should have had; • the subject matter of the advice sought by the client; • the client’s objective financial situation and needs; • where relevant, product features that the client particularly values (provided that the client understands the cost of and is prepared to pay for those features); and • whether the client receives a benefit that is more than trivial. Is your process sufficient? In its updated RG175, ASIC sets out its clear expectations in relation to processes for complying with the best interests duty. In particular, ASIC expects that processes ensure that, within the subject matter of the advice sought by the client: strategic. practical. astute. Liability limited by a scheme approved under the Professional Standards Legislation -2• the scope of the advice includes all the issues that must be considered for the advice to meet the client’s objectives, financial situation and needs; • if the scope of the advice changes, the change is consistent with the client’s objectives, financial situation and needs; • the client’s objectives, financial situation and needs are identified through inquiries or otherwise; and • the adviser focuses on providing advice that is not product specific, or on a combination of advice that is both product specific and non-product specific where this would better suit the client’s objectives, financial situation and needs. Advice that is not product specific may include advice to do nothing. ASIC makes it clear that it is more likely to take the view that processes for complying with the best interests duty are not effective and the duty is not being complied with if an advice model typically leads to a one-size-fits-all outcome. Advisers must consider their advice model to ensure it complies with the best interests duty. It is imperative that licensees review and implement processes to ensure they can prove they have taken reasonable steps to ensure their representatives comply with the best interests duty. Are you within the “safe harbour”? There is a “safe harbour” available such that, if advisers can show they have taken certain steps, they are considered to have complied with the best interests duty. In order to fall within the safe harbour, an adviser must: • identify the objectives, financial situation and needs of the client that were disclosed by the client through instructions; • identify the subject matter of the advice sought by the client and the objectives, financial situation and needs of the client that would reasonably be considered relevant to advice on that subject matter; • if it is reasonably apparent that information relating to the client’s relevant circumstances is incomplete or inaccurate, make reasonable inquiries to obtain to complete and accurate information; • assess whether the adviser has the expertise required to provide the client with advice on the subject matter sought and if not, decline to provide the advice; • if it is reasonable to consider recommending a financial product, conduct a reasonable investigation into the financial products that might achieve the objectives and meet the needs of the client and assess the information gathered in the investigation; • base all judgments in advising the client on the client’s relevant circumstances; and • take any other step that, at the time the advice is provided, would reasonably be regarded as being in the best interests of the client given their relevant circumstances. It is important for licensees and advisers to ensure that procedures and records can show that each of the elements of the safe harbour has been clearly satisfied. ASIC has provided detailed guidance on complying with each of the above elements. If you would like particular advice or further information on this please let us know. When is it reasonable to recommend a financial product? If the adviser considers it would be reasonable to recommend a financial product, the adviser must conduct a reasonable investigation into the financial products that might achieve the client’s objectives and needs and assess the information gathered. ASIC makes it clear that “a reasonable investigation” does not mean an investigation into every product available. However, if a client requests that an adviser consider a specific financial product the adviser must investigate that financial product. Before recommending that a client acquires a financial product, advisers must formulate the strategy on which they are basing the advice, taking into account their obligations to undertake reasonable investigations before determining whether to recommend a financial product. In some cases it will not be reasonable to recommend a financial product. strategic. practical. astute. -3Switching When recommending that a client switch to another financial product or investment option, advisers must consider and investigate the existing product, potential new financial products and the new product recommended to the client. Advisers have duties to disclose information in the statement of advice about the costs and benefits of switching between one financial product and another financial product. However, under FOFA, there are additional things that advisers need to do, such as determining whether it is reasonable to recommend financial products and finding out information about financial products beyond the existing product and product(s) the advisers recommend in order to determine which product(s) they recommend. When giving switching advice, advisers must consider the benefits and disadvantages including costs and risks of both products or investment options. ASIC considers that advice will only be appropriate if it would be reasonable to conclude that the net benefits that are likely to result from the product or investment option to be acquired are better than under the existing product. In determining whether there are overall cost savings for a client, advisers must take into account all of the circumstances including the costs of switching and the adviser fees if they are payable only if the switch is made. Approved product lists The best interests duty does not prevent or require the use of approved product lists. In some cases, advisers will be able to conduct a reasonable investigation into financial products by investigating the products on their approved product list. ASIC makes it clear that in other cases advisers may need to investigate and consider products that are not on the approved product list to show they have acted in the best interests of the client. However, this can result in authorisation issues where an authorised representative is only authorised to give advice on approved products. If advisers are unable to recommend products outside of their approved product list and they need to do this to meet their obligations, they must not provide the advice. This issue may arise where the client’s existing products or products requested by the client are not on the approved product list and the adviser has an obligation to consider those products. Tax implications outside the adviser’s competence Financial advisers providing tax advice in the context of providing financial product advice are currently exempt from the tax agent’s services regime. However this exemption will expire on 30 June 2013. The client’s tax position may often be relevant to the assessment of the client’s relevant circumstances. When there are material tax implications that go beyond advisers’ competence, ASIC provides 2 suggestions of how advisers can act in the best interests of the client and give appropriate advice. First, the financial advice can be based on tax advice given to the client by someone with appropriate expertise such as a registered tax agent. Second, the advice can be limited to matters on which the adviser is competent to advise and the adviser must take steps to ensure the client understands they should seek tax advice from a person with appropriate expertise before following the advice. Scaled advice ASIC has provided detailed guidance on providing scaled advice which is limited in scope. Importantly, ASIC’s guidance about complying with the best interests duty and related obligations remain equally relevant for advisers who are providing scaled advice or comprehensive advice. The obligations are the same. If you want further information on provision of scaled advice, please let us know. Please contact us if you require further advice in relation to the best interests duty or any other financial services implications for your business. CATHERINE EVANS Special Counsel CEvans@cowellclarke.com.au RICHARD BEISSEL Partner RBeissel@cowellclarke.com.au © COWELL CLARKE 2013. No part of this document may in any form or by any means be reproduced, stored in a retrieval system or transmitted without prior written consent. This article is for general information only and cannot be relied upon as legal advice. Do not act on the basis of this article but seek specific advice from your legal adviser. strategic. practical. astute.

![Literature Option [doc] - Department of French and Italian](http://s3.studylib.net/store/data/006916848_1-f8194c2266edb737cddebfb8fa0250f1-300x300.png)