Regulatory Guide RG 175 Licensing: Financial product advisers

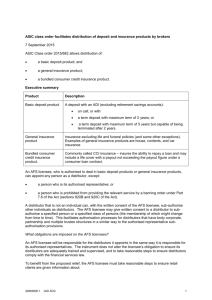

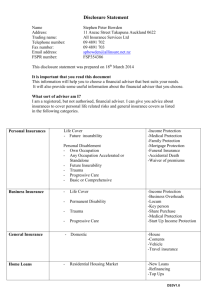

advertisement