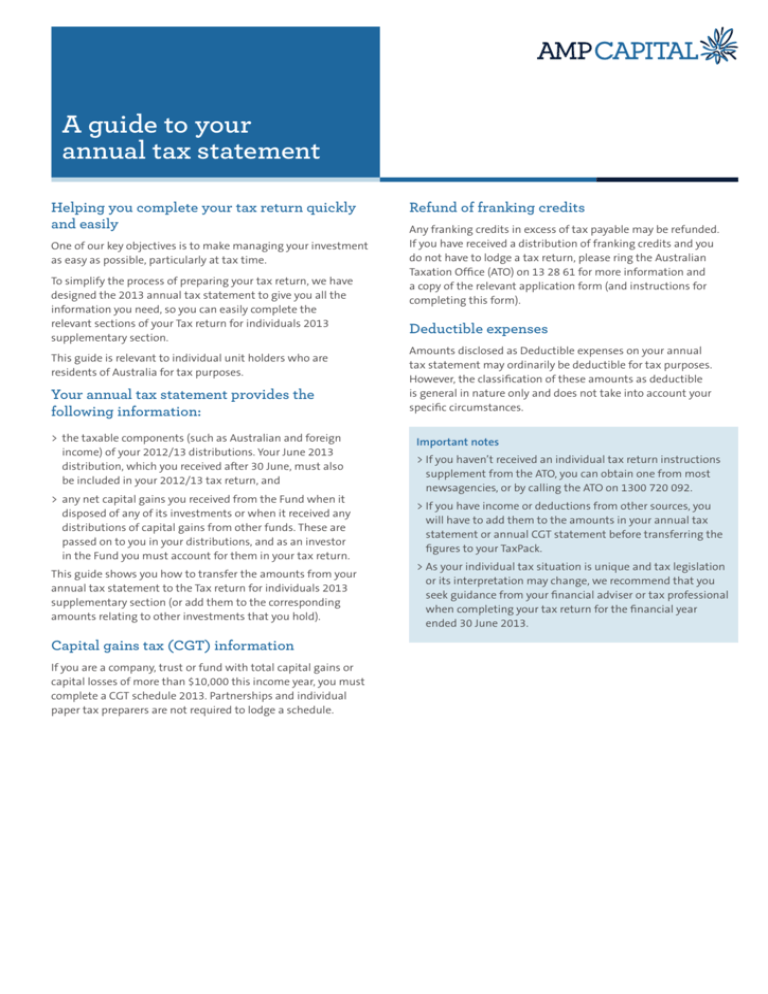

A guide to your annual tax statement

advertisement

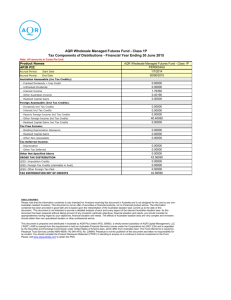

A guide to your annual tax statement Helping you complete your tax return quickly and easily One of our key objectives is to make managing your investment as easy as possible, particularly at tax time. To simplify the process of preparing your tax return, we have designed the 2013 annual tax statement to give you all the information you need, so you can easily complete the relevant sections of your Tax return for individuals 2013 supplementary section. This guide is relevant to individual unit holders who are residents of Australia for tax purposes. Your annual tax statement provides the following information: >> the taxable components (such as Australian and foreign income) of your 2012/13 distributions. Your June 2013 distribution, which you received after 30 June, must also be included in your 2012/13 tax return, and >> any net capital gains you received from the Fund when it disposed of any of its investments or when it received any distributions of capital gains from other funds. These are passed on to you in your distributions, and as an investor in the Fund you must account for them in your tax return. This guide shows you how to transfer the amounts from your annual tax statement to the Tax return for individuals 2013 supplementary section (or add them to the corresponding amounts relating to other investments that you hold). Capital gains tax (CGT) information If you are a company, trust or fund with total capital gains or capital losses of more than $10,000 this income year, you must complete a CGT schedule 2013. Partnerships and individual paper tax preparers are not required to lodge a schedule. Refund of franking credits Any franking credits in excess of tax payable may be refunded. If you have received a distribution of franking credits and you do not have to lodge a tax return, please ring the Australian Taxation Office (ATO) on 13 28 61 for more information and a copy of the relevant application form (and instructions for completing this form). Deductible expenses Amounts disclosed as Deductible expenses on your annual tax statement may ordinarily be deductible for tax purposes. However, the classification of these amounts as deductible is general in nature only and does not take into account your specific circumstances. Important notes >>If you haven’t received an individual tax return instructions supplement from the ATO, you can obtain one from most newsagencies, or by calling the ATO on 1300 720 092. >>If you have income or deductions from other sources, you will have to add them to the amounts in your annual tax statement or annual CGT statement before transferring the figures to your TaxPack. >>As your individual tax situation is unique and tax legislation or its interpretation may change, we recommend that you seek guidance from your financial adviser or tax professional when completing your tax return for the financial year ended 30 June 2013. Amounts shown in your annual tax statement can be transferred directly to the relevant sections in the Tax return for individuals 2013 supplementary section, or added to corresponding amounts relating to other investments you hold or the information from your personal annual CGT statement (if you received one). Wholesale and Retail Unit Trusts AXA Wholesale Investment Funds <fund name> Annual taxation taxation statement statement for for the the period period 1 1 July July 2012 2011 to to 30 30 June June 2013 2012 Annual <Mailing Name> <Address Line 1> <Address Line 2> <Address Line 3> Account details Investor name <Account Name> Investor number <Account Number> Taxation information summary Tax credits ($) Distributed amount ($) Distribution information Income Australian Franked distribution from trusts Other Australian Foreign Tax free Tax deferred Return of capital Capital Gains Discounted TARP Discounted NTARP CGT concession Non-discounted TARP Non-discounted NTARP Gross distribution Taxable income/(expense) ($) 21,065.90 50,176.22 14,310.38 13Q 35,376.28 50,176.22 13C 13U 5.74 0.92 20O 6.66 20E 20M 1,122.78 1,613.35 18A 18A 100.00 1,028.00 89,423.29 18A 18A 25.00 (25.00) 5.00 (5.00) 2.00 (2.00) 13R 18.00 5.00 11.00 13Y 13Y 13Y 22.00 24V 4.90 30.50 10.50 1,122.78 1,613.35 2,736.13 100.00 1,028.00 77,894.02 18H 18H 18H 18H 18H 14,311.30 Other taxable items Tax rebates TFN Tax less TFN Tax Refund Withholding tax less Withholding tax refund Income tax less Income tax refund Deductible expenses Adviser review fee Bank charges Client Advice fee Management expense rebate 13A 13A AMP Investors Limited Box 2780 Melbourne AXA Capital Customer Service GPO GPO Box 2780 Melbourne VIC VIC 30013001 Telephone: Facsimile: (03) 8688 5796 client.inquiry@ampcapital.com Telephone:1800 1800780 780085 085 Facsimile: (03) 8688 5789 Responsible Mutual Funds Management Ltd Ltd Responsibleentity: Entity:National National Mutual Funds Management ABN 32 32006 006787 787720 720AFS AFSLicence Licence No. 234652 ABN No. 234652 <TA number> Some of the items shown in this example may not appear on your personal annual tax statement if they were not relevant to your particular investment. These figures are used for illustrative purposes only. Please use amounts from your annual tax statement. Page(s) from the 2013 tax return for individuals (supplementary section) are published by the ATO Copyright Commonwealth of Australia, reproduced by permission. with a black or blue ballpoint pen only. Do not use correction fluid or tape. Print one letter or number in each box. Print X in appropriate boxes. Complete your details carefully to avoid delays in processing your tax return. See the Privacy note in the Taxpayer’s declaration on page 10 of your Tax return A guide to your annual tax statement for individuals 2013. Your tax file number (TFN) Your name Title – for example, Mr, Mrs, Ms, Miss Surname or family name Print your full name. Given names INCOME 13 Partnerships and trusts Include any deferred non-commercial business losses from a prior year at X or Y as appropriate and insert the relevant code in the TYPE box. Primary production N , Share of net income from trusts L , .00 I , .00 INCOME Landcare continued operations and deduction 15 .00 Distribution from partnerships for decline in value of water facility Net income orOther lossdeductions from business relating to amounts shown at N and L . TYPE 00 , To complete this item, you need to read and complete the Business and professional items schedule for individuals 2013. X Nettax primary production amount You cannot lodge a paper return. You must lodge your return using e-tax or a registered tax , agent. Non-primary production , .00 LOSS . Distribution from partnerships, INCOME continued less foreign income O 00 Show amounts of: , capital gains from trusts at item 18 and Share of net income from trusts, less capital Deferred non-commercial business losses 16 .00 foreign income at item 19 or 20. U , gains, foreign income and franked distributions Net incomethis oritem, lossyou from business complete need to read and complete the Business and professional items schedule for individuals 2013. 15 To Franked distributions .00 You cannot lodge a paper You must lodge your tax using e-tax or a registered tax agent.for individuals 2013. To complete this item, youreturn. needfrom to read andC complete the,return Business and professional items schedule trusts You cannot lodge a paper return. You must lodge your tax return using e-tax or a registered tax agent. Landcare operations expenses J .00 , TYPE Other deductions relatingor to repayments .00 management deposits 17 Net farmamounts , shown at O , U and C Y business losses 16 Deferred non-commercial .00 Deductible deposits DNet non-primary production amount , . 00 , , To complete this item, you need to read and complete the Business and professional items schedule for individuals 2013. LOSS Share of credits from income and tax offsets Early repayments .00 or a registered tax agent. You cannot aexceptional paper You must lodge Sharelodge of credit for taxreturn. withheld where C your tax return using. e-tax circumstances , 17 18 Australian business number not quoted P , Early repayments Share of franking credit N . .00 natural disaster , Q from franked dividends , . Net farm management deposits or repayments Other repayments Share of credit for tax file number amounts R , . 00 withheld from interest, dividends R , .00 deposits D and unit Deductible trust distributions .00 ,Net farm management deposits or repayments E , , Credit for TFN amountsEarly withheld from repayments . . M 00 C , , paymentsexceptional from closely held trusts circumstances a capital gains Capital gains Did you have You must print X in the YES box at G if you had an repayments NO YES . .00 G Share of credittax forevent tax Early paid by trustee S during the year? N amount of capital gains from a trust. , , natural disaster CODE Share of credit for Have amounts withheld you applied an . . Other repaymentsAM 00 from foreign resident withholding , YES exemption or rollover? R NO , Share of National rental affordability scheme tax offset Net farm management . capital gain E , depositsNet or repayments A B LOSS LOSS , .00 , , , , 00 ..00 Page 13 , , .00 , .00 Total current year capital gains H , Did you have a capital gains 18 gains You must print X in the YES box at G if you had an Personal services income (PSI) 14 Capital NO YES Net capitalduring losses tax event thecarried year? G . amount of capital gains from a trust. to later income years , To complete thisforward item, you need to read and V complete the Business and00 professional items schedule for individuals 2013. CODE Have you You applied an lodge your tax return using e-tax or a registered tax agent. You cannot lodge a paper return. must YES M NO 19 Foreign entities exemption or rollover? Did you have either a direct or indirect I NO in a controlled foreign company (CFC)? Sensitive Total current year capital gains H Have you ever, either directly or indirectly, caused the transfer of property – including money – W NO Net capital losses carried or services toforward a non-resident trust estate? to later income years V interest NAT 2679-06.2013 Net capital gain A YES CFC income K (when completed) .00 , Transferor YES trust income B .00 , 20 19 Foreign source entitiesincome and foreign assets or property .00 CFC income K T B L , , , , , , , , .00 ..00 00 .00 20 Foreign source income and foreign assets or undeducted property purchase price D WITH an , , .00 , , , , , , DidAssessable you have either a direct or income indirect foreign source interest in a controlled foreign company (CFC)? EI NO, YES, income Have you ever, either directly or indirectly, caused Other net foreign employment Transferor YES the transfer of property – including money – W NO trust income foreign pension or annuity income WITHOUT or services to a non-resident trustNet estate? an undeducted purchase price Net foreign pension or annuity income Assessable foreign source income E INCOME continued . rent R , Net foreign00 , OtherOther net foreign employment income net foreign source .00income Gross rent P 21 Rent , Also include at F Australian franking credits from a Net foreign pension or annuity income WITHOUT Australian franking credits from New Zealand franking company that you have received an undeducted purchase price .00 a New Zealand franking company deductions Q indirectly through a partnership orInterest trust distribution. , Net foreign pension or annuity income LOSS WITH an undeducted purchase Net foreignCapital employment – .00 works income deductions .00 price , , payment summary U F , Net foreign rent Net .00 rent .00 rental deductions Exempt foreignOther employment income N U , , Other net foreign source income . Also at F Australian credits from aO income tax companies offset Bonuses fromForeign lifefranking insurance andAustralian friendly societies 22 include , franking credits from New Zealand franking company that you have received a New Zealand franking company During the year did you own, or have indirectly through a partnership or trust distribution. an Forestry interest in, assets located outside Australia NO YES P LOSS managed investment scheme income 23 which had a total value of AUD$50,000 or more? Net foreign employment income – .00 payment summary U , , completed) Page 14 Sensitive (when Category 1 .00 foreign employment income N Type of income 24 OtherExempt , income Category 2 . Foreign income tax offset O During the yearTax didwithheld you own, or have – lump sum an interest in, assets locatedpayments outside Australia in arrearsP E NO which had a total value of AUD$50,000 or more? Taxable professional income Sensitive Page 14 Z TOTAL SUPPLEMENT INCOME OR LOSS , YES , T M L F .00 00 ..00 .. 00 00 ,, P less ( Q,, + F + U ) D , , R M W F , , , , , , , , , , A , , .00 .00 .00 .00 .00 .00 .00 LOSS LOSS LOSS LOSS LOSS LOSS LOSS LOSS LOSS LOSS LOSS TAX RETURN FOR INDIVIDUALS (supplementary section) 2013 Y , , .00 V , , .00 .00 .00 (when completed) , For the amounts in the right-hand column at items 13 to 24 add up all the income amounts and deduct any loss amounts. Transfer this amount to I on page 3 of your tax return. TAX RETURN FOR INDIVIDUALS (supplementary section) 2013 $ , , .00 LOSS Glossary Your quick reference guide to some of the terms used in your annual tax statement and your personal annual CGT statement (if you received one). Bank charges – debits tax applicable to distribution payments by cheque. Capital loss – this amount represents the capital loss on the redemption of units in the Fund. CGT – concession – where this term appears on your Investment Fund annual tax statement, it is the CGT discount amount of any actual distribution. This amount is not assessable for tax purposes, so you don’t need to declare this portion of the distribution in your tax return. No CGT cost base adjustment is required by you in relation to this amount. Where this term appears on your personal annual CGT statement, it refers to the benefit of applying the 50 per cent discount on the capital gain you have made on the disposal of units in the Fund. Discounted capital gains – where this term appears on your Investment Fund annual tax statement, it refers to capital gains made by the Fund from assets it disposed of that it had held for at least 12 months. The discount method allows the Fund to reduce the capital gain amount by a discount percentage of 50 per cent, after applying any available capital losses. The discounted capital gains have been split between those derived from taxable Australian real property (TARP) and those not derived from taxable Australian real property (NTARP). This split is only relevant for non-residents of Australia, as non-residents generally pay Australian tax only on TARP gains. If you are a resident taxpayer, you will need to include both the TARP and NTARP gains in your tax return. Non-residents of Australia should contact their tax adviser in relation to the correct treatment of these capital gains. Where this term appears on your personal annual CGT statement, it refers to capital gains made by you on units in the Fund, that you disposed of during the year and that you had held for at least 12 months. The discount percentage of 50 per cent has been used in calculating this amount. Please note that the method used to calculate gains/losses on units you have redeemed is the ‘first-in first-out’ basis. Therefore, when calculating any personal capital gain you have made on redemption of your units, we have treated the first units you acquired as being the first units you disposed of. Fees – Adviser review fee/Client advice fee – this fee is a negotiable fee agreed between you and your adviser and is paid to your adviser in consideration of the professional services he or she may provide. This is not a fee charged by the Responsible Entity. Foreign income – comprises the following: >> modified passive income – foreign >> interest income – foreign, and >> other income – foreign. Foreign income tax offsets – tax paid overseas on income earned outside Australia. Refer to the publication guide to foreign income tax offset rules (NAT 72923) to work out your entitlement to claim this full amount. Franked dividends – these are dividends received from Australian companies that have paid Australian tax on their earnings. When the Fund receives franked dividends the franking (tax) credits are passed on to investors. Franking credits – these are attributable to franked dividends received by the Fund. The full amount of distributable franking credits received by the Fund has been distributed to you even where a portion of the general expenses of the Fund has been applied against franked dividends received by the Fund. Franking credits are allowed as an offset against your Australian tax payable and may be refundable in certain circumstances. Income – Australian – distributions from trusts (excluding any net capital gains, foreign income and non-assessable amounts). This amount is your share of taxable income from dividends, interest, rental or other income derived from Australian investments, grossed up by any franking credits. Income – Foreign – assessable foreign source income less any deductible expenses incurred in relation to earning foreign income. Income tax – tax withheld from any payments of other income or capital gains by the Fund, at the applicable tax rate. Applies only to those who are non-residents of Australia for tax purposes. Interest income – Australian – relates to amounts earned on cash or fixed interest securities held in Australia. Interest income – Foreign – your share of interest income derived by the Fund from its overseas investments, net of foreign tax credits. Interest not subject to Non-Resident Withholding Tax (NRWT) – interest income derived from Australian investments where that income is prescribed under Australian tax law as exempt from tax to non-resident taxpayers. The distinction of this income from other Australian interest income shown on your annual tax statement is only relevant to non-resident investors. Modified passive income – Foreign – your share of dividend income derived by the Fund from its overseas investments, net of foreign tax credits. Non-discounted capital gains – where this term appears on your Investment Fund annual tax statement, it refers to capital gains made by the Fund where it has bought and sold the assets within a 12-month period, so the ‘discount’ method cannot be used. Glossary continued The non-discounted capital gains have been split between those derived from taxable Australian real property (TARP) and those not derived from taxable Australian real property (NTARP). This split is only relevant for non-residents of Australia as non-residents generally pay Australian tax only on TARP gains. If you are a resident taxpayer, you will need to include both the TARP and NTARP gains in your return. Non-residents of Australia should contact their tax advisers in relation to the correct treatment of these capital gains. Where this term appears on your personal annual CGT statement, it refers to capital gains made by you where you have bought and sold units in the Fund within a 12-month period, so the ‘discount’ method cannot be used. Please note that the method used to calculate gains/losses on units you have redeemed is the ‘first-in first-out’ basis. Therefore, when calculating any personal capital gain you have made on redemption of your units, we have treated the first units you acquired as being the first units you disposed of. Other income – Foreign – your share of income other than ‘modified passive income – foreign’ and ‘interest income – foreign’ derived by the Fund from its overseas investments, net of foreign tax credits. Return of capital – a non-assessable distribution of capital. A return of capital distributed to you will require a reduction to the cost base of your units in the relevant Fund. Tax deferred income – generally relates to amounts associated with building allowances and depreciation of plant and equipment. This amount is not assessable for tax purposes, so you do not need to declare this portion of the income distribution in your tax return. However, you are required to adjust your cost base or reduced cost base of your units for these amounts and therefore this may affect your future CGT liability. Tax free income – generally relates to amounts associated with infrastructure investments. This amount is not assessable for tax purposes, so you do not need to declare this portion of the income distribution in your tax return. TFN tax – tax withheld from any payments of relevant income by the Fund, at the maximum marginal tax rate plus Medicare levy, where you have not provided your tax file number (TFN). Unfranked dividends – these are dividends received from Australian companies where the company issuing the dividend has not paid Australian tax on the profits from which it is paying the dividend. Unfranked dividends – CFI – an unfranked dividend paid out of conduit foreign income (CFI) is equivalent to an unfranked dividend for an Australian resident taxpayer. The classification of unfranked dividend – CFI is only relevant to non-resident investors who may be entitled to a withholding tax exemption upon the income. Withholding tax – tax withheld from any payments of interest or unfranked dividend income by the Fund, at the applicable tax rate according to the unit holder’s country of residence. Applies only to non-residents of Australia. Note: these are only intended as brief definitions of the terms used in your annual tax statement and personal annual CGT statement (if you received one) and may not correspond to the definitions or the terms contained in income tax legislation. The tax information provided is based on the continuance of present laws and their interpretation. For a full explanation of these or any other terms, please contact your financial adviser or accountant. Contact us AMP Capital Investors Limited GPO Box 2780 Melbourne VIC 3001 Telephone: 1800 780 085 Facsimile: (03) 8688 5796 client.inquiry@ampcapital.com Responsible entity: National Mutual Funds Management Ltd ABN 32 006 787 720 AFS Licence No. 234652 Important note: This publication has been prepared to provide general information only and does not take into account the financial objectives, situation or needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Before making an investment decision, you need to consider (with or without the assistance of an adviser) whether this information is appropriate to your needs, objectives and circumstances. Past performance is not necessarily indicative of future performance. Detailed information about the product is contained in the PDS. Applications for investment in the product will only be accepted on receipt of an application form accompanying a current PDS. A copy of the PDS can be obtained by calling 137 292. National Mutual Funds Management Ltd and its associates derive income from issuing interests in the product, full details of which are contained in the PDS. Unless specifically stated, the repayment of capital or performance of our products is not guaranteed. This information is provided for persons in Australia only and is not provided for the use of any person who is in any other country. ... If you would like to know more about how AMP Capital can help you, please visit ampcapital.com.au, or contact one of the following: