Are fair prices derived from basic principles of justice? M. Hudon

advertisement

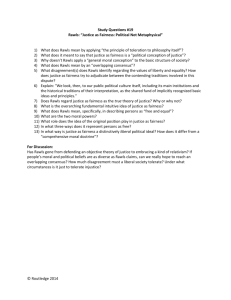

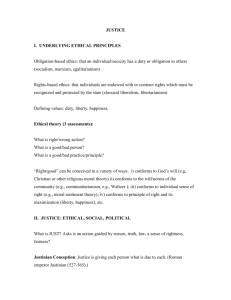

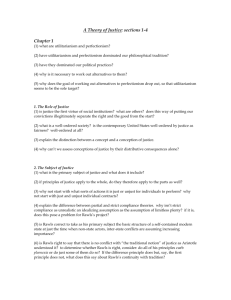

Fair interest rates when lending to the poor: Are fair prices derived from basic principles of justice? M. Hudon This paper addresses the fairness of prices, with a focus on fair interest rates as they apply to microlending transactions for the poor. Under different assumptions on fairness in interest rate policies and the principles of justice as described in A Theory of Justice (Rawsl, 1976), the paper determines the extent of the ‘just’ range of a price. Using the original notion of fair reservation price and fair bargaining range, it is shown that some unfair considerations can make the fair bargaining range negative. Therefore, we propose an additional criterion for fairness: a fair distribution of the benefits within the fair bargaining range between borrowers and lenders. This new criterion is particularly useful and relevant, at minimum, for sociallyminded ones active on the microfinance markets. JEL Classifications: L31, M54, O16, Q14 Keywords: justice, microfinance, interest rate, principles CEB Working Paper N° 06/015 2006 Université Libre de Bruxelles – Solvay Business School – Centre Emile Bernheim ULB CP 145/01 50, avenue F.D. Roosevelt 1050 Brussels – BELGIUM e-mail: ceb@admin.ulb.ac.be Tel. : +32 (0)2/650.48.64 Fax : +32 (0)2/650.41.88 Fair interest rates when lending to the poor: Are fair prices derived from basic principles of justice? Marek Hudon FNRS Research Fellow - Centre Emile Bernheim, Solvay Business School, Université Libre de Bruxelles (ULB) and Harvard University mhudon@fas.harvard.edu Harvard University, c/o Sue Wood, Byerly Hall 8 Garden Street, Cambridge MA 02138-3654 JEL Codes: L31, M54, O16, Q14 Keywords: justice, microfinance, interest rate, principles Are fair prices derived from basic principles of justice? A study of fair interest rates when lending to the poor1 Abstract: This paper addresses the fairness of prices, with a focus on fair interest rates as they apply to microlending transactions for the poor. Under different assumptions on fairness in interest rate policies and the principles of justice as described in A Theory of Justice (Rawsl, 1976), the paper determines the extent of the ‘just’ range of a price. Using the original notion of fair reservation price and fair bargaining range, it is shown that some unfair considerations can make the fair bargaining range negative. Therefore, we propose an additional criterion for fairness: a fair distribution of the benefits within the fair bargaining range between borrowers and lenders. This new criterion is particularly useful and relevant, at minimum, for sociallyminded ones active on the microfinance markets. 1 I thank Joshua Cohen and Amartya Sen for very useful discussions and comments on a first version. I also thank Beatriz Armendariz, Firas-Eugen Faso, Sylvie Fanta, Cyril Fouillet, Gilles Raveaud, Jay Rosengard, Guy Stuart, Ariane Szafarz, Philippe van Parijs, Jarl Verledens, Annabel Vanroose and Bernard Lietaer for written comments or discussions on earlier drafts. No agreement with my views, however, should be attributed to these persons, and all errors are entirely my own. I also thank the Marie-Christine Adam Funds for financial support This paper addresses the question of the fairness of prices, with a focus on fair interest rates as they apply to microlending transactions for the poor. Different assumptions and principles of fairness in interest rate policies are then explored. We will study what a fair price would be under the principles of justice as described in A Theory of Justice and ask how narrowly they define the ‘just’ range of a price. Rawls (1976) denies that additional criteria beyond his principles are needed to attain a just price, because prices are secondary norms that can be derived from his basic principles. When applying Rawls’ theory to the specific case of interest rates of microcredits to poor people in developing countries, it turns out that very high prices can lead to injustice in the system. It happens when the interest rates are so high that none of their additional effects in the system cannot compensate for the defects caused by that price. Two comments are made on the relevance of Rawls’ theory to fair prices. We will first question the rationality of the citizens in the original position: How critically minded can Rawls’ citizen be in the original position when assessing a fair interest rate or a fair wage? This paper only addresses the cases where the price taker can afford costcovering prices for supplier. In a credit case, it means that the clients can afford costcovering interest for the institution. In an employee-employer case, the assumption is that employees can afford or live with cost-covering wages for the institution. In many cases, this will mean a positive bargaining range. Nevertheless, the original notion of fair reservation price and bargaining range shows that some unfair considerations can make the bargaining range negative. Second, we propose an additional criterion for fairness inspired by Amartya Sen’s critical approach on global markets patterns: a fair distribution of benefits within the bargaining range between borrowers and lenders. We explore to what extent this new criterion could be relevant for the different types of investors, particularly for socially-minded investors in the microfinance markets. We finally outline a mechanism to pragmatically implement such a test, and show why it would be significantly preferable over usury laws which artificially lock in maximum interest rates, and are gaining now popularity in many developing countries. 1. Introduction on the case of the new institutions lending to the poor The last few decades have seen a dramatic development of microfinance institutions (MFIs) - institutions providing financial services to poor or very poor citizens. These institutions have demonstrated impressive repayment rates on their loans, while serving populations that were until now thought to be too risky for sustainable banking. However, these institutions typically have a much higher interest rate policy than conventional commercial banks. These higher interest rates are primarily due to the very heavy transaction costs that occur when lending small amounts to poor people. While microfinance interest rates usually range between 20 and 70% per year, depending on the environment of activity, they can however reach very high level, as high as 90% per year2. Ironically, many microfinance institutions have spread in countries where debates on usury were still ongoing (such as the Islamic countries), sometimes eluding the interest debates with the application of fees that are not subject to religious or cultural laws. The debate on microfinance services pricing policy is not only about ethics. It is also pragmatically crucial since each of the parties will always be at risk for the success of the transaction by the actions of the other one. The feeling of fairness, even if irrational, can play a major role in such a transaction. In the case of lending, if the client does not consider the interest rate policy fair, he or she could well choose not to repay3. This is particularly relevant in microfinance programs where no collateral is required, which obviously puts the lender at extra risk4. Moreover, the possibility of enforcing penalties for defaults is often very limited. The lack of classic collateral or the application of pressure may lead in some extreme cases to violent behavior5. Finally, if fixed too high, interest rates might attract only very risky borrowers. Institutions would then face an 2 In addition to high interest rates, hidden costs or fees can also make the actual loan cost prohibitive to the borrower (See Fernando, N. (2006), Understanding and Dealing With Interest Rates In Microcredit, Asian Development Bank, Manilla, p. 5.) . 3 For instance, the new « Voluntary Mutual code of Conduct »adopted in April 2006 in South-India after the recent debates on the microfinance conducts in Andra Pradesh can be understood due to the fear of social movement where borrowers would refuse to repay after the publication of articles arguing that microfinance institutions are exploiting their clients (Fouillet, 2006). Moreover, Cull et al. (2006) found that raising interest rates above a certain level (60% in their estimate) is associated with lower returns for microfinance individual-lenders. 4 Moreover, the negative domino effect where members of groups default due to the default of other members (Godquin, 2004), can increase the consequence of the default. 5 Recently, publications on unethical loan recovery practices, such as abusive language or coercive techniques of some of the microfinance institutions in the Andra Pradesh state of India motivated the local microfinance sector to establish a self-governed five-point ‘code of conduct’ (Fouillet, 2006). adverse selection. Innovations such as the use of social capital in group-lending developed in Bangladesh or progressive loan6 practices, try to reduce the risk to the lender. However, ultimately, any such transactions must still mostly rely on mutual trust among the partners. Many donors, experts or MFIs also deemphasized the debate on interest rates, arguing that the access to credit is the most important issue, and that the high turn-over of the activities of poor clients enables them to repay such high interest rates. Harper (1998) explains that the return on investment in the larger business was generally lower than for the smaller ones. Borrowers who would invest in micro-entreprise and particularly the smallest ones can afford to pay the high interest rates charged by the MFIs. Interest rate ceilings would limit access to market, but also the transparency regarding the actual total cost of loans7. A lot of governments, local and international leaders have praised for microfinance. Although the real impact of microfinance is difficult to measure, some evidence point to a very positive impact on many clients8. Yet, institutions charging high interest rates are nonetheless recurrently attacked, often by representatives of the local civil society who accuse them of usury or exploitation. A ‘purist’ deontological framework could then consider this debate as a conflict between the intrinsically inappropriate nature of some acts (such as charging very high interest rates), and the improvements that access to credit may bring to the poor9. Therefore, microfinance provides a good case study for the debate on the fairness of prices. The first question we need to assess is whether prices, such as interest rates or wages, can be fair, or if morality is simply not relevant in this setting. Morality of prices has historically been argued almost exclusively from a religious perspective. Heated theological debates on of the legality of interest have flourished for 6 Progressive loans are dynamic incentives used to secure higher repayment rates. In this methodology, borrowers can “expect a stream of increasing larger loans”. See Morduch, J., (1999), The Microfinance Promise, Journal of Economic Literature, 37, 4, p. 1583. Hulme, D. and P. Mosley (1996), Finance against Poverty, Volume 1, Routlege Publications: London. 7 Helms, B., Reille, X. (2004), Interest rates ceilings and microfinance: The story so far, CGAP Occasional Paper, 9, CGAP: The World Bank Group. 8 Impact studies in microfinance are a very controversial topic since few rigorous impact studies have been completed. Nevertheless, most practitioners agree that microfinance has a positive impact in most cases, for instance, by stimulating an empowerment process for the client. 9 On a similar debate, see Sen, A. (1993), p. 207. centuries10. The Council of Nice condemned interest in 325 AD, on the basis of the Old Testament’s prohibition of interest among fellow Jews. Aristotle denounced interest as the unnatural fruit of a barren parent11. Most of the opposition came from the view that interest was seen as a rent, an ‘unearned income’ and not as a result of a productive activity. Later, the theory of the just price tried to provide some moral constraints upon the formation of prices in medieval economic thought12. Recently, challenges on the prices charged for AIDS drugs, repudiated bonds13 and on the debt-burden for developing countries showed that the debates on interest rates and fair price are still relevant, and could even be useful for current issues on the morality of markets and contemporary ethics14. Moreover, the old debate about usury laws is still ongoing, and has even been refueled in many countries with the growing importance of Modern Islamic banking that prohibits charging interest. Some recent evidences have put in doubt the assumption that the interest rate level does not matter or impact poor customers15. The best available investment opportunities involve moderate returns for many poor households (Fernando, 2006, p. 12). High turnover and high margins depicted for street or markets vendors are not obtained by farmers in the rural area16. These could thus be more vulnerable to interest rate increases. Dehejia et al. (2005) found empirical evidence for this: the demand for credit by the poorest customers has been proven more sensitive to interest rate increases than for wealthier borrowers. Very high prices can thus also potentially entail moral consequences. On the one hand, we should wonder whether charging a very low interest rate is automatically just, independently from its impact on an institution’s sustainability. One has to recognize that the access to credit, even at very high interest rate levels, is certainly a major impediment in many remote areas. On the opposite side 10 Sen (1993); Conard (1959); Nelson (1949) Conard (1959), p. 97. 12 Johnson (1938); Hamouda and Price (1997) 13 Oosterlinck K., (2003); 14 Walsh (2004), p. 254. 15 Some clients surveys among poor tend to prove that these borrowers definitely care about the interest rate level. In a client survey of Ugandan microfinance clients, Wright and Rippey (2003, p. 18) found that the interest rate charged by the institution is one of the two main selection criteria (out of 18). clients have repeatedly cited interest rates as one of the top determinants of their choice of the financial service provider from whom they borrow. Furthermore, they found out that the main reason when borrowers change institutions is the interest rate level. Authors argue that interest rates start to become important after a certain development of the microfinance industry. Whatever the case, all agree that some very poor borrowers, at minimum, are sensitive to the interest rate level. 16 Moreover, they exhibit specific risk inherent to the activity and characteristics of land property (Mees, 2003). 11 of the argument, is it a sufficient condition that borrowers demonstrate a capacity to repay to assume that an interest rate policy is fair? Similarly, a very low salary or wage will be easily accepted if no better alternative exists. But is it sufficient that employees accept very low wages to say that the wage policy is fair? In order to further explore the notion of a fair interest rate, we will examine next what we will call the procedural approach to interest rate fairness. 2. The procedural perspective of a fair price We can first consider a definition of fairness as the impartial and equal application of a set of fixed rules. It is what Hooker (2005) calls formal fairness. Assuming a wellorganized market, fairness would then only require that its rules be correctly applied, impartially and equally to all customers. The outcome could well be extreme. For instance, if an institution decides to set its interest rate proportionally to the collaterals provided by the client, poor clients may pay exorbitant prices to borrow money - but they still would get a formally fair price. Additionally, we can include transparency of the interest rate policy to the requirements of a formally fair system17. Consumer protection laws can also help to prevent “abusive” lending and collection practices, mandatory disclosure on total loan costs, clearly defined complaint resolution procedures, mandatory consumer education to prevent abuse, and effective enforcement mechanisms18. All such impartial application of the rules, transparence and consumer protection laws are certainly useful, but represent what we can call a “minimalist” or “procedural” approach to fairness. This procedural requirement described for interest rate could also apply to other prices. For instance, a procedural wage would be a wage that is impartially applied, transparent and subject to some labor protection laws, for instance. It would certainly help prevent many major abuses, but how do we know whether the final outcome is fair or unfair? The first question to be addressed is: who determines the price19? The standard answer is that the price is fixed by the institution according to its perception of the demand. 17 Indeed, interest rate policies are not always transparent to all customers. It is even more the case for poor customers than can be easily abused. For instance, the structure of the interest rate, with flat or decreasing balance installments is not always well understood by the customers. Some surveys exhibit very low level of sophistication about interest rates among microfinance clients. 18 Helms, B., Reille, X. (2004), p. 10. 19 For comments on these sorts of difficulties, see Sen, A. (2002), Open and Closed Impartiality, Journal of Philosophy, 99, pp. 445-469. Nevertheless, the institution is not really independent from external influences and many actors play a role in this setting. From the institutions’ perspective, targeting poor clients may be based on getting additional clients to fulfill their growth objectives. These new clients could even be an imperative for the institution if they are used, for instance, as a proxy for additional disbursement of a third party such as an international donor agency or a philanthropic foundation. This could force the institution to accept more clients than desired and thus affect the supply of credit. From the borrowers’ perspective, because of the lack of competitor the potential clients may not have any other alternative than this particular institution, his relatives or friends and the moneylenders. The transaction can also turn out to be distorted because of cultural, socio-economical or political elements discriminating against the poor. In MFIs with social missions, employees can also influence the price level. In these institutions, salaries are often low in comparison with commercial players. Employees are also particularly sensitive to the values of the institution, and therefore could influence the strategy. In a cooperative structure where the clients are also the shareholders, the process is even more complicated, especially when the cooperatives also take deposits. Lastly, the environment in which the institution operates is particularly important. In some cases, the rest of the society may consider very high interest rates as unethical while some clients would just value the credit access. The same multiplicity of answers arises when one tries to determine who should be involved to determine what a fair price such as a wage, should be. All these actors might have conflicting interests and feelings, different from those of the current customers or lenders. The use of Rawls’ original position is a useful theoretical one to tackle the problem of such actors’ interests. Under the veil of ignorance, all deliberators ignore their personal position or social status. Rawls’ Theory of justice to study the application should therefore be brought to bear on our question. 3. A Rawlsian just price? Focusing our attention on the fairness of prices when lending to the poor, one may wonder if transcendental principles are sufficient, or if only relative comparisons or a specific sphere of justice could solve our particular case? On one hand, we can assume that the best procedure to evaluate fairness of a price is the application of transcendental justice principles, such as Rawls’ principles, and verify their impact at the micro-level of the transactions. One the other hand, one could argue that Rawls’ principles are designed for citizens trying to construct bases for their society; and that therefore economic transactions are out of order here. Private transactions between citizens and economic institutions would be fair if it the market price applies, and Rawls’ principles would only need to apply to public spheres. While it is true that Rawls’ theory and original position focuses on citizens trying to establish some justice criteria that are directly related to the role of the state, it also deals with the private relations that citizens have with their environment. Market interactions are certainly important to fulfill the principles of justice. As explained by Rawls: “There is no other criterion for a just distribution apart from background institutions and the entitlements that arise from actually working through the procedure” (Rawls, 2001, p. 51). In this transcendental approach, we focus on identifying some central arrangements that will enable a global response. We can however examine further and find some particular features of a just price. In a well-ordered society, Rawls considers that precepts and norms arise from the requirements of economic activity. Principles of justice should cover many cases of distribution in a perfectly competitive economy20. Rawls responds to criticisms on the realism of the assumption of competitive markets by addressing the case of exploitation. In Section 47 of his Theory of Justice, we can read: “The sense in which persons are exploited by market imperfections is a highly special one: namely the percept of contribution is violated and this happens because the price system is no longer efficient. But as we have just seen, this precept is but one among many secondary norms, and what really counts is the working of the whole system and whether these defects are compensated for elsewhere” (Rawls, 1971, p. 272). Any evaluation should thus be done on the basis of the whole system, not only on its sole level of the secondary norm, the price. In our case study, many possibilities become then possible. Advocates of higher interest rates would argue that access to credit can be the solution that will solve credit constraint at the micro level and will enable to develop activities or capacities. If social cares or free business development services and training are provided by international relief NGOs and are linked to credit, the effect 20 Rawls, J. (1971), pp. 269-271. on the system might be positive, especially for poor borrowers. The variations in prices and the prerequisites of position aim at influencing the choices in order to get an efficient and just outcome. The most important is the right of free association and the individual choice of occupation (p. 277). In Rawls’ theory, unfairness would thus occur only if the negative effects of price cannot be compensated by any other norm or precept in the whole system! The cause of exploitation is to be found in the background system. Exploitation is the consequence of some lack of basic rights and liberties that should normally be guaranteed by the application of the two first principles: equal basic liberties and equality of opportunity. In exploitation cases, very high prices can be linked to abuses of civil rights in absence of consumer protection laws, for instance. Such abuses should be avoided through appropriate laws and social regulation. Rawls adds that “in fact the notion of exploitation is out of place. It implies a deep injustice in the background system and has little to do with the inefficiency of markets”. It is thus not the inefficiency of markets that should be criticized, but injustice in the system. This is due to the deficiency of the whole system which is supposed to prevent these behaviors. Nevertheless, it is often the enforcement of the law, rather than simply its existence on the books, that often proves to be the most difficult in practice. In such a context, a stronger party may easily appear, take advantage of the weaker one and confiscate a disproportionate share of the benefits. This is how Alan Wertheimer (1996) defines ‘exploitation’. 21 In Wertheimer’s theory, exploitation can occur in a just economic system and non-exploitative transaction can take place in an unjust economic system22. We will now address two particular comments related to Rawls’ approach on prices. The first one will tackle the level of rationality available, i.e. to what extent are the citizens critic-minded in the original position. The second one will deal with the egalitarian criticism of Rawls and its application to fair prices. 4. How critically minded are Rawls’ citizens in the original position when assessing fair price? 21 22 Wertheimer, A. (1996) Kershnar, S. (2005), Giving Capitalists Their Due, Economics and Philosophy, 21, pp. 70-71. We now have a vision of how Rawls’ handles a fair price in his theory. The first comment we will make verifies the plausibility of Rawls’ assumptions in his procedure, and explores the difference in outcome we would have when we remove them. During the deliberation, the participants are placed under a veil of ignorance. The bargaining advantages are equalized since the deliberators do not know their social status or wealth23. Rawls has clarified the role and relevance of the original position in his later work and the fact that the decision process is only part of the core of its moral theory, when it is heuristic. As explained in Kantian Constructivism in Moral Theory: “So understood, the original position is not an axiomatic (or deductive) basics from which principles are derived but a procedure for singling out principles most fitting to the conception of the person most likely, at least implicitly, in a modern democratic society” (Rawls, 1980, p. 572). A fair negotiation can then happen among citizens of a given society. We can take this process to the micro-level of the loans to poor borrowers. Rawls argues that free and equal citizens make up their mind impartially in the original position. The rationality involved in the decision under the veil of ignorance can however still contain some nonneutral elements, such as the fact that markets are suitably regulated or efficient. The citizen should then be already critically minded before entering the original position24. The way Rawls “constructs the citizens in the original position” implies that they do no have any strong reason to be dissatisfied with the society they live in25. There are some “fundamentals” that he would not want to put at risk. If we challenge the assumption of “suitably regulate competition”, the whole system could be unstable since it can be considered as one of these “fundamentals”. While the outcome of Rawls’ original position is plausible and realistic or is made so that it is sensible in democratic societies with efficient markets, why could we not imagine that in our context, the citizens could well come up to a different order of the two principles, or even to different principles. The basic question becomes than: up to which level will he be able to doubt the system. One could for instance argue that under the veil of ignorance, a rational citizen would consider interest rates as a normal burden to finance activities or any investment26. Even 23 Rawls, J. (2001), p. 87. For this criticism, I am indebted to Arnsperger, C. (2005), What Is Utopian about the Realistic Utopia? Relocating Rawls in the Space of Normative Proposals, Revue internationale de philosophie, Spring 2005. 25 Arnsperger, C. (2005), p. 11. 26 For a good review of complementary currencies see Lietaer, B. (2001), The Future of Money, London: Random House or the forthcoming Of Human Wealth. (2006) 24 at this level, doubt could be raised on the neutrality of this rationale. Recent research on complementary currencies, that operate in parallel to the conventional ones, show that many communities successfully use complementary money without interest rates. This could, for instance, already, challenge this first assumption of this rationale man. Building on this point, very high interest rates for poor citizens could be more easily legitimized as rational for the citizen in the original position. The underlying principle could well be that when we rationally assess the risk of the borrowers, we invariably find out that poorer borrowers almost always lack collateral and are thus more risky. There is no doubt that people with no collateral, few assets, and low income would be very risky. Furthermore, cultural reasons or disparities in educational levels may exacerbate risk. In this case, an ordinary citizen from a modern democratic society might consider the relationship between wealth, risk and the interest rate to be rational. Even if the financial impact on the clients has not yet been clearly proven, the microfinance movement has shown that very poor clients can exhibit impressive repayment rates and that some of them are profitable for the financial institutions. The major problems of asymmetry of information or moral hazard could be partly addressed through features such as group lending and progressive lending. To obtain a good repayment rate, the methodology of the credit is what matters; suiting the needs of the client is more important than the intrinsic risk level. We can then say that all additional charges due to cultural or socio-economical elements would in this case be unjustified. But would the rational citizen living in 1960, before the success of MFIs was demonstrated, put that into question? Similarly, would the rationale citizen living in 1900, before the social laws fixed a minimal salary in Western Europe, put any level of wage into question? One could well argue that such new information would not lead to changes in the basic principles of justice but only to alterations in secondary norms or their application. The information would not in and of itself require new principles of justice. Only the secondary norms designed to reach the basic principles of justice would change. One could however consider that this new information is critical enough to broadly affect these societies and their principles of justice. It would therefore influence the citizens’ values and their relationships. For instance, all agree that the risk perception of the citizens and the access they have to credit affect the role and the scope of the markets in low-income countries. If taken to an extreme, some changes in the perception of the basic structure and assumptions would lead to paradigm changes that shape much more than the simple norms. Notions and principles of justice could therefore change, and the notions of justice would then be related to the current knowledge at the time of negotiation; the theory would not be transcendental anymore. One should not underestimate the importance of the “fundamentals,” but one must also wonder to what extend citizens are able to objectively criticize the system. 5. The inequality criticism and its application to fair price In G.A. Cohen’s view, there is hardly any inequality that satisfies the requirement set by the difference principle when it is conceived as Rawls does. Therefore, justice would require unqualified inequality rather than the “deep inequalities” justified by Rawls27. Rawls is well aware of market imperfections and presents his theory as an ideal scheme to provide some notion of what is just. He further adds that the “rational autonomy of the citizens in the original position contrasts with their full autonomy in the society”. In the full autonomy of everyday life, the citizens think of themselves in a certain way and think and act from the first principles of justice that would be agreed to”28. The basic structure is such that when the rules of cooperation are followed, the distribution of goods that result is acceptable as just or at least not unjust, whatever it is29. In order to enter into this debate, we can use the microeconomics notion of reservation price. The bargaining range is the space between the parties’ reservation prices. In the case of microfinance institutions, many assumptions could be made on what would be a reservation price. The institution’s reservation price could be the price enabling it to cover its costs. In microfinance, this is called the operational self-sufficiency. In a more conservative way, it could even include adjustments due to the cost of funding, if the institution did not receive subsidies. We can also adjust the income for inflation, in-kind donations, loan loss provisions etc. This institution is then the financially self-sufficient. Alternatively, donors or any public actor or philanthropist can certainly influence the reservation price, for instance through long-term subsidies. The institution then has lower reservation prices since it counts on the donors’ funds. Nevertheless, in many cases, these reservation price are not fully sustainable, since they bear the risk that the 27 Cohen, G.A. (1997), Where the Action is: On the Site of Distributive Justice, Philosophy and Public Affairs, 26, 1, pp. pp. 3-30. 28 Rawsl, J. (1980) 29 Rawls, J. (2001), p. 50. donor withdraws30. A withdraw would automatically lead to an increase of this reservation price. On the other side of the bargaining table, the borrower’s reservation price depends on his or her income, the profit margin if the loan is used for an income-generating activity, and the turn-over of that activity. If the borrower can afford the institution’s reservation price, the bargaining range will stretch from the break-even point of the institution to the customer’ break-even point31. If the negotiation in the bargaining range turns out on an interest rate entirely in favor of the institution, the clients’ loan will not provide him any surplus after the repayment of his loan. In contrast, if the interest rate is too low for the institution, for instance below its reservation price as defined earlier, its sustainability is put in danger. If both sides have the correct information on both real break-even points, there is little chance of the transaction getting completed, since the actual price is one of the two extremities, partly because the opportunity cost of the involvement in the transaction is high. The long-term sustainability of the institutions can also matter in the process, not only on the institution’s side but also from the customer’s perspective. For instance, consider an institution with a standard debt ratio and no other funding possibilities that is facing a choice on its funding policy for new loans to its borrowers. If no other source is possible, and the additional debt would lead the institution into a risky situation, the borrower might rationally prefer to bear a higher interest rate rather than put the institution at risk. A trade-off appears between the additional burden represented by the debt32 and the long term risk of bankruptcy. This is certainly the case when the borrowers are also savers or shareholders (such as in cooperatives). When the markets are not competitive, the loss of the institution also matters for the borrowers. Similarly, for wages, employees can be afraid that they will not find any new employer if their enterprise goes bankrupt or decide to outsource its activity to an area with lower salaries. The bargaining process is thus particularly complicated. What would then be a fair outcome? On the one hand, a Rawlsian understanding of the difference principle would mean that for every price that is higher than the break-even, the principle is respected since the 30 Nevertheless, one can estimate that some donors’ investment are on a sufficiently long term to be considered as sure. For example, a well-known foundation can decide to support a particular project of an institution during the next ten years. 31 On could even consider that that it is not the break-even point of the activity but of all his revenues. 32 The same logic might be introduced for any event that would affect the institution sustainability. poor are better-off. This position is also defended by many donors, as we have seen. Moreover, a strict interpretation of the difference principle condemning all incentive inequalities can make unreasonable expectations on our willingness to serve the good of others33. On the other hand, we can assume that it is not only the relative distribution of the two that matters. What matters also is how much the poor will benefit within the bargaining range. A parallel with Amartya Sen’s position on the current globalization challenges can be drawn and provides valuable input in understanding and developing this alternative to Rawls’ argument34. In his book, Sen (2006) comments that while many argue that globalization benefits all parties in comparison with the absence of cooperation, it is the distribution of the benefits of globalization that matters to assess the fairness of the process. The argument that the poor are better-off is not sufficient to legitimize the current international trade process. Transposing this argument to our field of interest, the fact that the poor take out a microcredit, manage to repay it and are better-off after its use is not sufficient to legitimize any rate of interest. If an institution wants to act fairly, the critical issue to address is not only whether the poor are getting marginally poorer or richer but also if they receive a fair share and a fair opportunity within the bargaining range among the lender and the borrower. The question is whether the distribution of the bargaining range is fair. The evaluation of the bargaining range should address all possible options and should take into account their impact on the borrowers. For instance, one should analyze the variety of funding policies practically and theoretically conceivable and their impact on both the sustainability of the institution and on the interest rate applicable to the borrower. Two funding policies policy could be equivalent from the viewpoint of the institution, but have a different impact on the client. The just price would then assess the fairness of the negotiation by the poor within the bargaining range. For instance, let us assume that the bargaining range of the transaction is worth 100%. Under Rawls’ assumptions, a split of 30% of the benefit accruing to the lender vs. 70% for the borrower could still be considered “just” if there is no other solution that would maximize the benefit of the poor taking into account the institution’s potential offer. In contrast, from the second perspective, such a distribution of benefits can be considered too lopsided to the lender’s benefit to be considered fair by some citizens. 33 34 Cohen, J. (2001), p. 364. For a similar argument but on globalization, see Sen (2006), pp. 132-136. In “Taking people as they are?” Joshua Cohen provided another perspective on the inequality debate. The right application of Rawls’ basic principles would in fact not lead to such levels of inequality: “Some inequalities will be condemned directly by a principle of justice, while others will not emerge in a just society because of the operations of just institutions." (Cohen, p. 22) The difference principle is subordinate to the first principle guaranteeing equal basic liberties but also to the principle of fair equality of opportunity. The intuition is that if they are correctly fulfilled, application of the difference principle as defined by Rawls could not lead to very unequal outcomes. Indeed, one of the basic problems in the case of lowincome countries is that they have far from perfect competitive markets. he principle of fair equality of opportunity would also be insufficient. Because of this, the result of the application of the difference principle could be very unequal. If the two first principles of justice would be fulfilled, the borrower would not or should not be obliged to accept higher interest rates or lower wages. When the background conditions are not fair, market transactions are likely not be to be fair and unjustified inequalities among people will develop35. Our elaboration on the basis of Sen’s argument on globalization would then be no real alternative to Rawls. The additional principle of balanced distribution of the bargaining range that we have drawn would then become useless, since all its content should be already addressed in Rawls’ two first principles. “While nothing guarantees that inequalities will not be significant, there is a persistent tendency for them to be leveled down by the increasing availability of educated talent and ever widening opportunities”36. However, are there no contexts that would legitimate the use of our proposal? 6. Which price is fair when lending to the poor in today’s society? In this section, we will tackle the potential trade-off between Rawls and Sen’s approach, and what we will call the fair reservation price. We first study two potential scopes of application of the criteria and then how its application. 35 36 Rawls, J. (1999), p. 42. Rawls, J. (1971), p. 137. We saw above that a Rawlsian could argue that if the two first principles are truly applied, our additional criterion would automatically be contained in these two principles. In any case, our additional criterion could be used as an “acid test”, a sort of security for socially-minded investors or international donors. The actors’ sense of responsibility and duty of assistance should be taken into account to assess the relevance of our indicator. The question is, does the institution feel responsible for the poverty of the borrowers and their community. Furthermore, how much responsibility does the institution acknowledge37? When the background conditions are not fair, which is the case in most areas where the MFIs are active, one could argue that an additional criterion should be added to balance the unjustified inequalities among people. For instance, the debate on global justice between the countries can be invoked to justify the use of the additional criterion in international transactions. A principle of global difference, similar to the difference principle used in the domestic case in A Theory of Justice,38 can be a justification for the global application of the additional criterion. The scope of application of this criteria can be either unrestricted or limited to some determined cases. On one hand, if taken to an extreme, a society would always require a fair bargaining range in order to apply its conception of justice. All investors, philanthropists, and donors coming from Northern countries should then behave in a socially responsible manner and fairly distribute the bargaining ranges.39 To make a parallel with the trade debate, this would be equivalent to a state that requires that all products would be fairly traded, for instance through the application of “fair trade” criteria. One the other hand, some could however argue that there is no reason to think that forprofits investors would favor a system of global difference. Most for-profit investors do not feel that they have directly caused the unfair background conditions and thus do not feel responsible for it. Consequently, one should not oblige them to pay the additional cost caused by the distribution of the bargaining range. Rawls’s rationality on the level of 37 The sense of responsibility can be due to a direct or indirect involvement but also from a cultural, historical perspective. 38 For instance, Beitz, C. (1999, p. 137) argues for a principle of distributive justice between societies since he believed that richer countries are richer because of the greater resources available to them. In our case, the most important is not the rationale but the principle of distributive justice. 39 In this paper, we have only addressed the case of positive bargaining range. Positive bargaining ranges occur when the reservation price of the borrower is bigger than the institution’s reservation price. These proposals also focus on this case. When the bargaining range is negative, one can consider that subsidies should be awarded by donors or that microfinance is not the best tool to alleviate poverty for these citizens. criticism could then prove to be correct and sufficient for traditional for-profit investors. As in Rawls’ theory, abuses and violations of the contribution precept would end up being judged as “exploitation”. The application of the criteria is then much more limited. It could then be used by socially-minded investors or international donors and put an extra emphasis when the mission of the investor clearly requires that there is no possible doubt on the benefits to the borrower. We can suppose that any deviation in this test would be more sensitive for social, non-profit investors or international donors. In both cases of international donor using funds from higher-income countries’ taxpayers, or social investors accepting lower return at the condition of a social result, the imperative of egalitarian outcome is supposed to be greater. The second point of this section is to define what should be a MFI’s reservation price. The goal is to determine what a good criteria of fair share would be. A potential difficulty is that an institution may well for good or bad reasons decide not to lend to some clients without a substantial incentive. This incentive would typically be an additional margin on the interest rate. Similarly, a top manager may only hire some categories of employees with a lower salary40. This additional price would then de facto decrease the bargaining range and thus ultimately affect the distribution within that range. In order to solve this problem, one could then define a real fair reservation price. This reservation would be the reservation price less, in some cases, the price of some elements that do not fulfil our principles of justice. If we keep thinking within Rawls’ theoretical framework, all prices that would be issued or related to a violation of one the two first principle of justice should be eliminated from the reservation price. If the additional margin does not violate our principles of justice then if would be accepted but the size of the margin must still be assessed. Indeed, even if one considers fair that a worker with higher qualification deserves a better wage, one will not automatically consider fair any additional margin due to the higher qualification. Similarly, it is not because some clients are more risky that any additional margin would be fair. The main challenge would then become the gathering of the relevant information, involving a variety of actors, in order to fix the fair reservation price. In the microlending 40 We can also take two examples provided by Joshua Cohen (2001). Let’s for instance imagine a Brahmin manager would consider all benefits to Dalit as a cost. An example for wage would be a manager of an institution who regard economic benefits to women as a cost. See Cohen, J. (2001), Taking People As They Are?, Philosophy and Public Affairs, 30, 4, p. 372. case, some accepted additional margins could be due to the cost of fund, the level of transaction costs or the risk of the transaction or the borrower. The fixation of the fair reservation price therefore requests a constant effort and creativity to lower or put into question the relevance of these margins. For small and fragile institutions, this represents a continual challenge. The last question to address concerns the people involved in the evaluation of the potential unfair elements. Even when they are socially minded, top managers face some clear conflicts of interest if they have to fulfil these tasks alone. The idea of a fair arbitration could also be useful in the process. Adam Smith invokes "impartial spectators". The impartial spectators are imagined observers who need not be members of the society41. They would not be the sympathetic spectators of the utilitarian doctrine but people whose situation and character enables to judge in accordance with these just principles without bias or prejudice42. The outcome on the fairness of the reservation price would come from the judgments of disinterested observers who are not themselves parties to the societal decisions. Taking this idea to the level of an MFI lending to poor people, one could imagine that the fairness of the interest rate could be judged by disinterested observers from the civil society. These could be independent administrators of the board. Alternatively, Ethics Committees could take into account all elements cited above. These disinterested observers should be independent from political abuse43. Concretely, after having gathered all information, the distribution of what would become the fair bargaining range would be examined by the Committee. The main caveat would be if this procedure turns out to be very costly for the institution. Nevertheless, if the cost is reasonable44 and not too time-consuming, one could justify this sort of an “ethical quality label” with potentially positive impact for the institution, its employees and the community it serves. 8. The issue of usury laws 41 Sen, A., What do we want from a theory of justice, mimeo, pp. 25-27. Rawls, J. (1971), p. 165. 43 In this case, the impartial spectator would play a similar role as the independent board members present in public institutions. 44 We can assume that the members from the civil society, such as NGOs working in another sector of activity, or other members of the Committee would provide information and participate for free. It is therefore mostly the cost of the organization of such a committee that would be involved. On the other hand, one such committee could be set up by donors to serve for many MFIs as the data would be of similar nature for all. 42 The last topic we will tackle concerns usury laws. After reading the above arguments, one may wonder which regulatory framework should emerge from the debate. Could a regulator make sure that an interest rate is fair for poor borrowers? We have seen that clients have limited bargaining power whenever there is insufficient competition. Some institutions have therefore charged exuberant interest rates, similar or just below to levels of moneylenders. In reaction, many governments are introducing new usury law or simply stronger usury laws in countries where they already exist in order to protect poor citizens. Helms and Reille (2004) found that about forty developing and transitional countries have introduced regulations about interest rate ceilings of some kind. Usury laws are certainly not new and have been largely studied. For instance and surprisingly, while Adam Smith was against the ban of interest rates, he recommended legal restrictions preventing the extortion of usury in the form of maximum interest rates. He was concerned that if interest rates rose too high, money would only be lent to “prodigals and projectors” who alone would be willing to pay exorbitant interest rates45. Thinking in Rawlsian terms, a usury law in a society is a secondary norm that could be designed to achieve a principle of justice. Theoretically, if a regulator could gather all the information on cost factors of an institution, he could try to determine the real bargaining range according to the institution’s potential market. The usury law could then be an effective norm to fulfil some principles. Nevertheless, one can doubt that all environmental contexts can be taken into account into the law. The law will probably lack the required flexibility to consider all singular cases and could easily violate some privacy rights if it had to do that correctly. Furthermore, if the maximum rate is fixed too low, the institution’s sustainability would be at risk, which would harm the leastadvantageous borrowers that have no other credit access. We conclude therefore that legislating maximum ceilings is a path that can easily backfire. 9. Conclusion In this paper we have studied a few notions of fair prices when lending to the poor. A procedural or “minimalist” approach of fairness would require the equal treatment or the non-discrimination of the clients, as well as transparence and consumer protection laws. 45 Smith, A. (1776), The Wealth of Nations, New York : Dutton, pp. 356-357 (quoted by Sen (1993)) In Rawls’ theory, any evaluation should be done on the basis of the whole system and not only on the sole level of a secondary norm such as the price. We express some doubt however that the rationality involved in the citizens’ decision under the veil of ignorance will not contain some non-neutral elements. We have then suggested an additional criterion that the borrowers should get a fair share and a fair opportunity within the bargaining range among the lender and the borrower. We have highlighted two approaches on the use of this criterion. The first one considers that this criterion should be applied to all investors. The second approach argues that it would be suited to the exigencies of social investors or international donors. To apply it, the involvement of a variety of actors and disinterested observers enables to gather a maximum of information and fix a fair reservation price. In both cases, this criterion would be preferable over the introduction of usury laws that easily can produce counter-productive effects. If applied to the current state of the microfinance sector, this criterion could shape the pricing strategy of many institutions targeting poor clients. Even if its application could sometimes represent an additional burden for institutions already working in difficult environments, the legitimacy of the disbursement of public funds could be at stake. This paper offers a first step to propose a new approach to fair prices. Further research is needed to assess and determine the various criteria of "fair shares" and their impact on the pricing policies. References: Armendariz de Aghion, B. and Morduch, J. (2005), The Economics of Microfinance, MIT Press: Cambridge. Arnsperger, C. (2005), What Is Utopian About the Realistic Utopia? Relocating Rawls in the Space of Normative Proposals, Revue Internationale de Philosophie, Spring 2005. Beitz, C. (1999), Political Theory and International Relations, Princeton University Press: Princeton. Conard, J. (1959), An Introduction to the Theory of Interest, University of California Press: Los Angeles. Cull, R., Demirgüç-Kunt, A. and J. Morduch (2006), Financial Performance and Outreach: A Global Analysis of Leading Microbanks, World Bank Policy Research Working Paper, 3827. Cohen, G.A. (1997), Where the Action is: On the Site of Distributive Justice, Philosophy and Public Affairs, 26, 1, pp. pp. 3-30. Cohen, J. (2001), Taking People As They Are?, Philosophy and Public Affairs, 30, 4, pp. 363-86. Collins, D. (2006), Financial Diaries, mimeo. Dehejia, R., Montgomery, H. and J. Morduch (2005). Do Interest Rates Matter? Credit Demand in the Dhaka Slums, ADB Institute Discussion Paper, No. 37, Manilla. Fernando, N. (2006), Understanding and Dealing With Interest Rates In Microcredit, Asian Development Bank, Manilla. Fouillet, C. (2006), La Microfinance Serait-Elle Devenue Folle ? Crise en Andhra Pradesh (Inde), BIM, 26 April 2006. Gauthier, D. (1986), Morals by Agreement, Oxford University Press: Oxford. Godquin, M. (2004), Microfinance Repayment Performance in Bangladesh: How to Improve the Allocation of Loans by MFIs, World Development, 32, 11, pp. 1909-1926. Hamouda, O. and B. Price (1997), The Justice of the Just Price’, European Journal. of the History of Economic Thought, 4, 2, pp. 191-216. Haprer, M. (1998), Profits for the Poor, Cases in micro-finance, ITDG, London. Hausman, D. (1989), Are Markets Morally Free Zones?, Philosophy and Public Affairs, 18, 4, pp. 317-333. Hayek, F. (1978), Law, Legislation and Liberty, vol. 2 (The Mirage of Social Justice). Helms, B. and X. Reille (2004), Interest Rates Ceilings and Microfinance: The Story So Far, CGAP Occasional Paper, 9, CGAP/ The World Bank Group: Washington D.C. Hulme, D. and P. Mosley (1996), Finance against Poverty, Volume 1, Routlege Publications: London. Kershnar, S. (2005), Giving Capitalists Their Due, Economics and Philosophy, 21, 1, pp. 65-87. Labie, M. (2001). Corporate governance in micro-finance organizations: A long and winding road, Management Decision, 39, 4, pp. 296-301. Lietaer, B. (2001), The Future of Money, Random House: London. Luchas, R. (1990), Why Does Not Capital Flow From Rich to Poor Countries ?, American Economic Review Papers and Proceedings, 80, 2, pp. 92-96 Mees, M. (2003), Interest Rates in the Field of Microfinance: A Technical or Political Choice?, Zoom Microfinance, 9, pp. 1-8. Morduch, J., (1999), The Microfinance Promise, Journal of Economic Literature, 37, 4, pp. 1569-1614. Nelson, B. (1959), The Idea of Usury, Princeton University Press: Princeton. Oosterlinck, K., (2003), The bond market and the legitimacy of Vichy France, Explorations in Economic History, 40, pp. 326-344. Porteous, D. (2006), Competition and Microcredit Interest Rates, Focus Note, 33, CGAP: World Bank. Rawls, J. (1971), A Theory of Justice. Harvard University Press: Cambridge. Rawls, J. (1980), Kantian Constructivism in Moral Theory, Journal of Philosophy, 77, 9, pp. 515-572. Rawls, J. (1999), The Law of Peoples, Harvard University Press: Cambridge. Rawls, J. (2001), Justice as Fairness: A Restatement. Belknap Press: Cambridge. Sen, A. (1985), The Moral Standing of the Market, Social philosophy and policy, 2, 2, pp. 1-19. Sen, A. (1993), On the Ethics and Economics of Finance, Economics and Philosophy, 9, pp. 203-227. Sen, A. (1995), Inequality Reexamined. Harvard University Press: Cambridge. Sen, A. (2002), Open and Closed Impartiality, Journal of Philosophy, 99, pp. 445-469. Sen, A. (2006), What Do We Want from a Theory of Justice, mimeo. Sen, A. (2006), Identity and Violence. The Illusion of Destiny, Norton: Boston. Smith, A. (1776), The Wealth of Nations, Dutton: New York. Stiglitz, J. and A. Weiss (1981), Credit Rationing in Markets with Imperfect Information, American Economic Review, 71, 3, pp. 393–410. Walsh, A., The Morality of the Market and the Medieval Schoolmen, Politics, Philosophy & Economics, 3, 2, pp. 241-259. Walzer, M. (1983), Sphere of Justice, Basic Books: New-York. Wertheimer, A. (1996), Exploitation, Princeton University Press: Princeton Wright, A., and P. Rippey (2003), The Competitive Environment in Uganda: Implications for Microfinance Institutions and Their Clients, MicroSave Working Papers, Microsave.