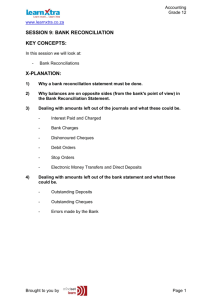

Page 1 of 12 TOPIC: BANK RECONCILIATION QUESTION 1: 42

advertisement

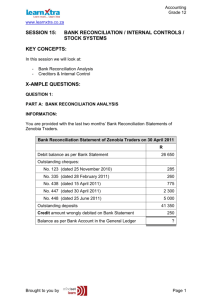

GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) TOPIC: BANK RECONCILIATION SECTION A: TYPICAL EXAM QUESTIONS Learner Note: Always answer in point form Make sure you learn your theory on bank reconciliations Open ended questions do not have one correct answer QUESTION 1: 42 marks 25 minutes BANK RECONCILIATIONS AND INTERPRETATION You are provided with information relating to Trial Traders REQUIRED 1.1 1.2 1.3 1.4 1.5 1.6 Explain why it is important for a business to prepare a bank reconciliation statement each month Calculate the correct totals for the Cash Receipts Journal and the Cash Payments Journal for August 2009 Complete the bank account in the General Ledger on 31 August 2009. Prepare the Bank Reconciliation Statement on 31 August 2009. Refer to information 3 below Calculate the amount invested in the fixed deposit What advice would you provide in order to avoid interest on the overdraft? Explain briefly. Refer to information 4 below Explain why the internal auditor should be concerned about the outstanding deposit of R23 456 Explain how cheque No.599 should be treated when the financial Statements are prepared on 31 August 2009. Provide a reason for your answer (3) (12) (6) (10) (3) (2) (3) (3) Page 1 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) INFORMATION 1. At the end of the previous month, 31 July 2009 , the following items were reflected in the Bank Reconciliation Statement: Favourable balance in the ledger of Happy Traders, R6 325 Favourable balance on the bank statement, R2 575 Outstanding deposit(dated 31 July 2009,R19 700 Outstanding cheques: No. 001(Dated 12 February 2009), R8 900 No.213 (Dated 1 April 2009), R3 400 No.313 (Dated 28 August 2009), R7 860 Note: Only cheque No.313 appeared on the Bank Statement in August 2009. 2. On 31 August 2009, the provisional totals in the Journals were: Cash receipts journal R87 000 Cash payments journal R109 000 3. The following items were reflected on the Bank Statement but not in the journals for August 2009: Direct deposit by a debtor, T.Twala, R3 400 Bank charges,R656 Interest on fixed deposit for August (10%p.a) R900 Interest on overdraft for August, R989 Debit order in favour of Safeway insurance Co. R770 Dishonoured cheque on 31 August 2009, originally presented by a debtor, C.Cheat, R2 600 4. The following differences were noticed: Cheque no.415 for repairs was shown in the CPJ as R1 779 but on the August bank statement as R1 997.The bank statement is correct. A deposit of R19 700 appeared on the bank statement on 1 August 2009, but did not appear in the August CRJ. A deposit of R23 456 dated 27 August 2009 appeared in the August CRJ but not on the August bank statement. The following cheques appeared in the August CPJ but not on the Bank Statement: No. 555(Dated 23 August 2009), R5 678 No.599 (Dated 31 December2009), R4 999 5. On 31August 2009 the Bank Statement reflected unfavourable balance of R17 087 [42] Page 2 of 12 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING GRADE 12 SESSION 15 QUESTION 2: 30 marks 20 minutes (LEARNER NOTES) BANK RECONCILIATION AND INTERNAL CONTROL Top Dog Traders employs Joe Cryme to write up the books, do the bank deposits and issue cheques. You are required to assist as internal auditor. REQUIRED: 2.1 Why does a business prepare a Bank Reconciliation Statement each month? (2) 2.2 Calculate the correct totals in the Cash Receipts Journal (CRJ) and Cash Payments Journal (CPJ) for October 2010. (10) 2.3 Prepare the Bank Reconciliation Statement on 31 October 2010. (10) 2.4 Refer to Information numbers 4 and 8 below. 2.4.1 It appears that Top Dog Traders will not be able to recover all amounts, or part of the amounts, lost due to the fraudulent activities of Joe Cryme. If you were the owner of this business, what steps would you take against Joe Cryme? Provide TWO steps. 2.4.2 Explain why the rule of prudence will be used in accounting for the fraudulent activities in the books and the financial statements. 2.4.3 Explain what was wrong with the procedures in the accounting department which led to this type of fraudulent activity. (2) (3) (3) INFORMATION: 1. At the end of the previous month, 30 September 2010, the following items appeared in the Bank Reconciliation Statement: Balance per Bank Statement Outstanding deposits for cash sales: Dated 28 September 2010 Dated 30 September 2010 Outstanding cheques: 502 (dated 19 April 2010) 613 (dated 24 September 2010) 614 (dated 27 September 2010) Balance per bank account 2. 3. 17 000 30 000 12 400 6 200 13 400 9 100 30 700 The balance on the Bank Statement is R40 092 (favourable) on 31 October 2010. The provisional totals in the journals for October 2010 before reconciling to the bank statement are: CRJ – R510 000 and CPJ – R463 600 Page 3 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) 4. From the bank reconciliation for September 2010 only the outstanding deposit of R12 400 and cheque No. 614 appeared on the October Bank Statement. The R30 000 reflected on the deposit slip, dated 28 September, was never deposited into the bank account by Joe Cryme. He cannot account for the whereabouts of the cash. 5. The October Bank Statement reflected bank charges of R1 310 and interest of R102 on the favourable bank balance. 6. A dishonoured cheque was reflected on the Bank Statement, R1 700. This was originally received from a debtor in payment of his account. 7. A direct deposit of R5 500 from a tenant was reflected on the Bank Statement. 8. As internal auditor you also detected that cheque No. 642 for R18 000 appeared on the Bank Statement, but not in the CPJ. The bookkeeper, Joe Cryme, forged the signatures and used the funds for personal benefit. 9. Cheque No. 633 was reflected in the CPJ as R2 630, but on the Bank Statement it was reflected as R6 230. The amount on the Bank Statement is correct. 10. The following items appeared in the October CRJ and CPJ, but not on the Bank Statement: No. 652 – R3 800 (dated 15 November 2010) No. 655 – R1 300 A deposit of R12 700 for cash sales. [30] Page 4 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) SECTION B: ADDITIONAL CONTENT NOTES Bank reconciliation entries at a glance The following table represents where transactions are to be entered: Transaction Direct deposit into the bank account as reflected on the B/S. Stop / debit orders / electronic payments appearing on the B/S. Bank charges and interest on overdraft. Cancellation of cheques (stale, stop payment, stolen or altered cheques). Interest on favourable bank balance. CRJ CPJ Bank DR Recon CR No entry Cheques issued, but not appearing on the B/S. Cheques outstanding on the previous B/R recon, but appearing in the current B/S. Cheques outstanding on the previous B/R recon, but still not appearing in the current B/S. Outstanding deposits. Deposit outstanding previously, but appearing in the current B/S. Dishonoured cheques. Post-dated cheques issued. Post-dated cheques received. Error in the CPJ Amount in the CPJ is higher than the original cheque. Amount in the CPJ is lower than the original cheque. Error on the B/S Amount incorrectly debited Amount incorrectly credited Page 5 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) SECTION C: HOMEWORK QUESTION 1: 40 marks 25 minutes RECONCILIATIONS AND INTERNAL CONTROL INFORMATION: You are provided with the last two months’ Bank Reconciliation Statements of Umlazi Traders. Bank Reconciliation Statement of Umlazi Traders on 30 April 2008 R Debit Balance as per Bank Statement 26 650 Outstanding Cheques: No. 123 (dated 25 November 2007) 285 No. 335 (dated 28 February 2008) 260 No. 438 (dated 15 April 2008) 775 No. 447 (dated 30 April 2008) 2 300 No. 448 (dated 25 June 2008) 5 000 Outstanding Deposits Credit Error on Bank Statement Balance as per Bank Account in the General Ledger 41 350 250 ? Bank Reconciliation Statement of Umlazi Traders on 31 May 2008 Debit Balance as per Bank Statement 23 270 Outstanding Cheques: No. 335 (dated 28 February 2008) 260 No. 448 (dated 25 June 2008) 5 000 No. 473 (dated 22 May 2008) 3 300 Outstanding Deposits Credit Balance as per Bank Account in the General Ledger 31 600 230 REQUIRED: Refer to the Bank Reconciliation Statements of April and May 2008 and answer the questions that follow: Page 6 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING 1.1 1.2 1.3 GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) According to the April 2008 Bank Statement, does Umlazi Traders have a favourable bank balance or an overdraft? Give a reason for your answer. Calculate the missing bank balance in the General Ledger of Umlazi Traders on 30 April 2008. State whether this is a favourable or unfavourable balance. Cheque No 123 does not appear on the May 2008 Bank Reconciliation Statement. This cheque for commission was not deposited by the payee, S Smit. 1.3.1 Briefly explain what the problem is with cheque No. 123 What entries would the bookkeeper have to make during May 2008 to deal with cheque 123. Which of the cheques shown as outstanding on the April 2008 Bank Reconciliation Statement was reflected on the May 2008 Bank Statement? (Write down only the cheque numbers.) The Bank Reconciliation on 30 April 2008 shows the item: “Credit Error on Bank Statement, R 250”. 1.5.1 Was this error corrected by the bank during May 2008? Give a reason for your answer 1.5.2 Give an example of the type of error that the bank could have made. Explain why cheques 335 and 448 appear on both the April and May 2008 Bank Reconciliation Statements. You must provide a different reason for each cheque (2) (6) (3) 1.3.2 1.4 1.5 1.6 (2) (4) (3) (3) (4) PROBLEM SOLVING 1. 7 As internal auditor of Umlazi Traders, you have noticed that both the April and May 2008 Bank Reconciliations reflect very large outstanding deposits. Your investigation into this matter shows that most of these amounts were in fact received by the cashier before the date on the Bank Statement. REQUIRED List points to include in a report to the Chief Accountant of Umlazi Traders highlighting your concerns and suggestions on the following points: 1.7.1 What you suspect the cashier is doing illegally which is resulting in these very large outstanding deposits. (3) 1.7.2 Discuss three internal control measures that could be implemented within the accounting department to avoid any further problems of this type occurring. (6) 1.7.3 Discuss two steps that could be taken should your suspicions of illegal actions by the cashier be confirmed. (4) Page 7 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING SENIOR SECONDARY INTERVENTION PROGRAMME GRADE 12 SESSION 15 (LEARNER NOTES) SECTION D: SOLUTIONS AND HINTS TO SECTION A QUESTION 1: 42 marks 25 minutes BANK RECONCILIATION AND INTERPRETATION 1.1 Explain why it is important for a business to prepare a bank reconciliation statement each month Good explanation=3 MARKS; Satisfactory=2; Incorrect=0 Expected response 1.2 Improves internal control-minimise fraud or error because records are checked to an external source CASH RECEIPTS CASH PAYMENTS Provisional total 87 000 Provisional total T.Twala 3 400 Bank charges 656 989 8900 Insurance Stale cheque 770 CCheat 2 600 Repairs 218 100 200 CORRECT TOTAL CORRECT TOTAL 1.3 109 000 900 Interest on overdraft Interest on f/deposit (3) (12) 114 233 LEDGER OF HAPPY TRADERS BANK May1 Balance 31 B/d 6 325 May Sundry 31 Sundry Accounts cpj accounts crj 100 200 Balance c/d 7 708 114 233 Jun . 114 233 114 233 Balance B/d 7 708 (6) Page 8 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING 1.4 GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) BANK RECONCILIATION STATEMENT AS AT 31 AUGUST 2009 Debit Debit balance as per bank statement Credit 17 087 23 456 Credit outstanding deposit Debit outstanding cheques: No.213 (Dated 1 April 2009) 3 400 No. 555(Dated 23 August 2009) 5 678 No.599 (Dated 31 December2009) 4 999 7 708 Credit balance as per Bank account 31 164 31 164 (10) 1.5 Calculate the amount invested in the fixed deposit R900x12=10 800=10 x=100 x=108 000 any other calculation acceptable What advice would you provide in order to avoid interest on the overdraft? Explain briefly Advice: Liquidate the interest on the fixed deposit Explanation: The interest on the overdraft will be at a higher rate than the 10% of the fixed deposit (5) 1.6 Explain why the internal auditor should be concerned about the outstanding deposit of R23 456 It should appear promptly on the Bank statement Fraud could be involved. E.g. the cashier. rolling of cash by the cashier Explain how cheque No.599 should be treated when the financial Statements are prepared on 31 August 2009. Provide a reason for your answer. Reduce the bank overdraftand increase the creditors The funds have not yet been lost at the Balance Sheet date as the cheque is post dated (6) TOTAL MARKS: 42 Page 9 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) QUESTION 2 2.1 Why does a business prepare a Bank Reconciliation Statement each month? Good explanation = 2 marks; Satisfactory =1; Incorrect =0 Expected responses for 2 marks: Improves internal control by minimising fraud or error because records are checked to an external source Improves internal control by identifying outstanding cheques and deposits To compare the books of the business with that of the bank in order to detect errors and/or dishonesty at an early stage The books of the business and that of the bank should agree and the bank balance should be the same in both books To reconcile the bank balance to the bank statement Expected responses for 1 mark: Internal control purposes To reconcile the bank account To identify the correct bank balance / update records To identify outstanding cheques and deposits Errors and dishonesty can be detected on a monthly basis 2.2 (2) Calculate the correct totals in the CRJ and CPJ for October 2010. Provisional totals # Be alert to R2 630 in CRJ & R6 230 in CPJ = R3 600 net effect: 1 mark Foreign items -1 max -2 Operation if one part correct CRJ 510 000 6 200 102 5 500 CPJ 463 600 30 000 1 310 1 700 18 000 # 3 600 521 802 518 210 (10) Page 10 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) 2.3 BANK RECONCILIATION STATEMENT AS AT 31 OCTOBER 2010 Debit Credit Balance as per Bank Statement 40 092 Outstanding cheques: No. 613 13 400 No. 652 3 800 No. 655 1 300 Outstanding deposits 12 700 Balance as per bank account operation if 34 292 one part correct 52 792 52 792 If 2-column method used without Debit / Credit headings assume left=Debit and right=Credit OR single column method OR could start with ledger balance Balance as per Bank Statement 40 092 Less outstanding cheques: Or brackets or Inspect – may be used treatment of figures to No. 613 13 400 award marks No. 652 3 800 if Add/Less No. 655 1 300 not reflected Add outstanding deposit 12 700 Balance as per bank account Operation if one part 34 292 correct (10) - 1 foreign entries max -2 2.4.1 Any TWO valid steps One mark each Possible answers: Set up a disciplinary hearing for Joe to answer to the allegations Recover what is possible from his salary that is owing to Top Dog Institute legal action against him (if the costs of the legal action are likely to be less than the amount recoverable) Terminate his employment with the firm / fire him Suspend Joe pending the investigation / move him to another department Lay a charge against Joe at the police station and get a case number Note: Mentioning professional bodies is not relevant. (2) Page 11 of 12 GAUTENG DEPARTMENT OF EDUCATION ACCOUNTING GRADE 12 SENIOR SECONDARY INTERVENTION PROGRAMME SESSION 15 (LEARNER NOTES) 2.4.2 Any valid explanation which indicates understanding of the rule of prudence Excellent explanation = 3 marks; Good = 2 marks; Satisfactory =1; Incorrect =0 Expected response for 3 marks: The business must regard this transaction in a pessimistic light as there is no certainty that any amounts will be recovered. Expected response for 2 marks: The rule of prudence dictates a conservative approach in reporting profits. Expected response for 1 mark: Pessimistic approach Conservative approach 2.4.3 Any valid explanation mentioning division of duties (3) Full explanation of one aspect = 3 marks Good explanation = 3 marks; satisfactory explanation = 2 marks; poor explanation = 1 mark; incorrect explanation = 0 marks Any aspects listed / mentioned without explanation = 1 mark each Expected response for 3 marks: Joe Cryme is responsible for all the vital activities relating to receipts, deposits and payments. Duties should be divided amongst employees in the business so that one employee serves as a check on another. Expected response for 1 mark each (max 2 if no explanation): Lack of internal control OR Lack of division of duties OR Lack of supervision OR Signatories on cheques are not acting responsibly (3) TOTAL MARKS: 30 Learner Note: From the above you can see the importance of understanding your concepts of bank reconciliations. As you attempt the homework, you need to ensure that you are able to answer the questions in the allocated time frames. If you have problems, you should refer either to the additional notes or your class teacher. The SSIP is supported by Page 12 of 12