solutions - Chabot College

advertisement

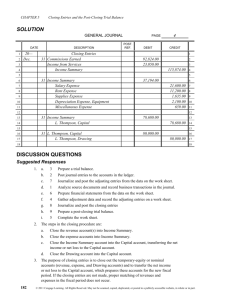

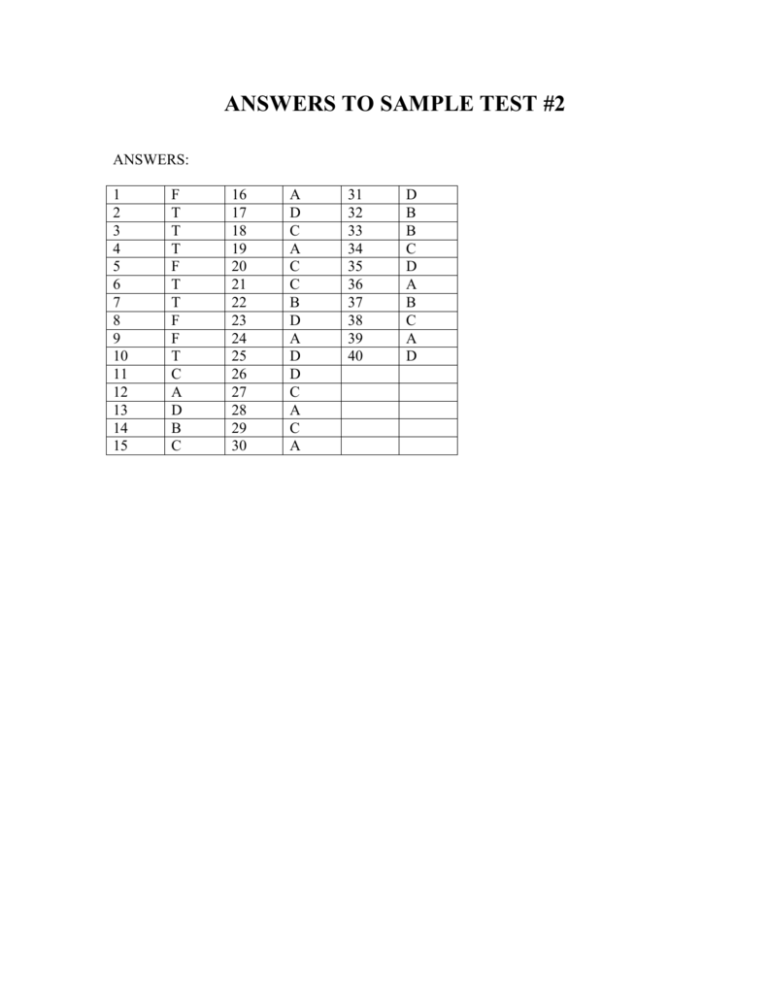

ANSWERS TO SAMPLE TEST #2 ANSWERS: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 F T T T F T T F F T C A D B C 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 A D C A C C B D A D D C A C A 31 32 33 34 35 36 37 38 39 40 D B B C D A B C A D PART B: PROBLEMS (45 pts total): 1. Use the following page (page 4) to journalize these transactions for May of 2008. Then post these transactions to the General Ledger that follows (the account names and numbers are preprinted): 2 pts per journal entry (total of 14 pts) + 11 pts for the general ledger. a. May 2 - Collected $325 from credit customers. b. May 4 - Purchased supplies for $180 on credit, invoice #DS01 c. May 5 - Performed services for $4,500 cash. d. May 9 - Purchased new equipment for $1,700. Issued check # 1135 for $1,000 as downpayment. The balance is due in 30 days, invoice #885. e. May 13 - Issued check #1136 for $700 to pay a creditor on account. f. May 26 - Purchased office furniture for $200 cash, check #1137. g. May 30 - Returned damaged supplies and received $50 cash back. GENERAL JOURNAL Page 4_ DATE 1 2 2008 May DESCRIPTION DEBIT POST. REF. CREDIT 1 2 3 4 Cash AR Collected cash from charge customers 101 111 Office Supplies AP Bought supplies, inv #DS01 121 202 Cash Fees Income Performed services for cash 101 401 3 2 5 00 2 3 2 5 00 4 5 6 5 4 7 8 1 8 0 00 6 1 8 0 00 9 5 11 12 4 5 0 0 00 10 4 5 0 0 00 13 9 15 16 17 18 19 Equipment Cash AP Bought equipment, issued ch. #1135 for downpayment, & received inv #885 151 101 202 1 7 0 0 00 14 1 0 7 0 0 0 0 00 00 13 23 18 19 AP Cash Issued ch #1136 to pay on acct 202 101 Office Furniture Cash Bought furniture with ch. #1137 138 101 Cash Office Supplies Returned damaged supplies for a cash refund 101 121 7 0 0 00 21 7 0 0 00 24 26 26 27 2 0 0 00 25 2 0 0 00 31 32 26 27 28 30 22 23 24 29 16 20 22 25 15 17 20 21 11 12 13 14 7 8 9 10 3 28 30 5 0 00 29 5 0 00 30 31 32 33 33 34 34 35 35 36 36 37 37 38 38 39 39 40 40 41 41 GENERAL LEDGER Cash ACCOUNT ACCOUNT NO. 101 POST DATE 2008 May DESCRIPTION 2 5 9 13 26 30 BALANCE REF. DEBIT J4 J4 J4 J4 J4 J4 325.00 4500.00 CREDIT 1000.00 700.00 200.00 50.00 AR ACCOUNT Debit 325.00 4825.00 3825.00 3125.00 2925.00 2975.00 ACCOUNT NO. 111 POST DATE 2008 April May DESCRIPTION 30 2 Balance REF. BALANCE DEBIT J1 J4 CREDIT Debit 325.00 ACCOUNT NO. 121 POST DATE 2008 May DESCRIPTION 4 30 REF. J4 J4 BALANCE DEBIT CREDIT 180.00 50.00 Office Furniture ACCOUNT Debit 2008 May DESCRIPTION 26 ACCOUNT NO. 138 REF. J4 BALANCE DEBIT CREDIT Debit ACCOUNT NO. 151 POST DATE 2008 May DESCRIPTION 9 Credit 200.00 200.00 Equipment ACCOUNT Credit 180.00 130.00 POST DATE Credit 1,000.00 675.00 Office Supplies ACCOUNT Credit BALANCE REF. DEBIT J4 1700.00 CREDIT Debit 1700.00 Credit ACCOUNT NO. 202 AP ACCOUNT POST DATE 2008 May DESCRIPTION 4 9 13 REF. J4 J4 J4 BALANCE DEBIT CREDIT 180.00 880.00 180.00 700.00 ACCOUNT NO. 401 POST DATE 2008 May DESCRIPTION 5 Credit 180.00 700.00 Fees Income ACCOUNT Debit REF. J4 BALANCE DEBIT CREDIT 4500.00 Debit Credit 4500.00 2. Use the journal form below (page 5) to journalize the following adjustments (2.5 pts for each transaction). a. Purchased supplies for $1,000 on May 1, 2008. Inventory of supplies as of May 31, 2008, $300. b. Signed a 4-month contract for $1,200 prepaid advertising on May 1, 2008. Record the adjustment for the amount of the contract that expired during the month of May. c. Rent expired during the month of May 2008, $700. d. Depreciation is computed using the straight-line method. Equipment purchased on May 1, 2008, for $16,800 has an estimated useful life of 5 years with no salvage value. Record the adjustment on May 31, 2008. Page GENERAL JOURNAL DATE 1 2 3 4 DESCRIPTION Adjusting Entries 2008 May 31 Supplies Expense Supplies POST. DEBI REF. T 5 CREDIT 1 2 3 7 0 0 00 7 0 0 00 4 5 6 7 5 31 Advertising Expense Prepaid Advertising 6 3 0 0 00 3 0 0 00 7 8 9 10 8 31 Rent Expense Prepaid Rent 7 0 0 00 11 12 13 9 7 0 0 00 10 11 31 Depreciation Expense - Equipment Accumulated Depreciation - Equipment 2 8 0 00 12 2 8 0 00 13 14 14 15 15 16 16 17 17 18 18 19 19 20 20 21 21 22 22 3. On December 31, 2008, the ledger accounts of Barsky Repair have the following balances after all adjusting entries have been posted (10 pts): Cash Supplies Equipment Accumulated Depreciation, Equipment Accounts Payable R. Barsky, Capital R. Barsky, Drawing $ 1,700 1,800 5,300 1,200 400 6,700 16,300 Income Summary Income from Services Wages Expense Rent Expense Utilities Expense Depreciation Expense, Equipment Supplies Expense Miscellaneous Expense $ 0 24,900 1,600 3,600 1,100 600 800 400 Journalize the four closing entries (using page 6 of the general journal below) in the proper order: Page 6 GENERAL JOURNAL DATE 1 2 3 4 DESCRIPTION POST. DEBI REF. T CREDIT 1 Closing Entries 2008 Dec 31 Income from Services Income Summary 2 3 24 9 0 0 00 24 9 0 0 00 4 5 6 7 8 9 10 11 12 5 31 Income Summary Wages Expense Rent Expense Utilities Expense Depreciation Expense – Equipment Supplies Expense Miscellaneous Expense 1 6 0 0 3 6 0 0 1 1 0 0 6 0 0 8 0 0 4 0 0 13 14 15 18 00 00 00 00 00 00 7 8 9 10 11 12 13 31 Income Summary R. Barsky, Capital 16 8 0 0 00 14 16 8 0 0 00 15 16 17 6 8 1 0 0 00 16 31 R. Barsky, Capital R. Barsky, Drawing 16 3 0 0 00 17 16 3 0 0 00 18 19 19 20 20 21 21 22 22