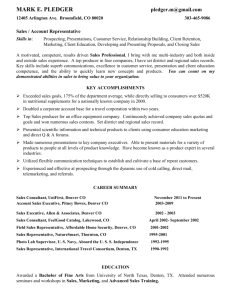

Nov 3, 2014 - centennial realty advisors

advertisement

November 3, 2014 Trammell Crow’s Feat: Giving Plant Site a Lift The long-toxic Asarco smelter site in Globeville, nearing the end of a massive Superfund cleanup, has landed a major-league developer to kick-start its new life. Trammell Crow Co. has signed on to redevelop the 77-acre property in a key move to give Globeville a share of Denver’s urban renaissance. Denver’s largest and highest-profile developer, Trammell Crow has agreed to buy the smelter site from EnviroFinance Group and build the biggest industrial park in central metro Denver. At completion, the $85 million Crossroads Commerce Park will have 12 warehouse, distribution and light-manufacturing buildings encompassing 1 million square feet. More important to historically downtrodden Globeville, the project will bring an estimated 800 to 1,500 jobs. “It seems like it will be a real positive development for the community,” said David Oletski, a native of the gritty neighborhood that spans both sides of Interstates 70 and 25. “A workforce like that will impact the neighborhood in positive ways,” said Oletski, whose grandfather worked at Asarco’s Globe smelter. “We haven’t seen activity like this in years.” The smelter site runs west of Washington Street between East 51st and 55th avenues, with the southern section in Denver’s Globeville neighborhood and the larger northern piece in Adams County. That makes the site central to a broad urban-renewal initiative, including the rebuilding of I70, redevelopment of the National Western Stock Show complex, new light-rail stations and improvements along Brighton Boulevard in the booming River North neighborhood. “The redevelopment of that site represents an important milestone for both the (Globeville) neighborhood itself and for the city,” said Kelly Leid, executive director of the North Denver Cornerstone Collaborative, spearhead for the city of Denver’s redevelopment plans. “The experience that Trammell Crow would bring to that project would be phenomenal.” Dallasbased Trammell Crow has developed $2 billion of Denver-area projects during the past 10 years. The portfolio includes the multimodal transit hub at Denver Union Station, DaVita Inc.’s headquarters, the History Colorado Center, the Wellington E. Webb Municipal Building and the Ralph L. Carr Colorado Judicial Center. Denver-based EnviroFinance Group is redeveloping the old St. Anthony hospital site near Sloan’s Lake in Denver. Trammell Crow senior managing director Bill Mosher said his firm had been searching for an industrial development location along I-70 and found the smelter site to be ideal. “It’s a terrific location today. And given all the investment happening in the area, it’s going to become really fantastic in a few years,” Mosher said. Trammell Crow senior director Ann Sperling said she expects strong interest from tenants and buyers because demand for warehouse and distribution space is high and vacancy rates are low, particularly in central Denver. The Globe smelter operated for 120 years, from 1886 to 2006. It was declared an EPA Superfund site in 1993, after regulators determined that the plant had spread lead and arsenic pollution through parts of a 4.5-square-mile area. Brownfields developer EnviroFinance Group began overseeing site remediation in 2011. Cleanup work is scheduled for completion by the end of January. EFG will then build roads and infrastructure and sell finished parcels to Trammell Crow for development of buildings starting next summer. Plans are underway by Denver and Adams County to enlarge and improve Washington Street to accommodate expected higher traffic volume. Barry Gore, president and CEO of Adams County Economic Development, described the Crossroads project as “a once-in-ageneration opportunity for Adams County and Denver.” EFG executive vice president Mary Hashem said feedback from neighbors has been almost entirely positive. “Bringing jobs and economic vitality are what the neighborhood is interested in,” she said. “We’ve assured them that heavy industrial activities will not be coming back to this property.” (Denver Post) ▪▪▪ LoDo Commands 20% Higher Rents than the Rest of Downtown Denver It's no secret that LoDo is the most popular part of downtown these days for construction, real estate deals, new businesses and social activity for thousands of Denverites, including the highly sought millennial age group. But a new report quantifies just how much people want to be in LoDo — or lower downtown for newly minted Coloradans — by demonstrating how much more they'll pay for office space to locate their businesses there compared to other parts of downtown. Average rents for Class A office space in LoDo were around $40 per square foot for a full-service lease in the second quarter, compared with around $33 per square foot for office properties in all of downtown combined, making lease rates in LoDo about 21 percent higher, according to a report published by Los Angeles-based real estate firm CBRE Group Inc. called "The LoDo Premium." The report uses boundaries for LoDo set in the 1960s and splits downtown into four "micro-markets." The micro-markets include LoDo, which reaches from Regional Transportation District's West Line to a historic demarcation halfway between Market and Larimer streets. Adjacent to LoDo is the Skyline neighborhood, between the LoDo boundary and Arapahoe Street. Skyline benefits from being adjacent to LoDo when it comes to getting higher lease rates, outperforming the other two micro-markets, Mid-Central Business District and Uptown, said Chris Phenicie, senior vice president at CBRE. In the second quarter, Skyline was able to attract rents of around $37 per square foot, while Uptown properties got around $35 and Mid-Central Business District brought in around $32, according to the report. But even with the higher rents in LoDo, office users are willing to pay the price, as the level of absorption in the area demonstrates. Since the end of the recession, LoDo has had 1.4 million square feet of positive net absorption while the rest of downtown recorded flat or slightly negative levels of net absorption in the years between the second quarter of 2009 and the second quarter of 2014, according to the report. In the wake of the recession, many downtown office users "right-sized," scaling back the amount of space they needed after shrinking their companies to survive the downturn. One large example is 1801 California, the 53-story building formerly occupied entirely by Qwest Communications, Phenicie said. In CenturyLink's acquisition of Qwest in 2011, 800,000 square feet in 1801 California was vacated, a big hit to absorption in the Mid-Central Business District. Meanwhile, companies have flocked to LoDo in search of proximity to transit with the opening of the redeveloped Union Station and the "cool factor" that LoDo brings, Phenicie said. While Union Station itself has certainly been a draw, the resulting influx of apartments to the area and large commitments to LoDo by large companies, such as the 270,000-square-foot headquarters built in 2011 by dialysis company DaVita Inc. at 1550 Wewatta St., help make the area attractive enough that businesses will pay the premium price associated with the area. "People are willing to pay more in rent for the things they deem desirable," Phenicie said. (Denver Business Journal) Denver Apartment Vacancy Drops Below 4% Apartment vacancies in metro Denver in the third quarter dropped almost a full percentage point to 3.9 percent, according to the latest Denver Metro Area Apartment Vacancy and Rent Survey. In the second quarter, the vacancy rate was 4.7 percent. From second to third quarter, the average rent in the metro area rose to $1,145 per month, about a 2 percent increase over the previous quarter when the average rent was $1,117 per month. The data in the report are compiled quarterly by the University of Denver Daniels College of Business and Colorado Economic and Management Associates. Net absorption of apartments in Denver increased quarter-over-quarter, with 4,470 units absorbed in the third quarter, compared with 3,127 last quarter. "The third quarter absorption yielded impressive results that exceeded the strong second quarter results, demonstrating the desirability of the Denver market, supported by an increase of in-migration, a decreasing unemployment rate, and increased business activity," said Ron Throupe, associate professor at Daniels College of Business and co-author of the report. "This year's total absorption count shows the strength of household formations and desirability of Denver. In 2014, Colorado and Denver have become highly ranked locations by many surveys on business and lifestyle," Throupe said. (Denver Business Journal) ▪▪▪ Two Strong Quarters in a Row for GDP, but Economy Still a Little Soft The Federal Reserve's confidence in the economy was rewarded by a better-than-expected report on economic growth in the third quarter. Gross domestic product increased at an annual rate of 3.5 percent in the third quarter, according to an initial estimate by the Bureau of Economic Analysis. We can thank personal consumption, exports, nonresidential fixed investment and government spending for this jump, according to the bureau. The strong third quarter followed 4.6 percent GDP growth in the second quarter — the best back-to-back quarters for the economy since 2003, as Bloomberg notes. So it looks like the economy was only taking a short winter's nap in the first quarter of the year, when GDP declined. "The economy has bounced back strongly," said Jason Furman, chairman of President Barack Obama's Council of Economic Advisers. But, as Obama administration officials always point out, "more must still be done to boost growth both in the United States and around the world by investing in infrastructure, manufacturing and innovation; and to ensure that workers are feeling the benefits of that growth, by pushing to raise the minimum wage and supporting equal pay," Furman writes. There were "some signs of softness" in the economy, notes Chad Moutray, chief economist for the National Association of Manufacturers. "While consumer spending and fixed investments provided a boost in the third quarter, the pace of growth slowed from the prior quarter, beyond the swing of the pendulum after such a strong rebound in the second quarter. This included softness in equipment spending and the housing market, and inventory spending was also a negative." Manufacturers, however, "remain mostly upbeat about future demand and production, which bodes well for future quarters," Moutray writes. (Denver Business Journal) FED TARGET RATE 3 MONTH LIBOR PRIME RATE 10 YEAR TREASURY 30 YEAR TREASURY CURRENT .25 .23 3.25 2.35 3.07 1 MONTH PRIOR .25 .24 3.25 2.39 3.09 1 YEAR PRIOR .25 .24 3.25 2.56 3.64