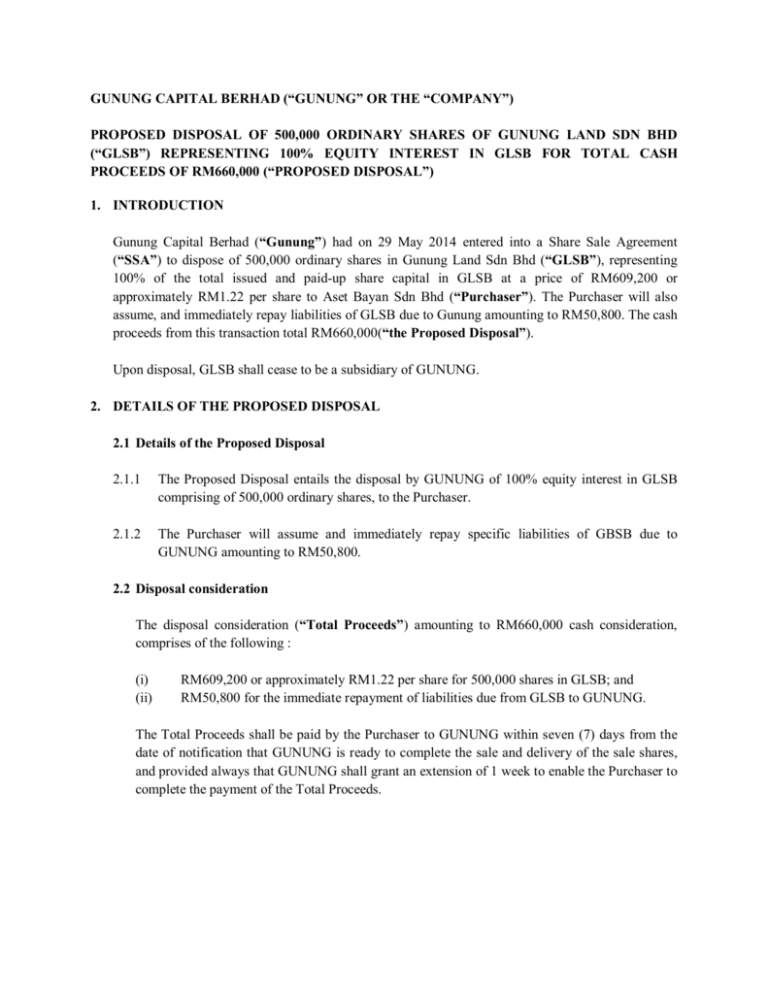

GUNUNG CAPITAL BERHAD (“GUNUNG” OR THE “COMPANY

advertisement

GUNUNG CAPITAL BERHAD (“GUNUNG” OR THE “COMPANY”) PROPOSED DISPOSAL OF 500,000 ORDINARY SHARES OF GUNUNG LAND SDN BHD (“GLSB”) REPRESENTING 100% EQUITY INTEREST IN GLSB FOR TOTAL CASH PROCEEDS OF RM660,000 (“PROPOSED DISPOSAL”) 1. INTRODUCTION Gunung Capital Berhad (“Gunung”) had on 29 May 2014 entered into a Share Sale Agreement (“SSA”) to dispose of 500,000 ordinary shares in Gunung Land Sdn Bhd (“GLSB”), representing 100% of the total issued and paid-up share capital in GLSB at a price of RM609,200 or approximately RM1.22 per share to Aset Bayan Sdn Bhd (“Purchaser”). The Purchaser will also assume, and immediately repay liabilities of GLSB due to Gunung amounting to RM50,800. The cash proceeds from this transaction total RM660,000(“the Proposed Disposal”). Upon disposal, GLSB shall cease to be a subsidiary of GUNUNG. 2. DETAILS OF THE PROPOSED DISPOSAL 2.1 Details of the Proposed Disposal 2.1.1 The Proposed Disposal entails the disposal by GUNUNG of 100% equity interest in GLSB comprising of 500,000 ordinary shares, to the Purchaser. 2.1.2 The Purchaser will assume and immediately repay specific liabilities of GBSB due to GUNUNG amounting to RM50,800. 2.2 Disposal consideration The disposal consideration (“Total Proceeds”) amounting to RM660,000 cash consideration, comprises of the following : (i) (ii) RM609,200 or approximately RM1.22 per share for 500,000 shares in GLSB; and RM50,800 for the immediate repayment of liabilities due from GLSB to GUNUNG. The Total Proceeds shall be paid by the Purchaser to GUNUNG within seven (7) days from the date of notification that GUNUNG is ready to complete the sale and delivery of the sale shares, and provided always that GUNUNG shall grant an extension of 1 week to enable the Purchaser to complete the payment of the Total Proceeds. 2.3 Other salient terms of the SSA The other salient terms and conditions of the SSA are as follows: 2.3.1 The SSA shall be conditional upon the Purchaser fully settling the GLSB debt to the Vendor. 2.3.2 Total Proceeds means the sum of RM660,000 comprising of RM609,200 payable by the Purchaser to GUNUNG for the Sale Shares and RM50,800 for amount due to GUNUNG. 2.3.3 The Purchaser shall pay the Total Proceeds to GUNUNG within 7 days from the date of notification by GUNUNG that they are ready to complete the Share Sale and delivery of sale shares. 2.3.4 The SSA shall be deemed to be completed upon the release of the Total Proceeds by the Purchaser to GUNUNG. 2.4 Basis of arriving at the Total Proceeds (Disposal Consideration) The Total Proceeds of RM660,000 was arrived at on a commercial arms length basis after taking into consideration: (i) the audited net asset value of GLSB as at 31 December 2013 amounting to RM626,125; and (ii) the total liabilities of GLSB due to GUNUNG amounting to RM50,800; and (iii) the un-audited net asset value of GLSB as at 31 March 2014 amounting to RM613,082. 2.5 Original cost of investment The original cost and date of investment in GBSB is as follows; Date 29 September 1998 Number of shares of par value RM1.00 500,000 Cost (RM) 523,965 2.6 Liabilities to be assumed by the Purchaser As provided in the SSA, the Purchaser will assume and shall immediately repay, prior to completion, RM50,800 of liabilities of GBSB due to GUNUNG. 3. PROPOSED UTILISATION OF PROCEEDS The cash proceeds from the Proposed Disposal will be wholly utilised as working capital. 4. INFORMATION ON GLSB GLSB is a private company limited by shares incorporated in Malaysia under the Companies Act, 1965. Its present authorised share capital is Ringgit Malaysia five hundred thousand only (RM500,000) divided into five hundred thousand (500,000) ordinary shares of Ringgit Malaysia One (RM1.00) each of which five hundred thousand (500,000) ordinary shares have been issued and fully paid-up. The principal business of GLSB is property investment holding. The audited net assets of GLSB as at 31 December 2013 was RM626,125 and the unaudited net assets as at 31 March 2014 was RM613,082. The audited net loss of GLSB for the financial year ended 31 December 2013 was RM3,976 and the unaudited net profit for the first three months ended 31 March 2014 was RM13,042. 5. INFORMATION ON THE PURCHASER Aset Bayan Sdn Bhd (“the Purchaser”) is a private company limited by shares incorporated in Malaysia under the Companies Act, 1965. Its present authorised share capital is Ringgit Malaysia one hundred thousand only (RM100,000) divided into one hundred thousand (100,000) ordinary shares of Ringgit Malaysia One (RM1.00) each of which one thousand (100,000) ordinary shares have been issued and fully paid-up. The principal business of the Purchaser is construction and property rental. 6. RATIONALE FOR THE PROPOSED DISPOSAL The Proposed Disposal is in line with GUNUNG’s plan to focus on chartering of land-based transportation assets & specialty vehicles, the development of mini-hydropower, and to dispose of non-core assets. Furthermore GLSB, has no revenue. GUNUNG will capitalize on the opportunity to wholly dispose GLSB and generate cash proceeds of RM660,00 to be utilized as working capital. 7. RISK FACTORS The Proposed Disposal is conditional upon the Conditions Precedent being fulfilled. As such the Proposed Disposal may not be completed if the Conditions Precedent is not fulfilled. In addition, the Proposed Disposal may not be completed in the event the Purchaser defaults in payment of the Total Proceeds. 8. EFFECTS OF THE PROPOSED DISPOSAL 8.1 Share Capital and Substantial Shareholders’ Shareholding The Proposed Disposal will not have any effect on the issued and paid-up share capital of and the substantial shareholdings in GUNUNG. 8.2 Net Assets and Gearing The Proposed Disposal is not expected to have any material impact on net assets and gearing of GUNUNG. 8.3 Earnings and earnings per share The Proposed Disposal is not expected to have a material impact on GUNUNG’s earnings for the financial year ending 31 December 2014. The Proposed Disposal is expected to result in a gain on disposal of approximately RM85,235 at the Company level. 9. DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS None of the Directors or major shareholders of GUNUNG and/or persons connected to them have any interest, direct or indirect, in the Proposed Disposal. 10. APPROVALS REQUIRED The Proposed Disposal is not subject to the approval of the shareholders of GUNUNG or any Government Authority. 11. DIRECTORS’ STATEMENT The Board of Directors, having considered the relevant aspects of the Proposed Disposal, including the rationale, basis of arriving at the Disposal Consideration, salient terms of the SSA, is of the opinion that the Proposed Disposal is in the best interest of GUNUNG. 12. PARAGRAPH 10.02(G) OF THE LISTING REQUIREMENTS OF BURSA MALAYSIA SECURITIES BERHAD The highest percentage ratio pursuant to paragraph 10.02(g) of the Listing Requirements of Bursa Malaysia Securities Berhad applicable to the Proposed Disposal is 0.71%. 13. ESTIMATED TIME FRAME FOR COMPLETION Barring any unforeseen circumstances, the Proposed Disposal is expected to be completed before end-June 2014, unless otherwise extended. 14. DOCUMENTS FOR INSPECTION The SSA is available for inspection at the registered office of GUNUNG 11B, Level 2, Greentown Business Centre, Persiaran Greentown 9, 30450, Ipoh, Perak Darul Ridzuan, during the normal working hours from Monday to Friday (except public holidays) for a period of one (1) month from the date of this announcement. This announcement is dated 29 May 2014.