Teavana Presentation for ICR XChange 1.9 v.2 [Compatibility Mode]

advertisement

![Teavana Presentation for ICR XChange 1.9 v.2 [Compatibility Mode]](http://s3.studylib.net/store/data/008295694_1-7372a66a35639a3500518d2e14f9b365-768x994.png)

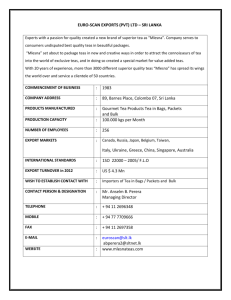

Investor Presentation January 2012 FORWARD-LOOKING STATEMENTS This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect management’s current views and estimates regarding our industry, business strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. You can identify these statements by the fact that they use words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future” and similar terms and phrases. We cannot assure you that future developments affecting us will be those that we have anticipated. Actual results may differ materially from these expectations due to risks relating to our strategy and expansion plans, the availability of suitable new store locations, risks that consumer spending may decline and that U.S. and global macroeconomic conditions may worsen, risks related to our continued retention of our senior management and other key personnel, risks relating to changes in consumer preferences and economic conditions, risks relating to our distribution center, quality or health concerns about our teas and tearelated merchandise, events that may affect our vendors, increased competition from other tea and beverage retailers, risks relating to trade restrictions, risks associated with leasing substantial amounts of space, and other factors that are set forth in the Company’s filings with the Securities and Exchange Commission (“SEC”), including risk factors contained in the final prospectus relating to the IPO included in the Company’s Registration Statement on Form S-1 (File No. 333-173775) filed with the SEC and available at www.sec.gov. If one or more of these risks or uncertainties materialize, or if any of our assumptions prove incorrect, our actual results may vary in material respects from those projected in these forward-looking statements. Any forwardlooking statement made by us in this presentation speaks only as of the date on which we make it. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws. . 1 INTRODUCING TEAVANA – Large, rapidly growing specialty retailer of premium loose-leaf teas and tea-related merchandise 2010 SALES BREAKDOWN Prepared Beverages – One of the world’s largest branded, multi-channel specialty tea retailers – Currently operate 196 stores in leading malls and lifestyle centers in the US 4% Tea-Related Merchandise 40% 56% – Brand associated with: Premium Loose-Leaf Teas – Premium tea products – “Heaven of Tea” store ambiance – East Meets West healthy living lifestyle Average Ticket of $36 2 POWERFUL GROWTH & PROFITABILITY NET SALES KEY 2010 STATISTICS $125 Sales per Comparable Store $90 $64 2008 $862,000 Comparable Store Sales Growth 2009 8.7% Gross Margin 62.9% Operating Margin 18.8% 2010 OPERATING INCOME $23 $12 Net Income Growth 126.9% **All stores profitable in 2010 $5 2008 2009 2010 With opportunity to grow store base to 500 stores in the US by 2015 Note: Dollars in millions, except sales per comparable store. 3 INVESTMENT HIGHLIGHTS Market-Defining Brand Driving Category Growth World’s Finest Teas and Tea-Related Merchandise “Heaven of Tea" Retail Experience Powerful and Consistent Store Model Significant and Tangible Growth Opportunities Superior Profitability Deep Rooted Culture Driven By Experienced Management Team 4 Driving the Tea Revolution LARGE & GROWING MARKET – Tea is the second most consumed beverage in the world GLOBAL TEA SALES (1) US $5.2BN – US tea market is a small portion of total market – US tea consumption significantly lags rest of world – #22 in per capita consumption (2) – Strong projected growth in US of +6% per year through 2014 – Key growth drivers include: – Increasing focus on health and wellness – Growing consumer awareness of tea Rest of World $51.4BN STRONG PROJECTED GROWTH (2) US Tea Market $6.6BN $5.2BN – Epicurean preferences in food and beverage (1) (2) Source: Euromonitor 2009. Source: Mintel, May 2010. Historical 2014 5 DRIVING THE TEA REVOLUTION Leading Retail Presence 196 high-traffic locations (Multiple times greater than next largest US specialty tea retailer) World’s Finest Teas & Teawares World’s finest selection of premium loose-leaf teas and tea-related merchandise Heaven of Tea Retail Experience Deep-Rooted Culture Interactive, informative and immersive retail experience Passionate teaologists promoting enjoyment of tea 6 LEADING RETAIL PRESENCE IN HIGHTRAFFIC LOCATIONS – Locate stores in high-traffic locations in leading malls and life-style centers – Focus on premium anchors and cotenants KEY STORE STATISTICS 2010 Average Store Size 2010 Store Openings – Leverage our highly experienced real estate team and sophisticated store development process Sales per Gross Square Foot – Disciplined, highly analytical approach utilizes proprietary database and regression model Average Ticket Sales per Comparable Store 888 sq. ft. 38 $994 $862,000 $36 **All stores profitable in 2010 – 500+ store sites already identified in the US 7 WORLD’S FINEST TEAS & TEAWARES LOOSE LEAF TEAS (56%) TEA-RELATED MERCHANDISE (40%) – Over 100 varieties of premium looseleaf teas – Artisanal teawares and other tearelated merchandise – Sourced globally from world’s premium tea gardens, estates and brokers – Carefully selected assortment – Single Estate = 20%; Blended = 80% – Development of Teavana branded products – Selected from global tea cultures Selected Products Origination Single Estate Originate from individual tea plantations, estates or gardens Single Estate Blends Single estate teas blended with spices, herbs, flower petals, essential oils of fruit Herbal Blends Herbal infusions made from various brushes, shrubs, fruits, herbs and flowers Note: Teapots Tea Cups & Mugs Cast-iron Tetsubin teapots from Japan, Yixing clay teapots Handcrafted ceramic tea cups, Petite Fleur Suspendu Tea Set Teavana Perfect TeaMaker, Zojirushi Tea Accessories Hybrid Water Heater Décor, Food Tea-infused aromatic candles, Asianinspired statues, artisanal honeys & Media Percentages represent 2010 sales. Excludes prepared beverages, representing 4% of sales. 8 OUR WALL OF TEA ORIGIN TASTES PRICE PER 2OZ. POPULAR FLAVOR Fujian Province (China) Subtle, complex, delicate $10 – $22 Silver Yin Zhen Pearls White Ayurvedic Chai China, Japan Aromatic and fresh-tasting $5 – $20 Jasmine Dragon Phoenix Pearls Gyokuro Imperial China, Taiwan Light, rich liqueur $8 – $25 Monkey Picked Oolong Maharaja Chai Oolong India, Sri Lanka, China Light-to-strong and full-bodied $3 – $40 Golden Monkey Black Dragon Pearls South Africa $5 – $8 Rooibos Naturally sweet, nutty Rooibos Tropica Blueberry Bliss South America $6 – $7 Maté Woody, invigorating body Samurai Chai Maté Raspberry Riot Lemon Maté Global Smooth, gentle, roasty $5 – $9 Wild Orange Blossom Pineapple Kona Pop! White Green Oolong Black Herbal Infusions Two ounces brew approximately 20 – 25 8 oz. cups 9 DEEP ROOTED CULTURE EMBRACING A PASSION FOR TEA Our Culture Passion For Tea Allows Us To: – Attract and retain committed team members – Build a talent pipeline to support our store growth Extensive Training Career Development & Individual Enrichment – Inspire in our team members a passion for tea and the tea lifestyle that drives: – Acquisition of new customers at our stores – Strong customer loyalty – Experience minimal turnover among our regional and area managers 10 COMMITTED AND PASSIONATE MANAGEMENT TEAM (1) NAME TITLE YEARS AT TEAVANA Andrew Mack Co-Founder, Chairman and Chief Executive Officer 14 Dan Glennon EVP, Chief Financial Officer 6 Peter Luckhurst EVP, Operations 6 Robert Shapiro(1) Senior Vice President, Real Estate 6 Carol Joyner Vice President, Real Estate <1 Juergen Link Vice President, Distribution 6 Jay Allen Vice President, e-commerce 3 Patrick Farrell Vice President, Merchandising 3 Robert Shapiro is retiring at the end of fiscal 2011. 11 Growth Opportunities MULTIPLE ATTRACTIVE GROWTH OPPORTUNITIES New Stores – 500 US store opportunity achievable by 2015, up from 196 stores at the end of Q3 2011 Comp Store Sales – Introduce new customers to tea e-Commerce – Grow to 10%+ of sales (7% currently) Increase Margins – "Trade up" of existing customers – Merchandise mix naturally shifts towards higher margin loose-leaf tea sales as stores mature – Increase scale with suppliers and leverage fixed cost base International Expansion – Pursue opportunities for franchise and Company owned stores 12 HIGHLY CONSISTENT STORE BASE NATIONAL PRESENCE RECENT STORE OPENINGS Q311 Store Count – Anchorage, AL 58 47 46 45 – Chattanooga, TN – Chicago, IL – Clearwater, FL – Grand Rapids, MI Central West Southeast Northeast CONSISTENT PERFORMANCE 2010 Sales / Store – Indianapolis, IN – Lincoln, NE – Los Angeles, CA Average $862,000 – Norfolk, VA – Nashua, NH – Staten Island, NY Central West Southeast Northeast 13 ATTRACTIVE NEW STORE ECONOMICS NEW STORE ECONOMICS Avg. Store Size (sq. ft.) Annual Sales 4 Wall Contribution Net Cash Investment (1) Cash on Cash Return Payback Period (1) 900 -1,000 $600,000 - $700,000 ~25% $200,000 - $250,000 ~75% ~18 Months Includes store build out (net of tenant allowances), inventory and cash pre-opening costs. 14 CLASS OF 2011 STORES: PRODUCTIVITY – Productivity of the 2011 class is tracking at or above the top of the new store model range of $600,000 - $700,000 2010 Store Sales Other Sales (1) Total Sales Comp Sales (Stores Only) Number of Stores 2011 Q1 Q2 Q3 Q4 Q1 Q2 Q3 22.8 20.7 22.4 46.0 31.7 29.1 31.0 91.8 3.0 2.3 2.4 5.2 3.3 2.2 2.4 7.9 25.8 23.0 24.7 51.2 34.9 31.3 33.4 99.7 15.7% 6.9% 5.9% 7.5% 6.0% 6.9% 6.0% 6.2% 118 128 141 146 161 179 196 196 91% 85% 83% 85% New Store Productivity – Note: (1) YTD If we used a 12 month comp methodology, rather than our current 15 month methodology, the new store productivity YTD would be 87%, rather than 85% Dollars in millions Includes e-commerce, franchise, and sales from SpecialTeas brand that ceased operation on the last day of fiscal 2010. 15 CLASS OF 2011 STORES: SQUARE FOOTAGE – Store sales and contribution do not correlate with the size of our stores – The average size of the stores opened in 2011 is higher than the average size for the existing stores(1), however… – …the occupancy cost as a % of sales for the stores opened in 2011 is projected to be slightly less than that of the existing stores 2011 STORES COMPARED TO EXISTING STORES Average Gross Square Feet Occupancy Cost as a % of Sales(2) Total Occupancy Cost $ Occupancy Cost per Gross Square Foot (1) (2) Existing stores represent stores opened in 2010 and prior. Projected on an annualized basis. 15% higher 1,023 vs. 888 sq. ft. Slightly Lower Lower Much Lower 16 DRIVE INCREASED COMPARABLE STORE SALES Introduce New Customers To Tea Transition To Higher Grade Teas And Merchandise Consistency In Product Offering – Introduce new customers to the benefits and enjoyment of tea – Educate customers on healthful qualities and pleasures of tea – Customers more familiar with teas tend to trade up to higher priced teas and purchase increased quantities of tea – Continual experimentation – Continue to provide high quality tea and tea-related merchandise to enhance customer loyalty and introduce new customers to tea HISTORICAL COMPARABLE STORE SALES 8.4% 3.7% 2006 6.9% 8.7% 3.0% 2007 2008 2009 2010 17 CONSISTENTLY POSITIVE SAME STORE SALES QUARTERLY COMPARABLE STORE SALES (EX ECOMMERCE) SINCE 2009 15.7% 10.7% 8.7% 7.5% 6.9% 6.9% 6.0% 5.9% 5.5% 6.0% 1.4% Q1'09 Q2'09 Q3'09 Q4'09 Q1'10 Q2'10 Q3'10 Q4'10 Q1'11 Q2'11 Q3'11 18 COMP SALES: TRANSACTIONS OR UNITS Total Comp(1) Ticket / Transactions Sales Average Transactions Sales Ticket 10% Price per Unit Units Sales - 6.2% 2011 YTD(2) Price / Units OR + + + 10% 8.7% + 2010 + + + 10% 2009 - 6.9% + + - – Units contributed more to comp sales than price for the period from 2009 to 2011 YTD – Unit comps have been positive every year since at least 2007 – – (1) (2) Unit comps for tea only (all sold on a per ounce unit basis) have been positive every year since at least 2007 Customers are buying significantly higher units per transaction Store comp only, excluding e-commerce and including beverage sales. 2011YTD is through Q3. 19 AVERAGE TICKET: AUR / UPT Average Ticket(1) 10% AUR / UPT Price per Units per Average Unit Transaction Ticket 2011 YTD(2) + + 10% 2010 + + 10% 2009 + - – UPT contributed more to average ticket than price for the period from 2009 to 2011 YTD – UPT has been positive every year since at least 2007 – (1) (2) UPT for tea only (all sold on a per ounce unit basis) has been positive every year since at least 2007 Store comp only, excluding e-commerce and including beverage sales. 2011YTD is through Q3. 20 EXPAND OUR ONLINE PRESENCE – Powerful tool for branding, marketing and driving sales E-COMMERCE AS % OF SALES – 7% of total sales in 2010 10%+ – 46% Y-o-Y growth in 2010 – Customer database with over 300,000 email addresses 7.0% 5.8% 2008 2010 2015E 21 INCREASE OUR HIGHLY ATTRACTIVE MARGINS GROSS MARGIN EXPANSION – – – – Customers graduate from merchandise purchases to replenishment of favorite teas and experimentation with new varieties Gross margin of tea is significantly higher than merchandise As store matures, naturally experience gross margin expansion Realized margin gains due to shift in supply chain from wholesale to direct sourcing ECONOMIES OF SCALE – – Leverage corporate and other fixed costs Gross margin benefits from growing scale with suppliers Gross Margin and Teas as % of Net Sales Operating Margin 18.8% 57.4% 51% 2008 Gross Margin 59.6% 62.9% 13.5% 7.5% 54% 2009 56% 2010 2008 2009 2010 Tea as % of Net Sales 22 SELECTIVELY PURSUE INTERNATIONAL EXPANSION – Compelling opportunity to further expand internationally through franchised and companyowned stores – Utilize franchise arrangements with local partners in key regions – Expand Teavana brand globally and participate in strong tea growth internationally First directly owned Canadian store opened in December 2011 196 Stores 16 Stores 2 Franchise Stores 16 Franchise Stores Partner - Casa Internacional Existing Presence Alshaya franchise agreement announced September 2, 2011 Near-Term Potential Future Markets Agreement covers 8 MiddleEastern countries-first store expected in fiscal 2012 Long-Term Potential Future Markets 23 Superior Financial Performance POWERFUL TRACK RECORD OF GROWTH $125 $90 Net Sales $34 2006 Number of Stores $47 2007 47 59 2006 2007 $64 2008 87 2008 8.4% Comparable Store Sales 3.7% 2006 ’06 – ’10 CAGR 39% 2009 108 2009 6.9% 2010 146 33% 2010 8.7% 3.0% 2007 2008 2009 2010 $23 99% (1) $12 Operating Income Note: (1) ($0) 2006 $3 $5 2007 2008 2009 2010 Dollars in millions. Represents CAGR from 2007 – 2010. 24 SUPERIOR PROFITABILITY GROSS MARGIN OPERATING MARGIN 18.8% 62.9% 59.6% 13.5% 57.4% 7.5% 2008 2009 2010 2008 2009 2010 25 STRONG BALANCE SHEET TO SUPPORT GROWTH AS OF OCTOBER 30, 2011 – Historically funded new store growth out of cash flow from operations Total Debt Total Liquidity(1) – Strong liquidity supported by Revolving Facility $4.5mm $35.3mm (1)Cash plus availability on $40mm revolver facility – Revolver used for seasonal working capital requirements Strong liquidity profile expected to continue given strong cash flow 26 MOMENTUM CONTINUING IN 2011 Thirty – Nine weeks ended Oct 30, 2011 Thirty – Nine weeks ended Oct 31, 2010 Y-o-Y ∆ Sales 99.7 73.5 36% Ending store count Comparable Store sales -Including e-commerce -Excluding e-commerce 196 141 55 8.7% 6.2% 10.6% 8.7% Gross Margin 62.5% 59.6% +290 bps Operating Income Operating Margin 10.4 10.5% 6.9 9.4% 50% +110 bps 5.3 2.8 86.0% 5.3% 3.8% +150 bps Net Income % Sales 27 FISCAL 2011 OUTLOOK: REITERATING GUIDANCE – For 2011 Q4, net sales are expected to be in the range of $62 million - $66 million based on comparable store sales, including e-commerce, increasing in the mid-single digits – Net income is expected to be in the range of $11.2 million - $12.0 million, or $0.29 to $0.31 per diluted share – For fiscal 2011, net sales are expected to be in the range of $162 million - $166 million – Net income is expected to be in the range of $16.5 million to $17.3 million, or $0.43 to $0.45 per diluted share 28 INVESTMENT HIGHLIGHTS Market-Defining Brand Driving Category Growth World’s Finest Teas and Tea-Related Merchandise “Heaven of Tea" Retail Experience Powerful and Consistent Store Model Significant and Tangible Growth Opportunities Superior Profitability Deep Rooted Culture Driven By Experienced Management Team 29 Opening the Door to Health, Wisdom & Happiness