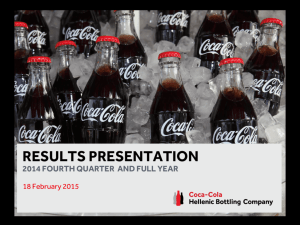

Deutsche Bank - presentation - Coca

advertisement

Forward-looking statements Unless otherwise indicated, the condensed consolidated financial statements and the financial and operating data or other information included herein relate to Coca-Cola HBC AG and its subsidiaries (“Coca-Cola HBC” or the “Company” or “we” or the “Group”). This document contains forward-looking statements that involve risks and uncertainties. These statements may generally, but not always, be identified by the use of words such as “believe”, “outlook”, “guidance”, “intend”, “expect”, “anticipate”, “plan”, “target” and similar expressions to identify forward-looking statements. All statements other than statements of historical facts, including, among others, statements regarding our future financial position and results, our outlook for 2014 and future years, business strategy and the effects of the global economic slowdown, the impact of the sovereign debt crisis, currency volatility, our recent acquisitions, and restructuring initiatives on our business and financial condition, our future dealings with The Coca-Cola Company, budgets, projected levels of consumption and production, projected raw material and other costs, estimates of capital expenditure, free cash flow, effective tax rates and plans and objectives of management for future operations, are forward-looking statements. You should not place undue reliance on such forward-looking statements. By their nature, forward-looking statements involve risk and uncertainty because they reflect our current expectations and assumptions as to future events and circumstances that may not prove accurate. Our actual results and events could differ materially from those anticipated in the forward-looking statements for many reasons, including the risks described in the UK Annual Financial Report and the annual report on Form 20-F filed with the U.S. Securities and Exchange Commission (File No 1-35891) for Coca-Cola HBC AG and its subsidiaries for the year ended 31 December 2013. Although we believe that, as of the date of this document, the expectations reflected in the forward-looking statements are reasonable, we cannot assure you that our future results, level of activity, performance or achievements will meet these expectations. Moreover, neither we, nor our directors, employees, advisors nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. After the date of the condensed consolidated financial statements included in this document, unless we are required by law or the rules of the UK Financial Conduct Authority to update these forward-looking statements, we will not necessarily update any of these forwardlooking statements to conform them either to actual results or to changes in our expectations. 2 Overview 3 Coca-Cola HBC at a glance €7 billion revenues 2.1 billion unit cases sold 28 countries of operation over 3 continents 11 consecutive quarters of currency-neutral revenue per case growth (as at Q1 2014) 50 billion servings per annum with significant exposure in emerging markets 585 million population # 1 in Sparkling Beverages 38,089 employees growing on average at c.1% per annum in 23 out of 24 markets 68 plants in operation and 324 warehouses and distribution centres Source: FY2013 data unless otherwise stated; Nielsen market share data 4 A diverse and balanced portfolio Emerging markets Developing markets Armenia, Belarus, Bosnia and Herzegovina, Bulgaria, FYROM, Moldova, Montenegro, Nigeria, Romania, Russia, Serbia, Ukraine Czech Republic, Croatia, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, Slovenia Population: 417 million GDP/capita: US$ 7,186 Population: 77 million GDP/capita: US$ 14,854 Established markets Austria, Cyprus, Greece, Italy, Northern Ireland, Republic of Ireland, Switzerland Population: 91 million GDP/capita: US$ 36,929 2013 breakdown Volume unit cases Net sales revenue Comparable EBIT Total 32% 18% 37% 33% 16% 9% 50% 47% 58% 2,061m €6,874m €454m 5 Financial highlights Net sales revenue Volume Reported NSR per unit case by segment 6,544 6,762 6,824 7,045 6,874 in million unit cases in Euros 2,069 2,105 2,087 2,085 2,061 3.38 2,928 2,862 2,835 2,702 2,540 3.16 1,149 1,140 1,162 2,467 2,760 2,828 3,195 3,229 Gross profit margin 2009 2010 2011 2012 2013 OPEX as a % of revenue 30.4% 30.3% 40.3% 40.4% 2009 2011 2012 2013 10.1% 7.7% 30.0% 6.4% 6.6% 453 454 2012 2013 29.4% 28.9% 35.9% 35.5% 651 2011 2010 Comparable EBIT and EBIT margin 9.9% 37.7% 2010 3.34 1,148 1,106 2009 2010 2011 2012 2013 Emerging Developing Established 2009 3.23 3.27 2012 2013 2009 2010 2011 2012 2013 2009 687 523 2010 2011 All numbers in million Euros unless otherwise stated 6 The opportunity we see Business growth Per capita development Market share growth Emerging markets exposure Diverse product portfolio Margin leverage Revenue growth management Operational leverage Operational cost control Infrastructure rationalisation and logistics optimisation SAP W2 exploitation and Shared Services Revenue-generating capital expenditure 7 Footprint with attractive long-term potential 660 584 2013 Total sparkling category servings per capita 461 219 220 Poland Serbia & Montenegro 301 Austria 209 Romania 166 Greece Russia 166 Italy 123 142 204 298 321 353 Mexico United States Germany Belgium Great Britain Spain Europe average (38 countries) 47 Ukraine 105 Nigeria Emerging 93 134 Coca-Cola HBC Established 201 Egypt Developing 208 France 280 Switzerland 416 Per capita consumption: Average number of 237ml or 8oz servings consumed per person per year in a specific market. Coca-Cola Hellenic’s per capita consumption is calculated by multiplying our unit case volume by 24 and dividing by the population. Source: The Coca-Cola Company, 2013 data 8 Driving revenue ahead of volume Package mix Single-serve 39% Multi-serve 61% Category mix Energy drinks, 1% RTD Tea, 5% Juice, 6% Low calorie sparkling beverages, 6% Water, 18% Channel mix Immediate consumption 31% Future consumption 69% Pricing opportunities Other still, 1% Sparkling beverages, 63% 9 Strategy 10 Winning in the marketplace 43 % +0.8 Coca-Cola HBC share in sparkling 18 % +0.8 Coca-Cola HBC share in NARTD 18 % +0.8 Biggest competitor share in sparkling 8 % +0.7 Biggest competitor share in NARTD 12 % -2.3 Private label share in sparkling 17 % -2.1 Private label share in NARTD Source: Nielsen 2013 market share data; company analysis NARTD: Non-alcoholic ready-to-drink 11 Deploying initiatives to win in the marketplace Italy FC RED Score Right Execution Daily RED 75 53 25 2011 2012 2013 12 Growing revenue ahead of volume • Delivered currency-neutral net sales revenue per case growth for 11 consecutive quarters • Implemented OBPPC architecture to ensure relevance to the consumer • Recovering economies expected to present pricing opportunities Occasion Brands Packages Prices Channel 13 Increasing consumption of SSDs in Italy with OBPPC Implementation The right pack, in the right zone INCIDENCE ZONE 1. 2. 3. 4. Dairy (NEW) Water section Check-out and cooler Bakery 1L 0.50L 1.75L 6x0.33L FREQUENCY ZONE 1. 2. 3. 4. Cheese and cold cuts counter Ready meals Fruit and vegetables Pasta UPSIZE ZONE 1. 2. Promotional main hall Promotional area 2x1.5L 4x1.5L UPSCALE ZONE 1. 2. 3. 4. Cookies and snacks Juices for Minican Check-out Spirits (NEW) 12x0.15L 4x0.5L 14 Committing to cost leadership Infrastructure optimisation Number of plants -32% since 2008 in the Established and Developing segments Operational control OpEx reduction -190 bps as % of NSR, since 2008 Number of distribution centres -9% since 2008 Number of warehouses -16% since 2008 15 Optimising the supply chain network Italy From 5 core plants in 2012 to 3 core plants in 2014 Opportunity Execution Result Network complexity 3 plants near the biggest demand areas Implementation in 14 months Leveraging the size of our plants Asset utilisation Reduction in fixed cost High speed line No plant under 40m unit cases +10 % on asset utilisation 90bps reduction in supply chain cost1 as a % of net sales revenue New high speed line in Nogara 1 Supply chain cost includes Production, Overheads, Warehousing, Distribution and Haulage 16 Generating free cash flow Working capital Bolt-on acquisitions Negative year-end position of local brands mainly in still drinks Capital expenditure Strong balance sheet 5.5-6.5% of NSR Net Debt to Comp. EBITDA at 1.9x Returning cash to shareholders Source: FY2013 data unless otherwise stated 17 Significant cash generation in Italy To CCHBC Group 0.19 € (60%) Cash flow from operations1 290m€ = 0.32 € per unit case sold Investments for growth 0.13 € (40%) 1 Cash flow from operations in the last three years 18 The Best is Yet to Come! • We have medium to long-term opportunities • volume and revenue growth • improvement in the cost structure • We are executing well in every area where we have control • Our current platform is more efficient than in peak margin years and should ensure that volume growth in the future adds momentum to margin expansion • The initiatives we have in place, combined with the potential for volume momentum, give us confidence that the best is yet to come! 19