Quarterly Report Sept 2013

advertisement

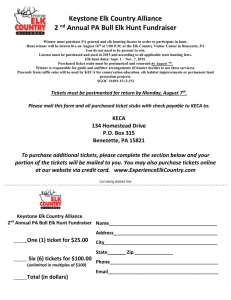

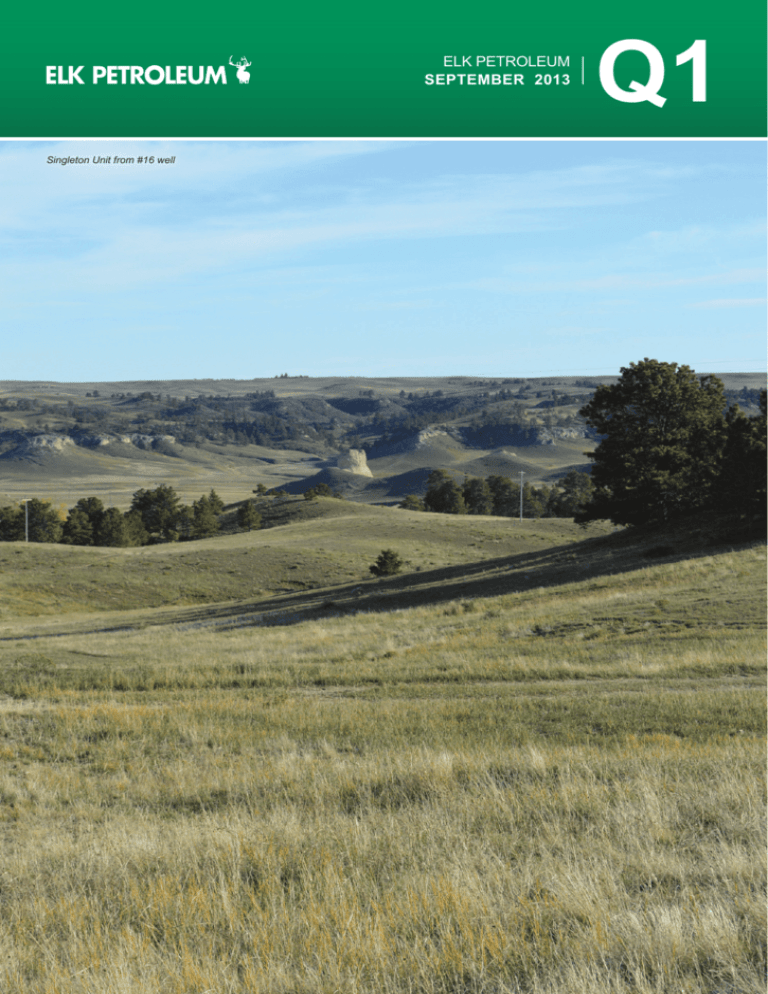

ELK PETROLEUM SEPTEMBER 2013 Singleton Unit from #16 well Q1 Q1 ELK PETROLEUM september 2013 Highlights GRIEVE ENHANCED oil RECOVERY PROJECT RESPONDS WELL TO CO2 & WATER INJECTION • Reservoir pressure is responding to CO2 and water injection - pressure increase is tracking forecast - expected to be up by over 600psi by YE2013 •E fforts underway to accelerate pressurisation and first oil production: -C O2 injection rate has been resumed at or above prior 33 million cubic feet per day rate after the annual 3-week shut-in occurred in September. - Water injection rate capability to be trebled to 20,000 to 25,000 barrels per day in November. • Site preparation for the high voltage substation is complete GRIEVE CRUDE EXPORT PIPELINE • Steps to monetise of the pipeline: - Denbury now exploring acquisition of an interest in Elk’s oil pipeline - A private equity firm and a midstream company are also considering taking up an interest - Sale to Natrona Pipeline Company for US$9 million on hold until alternatives tested ASH CREEK • Studies add potential in Lower Shannon • Farm-out plan initiated; costs reduced NEW ACQUISITION • Elk has executed purchase and sale agreement to acquire the Singleton oil field in Nebraska - Material EOR potential - Successful due diligence should lead to January 2014 acquisition - New strategic focus area: D-J Basin near Denver CORPORATE • A successful capital raising from institutions and sophisticated investors was achieved in late July with the commitment of AUD$2 million • Refocusing of forward plan well underway 2 Q1 ELK PETROLEUM september 2013 CEO’S COMMENTARY Since taking over as CEO, I have led a review of all of the Company’s projects and opportunities as well as its core strengths. In the first quarter of Elk’s 2013-14 fiscal year, the Company has taken a number of steps to reposition the Company by refocusing its business plan to concentrate its future activities on CO2-based EOR projects and to improve its funding position to bridge the time period until it receives material cash flow from its interest in the Grieve EOR project. Elk’s core strength is its ability to identify potential CO2based EOR projects and to bring together the diverse pieces that get CO2-based EOR projects up and going. This core strength is reflected in the Company’s success in taking the Grieve oil field from a 10 BOPD nearabandonment operation to a US$100 million investment, operated by the premier US operator for CO2-based EOR projects. This first project has established Elk’s credibility in this sector, provided Elk with development experience by working closely with the Grieve operator, and with the commencement of both CO2 and water injection, Elk will soon realise a material and transforming cash flow. The Company now plans to capitalize on these strengths to replicate this success. The post-quarter agreement to acquire the Singleton oil field in Nebraska is the first step in this process. As part of this repositioning, the Company has expanded its review of CO2 sources and is exploring anthropogenic sources as well as more natural sources such as the La Barge field source that supplies the Grieve EOR project. Elk is concentrating initially on the Denver-Julesburg (or D-J) Basin that covers parts of Colorado, Nebraska and Wyoming. In regard to addressing the Company’s forward funding needs; the Company is undertaking a number of efforts to meet its financial needs until its share of Grieve cash flow commences. These include cutting administrative costs, holding discussions with the Grieve field operator, Denbury Resources (Denbury), in regard to modifying the financial arrangements between Denbury and Elk, including Denbury acquiring an interest in Elk’s Grieve oil export pipeline. In addition, the Company has initiated an active program to farm-out or sell a major interest in the Ash Creek oil field and related EOR project plans for this field. Elk is also exploring a number of financing options to provide any additional funds needed to advance the Company’s revised plans. I am excited about the early outcomes of our efforts to reposition the Company’s forward plan. I look forward to bringing you more positive news in coming reports. Dr Scott Hornafius Chief Executive Officer 3 Q1 ELK PETROLEUM september 2013 GRIEVE ENHANCED OIL RECOVERY (EOR) PROJECT Injection of CO2 and water for the re-pressurisation of the Grieve oilfield continued throughout the reporting period. The reported volumes of CO2 and water injected to the end of August 2013 were nearly 6 billion cubic feet of CO2 and nearly 800,000 barrels of water. These volumes equate to average daily injection rates of 33 million standard cubic feet per day (MMSCFD) and approximately 8,000 barrels of water per day (BWPD). A number of bottom hole pressure (BHP) surveys have been conducted before and since injection commenced; the results are shown in the following figure. Grieve Reservoir Pressures 1400 1200 1000 Water Injection 800 CO2 Injection 600 Simulation Grieve #20 400 Grieve #22 Grieve #11 200 5 Dec 12 Jan 13 Feb 13 Mar 13 Apr 13 May 13 The results indicate the increase in BHP to be in line with the operator’s forecast (note: there was no change in BHP throughout September due to the cessation of the supply of CO2 to allow ExxonMobil to undertake routine annual maintenance at their Shute Creek gas plant, the source of CO2 to the Grieve EOR project). The trend indicates that reservoir pressure should have increased by over 100% or 600 psi in the 9 months to year-end 2013. This interim outcome will be sensitive to how much CO2 and water is injected over the remainder of this year. The field operator has indicated that it is striving to increase the CO2 injection rate in November. It also expects to have installed a new and larger downhole pump in the Grieve water source well by early November and this pump will enable the water injection capability to be trebled to a rate of up to 25,000 BWPD. Sustaining Jun 13 Jul 13 Aug 13 Sep 13 Oct 13 Nov 13 Dec 13 these injection rates should accelerate the re-pressuring operation and hence the time for the reservoir pressure to reach minimum miscible pressure (MMP) at which the injected CO2 and oil become miscible and the reservoir oil starts to move again leading to first oil production from the project. While the operator has not revised its early 2015 outlook for first oil, the Company sees the potential for acceleration of this timing depending upon the levels of CO2 and electricity supplies available. Concurrent with the field operations, site preparation for the substation that will provide for the supply of high voltage electrical power to the Grieve field is complete. The route and location for the power poles to bring the power 3 miles from the substation to the Grieve field have also been established. 4 Q1 ELK PETROLEUM september 2013 GRIEVE CRUDE PIPELINE A number of parties, including Denbury, have expressed an interest in purchasing a partial or total ownership of the Grieve pipeline. Given that one or more of these discussions could provide a better solution for the Company than the previously announced plan to sell the pipeline to Natrona Pipeline LLC (NPL), the efforts by NPL to raise funds through a private placement to US investors has been temporarily suspended. In the case of Denbury, Elk is exploring a wider re-arrangement of its current funding agreement with Denbury. Monetization of the pipeline in one form or another remains a major part of the Company’s near-term funding plans and a priority. ASH CREEK OIL FIELD EOR PROJECT Further core and fluid laboratory work and simulation studies of the Ash Creek reservoir continue to indicate that the field has significant potential as an an surfactantpolymer based EOR project. The simulation work also has highlighted supplementary secondary recovery potential in the lower Shannon formation, which was not effectively swept by historical water flooding. A farm out program has been initiated: a number of regional producers have been approached and Elk plans to present the farm out opportunity at various US oil industry prospect shows that are occurring over the next few months. Trusler #15 – an Ash Creek re-development well 5 Q1 ELK PETROLEUM september 2013 NEW ACQUISITION Elk has been pursuing the acquisition of an oil field in Nebraska for some time following identification of this area, as well as the wider D-J Basin, as holding significant potential for EOR projects. Nebraska also has favourable tax and other business terms that encourage development. Significant efforts were undertaken in the quarter to complete negotiations and preliminary due diligence. A purchase and sale agreement (PSA) with Coral Production Corporation (Coral) for the Singleton Unit was executed in early October. The Singleton Unit also provides the advantage of upside potential in deeper unconventional plays. In addition, Elk has established a good working relationship with Coral, which holds a number of interests in the area around the Singleton oil field. Due diligence associated with the PSA is expected to be concluded no later than 10 January 2014. Historical oil production from the Singleton Unit reached peak rates in the order of 4,000 barrels of oil per day and resulted in primary and secondary oil recovery of approximately 11 million barrels. Production came from two J-sands, which are of excellent quality and which occur at a depth of about 5,600 feet. These latter factors make the two J sands an attractive EOR opportunity. The application of tertiary EOR recovery technology to the Unit is expected to result additional oil recovery in the order of 2-4 million barrels of a sweet 37 degree API gravity crude. The Unit has 18 wells currently available for re-entry out of approximately 52 J wells historically drilled to exploit the field. The Unit covers 2,386 acres. The acquisition also includes production facilities that can be re-commissioned to support near term production while the engineering and development of an EOR project is undertaken. The Singleton Unit is located in the southwest region of the Nebraska Panhandle in the oil prone D-J Basin, which straddles sections of Colorado, Nebraska and Wyoming. Singleton Unit from #16 well Denbury-Julesburg (D-J) Basin Singleton Unit Facilities 6 Q1 ELK PETROLEUM september 2013 NEW ACQUISITION (cont.) The high quality in terms of permeability and porosity of the two J sands can be seen in the following thin section of a core taken from these sands. The light blue areas indicate an average pore space of approximately 20%-25% in the sandstone; the resulting permeability is in the range of 200 to 800 millidarcies, which should provide for a very efficient tertiary EOR recovery project. The accompanying log shows a typical section of the sands as they occurred at existing Singleton wells and the log again highlights the quality and EOR suitability of J-1 and J-2 sands. Petrographic view of a thin section of Singleton core Typical Singleton Log Apart from the upside EOR potential of the J sands of the Singleton Unit, Chama Oil & Minerals (in a JV with Devon Energy) recently completed two wells (a vertical well and a horizontal well) to Permian and Pennsylvanian targets immediately to the south of the Singleton Unit. The results of both wells are currently held as confidential information suggesting possible upside potential for these deeper formations as they occur within the Singleton Unit boundary. Future site for Grieve processing and storage facilities 7 Q1 ELK PETROLEUM september 2013 CORPORATE Dr. Neale Taylor, the Company’s Chairman, who moved to the USA in a temporary executive position in January 2012, returned to Australia in late October and will complete his current executive obligations from Australia before resuming his role as non-executive chairman of Elk Petroleum Limited from 1 January 2014, subject to his re-election at the 2013 AGM. CAPITAL RAISING As announced in Elk’s June Quarterly ASX Report, $2 million was raised in the reporting period with the placement of 12,500,000 fully paid shares at an issue price of $0.16 per share to sophisticated investors and institutional clients of D.J. Carmichael. Every two shares allotted in the placement will receive one free unlisted option with an expiry date of 1 February 2015 and an exercise price of $0.25. PRODUCTION Total gross production during the September 2013 Quarter was 931 barrels from Ash Creek and approximately 12 per cent lower than the June 2013 Quarter. The reduction in production was the result of the loss of one well in the field for approximately two months of the reporting period due to a downhole pump problem. The well was placed back in production in late August. FINANCIAL POSITION Elk’s closing cash position as at 30 September 2013 was AU$1.874 million. Expenditure of AU$1.079 million during the September 2013 quarter covered operations at Ash Creek, new project studies and overheads. The average price received for Ash Creek oil for the Quarter was US$96.77 per barrel which was a 13.5 per cent increase over the previous quarter. The average exchange rate for the period was 0.9152 USD per AUD. 8 Q1 ELK PETROLEUM september 2013 For further information please contact: Dr. Scott Hornafius Chief Executive Officer +1 307 265 3326 info@elkpet.com www.elkpet.com Elk Petroleum Limited is an Australian Securities Exchange-listed oil and gas production, development and exploration company with assets located in the Rocky Mountains, USA. Elk’s strategy is to acquire and re-develop mature oil fields in the USA using both conventional and new extraction techniques. 9